Friday August 10, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

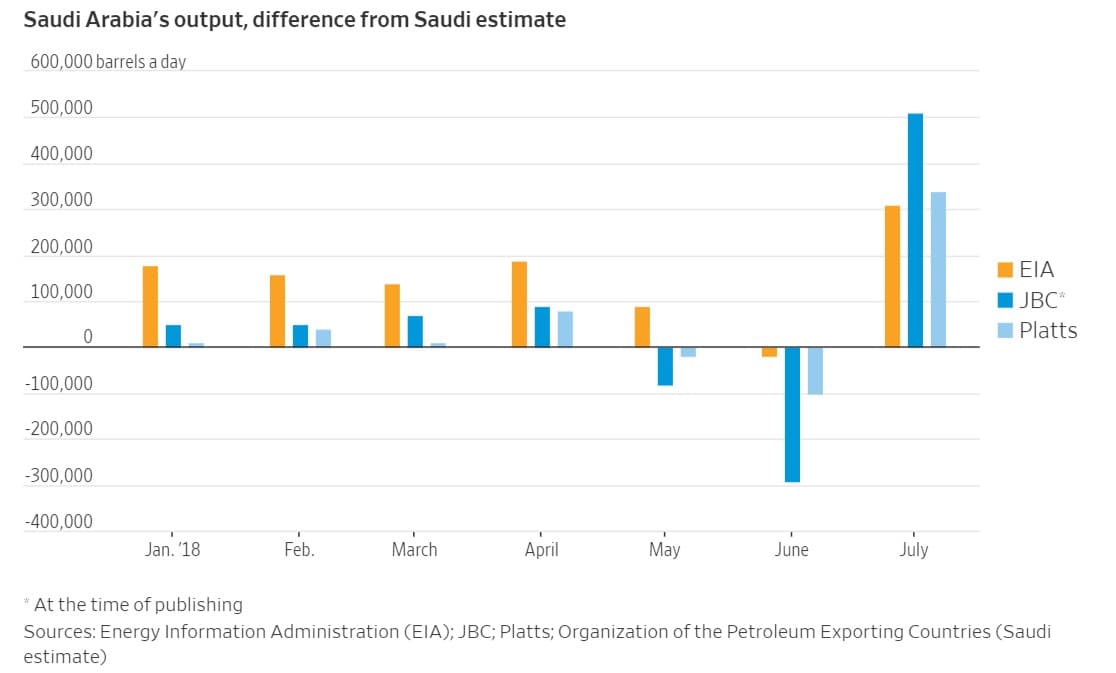

1. How much oil is Saudi Arabia producing?

(Click to enlarge)

- There has been a sudden discrepancy in the oil production figures for Saudi Arabia from different sources, muddling the global supply picture.

- The Wall Street Journal reports that Saudi Arabia has “pressed independent energy analysts to alter their estimates of its oil production.” Riyadh told OPEC that it cut oil production in July to 10.29 million barrels per day (mb/d), but the EIA and independent analysts say that Saudi Arabia actually increased output. S&P Global Platts puts Saudi output at 10.6 mb/d.

- The difference in various estimates amounts to around 0.5 mb/d.

- If Saudi Arabia is intentionally misleading the market in order to persuade fellow OPEC members that it is not overproducing, it could scramble the market.

- “The Saudis have been giving the impression they know what they are doing...They could lose credibility,” said John Hall, chairman of U.K. consultancy Alfa Energy. “It could increase volatility” in prices.

2. Refiners begin cutting fuel oil inventories

(Click to enlarge)

- The International Maritime Organization (IMO) has new rules…

Friday August 10, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. How much oil is Saudi Arabia producing?

(Click to enlarge)

- There has been a sudden discrepancy in the oil production figures for Saudi Arabia from different sources, muddling the global supply picture.

- The Wall Street Journal reports that Saudi Arabia has “pressed independent energy analysts to alter their estimates of its oil production.” Riyadh told OPEC that it cut oil production in July to 10.29 million barrels per day (mb/d), but the EIA and independent analysts say that Saudi Arabia actually increased output. S&P Global Platts puts Saudi output at 10.6 mb/d.

- The difference in various estimates amounts to around 0.5 mb/d.

- If Saudi Arabia is intentionally misleading the market in order to persuade fellow OPEC members that it is not overproducing, it could scramble the market.

- “The Saudis have been giving the impression they know what they are doing...They could lose credibility,” said John Hall, chairman of U.K. consultancy Alfa Energy. “It could increase volatility” in prices.

