The U.S. Administration’s decision to grant waivers on its Iran sanctions has placated fears that legal Iranian volumes will completely disappear from global markets. For many weeks and months, it seemed that the Trump Administration would relentlessly push the sanctions through; however, in the end it prioritized midterm elections and a more gradual implementation of sanctions, (temporarily) marginalizing National Security Advisor John Bolton. In October, Iran exported or placed into floating storage 1.7-1.8 mbpd of crude, a number that left it roughly flat month-on-month and everyone expected the November export debacle. However, under the U.S. sanctions, the eight “constituencies” that were granted Significant Reduction Exemption (SRE) have the possibility to import up to 1.5 mbpd, making the sanctions whammy largely rhetoric. Yet the devil, as usual, is hidden in the details.

(Click to enlarge)

China and India were the largest markets for Iranian crude before the onset of sanctions and will remain such for the upcoming six months. More than 29 percent of all Iranian crude exports this year went to China and after November 4, Beijing’s share will increase to around 33 percent. India will remain the second-largest importer, taking up around one-fifth of the total, followed by South Korea which has had difficulties replacing South Pars condensate with other grades, forcing it to revert to Iranian volumes despite a weak naphtha market currently. It would…

The U.S. Administration’s decision to grant waivers on its Iran sanctions has placated fears that legal Iranian volumes will completely disappear from global markets. For many weeks and months, it seemed that the Trump Administration would relentlessly push the sanctions through; however, in the end it prioritized midterm elections and a more gradual implementation of sanctions, (temporarily) marginalizing National Security Advisor John Bolton. In October, Iran exported or placed into floating storage 1.7-1.8 mbpd of crude, a number that left it roughly flat month-on-month and everyone expected the November export debacle. However, under the U.S. sanctions, the eight “constituencies” that were granted Significant Reduction Exemption (SRE) have the possibility to import up to 1.5 mbpd, making the sanctions whammy largely rhetoric. Yet the devil, as usual, is hidden in the details.

(Click to enlarge)

China and India were the largest markets for Iranian crude before the onset of sanctions and will remain such for the upcoming six months. More than 29 percent of all Iranian crude exports this year went to China and after November 4, Beijing’s share will increase to around 33 percent. India will remain the second-largest importer, taking up around one-fifth of the total, followed by South Korea which has had difficulties replacing South Pars condensate with other grades, forcing it to revert to Iranian volumes despite a weak naphtha market currently. It would be myopic to see the eight SREs as anything but diplomatic maneuvering – a commitment not to antagonize China and India too much, at the same time taking a poke at European nations that intended to run a joint campaign against Trump’s unilateralism. In fact, it is by no means a coincidence that the only EU countries to receive waivers are Eurosceptic outliers.

The chosen group of eight accounted for 80 percent of Iranian exports last year and 83 percent this January-October. Thus, the stated ambition to “bring Iran down to zero” seems to be off the agenda for now, or at least temporarily delayed until April 2019. The next round of U.S. sanctions does create a new modus vivendi, a more constrained and painful for Iran, yet allow for some breathing space. But let’s take a closer look.

