The bullish news of the OPEC+ output cut is wearing off, and the market is once again focusing on the possibility of a global recession.

Reader Update: The most recent Intelligent Investor report for GEA subscribers details the strengths and weaknesses of two promising oil stocks. The 10-page report is exactly the kind of thing energy investors should be reading ahead of a potential oil price rally. As a member of Global Energy Alert, you will get this report and immediate access to every other report we’ve ever published.

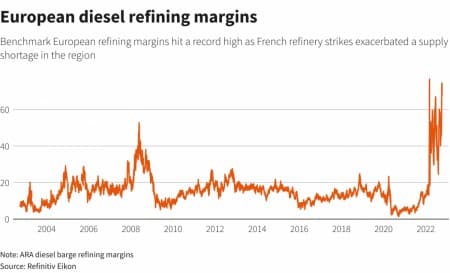

Chart of the Week

French refinery strike aggravates middle distillate pain

- Diesel cracks have hit all-time highs this week in both Europe and North America as an already super-tight inventory situation has been aggravated by the ongoing French refinery strike.

- With the first refinery walkouts starting September 20, France’s refining capacity was reduced to a little below 40% of nameplate capacity, forcing Paris to release strategic product stocks.

- As the U.S. is heading into harvest season with diesel inventories 20 million barrels lower than a year ago, the U.S. still exports diesel into Europe despite unprecedentedly tight physical availability.

- According to Reuters calculations, the benchmark European diesel refining margin and US distillate margin shot up to $77/barrel on Monday, easing somewhat to around $70/barrel in today’s trading.

Market Movers

- U.S. major ExxonMobil (NYSE:XOM) is reportedly considering buying Denbury Inc. (NYSE:DEN), a EOR specializing oil producer – even though there is still no final decision made, the firm’s stocks went up 8% yesterday.

- In a spectacular case of hedging gone awry, shale producer EOG Resources (NYSE:EOG) paid $847 million to settle wrong-way hedges on flat prices of oil and gas in Q3 2022 alone.

- Technology firm Honeywell (NASDAQ:HON) is preparing to roll out a new technology that would produce lower-carbon jet fuel from ethanol, lowering GHG emissions by as much as 80% compared to oil.

Tuesday, October 11, 2022

Amidst the endless seesawing of oil prices, last week’s strong OPEC+ message continues to reverberate in the markets, primarily in the United States where the drastic production cut has nudged legislators to reevaluate their relationship with Middle Eastern kingdoms. Yet another topic emerged this week, an evergreen classic pushing oil prices down – Chinese COVID lockdowns are back on the agenda as the cities of Shanghai and Shenzhen are increasingly likely to see movement restrictions amidst a flareup in infection cases.

U.S. Might Revive NOPEC. U.S. lawmakers are considering passing legislation that would target OPEC on the grounds of the oil group breaching antitrust legislation, potentially even reviving the NOPEC legislation from earlier years, remove U.S. troops stationed in Saudi Arabia and UAE and cut arms supplies.

Iranian Deal Still a Distant Possibility. U.S.-Iranian nuclear talks on how to revive the 2015 JCPOA agreement are likely to resume after the U.S. midterm elections on 8 November, said the Russian envoy to the Vienna talks, saying the sides are “5 seconds away” from reaching a final agreement.

Historic Lebanon-Israel Deal Within Arm’s Reach. According to news reports, the government of Lebanon is satisfied with the latest draft of a U.S.-brokered maritime border deal with Israel, saying that it satisfies all of its requirements and could imminently lead to a “historic” deal.

Heavy Rainfall Endangers India Harvest. As if the Russia-Ukraine war were not enough, heavy rainfall in India has damaged key summer crops such as rice, soybean, and cotton, putting quite an upside pressure on inflation (already at 7%) and potentially forcing the Bank of India to raise interest rates again.

Germany Still Mired in Disagreement. The German government has failed to approve a draft law that would put two of the country’s last nuclear power plants on reserve after their halt in late 2022, following an objection from the finance ministry that the lifespan extension should be longer than April 2023.

Alberta Rises Against Federal Government. Canada’s province of Alberta is set to mount a battle against the Trudeau federal government after Danielle Smith was voted in as its new premier, pledging to defy federal laws it does not like and legally challenge the government’s carbon tax.

Money Keeps on Flowing Out of Markets. The exodus of investors from global bond and equity fund markets continues as last week saw the seventh straight week of withdrawals, totaling almost $25 billion, whilst the money markets saw a net influx of $63 billion, the highest weekly figure since July.

UN Agrees on Joint Aviation Goals. The International Civil Aviation Organization (ICAO) agreed to a long-term goal of reaching net-zero aviation emissions by 2050 despite challenges from China saying developing nations are unlikely to meet that goal.

European Gas Price Fall to Lowest Since July. Europe’s benchmark TTF spot prices have dropped to their lowest in three months, at €160 per MWh or $51/mmBtu, as a milder-than-expected autumn has been keeping market sentiment upbeat, buttressed by ample supplies of LNG arriving to Europe.

French Strikes Plunder Product Stocks. With refinery strikes moving into their fourth week in France, the largest trade union CGT declined to end blockades of downstream assets in return for TotalEnergies’ (NYSE:TTE) to bring wage talks forward, with fuel output already 60% down.

Russia Seizes Last Western-Led Oil Project. Russian President Vladimir Putin signed a decree establishing a new operator company for the Sakhalin-1 oil and gas project, the last PSA agreement to be still led by a Western firm – ExxonMobil (NYSE:XOM) – as sanctions brought its production to a halt.

Austria Sues EU For Greenwashing. The government of Austria has filed a legal challenge against the European Union’s classification of nuclear energy and gas as “green” in its taxonomy, seeking to enlist as many other countries (Germany or Denmark) into the legal action as possible.

Saving California’s Oil Producers. According to recent rumors, California-focused oil producer Berry Corporation (NASDAQ:BRY) is exploring strategic options that could lead to its sale – despite being one of the oldest firms in the state, producing oil in California is becoming an increasingly uphill battle as the state is to phase out production by 2045.

By Tom Kool for Oilprice.com

More Top Reads from Oilprice.com:

- OPEC+ Oil Output Hits Highest Level Since April 2020 But Remains Below Target

- The Implications Of U.S. SPR Withdrawals

- Has OPEC+ Dictated The Outcome Of The U.S. Mid-term Elections?