As the US-China trade war seems to be spiraling out of control, not even the renewed conflict potential in the Middle East and ever-tight physical crude supply were enough to produce a more substantial crude price jump. For much of the past seven days, crude prices remained in a limbo when an array of various factors seemed to counteract each other – first global economic growth forecasts for 2019 were cut, then Middle Eastern safety concerns sprung up, then tight supply came into prominence again, only to be eventually overpowered by another buildup of US commercial crude inventories.

As of Wednesday afternoon, global benchmark Brent traded at 70.5-71 USD per barrel, whilst WTI was assessed at 61.2-61.4 USD per barrel.

1. Traders Sell Contaminated Russian Crude to Asia

- The Russian organic chloride contamination saga is edging to its end as Chinese refineries bought most of the crude that was sitting idle in the Baltic Sea for days.

- At least two VLCCs are currently en route to China, MT New Comfort and MT Amyntas, having loaded contaminated Urals from Aframaxes in the region via STS transfer.

- Some 15 distressed Aframax cargoes were stuck in the Baltic Sea after traditional Urals buyers refused to allow cargoes from Ust-Luga – Chinese appetite for risk has cleared more than half of contaminated volumes.

- As per market reports, global trading house Vitol sold a VLCC to Chinese teapot refiner Bora Group, with Unipec sending…

As the US-China trade war seems to be spiraling out of control, not even the renewed conflict potential in the Middle East and ever-tight physical crude supply were enough to produce a more substantial crude price jump. For much of the past seven days, crude prices remained in a limbo when an array of various factors seemed to counteract each other – first global economic growth forecasts for 2019 were cut, then Middle Eastern safety concerns sprung up, then tight supply came into prominence again, only to be eventually overpowered by another buildup of US commercial crude inventories.

As of Wednesday afternoon, global benchmark Brent traded at 70.5-71 USD per barrel, whilst WTI was assessed at 61.2-61.4 USD per barrel.

1. Traders Sell Contaminated Russian Crude to Asia

- The Russian organic chloride contamination saga is edging to its end as Chinese refineries bought most of the crude that was sitting idle in the Baltic Sea for days.

- At least two VLCCs are currently en route to China, MT New Comfort and MT Amyntas, having loaded contaminated Urals from Aframaxes in the region via STS transfer.

- Some 15 distressed Aframax cargoes were stuck in the Baltic Sea after traditional Urals buyers refused to allow cargoes from Ust-Luga – Chinese appetite for risk has cleared more than half of contaminated volumes.

- As per market reports, global trading house Vitol sold a VLCC to Chinese teapot refiner Bora Group, with Unipec sending the other VLCC to the Eastern Chinese port of Ningbo.

- Affected traders like Vitol or Trafigura were reluctant to offer double-digit discounts to European customers and pinner their hopes instead on Saudi Arabia’s oil-burning power plants.

- In the end, however, it was China which seems to be eager to take in the contaminated crude as the corroding qualities of organic chlorides make it dangerous for the Saudis to power burn.

2. Alaskan North Slope Rising to Highest Ever Premium

- The Alaskan North Slope (ANS) has hit a record-high premium to ICE Brent this week, with July delivery cargoes trading at as much as a 1.35 USD per barrel premium over September ICE Brent.

- West Coast refiners have grown a very strong liking for ANS, on the back of arbitration being largely out of question right now due to a relatively extensive WTI-Brent spread.

- Adding to the appreciation of ANS is the gradual decline of Alaskan production – having peaked at 2mbpd in 1988, Alaska now produces less than 0.5mbpd.

- ANS is a 32° API and 0.95 percent Sulphur content medium grade – a perfect fit for California refineries which are generally configured to process heavy crude.

- Even if the West Coast’s (currently quite limited) access to US shale crude were to be improved, California’s refiners would still probably prefer running imported Canadian crude.

