Friday, September 13, 2019

1. OXY’s free cash flow yield

- Morgan Stanley singled out Occidental Petroleum (NYSE: OXY) as a free cash flow growth story going forward, after assessing the company’s acquisition of Anadarko Petroleum.

- “Just one month after closing the acquisition of APC, planned integration, debt reduction via asset sales, and execution on synergies are all on track” Morgan Stanley said in a note.

- “Successful execution could underpin one of the more differentiated rates of change and free cash flow growth stories among large cap E&Ps and global majors,” the bank added.

- Occidental offers a “best in class 7% yield,” which could double to 14% by 2022, which could leave “ample room for incremental return of cash via dividend growth and buybacks,” Morgan Stanley said.

- The bank reiterated an equal-weight rating for now, but pointed out the positive upside.

2. Corn prices crashed over past month

- The U.S. and China have made some significant moves to tamp down tension regarding the trade war. China delayed some tariffs, and Trump responded with a two-week delay.

- Corn prices have crashed over the past month, after the last data release from the U.S. Department of Agriculture, which revealed more supply than expected.

- “The favourable growing conditions in recent weeks have helped corn plants develop, prompting many private market observers to adjust their yield estimate up to the…

Friday, September 13, 2019

1. OXY’s free cash flow yield

- Morgan Stanley singled out Occidental Petroleum (NYSE: OXY) as a free cash flow growth story going forward, after assessing the company’s acquisition of Anadarko Petroleum.

- “Just one month after closing the acquisition of APC, planned integration, debt reduction via asset sales, and execution on synergies are all on track” Morgan Stanley said in a note.

- “Successful execution could underpin one of the more differentiated rates of change and free cash flow growth stories among large cap E&Ps and global majors,” the bank added.

- Occidental offers a “best in class 7% yield,” which could double to 14% by 2022, which could leave “ample room for incremental return of cash via dividend growth and buybacks,” Morgan Stanley said.

- The bank reiterated an equal-weight rating for now, but pointed out the positive upside.

2. Corn prices crashed over past month

- The U.S. and China have made some significant moves to tamp down tension regarding the trade war. China delayed some tariffs, and Trump responded with a two-week delay.

- Corn prices have crashed over the past month, after the last data release from the U.S. Department of Agriculture, which revealed more supply than expected.

- “The favourable growing conditions in recent weeks have helped corn plants develop, prompting many private market observers to adjust their yield estimate up to the already very high level of the USDA estimate,” Commerzbank said in a note on Thursday.

- The slight thaw in U.S.-China trade relations could lead to purchases of corn by China, but that remains to be seen.

3. India’s car sales crater

- India’s car sales plunged by more than 40 percent in August from a year earlier, and they were down by 31 percent in July. Car sales have declined for nine straight months.

- India has long been hyped as one of the largest sources of oil demand growth going forward, expected to surpass China. But this year has been a huge disappointment. Diesel demand was up only 50,000 bpd in 1H2019 compared to the same period in 2018. Gasoline consumption was only up 60,000 bpd, according to the IEA.

- The FT called India’s car industry crisis the “worst since records began more than two decades ago.” Some 300,000 jobs have been shed in India’s car sector.

- “We have never seen a crisis as painful as this one,” Puneet Gupta, an automotive analyst at IHS Markit, told the FT. “When the market is flat we see people getting worried. This time it’s minus 40 per cent, which is unimaginable…We are moving backwards rather than moving forwards.”