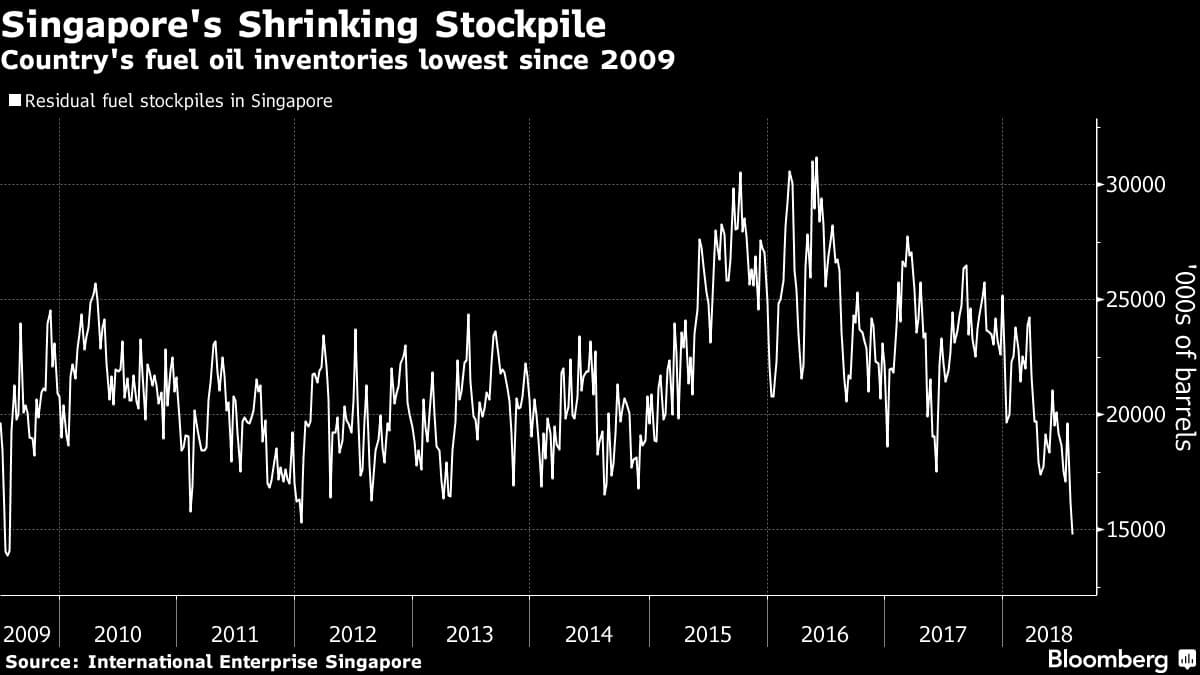

2. Refiners begin cutting fuel oil inventories

(Click to enlarge)

- The International Maritime Organization (IMO) has new rules set to take effect on January 1, 2020 that will require ship owners to cut the sulfur content in their fuels. The market for dirty fuel oil will be severely curtailed.

- In anticipation of those rules, refiners are already beginning to cut their stockpiles of fuel oil.

- According to Bloomberg, inventories of high-sulfur fuel oil in the U.S. and Singapore have plunged this year. In the U.S., heavy fuel oil inventories are at their lowest level seasonally in three decades, while in Singapore they are at a nine-year low.

- Prices for fuel oil used in ships have soared, sharply narrowing the discount relative to Brent.

3. Cushing inventories plunge

(Click to enlarge)

- Crude oil inventories at the Cushing hub in Oklahoma have plunged this year, falling to just 21.5 million barrels in the first week of August, down from 56 million barrels a year earlier.

- Part of the decline is due to the broader tightening in the oil market. OPEC+ kept supply off of the market, demand continues to rise, and several outages in Libya, Venezuela and Angola helped drain inventories earlier this year.

- The additional declines at Cushing this summer can also be attributed to the temporary outage at Suncor Energy’s (NYSE: SU) Syncrude oil sands facility.

- "The Cushing situation is becoming a bigger and bigger concern for the market," John Kilduff, founding partner for Again Capital LLC., told Bloomberg in early August. "When we get these reports it’s a reminder of the big problems we have with respect to Cushing. It’s very bullish, despite all the other production efforts going on."

- However, Cushing’s strategic importance is on the wane. In the past, Cushing was important as a gathering point and storage center for crude oil from different places.

- Now, upstream production is concentrated in West Texas, and all of that oil is trying to get to the Gulf Coast, where it can either be refined or exported. That somewhat cuts Cushing out of the picture.

