Friday March 2, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Oil outages have declined

(Click to enlarge)

- The volume of unplanned oil production outages has significantly declined in recent years, although much of the restored output has come from Iran, which boosted output following the removal of sanctions in 2016.

- Libya also added capacity back to the market, lowering the overall volume of disrupted supply.

- At the start of 2018, just over 2 million barrels per day (mb/d) of global supply was offline, a figure that is up by nearly 1 mb/d due to outages in Venezuela and Iraq.

- Still, disrupted capacity is relatively low.

- The flip side is that OPEC’s spare capacity – idled capacity that can be ramped up quickly – is also dwindling. When OPEC lets its production limits expire and it ramps up production again, that will add new barrels to the market, but it will also narrow spare capacity further.

- The EIA predicts that global spare capacity will fall to 1.24 mb/d by the third quarter of 2019, a historically low level.

2. Hedge funds shrink bullish bets

(Click to enarge)

- Hedge funds and other money managers have cut their bullish bets for several consecutive weeks, a trend…

Friday March 2, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Oil outages have declined

(Click to enlarge)

- The volume of unplanned oil production outages has significantly declined in recent years, although much of the restored output has come from Iran, which boosted output following the removal of sanctions in 2016.

- Libya also added capacity back to the market, lowering the overall volume of disrupted supply.

- At the start of 2018, just over 2 million barrels per day (mb/d) of global supply was offline, a figure that is up by nearly 1 mb/d due to outages in Venezuela and Iraq.

- Still, disrupted capacity is relatively low.

- The flip side is that OPEC’s spare capacity – idled capacity that can be ramped up quickly – is also dwindling. When OPEC lets its production limits expire and it ramps up production again, that will add new barrels to the market, but it will also narrow spare capacity further.

- The EIA predicts that global spare capacity will fall to 1.24 mb/d by the third quarter of 2019, a historically low level.

2. Hedge funds shrink bullish bets

(Click to enarge)

- Hedge funds and other money managers have cut their bullish bets for several consecutive weeks, a trend that has coincided with a fall back in prices.

- For the week ending on February 20, major investors slashed their combined net long position in six important oil futures and options by the equivalent of a combined 48 million barrels, as Reuters points out.

- The bullish positioning had reached record heights, and it is no surprise that after oil market sentiment started to get a little jittery, investors pocketed profits by selling off their long positions. The speculative selloff likely accentuated the price correction.

- Still, the positioning of hedge funds and other money managers remains bullish, with the long-to-short ratio at nearly 10:1, according to Reuters, down only slightly from the high of 12:1 in January.

3. Smaller E&Ps beating out oil majors on buybacks this year

(Click to enlarge)

- The oil majors have long played an important role for investors, offering solid returns and hefty dividend payouts. More recently, share buybacks have also provided a jolt to share prices.

- However, so far in 2018, while the oil majors still pay out way more in dividends than smaller E&Ps, the latter group is buying back more shares than the majors. It is unclear if this will last.

- Bloomberg Gadfly found that the refining industry is offering a 7 percent yield to investors, compared to just 4 percent for the majors and 4 percent for E&Ps.

- Meanwhile, not all E&Ps are prioritizing shareholders. Investors are probably still better off with the oil majors and their juicy dividends.

