Friday, September 6, 2019

1. Oil surplus not going away

- The oil market could see a supply surplus and inventory builds for the next five quarters, according to Morgan Stanley.

- Morgan Stanley says that the Brent futures curve is currently in a state of backwardation, but that will likely flatten out in the coming months as the glut worsens.

- Backwardation – when near-term futures trade at a premium to longer-dated contracts – is usually a sign of tightness. Contango – when near-term futures trade at a discount – tend to signal looser conditions.

- Currently, the backwardation has held up even as oil prices have been flat.

- “Our inventory days-of-demand cover model suggests timespreads are already elevated versus current inventories, with further builds expected,” the investment bank wrote. The bank predicts the spreads will narrow and flatten by the end of the year.

2. Commodities volatile on trade war

- The amped up rhetoric around the U.S.-China trade war has significantly affected investment flows. As Standard Chartered notes, President trump tweeted about China three times in March, twice in April, but then 58 times in May.

- “The surge in China-related comments in the first half of May represented a significant escalation of trade tensions and was associated with sharp price falls across trade-sensitive commodities,” Standard Chartered said in a note. “Hedge fund positioning also shifted significantly…

Friday, September 6, 2019

1. Oil surplus not going away

- The oil market could see a supply surplus and inventory builds for the next five quarters, according to Morgan Stanley.

- Morgan Stanley says that the Brent futures curve is currently in a state of backwardation, but that will likely flatten out in the coming months as the glut worsens.

- Backwardation – when near-term futures trade at a premium to longer-dated contracts – is usually a sign of tightness. Contango – when near-term futures trade at a discount – tend to signal looser conditions.

- Currently, the backwardation has held up even as oil prices have been flat.

- “Our inventory days-of-demand cover model suggests timespreads are already elevated versus current inventories, with further builds expected,” the investment bank wrote. The bank predicts the spreads will narrow and flatten by the end of the year.

2. Commodities volatile on trade war

- The amped up rhetoric around the U.S.-China trade war has significantly affected investment flows. As Standard Chartered notes, President trump tweeted about China three times in March, twice in April, but then 58 times in May.

- “The surge in China-related comments in the first half of May represented a significant escalation of trade tensions and was associated with sharp price falls across trade-sensitive commodities,” Standard Chartered said in a note. “Hedge fund positioning also shifted significantly in the wake of the May tweets; our crude oil money-manager positioning index (MMPI) slipped from +41 in late-April to -34 at end-May.”

- Gold has performed strongly as investors exit various commodity and equity sectors and rush into gold as a safe haven. More accommodative positions from central banks have also helped gold (although dovish turns haven’t helped other commodities).

- The market is very reactive at the moment, “[I]nvestors are responding solely to a top-down narrative, with individual commodity fundamentals playing a limited role,” Standard Chartered concluded.