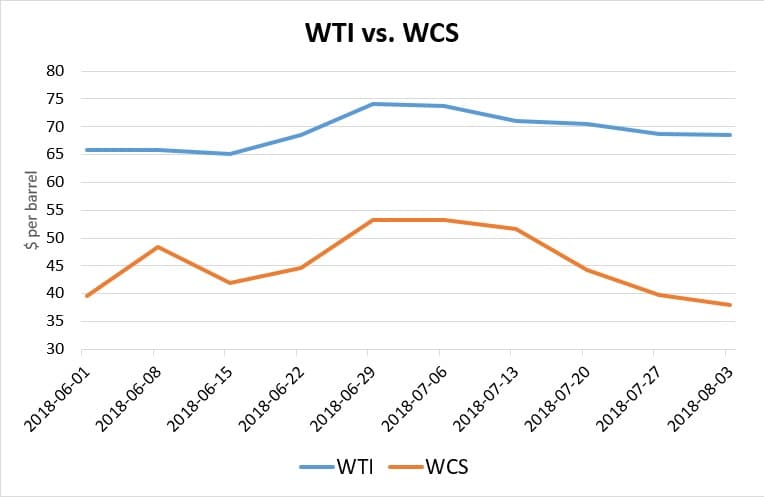

4. WCS discount widens

(Click to enlarge)

- The price between Western Canada Select (WCS), which tracks heavy oil in Alberta, and WTI, has widened to its largest gap in five years.

- WCS dropped below $40 per barrel in early August, falling to as low as $38 per barrel this week. Meanwhile, WTI is in the upper $60s per barrel.

- WCS often trades at a discount, a reflection of transportation costs as well as quality differences. But a $31-per-barrel discount is steep by any standard, and it’s the largest differential since 2013.

- The discount is the result of pipeline bottlenecks. Takeaway capacity from Alberta is basically used up, even as new supply came online over the past year. Without a major new pipeline expected for the next 18 months at the very least, the discount should stick around.

5. Saudi Arabia’s oil inventories have been declining for almost 3 years

(Click to enlarge)

- Bloomberg reports that oil exports from the five Gulf State members of OPEC declined by 1.1 million barrels in July. The drop off could be the result of an uptick in electricity generation during hot summer months.

- But Saudi Arabia has cut down its peak summer oil demand by burning more natural gas. In any event, June would have been a hot month as well, so the drop in exports between June and July can’t be chalked up to summer air conditioning needs.

- As such, Bloomberg argues, more oil must be heading into storage. As of April, Saudi stockpiles were close to a three-year low. In May, however, stockpiles ticked up.

- Saudi inventory levels will take on greater importance later this year as Iranian supply goes offline. As Saudi Arabia dips into spare capacity when it ramps up production, inventories will be one of the few remaining buffers to meet any unforeseen supply gap.