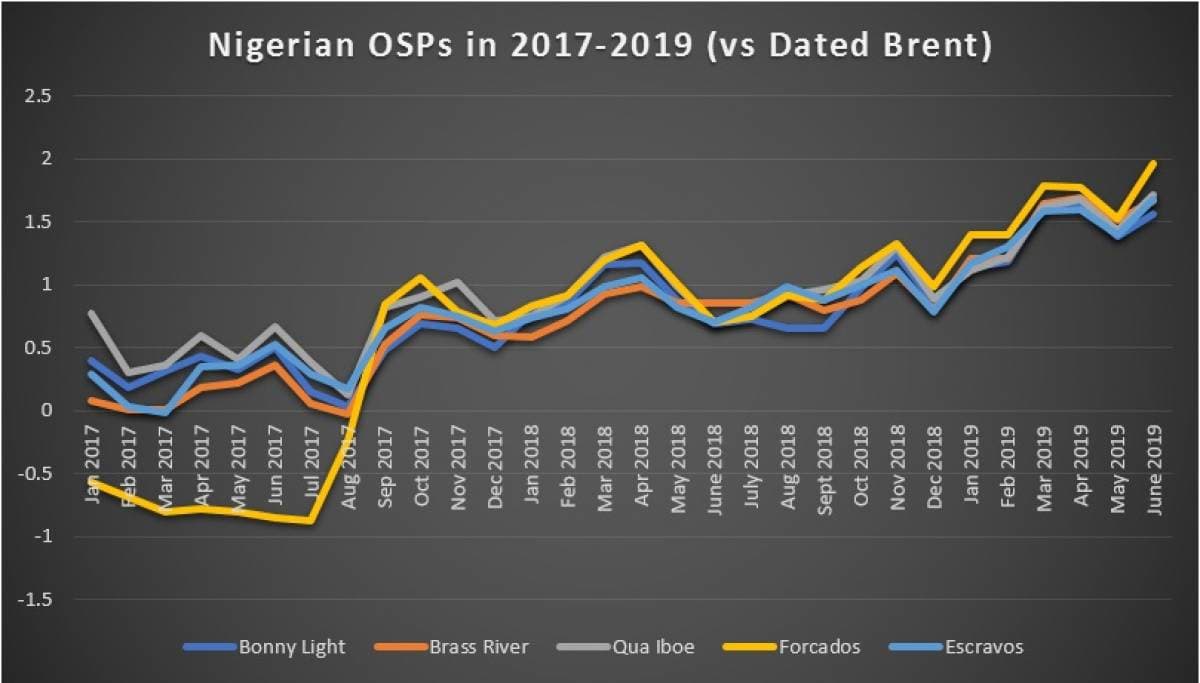

3. Nigeria’s OSPs Bounce Back from May Drop

- The Nigerian oil company NNPC has raised the official selling prices for June-loading cargoes by 20-40 cents per barrel, bouncing back from the May price drop.

- The OSP hike was largely anticipated as European refining margins for gasoline – the indicator of European demand for WAF crudes - overcame the early spring slackness and surged, especially the FOB Rotterdam.

- Qua Iboe, Forcados and Escravos have risen to their highest in years, at hefty premiums to Dated Brent (+1.71 / +1.96 / +1.68 respectively).

- Despite both Bonny Light and Amenam declared force majeure for most of May 2019 after one of the pipelines caught fire, local sources indicate that the loading schedule has so far been kept.

- June crude loadings are expected to surpass 2mbpd for the first time this year, in a quite evident breach of the January-June OPEC+ Agreement which caps Nigerian exports at 1.69mbpd.

- The emergence of new streams, such as the 150kbpd Total-operated Egina field, make it increasingly difficult for the cash-strapped federal government to comply with global commitments.

4. Iran Puts Brave Face on Sorry Business

- The Iranian national oil company NIOC raised all its June-loading official selling prices, in line with other Middle Eastern producers.

- NIOC hiked the prices of Asia Pacific-bound cargoes by 0.35 and 0.65 USD per barrel for Iranian Heavy and Iranian Light cargoes, respectively, still a bit lower than the 0.4-1.2 USD per barrel increase by Saudi Aramco.

- The Iranian Light-Arab Light and Iranian Heavy-Arab Medium differentials remain thus the widest in more than 20 years.

- Following through with a peculiar tradition since the last Iranian cargo sailed for NW Europe in July 2018 (a VLCC to the French port of Le Havre), NIOC hiked NW Europe-destined June cargoes by 65-75 cents per barrel.

- June cargoes destined for the Mediterranean were increased by 40-80 cents per barrel, which is pertinent only for Turkey which is still yet to purchase its first post-sanctions cargo.

- Iran exports in April 2019 have averaged around 1mbpd, whilst May has only seen so far two post-waivers loadings.

- MT Hasna loaded on May 06 and is heading to the Chinese hub of Dalian in Liaoning Province, whilst MT Pacific Bravo, loaded May 16, seems to be on its way to Indonesia.

5. Kuwait Releases Unsurprising June-loading OSPs

- The Kuwaiti national oil company KPC has lifted the June-loading official selling prices for its flagship KEC and KSLC crudes, mimicking Saudi Aramco’s move early May.

- June-loading KEB cargoes bound for Asian markets were set at a +1.15 USD per barrel premium over the Oman/Dubai average, hewing off 5 cents from last month’s 0.35 USD per barrel KEB-AXL differential.

- KPC rolled over its US-bound June-loading KEC cargoes, whilst hiking European prices by 0.5-0.6 USD per barrel to reflect Urals still trading at substantial premiums against Dated Brent.

- By increasing the premium of KSLC, Kuwait’s super light grade, by 0.8 USD per barrel month-on-month, June marks the first time ever that the KSLC-AXL differential turned negative.

- Kuwaiti exports in May 2019 have been so far below the 2019 average, with only 1.58mbpd sold as of today, compared to 2.16mbpd in April and 1.86mbpd in March.

6. The US Imports More and More Russian Crude

- The increasingly tighter sour crude market is compelling American refiners to look elsewhere so as to replace lost Venezuelan and Iranian volumes, breathing new life into imports of Russian crude.

- Both in March and April 2019, the US imported 5.3 million barrels of Russian crude (incl. CPC volumes which might be Kazakhstani in origin but exported from the Russian port of Yuzhnaya Ozereevka).

- This year so far the United States has imported 132kbpd of Russian crude, up by almost a third from last year’s 101kbpd.

- In 2015-2017 Russian exports to the US averaged a mere 24kbpd, primarily ESPO Blend destined for US West Coast refiners.

- Even though it is predominantly heavy sour Venezuelan cargoes that became absent from the US refining landscape, heretofore US refiners were buying light sweet CPC Blend and medium Urals from Russia.

7. Saudi Aramco Commits to Port Arthur LNG

- Saudi Aramco signed a 20-year agreement with US LNG producer Sempra Energy, committing to buy 5 million tons of LNG per year from its Port Arthur LNG project.

- With this, Saudi Aramco would account for almost half of Port Arthur LNG’s presumed 11mtpa nominal production capacity (the Polish PGNiG having committed further 2mtpa in December 2018).

- Concurrently, Saudi Aramco agreed to buy 25 percent in Phase I of Port Arthur LNG, raising questions it would carry on with a similar investment into the NOVATEK-led Arctic LNG-2.

- Throughout 2019, there has been a flurry of speculation that Saudi Aramco might be taking a stake of up to 30 percent in $20 billion Arctic LNG-2.

- At present, it seems somewhat unlikely that Saudi Aramco would take home American LNG, most probably it sees Port Arthur LNG volumes as a suitable platform to boost its LNG trading books.