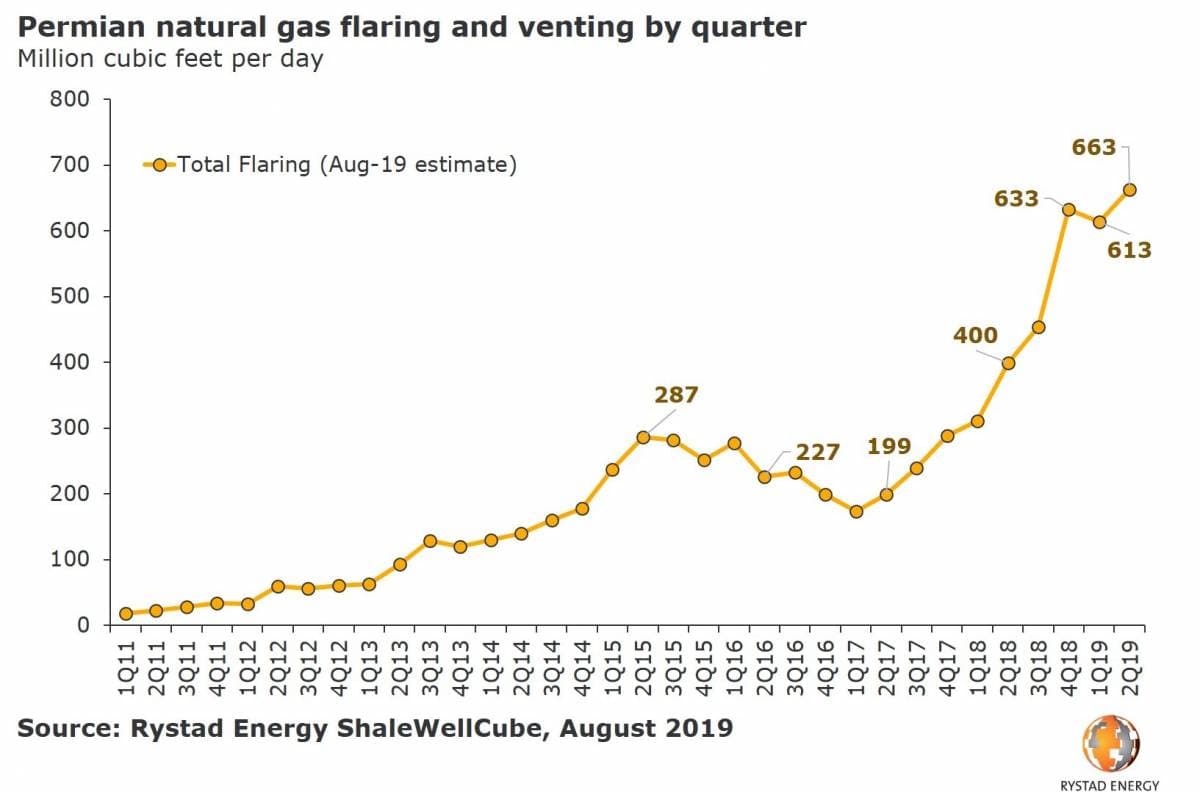

3. Flaring fell in first quarter

- Rampant natural gas flaring in the Permian – due to lax oversight from state regulators and inadequate pipeline infrastructure – hit record highs this year.

- But flaring actually dropped a bit in the first quarter, according to new data from Rystad Energy that showed a downward revision from previous estimates.

- “This is the first time that has happened over the past 1.5 years. Prior to this, gradual upward revisions of previous estimates were the norm,” Artem Abramov, Rystad Energy’s head of shale research, said in a statement.

- However, flaring has continued to rise unchecked. “There are no signs of any significant reduction going forward. On the contrary, the preliminary natural gas flaring estimate for the second quarter this year shows a new all-time high,” Abramov added.

4. Dollar strength has weighed on crude

- The U.S. dollar typically trades inversely with crude oil. A stronger dollar makes oil expensive to much of the world, pushing down demand, while the reverse is also true.

- The recent strength of the dollar has kept oil prices in check, even amid outages and a tightening up of inventories. Emerging market weakness, the U.S.-China trade war, the weakening yuan, and subsequent depreciation of other currencies have conspired to push the dollar up.

- This past week saw some of these trends reverse. The U.S. and China agreed to hold trade talks in October, boosting sentiment. Hong Kong saw a de-escalation of tensions. The UK parliament has acted to reduce the likelihood of a no-deal Brexit.

- “All of this has contributed to higher risk appetite among investors, while at the same time boosting outflows from safe havens such as the US dollar,” Commerzbank wrote in a note. “The oil price and the dollar often follow divergent paths.”