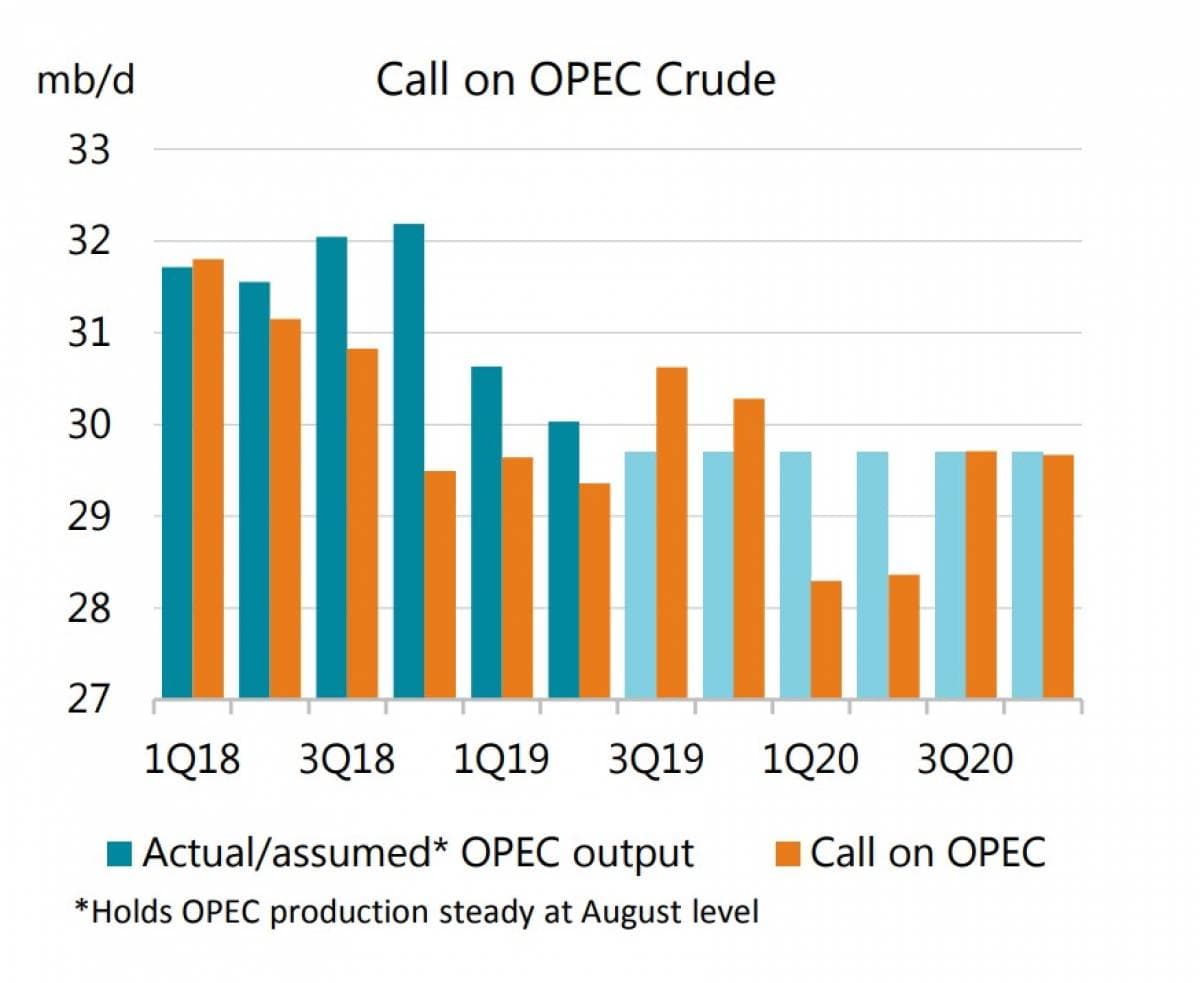

4. OPEC faces over-supply dilemma

- The IEA said that the oil market could see inventory drawdowns for the second half of this year by about 0.8 mb/d. But next year, a major glut looms.

- The “call on OPEC” could average 30.5 mb/d in 2H2019, but that is expected to fall sharply to 28.3 mb/d in 2020 due to rising non-OPEC supply and weak demand.

- In other words, OPEC faces a choice of having to cut by another 1.4 mb/d or risk another oil price slide.

- This scenario has some risks to it. The IEA is sticking with a 1.1 mb/d demand growth rate for 2019 and 1.3 mb/d for 2020. That is a little more optimistic than other analysts. If that turns out to be wrong on the downside, OPEC faces an even worse problem.

- On the other hand, the IEA continues to talk about “strong” supply growth in the U.S., even as output has slowed dramatically this year. The agency still expects the U.S. to add 1.3 mb/d in 2019 and 1 mb/d in 2020. Again, these could be optimistic – if shale grows at a slower pace, that would make OPEC’s job easier.

5. Palladium hits all-time high

- Palladium jumped to an all-time high this week at over $1,570 per troy ounce.

- Palladium is a precious metal used in cars to control emissions.

- Thus, the weak global auto market undercuts the bullish narrative. “Palladium appears to be completely ignoring the persistently weak auto sales in China,” Commerzbank said in a note. “After the Chinese government significantly reduced the subsidies for electric vehicles in June, their sales have also decreased noticeably.”

- Standard Chartered said that supply disruptions might be pushing up prices. “On a fundamental basis for platinum and palladium in particular there are the ongoing wage negotiations taking place in South Africa,” the bank said in a report. “It is not our base case that we expect there to be significant supply disruption, but given that the palladium market is already undersupplied, any incremental losses in production are likely to only tighten the market further.”

6. IMO rules suddenly showing up in market prices

- The IMO rules on sulfur concentrations in marine fuels take effect on January 1, 2020. The rules lower allowed sulfur concentrations from 3.5 percent to 0.5 percent.

- Roughly two-thirds of the global market for marine fuel is high-sulfur fuel oil (HSFO), so the rules are set to dramatically alter the market.

- HSFO is trading more than $30 per barrel below very low sulfur fuel oil (VLSFO), a discount that has blown out only recently as refiners and shippers prepare for the rules.

- Some HSFO demand will remain alive as a portion of shipowners install costly scrubbers, allowing them to continue using HSFO with the sulfur scrubbed.

- According to Bank of America Merrill Lynch, demand for HSFO drops from 3.25 mb/d in 2019 to 1.375 mb/d in 2020. Demand then rises as more scrubbers are installed, allowing consumption of high-sulfur fuels to recover to 2.275 mb/d in 2025.

7. Shale runs into productivity problems

- “[We believe the single most important longer-term driver of oil prices and energy markets over the next five years will be changes in U.S. well productivity,” Raymond James analysts said in a report.

- On that front, U.S. shale is running into trouble, with initial production rates for 30 days (IP-30) and 90 days (IP-90) stagnating so far in 2019 after years of double-digit growth. In the Permian, IP-90 rates are actually down by 10 percent this year.

- “We believe that this represents clear evidence that U.S. well productivity gains are beginning to reach maximum limits and may even roll over in the coming years as the industry struggles to offset well interference issues and rock quality deterioration,” Raymond James said.

- If this trend continues, and shale wells produce less than anticipated, it adds up to slower U.S. oil production growth and a major upside risk to oil prices.