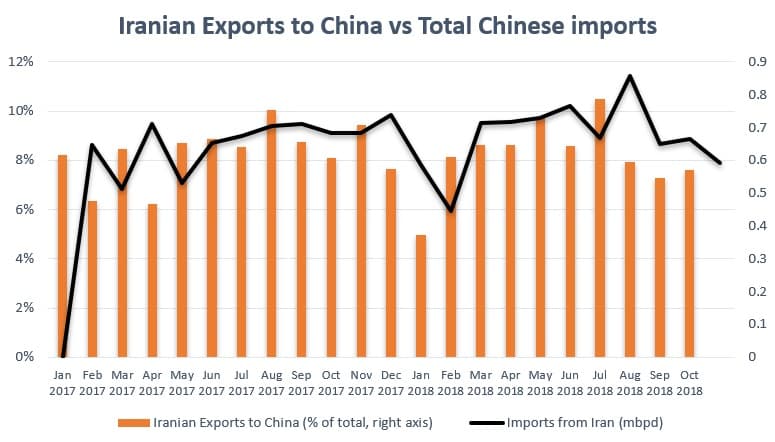

1. China: allowed to import 0.5 million barrels per day.

China is expected to import around 0.5 mbpd in the upcoming months covered under the waivers’ duration, a slight drop from its August-October imports that averaged 0.63 mbpd. China’s importance to Iran is also underpinned by the fact that NIOC has decided to use bonded storage in Northeastern Chinese ports such as Zhoushan and Dalian, simultaneously with filling up part of its VLCC fleet around Kharg Island to repeat the floating storage story of the previous U.S. sanctions levy. Apart from Trump’s drive to keep fuel prices down, the possibility of Chinese retaliation was the most important factor in the waivers’ taking place in the first place. Oftentimes you would encounter 0.35mbpd as the allocated monthly volume, however, this does not take into account equity barrels from Iran (which, by the way, China might boost in case it decides to invest even more in Iran).

(Click to enlarge)

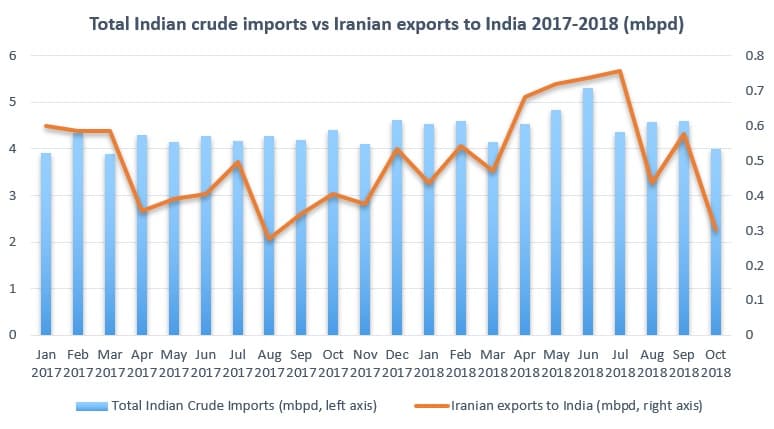

2. India: 0.3 million barrels per day.

India is the second largest buyer of Iranian crude and due to a plethora of reasons – rupee depreciation and possibility of using rupees instead of U.S. Dollars, geographical proximity etc. – made its intention to stick to some portion of Iranian imports well known before the waivers announcement took place. For instance, Indian refiners nominated 9 million Iranian barrels (roughly 0.3 mbpd) for November 2018 in times when the public was still unaware that the waivers would be issued. Now we know that the Indian waiver stipulates exactly such an amount – 0.3 mbpd – half of the 2017-2018 average of 0.65mbpd. As opposed to Northeast Asian refiners, India takes only a small volume of condensate and rather imports Iranian Heavy and Soroosh.

(Click to enlarge)

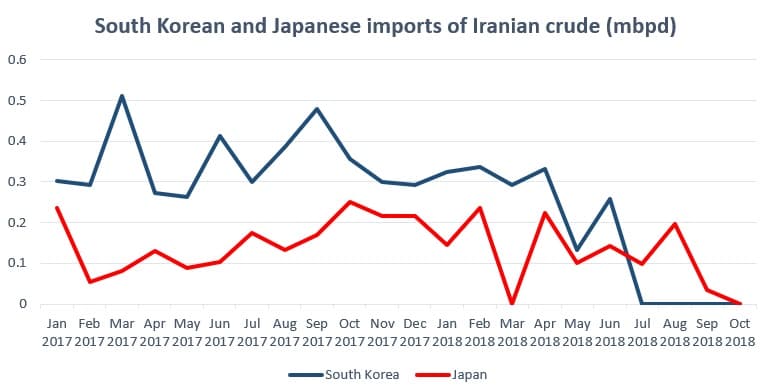

3. Japan and South Korea: 0.25-0.3 million barrels per day.

Both Japanese and South Korean authorities have confirmed that they will start buying Iranian crude again as soon as possible. The two nations spearheaded the sanctions compliance drive in Asia Pacific, demonstrating commitment to comply as they still fall under Washington’s security umbrella, with South Korea weeding out Iranian imports in July, whilst Japan bought its last cargo in September. Both are expected to buy primarily South Pars Condensate (150-200kbpd for South Korea and around 100kbpd for Japan), baseload feedstock for numerous splitters there. In the pair of two, it is missing South Korean volumes that would sting Iran more as its 2017 import average was almost half of the currently allocated one – 350 kbpd. Iran, however, has taken steps not to let its Pars condensate go to waste, most notably by ramping up production at its Persian Gulf Star Condensate Refinery in Bandar Abbas.