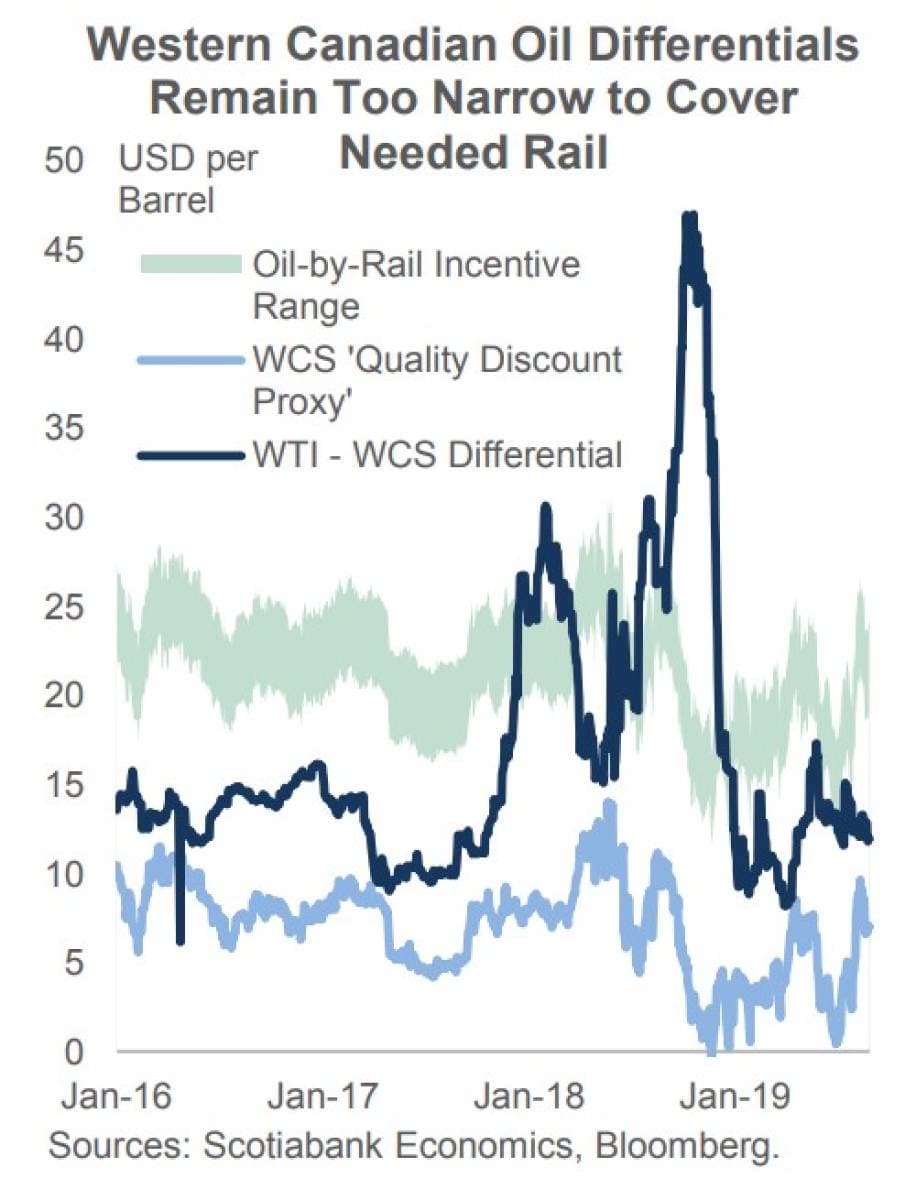

5. Canadian oil prices too high for rail

- The mandatory production cuts from Alberta earlier this year were recently extended through the end of 2020 as pipeline delays push off the date of new midstream capacity.

- The production cuts – originally set at 325,000 bpd, but steadily eased in recent months – have helped to push up Canadian oil prices. Western Canada Select (WCS) sold at a greater-than $50-per-barrel discount last year at its worst. That has narrowed to around $11 to $12 per barrel more recently.

- However, WCS has likely converged too far towards WTI to justify shipping increasing volumes of oil by rail. Rail economics require a WCS discount of at least $15 per barrel relative to WTI, according to Scotiabank.

- “The WCS discount is currently sitting at less than $12 per barrel under WTI, well below the level that allows producers to profitably ship crude by rail,” Scotiabank said in a note.

