Recently, the Energy Information Administration (EIA), the International Energy Agency (IEA) and BP updated their outlooks for U.S. oil production.

All of these projections have one thing in common: Over the next few years, U.S. production growth is going to far outstrip OPEC’s production growth. As a result, the U.S. will gain market share at OPEC’s expense.

This scenario would continue a trend that started a decade ago when the U.S.’s production gains began to outstrip those of OPEC, as well as every other oil-producing country in the world.

EIA Forecast

The EIA’s latest Annual Energy Outlook (with projections to 2050) models several scenarios for future oil production. (It was also the topic of a recent article). The EIA’s base case assumes that known technologies continue to improve along recent trend lines. Additional cases consider either lower costs and higher resources, or higher costs and lower resources than the base case.

In even the most pessimistic case, tight oil grows by another million barrels per day (BPD) from 2017 levels by about 2022. The base case projects growth of approximately three million BPD over the next five years. The optimistic scenario projects sharply higher tight oil growth of nearly nine million BPD by 2050. Related: Which Oil Major Has The Best Investment Strategy?

BP Forecast

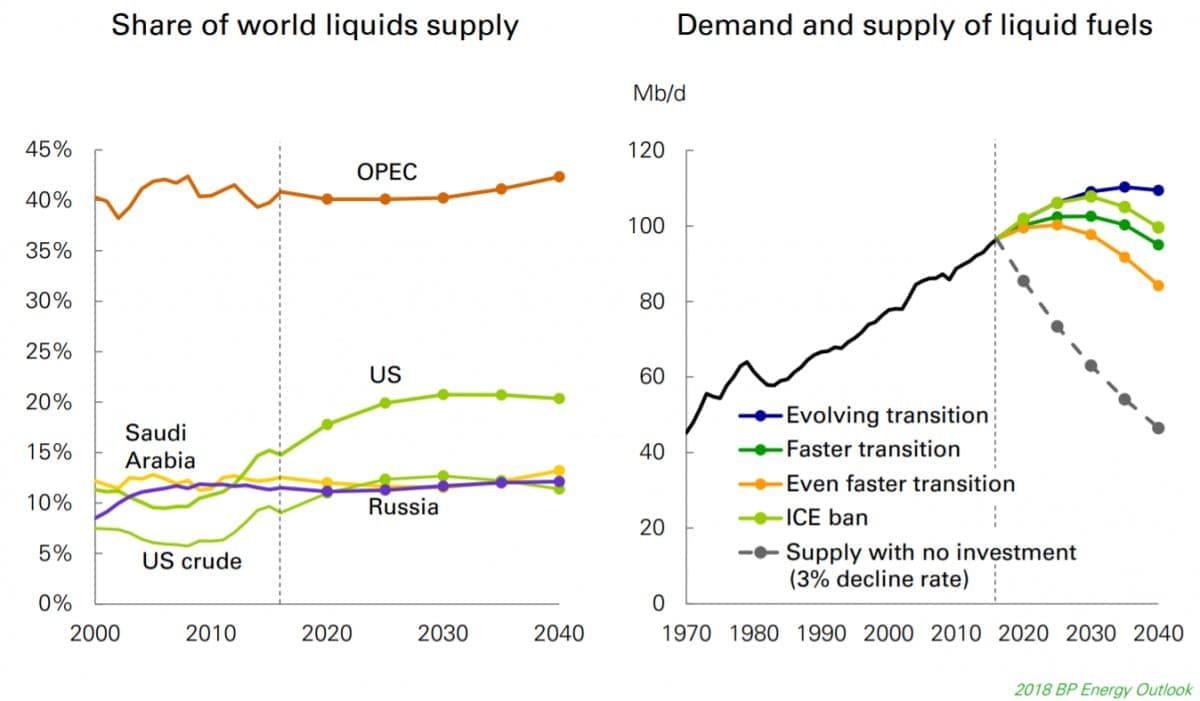

BP made its projections in its recently released 2018 Energy Outlook, predicting that the U.S. will become “by far the largest producer of liquid fuels.”

BP’s base case scenario assumes much the same conditions as the EIA’s base case. BP’s base case “assumes that government policies, technology and social preferences continue to evolve in a manner and speed seen over the recent past.”

Under this scenario, BP projects that U.S. tight oil production grows by around five million BPD, peaking at close to ten million BPD in the early 2030s. BP projects in this scenario that U.S. oil producers will take market share from both OPEC and from Russia.