(Click to enlarge)

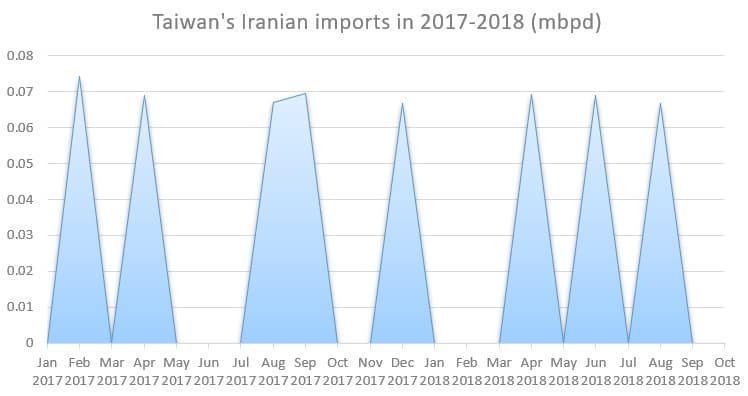

4. Taiwan: 0.05 million barrels per day.

The inclusion of Taiwan into the list of eight is the biggest mystery of the US Administration’s decision, as Iran is a largely irrelevant supplier to this “jurisdiction”, to use Secretary of State Pompeo’s wording. In the past two years, Iranian exports to Taiwan have never climbed above 100kbpd on a monthly basis, in fact Iran accounts only for 2-3 percent of its total needs. The United States, Saudi Arabia and the United Arab Emirates are Taiwan’s largest suppliers, jointly making up two-thirds of its imports (23-23-19 percent). Thus, the Taiwan waiver is a largely symbolic measure, a token of appreciation if you wish towards Taiwan’s siding with the US – given that the US has sanctioned Iran’s financial system, too, the jurisdiction lacks the ties and channels to conduct any sort of substantial trade with Iran.

(Click to enlarge)

5. EU countries and Turkey: 0.25 million barrels per day.

The Trump Administration has granted waivers to Greece and Italy, whose refineries have been traditionally using Iranian grades. Yet European countries are the weakest link of the exemptions – it is widely expected that Greek and Italian interest in resuscitating Iranian imports will be minimal and that it is them that “will bring their imports to zero within weeks”, as State Secretary Pompeo stipulated. The choice of the two is a highly politicized one, too – the U.S. Administration has highlighted that it would not grant waivers to the European Union as a whole, rather chose two countries which demonstrated anemic support for intra-EU measures against the U.S. sanctions. In fact, Spain has imported twice as much Iranian crude as Greece this year (heretofore 46 million barrels in total), yet did not get a waiver despite its refineries being geared to Iranian.

(Click to enlarge)

In a similar fashion, France, whose Total was one of the largest investors in Iran’s upstream sector with its South Pars 11 project, imported as much crude as Greece (16 million barrels), yet saw its waiver claim rejected already in June this year. Turkey found itself in a much more comfortable negotiating position that its European counterparts because all the geopolitical noise notwithstanding, the U.S. needs an ally in Ankara. As a consequence, no one was really surprised to see a mutually acceptable waiver volume of 0.1-0.15 mbpd of Iranian imports for Turkish refiner TUPRAS and others. Turkey already lowered its intake of Iranian this year from 0.22 mbpd in 2017 to 0.15 this January-October, so sticking to the foreordained path is the path to follow.

All in all, one can see that the U.S. waivers were a finely deliberated diplomatic move and that the oft-promised punishment vis-à-vis Iran is still yet to come. The Trump Administration has dealt a heavy blow on Tehran – at the end of the day, it has managed to clear 1 million barrels per day worth of Iranian exports within six months – yet that blow is far from being fatal, at least as long as oil prices remain above the 57 USD per barrel Iran needs to balance out its budget. November 2018 will be the worst Iranian month of the year, reflecting Asian sanction fears with exports skirting the 1mbpd figure, yet afterwards the waivers will allow Iran to rebound back to a more comfortable level of 1.3-1.4 mbpd.