Friday August 31, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

(Click to enlarge)

Key Takeaways

- Crude inventories dipped more than expected, helping to push up oil prices this week.

- Unlike in previous weeks, imports remain subdued.

- Gasoline demand was up sharply, and stocks were down, another bullish sign.

1. Midland discount rises to more than $20 per barrel

(Click to enlarge)

- The discount for Midland WTI relative to WTI in Houston surpassed $20 per barrel in recent days.

- That means that for oil producers in West Texas who have not secured pipeline space or hedge for their production, they are selling their oil on the spot market somewhere in the mid-$40s per barrel, while WTI sits near $70.

- The pipeline crunch is expected to grow worse this year as more output comes online, which means the discount is not going away.

- This will damage cash flow for Permian drillers for the next few quarters, and they should underperform E&Ps focused on the Eagle Ford and Bakken for the next year or so.

2. Argentina’s peso crashes again

(Click to enlarge)

- Argentina’s peso has lost more than 50 percent of its value this year, and its descent continues.…

Friday August 31, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

(Click to enlarge)

Key Takeaways

- Crude inventories dipped more than expected, helping to push up oil prices this week.

- Unlike in previous weeks, imports remain subdued.

- Gasoline demand was up sharply, and stocks were down, another bullish sign.

1. Midland discount rises to more than $20 per barrel

(Click to enlarge)

- The discount for Midland WTI relative to WTI in Houston surpassed $20 per barrel in recent days.

- That means that for oil producers in West Texas who have not secured pipeline space or hedge for their production, they are selling their oil on the spot market somewhere in the mid-$40s per barrel, while WTI sits near $70.

- The pipeline crunch is expected to grow worse this year as more output comes online, which means the discount is not going away.

- This will damage cash flow for Permian drillers for the next few quarters, and they should underperform E&Ps focused on the Eagle Ford and Bakken for the next year or so.

2. Argentina’s peso crashes again

(Click to enlarge)

- Argentina’s peso has lost more than 50 percent of its value this year, and its descent continues. On Wednesday, the peso fell by 7.5 percent against the dollar.

- Earlier this year, Argentina secured a $50 billion bailout package from the IMF, and its central bank has dramatically hiked interest rates in an effort to stop the slide in the peso, although those efforts have clearly been insufficient.

- The peso crisis now rivals the damage done to Turkey’s lira. More broadly, the decline of a range of emerging market currencies poses downside risk to the global economy.

- Not only will a slowdown hurt crude oil demand generally, but these sharp dips in emerging market currencies will make crude oil – which is priced in U.S. dollars – vastly more expensive, potentially causing a deeper decline in demand.