(Click to enlarge)

Projected oil supply and demand picture.

But the BP projections allow that U.S. tight oil could grow faster or for longer than projected in the base case scenario, depending on the availability of finance and resources. For example, if the rig count doubled by 2025, U.S. tight oil could peak earlier at around 12 million BPD but would then decline more rapidly if the same total resource is extracted over the Outlook period.

In BP’s “greater resource” scenario, stronger productivity gains increase recoverable resources. In this case, U.S. tight oil could potentially grow to around 15 million BPD and remain at that level for the rest of the Outlook period.

IEA Forecast

This week the IEA released Oil 2018, its five-year market analysis and forecast. The report notes, “Over the next three years, gains from the United States alone will cover 80 percent of the world’s demand growth.”

Dr. Fatih Birol, the IEA’s executive director, said, “The United States is set to put its stamp on global oil markets for the next five years,” but he also noted that a weak global investment climate raises concerns of supply shortages after 2020.

The IEA projects that global oil production capacity will grow by 6.4 million BPD by 2023. U.S. production, led by an expected doubling of production in the Permian Basin, is projected to rise by 3.8 million BPD by 2023.

One Group Disagrees

Interestingly, some U.S. oil producers dispute these rosy growth scenarios. This week Mark Papa, former CEO of EOG Resources and presently chairman and CEO of Centennial Resource Development, told The Wall Street Journal that he is skeptical of the forecasts that U.S. production growth will swamp global supplies.

Papa noted that most of the best drilling locations in North Dakota and South Texas have already been drilled. He further stated that there are operational challenges in getting that oil produced — a factor I also highlighted in a previous column.

Continental Resources CEO Harold Hamm has also questioned these optimistic production forecasts. Hamm has called EIA projections “just flat wrong” and warned that such high projections are distorting global oil prices.

Of course, Papa and Hamm would both benefit from higher oil prices, so it’s fair to speculate that their opinions on the matter may not be wholly objective. Related: Post Tillerson: Is The Iran Nuclear Deal At Risk?

Conclusions

In any case, it seems likely that U.S. tight oil production will continue to grow for the foreseeable future. That presents both risks and opportunities. There is little doubt that many financially disciplined oil companies and oilfield services companies will profit from this growth.

The risk, of course, is that such strong production growth leaves little room for other producers around the globe to increase production. This potentially puts OPEC in an awkward spot — one that could eventually lead to another price war.

By Robert Rapier

More Top Reads From Oilprice.com:

- EIA Stuns Oil Market With Huge Inventory Build

- Alberta Ready To Fight For Trans Mountain Oil Pipeline

- Chinese Oil Production Hits Record Low

Their credibility has been questioned by so many organizations and experts around the world prominent among them is MIT, the Saudi oil minister, Mr Khalis al-Falih and pioneers in shale oil production such as Mark Papa, CEO of EOG Resources who told the Wall Street Journal that he is sceptical US production growth will swamp global supplies and Harold Hamm, CEO of Continental Resources who also questioned these optimistic production forecasts. Hamm has called EIA projections “just flat wrong” and warned that such high projections are distorting global oil prices.

The EIA, IEA, BP and the Financial Times will always try to depress oil prices with their hype about increases in US oil production and significant build in US oil inventories, but the global oil market has seen through their ploys. They failed in 2017 to prevent the oil price breaking through the $60 barrier and they will definitely fail in 2018 to prevent the price from breaking through the $70 barrier.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

Mr. Hamm & Papa both have proven to investors that they have restraint & excellent ND positions. My partners & I can vouch for Mr. Hamm & Papa, we’ve done business with them for years. They have a considerable inventory & yet Hamm/Papa are showing excellent restraint with vs. pumping like madmen. Hamm’s crews fracked a DUC 5113 IP BO only not E new well last week, that’s no fluke.

Accidentally stumbled on a MONSTER Three Forks CLR Hamm well, Dunn county ND.

Last week CLR had a well go offline during neighboring frac to IA 1 mile from our interests. Looked records up & it’s sitting with only a 813 IP bo. But THING IS it has 1.6m cum bo since 2011 & has pumped at rates not known by anyone not watching ND well performance. Lazy analysts these days baffle some, but not us ND families following the industry.

If your Thinking what the speculators want you to think, Bakken folks will chuckle all the way to the bank. The facts are in the geology & the extraction rates or overall per well EURs.

Cheers