- In other words, if more oil is going to move by rail – and because of flat pipeline capacity, rail is needed to move additional volumes – WCS prices will need to fall.

6. Permian with low decline rates

- Older shale wells tend to decline by around 20 percent per year without intervention, according to Rystad Energy.

- “Contrary to common belief, the Permian Basin systematically offers the lowest oil decline rates, along with the Bakken Shale,” Rystad said.

- Meanwhile, the Eagle Ford and the DJ basins suffer from much steeper decline rates over the first eight years of production.

- Shale wells see a dramatic drop off in output shortly after an initial peak, with a median decline rate in the second year of production of 62 percent.

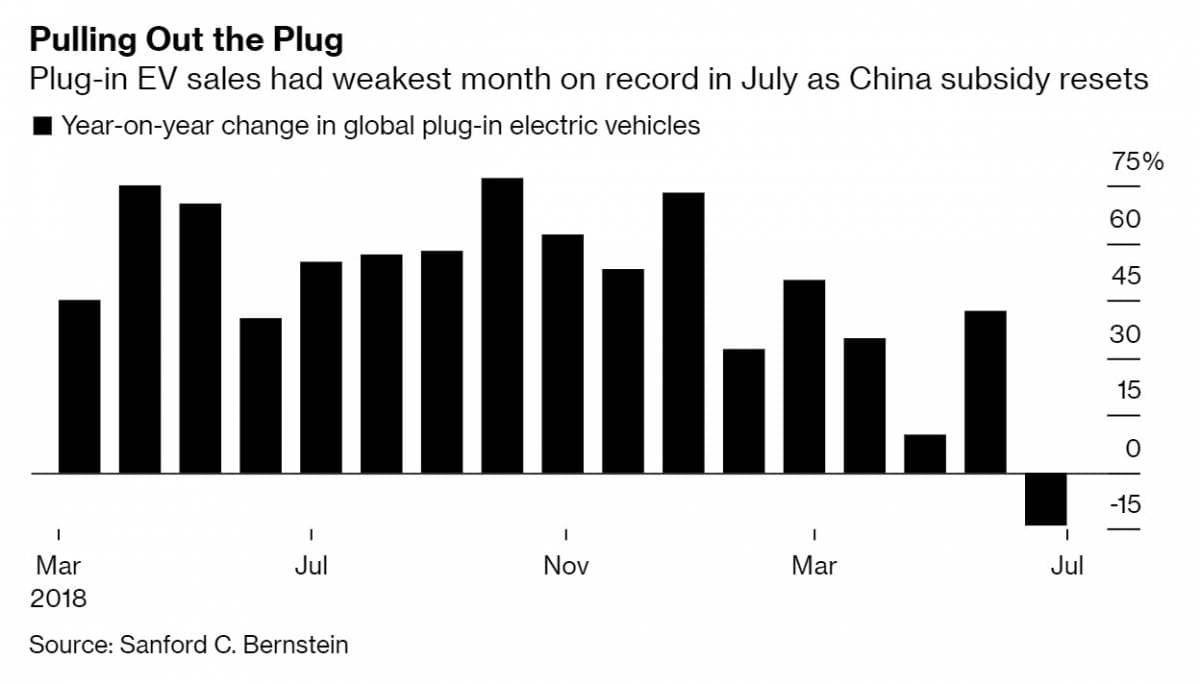

7. EV sales decline for first time

- Global sales of electric vehicles declined year-on-year in July for the first time on record. Sales fell by 14 percent to roughly 128,000, according to Bloomberg and Bernstein.

- The contraction came after China pared-back incentives for EVs. “Unsurprisingly the growth momentum halted in July amid subsidy cuts,” Bernstein analysts said. “Despite expected short-term weakness in 2H19, we continue to be positive on long-term EV demand.”

- In the first seven months of the year, global EV sales grew by 35 percent.

- Full-year sales are expected to still increase by between 23 and 48 percent.