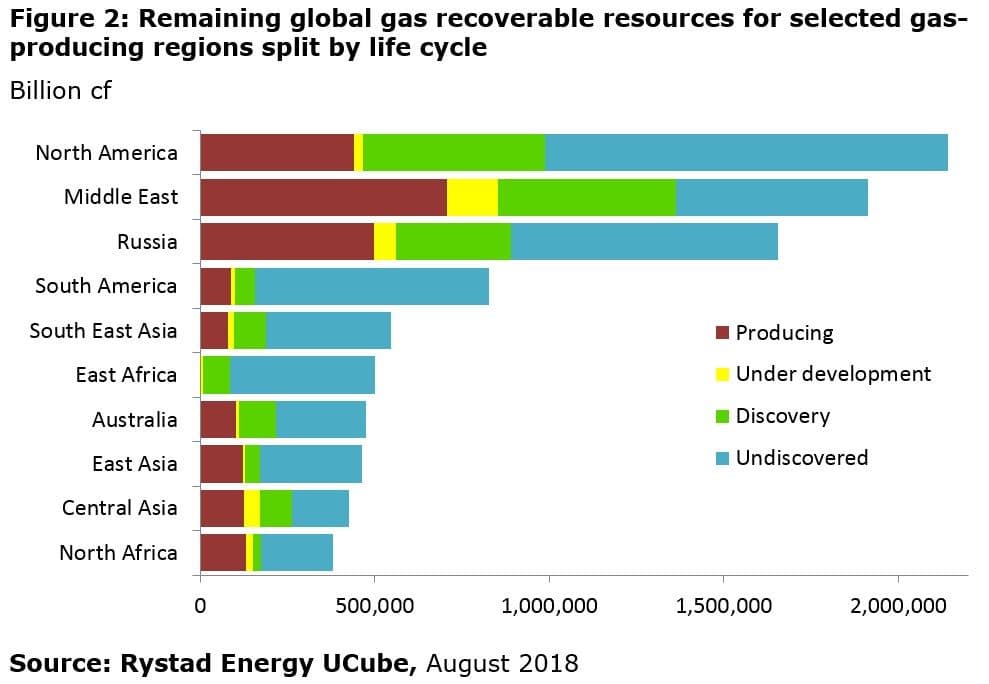

3. North America largest gas producer, largest reserves yet to produce

(Click to enlarge)

- North America is the largest natural gas producer in the world, expected to average 98 billion cubic feet per day (Bcf/d) this year, according to Rystad Energy. 70 percent of that figure is shale gas.

- Russia is the second largest producer at 67 Bcf/d.

- About half of the remaining global recoverable dry gas resources are located in North America, the Middle East and Russia. North America has the largest remaining reserves.

- These resources are concentrated in the Marcellus and Utica shale plays in Appalachia, the Montney shale in Alberta, and the Permian and Eagle Ford shales in Texas.

- North America also has the lowest breakeven prices in the world at about $4.8/kcf, Rystad Energy says. In the Middle East, breakevens average $5.3/kcf, and in Russia it stands at $6.3/kcf, and higher elsewhere.

- In short, natural gas is expected to see significant growth going forward, and much of the action will be concentrated in North America.

4. Iran’s oil exports falling

(Click to enlarge)

- U.S. sanctions on Iran’s oil exports are set to take effect in about two months, but shipments are already declining faster than expected.

- Iran’s oil exports have declined from 2.68 million barrels per day (mb/d) in April to 2.34 mb/d in July. August is shaping up to be the worst month yet, with a steep drop to 1.66 mb/d.

- The losses are set to continue unabated through the rest of this year, and according to SVB Energy International, the losses in the coming months could look roughly like this: Exports declining to 1.4 mb/d in September, 1.2 mb/d in October and finally to 0.8 mb/d in November. It’s an estimate of what is possible, not necessarily intended to be precise figures. Still, it is illustrative of the magnitude of the coming decline.

- European refiners have already been slashing purchases, and India is negotiating with the U.S. over sanctions waivers contingent upon steep declines in imports from Iran.

- Banks and shipping insurance companies are closing the door on Iran, making it difficult for Iran to attract buyers.

- This creates upside risk to oil prices. “I am not sure this drop is really got priced in,” Helima Croft, the chief commodities strategist at Canadian broker RBC, told the Wall Street Journal. “Many markets participants still seem to believe that the decline will be smaller because President Trump would not dare risk overt tightening the market.”

5. Natural gas flaring

(Click to enlarge)

- A pipeline shortage in the Permian for natural gas has translated into a spike in flaring this year.

- The Wall Street Journal estimates that $1 million worth of natural gas is burned every day in the Permian.

- Permian drillers are flaring more than 300 million cubic feet of gas every single day, or about 3 percent of the total gas produced in the region.

- The flaring produces greenhouse gases that are roughly equivalent to the emissions from 2 million cars, the WSJ says.

- Texas regulators have declined to rein in the practice. “There’s nothing for us to do,” Ryan Sitton, a member of the Texas Railroad Commission, which regulates oil and gas operations, told the WSJ. “If gas becomes a waste product, people will flare it.”