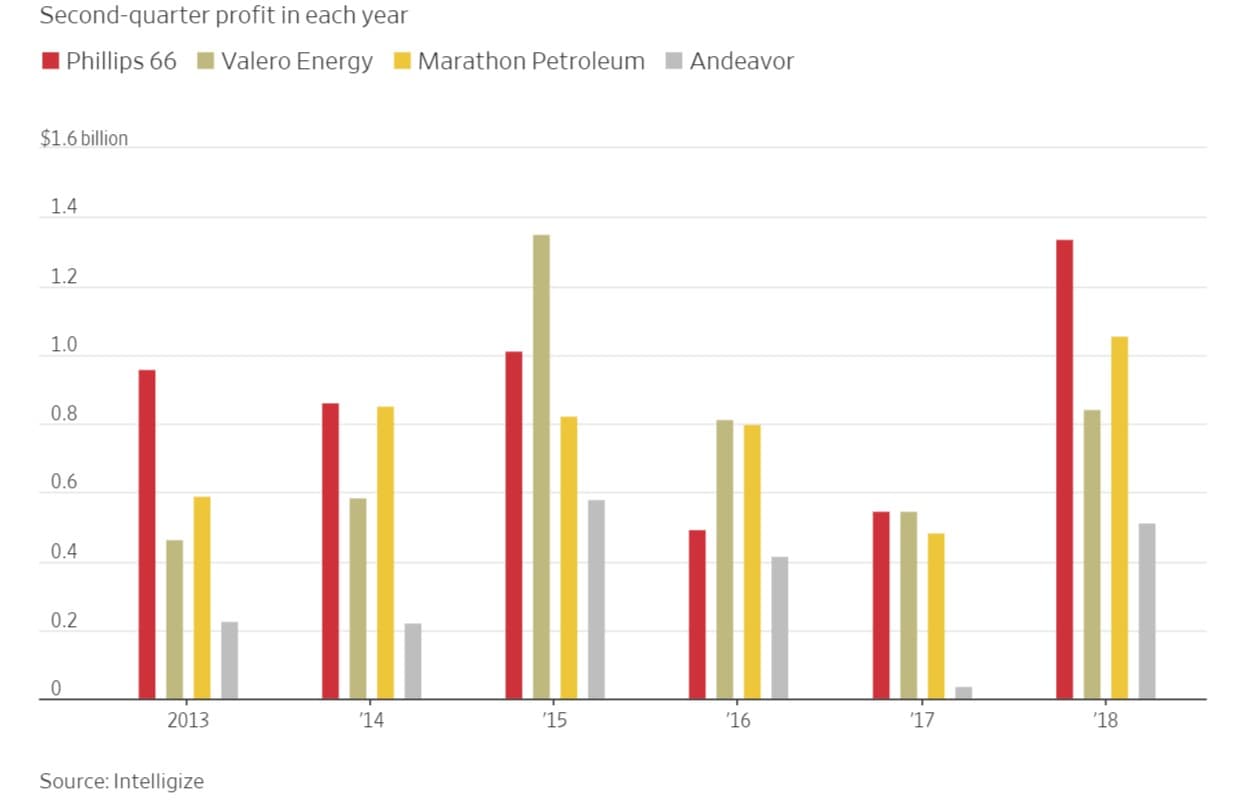

6. Refiners see profits rise

(Click to enlarge)

- U.S. refiners are enjoying some good times. Many American refiners just posted their best second quarter figures in years, owing to record oil production and a pipeline bottleneck that has led to price discounts.

- Downstream units tend to perform inversely to upstream operations. Higher oil prices, which benefit oil producers, typically hurt refiners because motorists cutback on consumption.

- However, oil prices surged in the second quarter, and U.S. refiners posted impressive results. WTI fell sharply below Brent in the second quarter, plunging to a discount that exceeded $10 per barrel.

- That meant that refiners could scoop up cheap oil, refine it, and export products abroad at prices more closely linked to higher Brent prices.

- Phillips 66 (NYSE: PSX) earned $12.28 per barrel in the second quarter, up from $8.44 per barrel a year earlier, according to the Wall Street Journal. Marathon Petroleum (NYSE: MPC) earned $15.40 per barrel, up from $11.32 a year earlier.

- Sandy Fielden, director of research for Morningstar Inc., told the WSJ that right now refining is a “cash cow.”

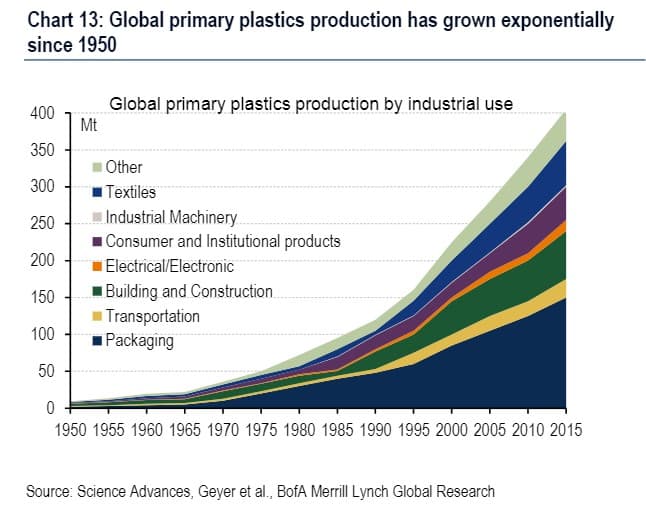

7. Petrochemicals take over oil demand

(Click to enlarge)

- Even as oil demand peaks, oil consumption in the petrochemical sector is set to rise significantly. In fact, it could be one of the very few sectors that sees oil demand growth over the next few decades.

- Global plastics production more than doubled between 1995 and 2015, according to Bank of America Merrill Lynch, surpassing 400 million tonnes per year. Because plastic consumption is heavily correlated with population and incomes, demand is only set to rise.

- About a third of plastics are used for packaging. Corporate decisions and government policies are starting to attack plastic demand, but BofAML says that it will only have a marginal impact on demand.

- Cheap oil and natural gas liquids in the U.S. has led to an investment boom in ethane crackers and other petrochemical facilities. Cheap plastics will make it difficult for alternative bio-based materials to gain a foothold.

- Overall, the petrochemical sector could add between 4 and 6 mb/d of additional crude oil demand by 2040, according to IEA forecasts, while overall oil demand could fall over that time frame (because of a drop in transportation demand).

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.