Heard on the Street

U.S. stocks draw, demand looks robust, and Iran sanctions loom

“[In view of the latest price dynamism and the visibly growing market uncertainty ahead of the Iran sanctions, we do not rule out a short-term price rise to $80 per barrel.” – Commerzbank

Non-OPEC supply set to rise sharply

“Heading into 4Q18, we now expect a further bump up in global production coming from non-OPEC countries. Currently, non-OPEC supply outages are at a 15 month high of 730 kb/d. However, nearly half of these volumes are in the process of being restored as Canadian Syncrude facilities resume operations. Also, the recently announced Sudan-South Sudan agreement may allow volumes there to recover. Furthermore, the ramp up of greenfield projects in Canada and Brazil, and growth from tight oil producers in the US should provide a substantial boost to non-OPEC supplies over the course of 2H18, taming upside pressures on Brent crude oil prices.” – Bank of America Merrill Lynch

Natural gas storage levels exceptionally low, but no cause for concern

“We expect a fundamentally tight start to the 2018/2019 winter and then a gradual giving way to a looser market in the spring and summer. Led by a wave of new LNG facilities coming online, we expect demand growth to be stout, but even stronger increases in gas production should outweigh to push prices down – assuming pipes come online as expected.” – Barclays

6. Brazil’s decline rates have led to disappointing production

(Click to enlarge)

- The oil market downturn that began in 2014 forced savage cuts to spending, which translated into faster decline rates at older fields.

- Brazil has long been held up as one region that could see enormous supply increases from the prolific pre-salt oil fields. But rapid decline from existing fields have offset production gains.

- In 2017, Brazil only added 130,000 bpd, disappointing estimates “due to freefalling production in the Campos Basin,” according to Bank of America Merrill Lynch.

- The recent rebound in prices could slow the decline.

- “In 2018, upstream capex has rebounded further and the global drilling activity has rebounded which are likely contributing to slower decline rates,” BofAML said in a note.

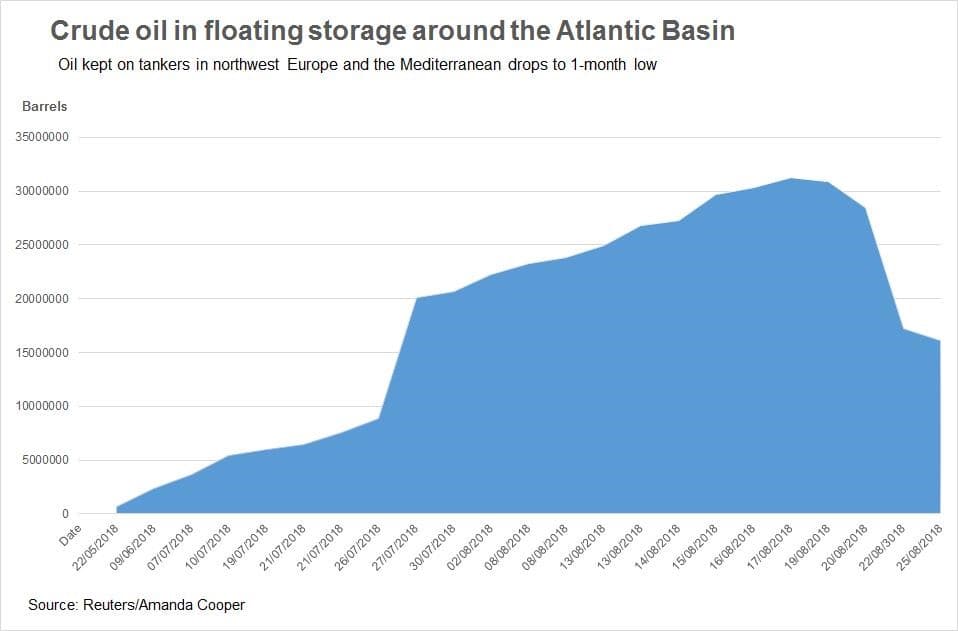

7. Floating storage declines as Iran cuts loom

(Click to enlarge)

- Oil sitting in floating storage in the Atlantic Basin has fallen by half in recent weeks, “suggesting oil traders are bracing for a further supply loss from Iran,” according to Reuters.

- Floating storage surged this summer in the Atlantic Basin on higher OPEC production, U.S. oil exports, a return of Libyan and Nigerian supply, and a weaker oil futures structure that incentivized storage.

- But the surplus is rapidly eroding as refiners stock up ahead of supply losses from Iran.

- Reuters said that as recently as one week ago oil traders reported a surplus of around 30 cargoes, equivalent to 930,000 bpd. Now just a handful of cargoes remain unsold

- The move suggests a return to backwardation for oil futures, a tighter market, and potentially higher prices.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.