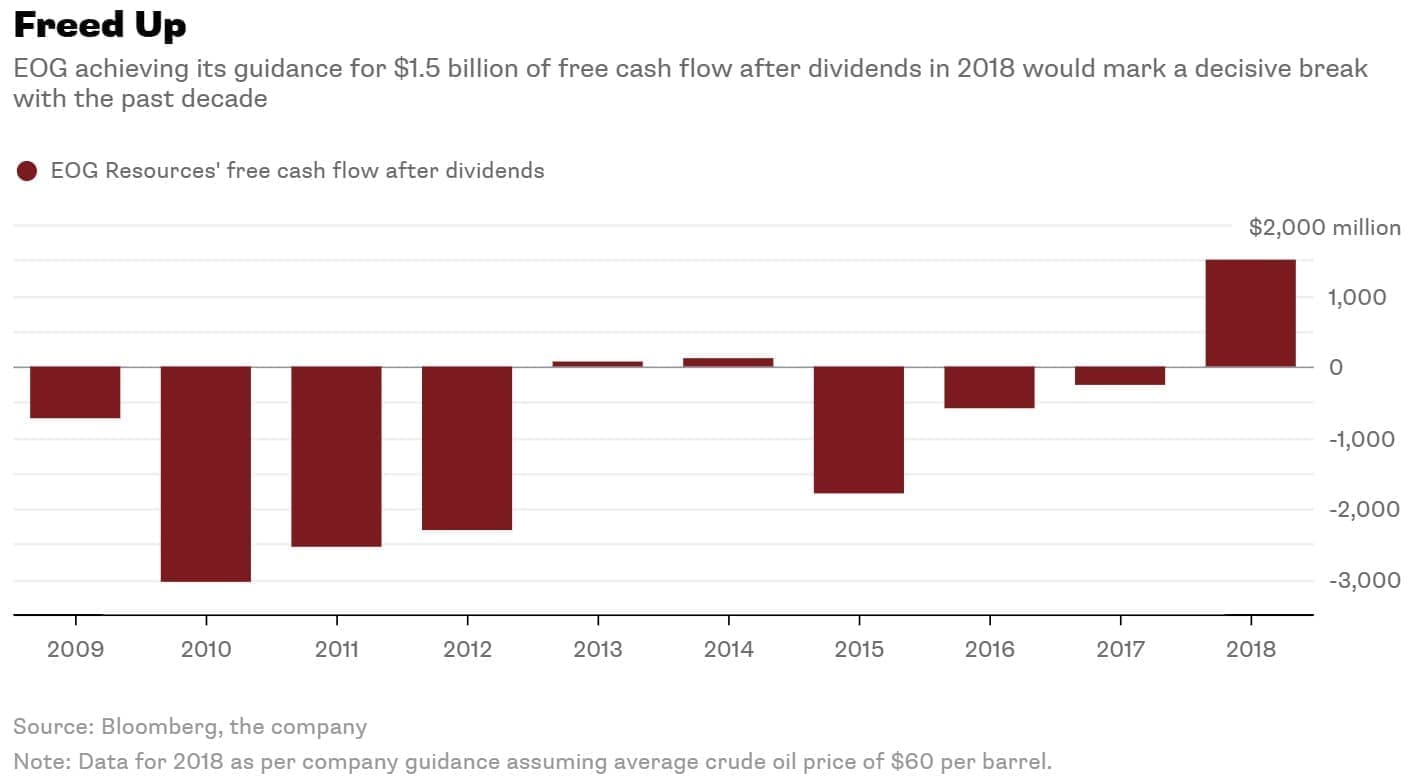

4. Shale eyes profits

(Click to enlarge)

- After years of burning through cash at a torrid pace, many U.S. shale companies are hoping to post profits in 2018, essentially for the first time.

- EOG Resources (NYSE: EOG) is one example. Last year, EOG’s revenue covered capex but not quite the dividend payout. This year, EOG expects to post $1.5 billion in free cash flow after dividends, assuming $60 per barrel.

- That comes despite plans to boost spending by 36 percent this year. Production is also expected to rise by 17 percent.

- In other words, EOG is aiming to boost both spending and production this year, while also improving its cash flow. In the debate over whether to grow production or prioritize shareholder returns, EOG is having its cake and eating it too.

5. Drilling costs on the rise

(Click to enlarge)

- Drilling costs in Oklahoma’s SCOOP and STACK shale plays are expected to rise this year.

- Average drilling and completion costs bottomed out in the third quarter of 2016, according to Rystad Energy, and have since increased by 13 percent in SCOOP and 25 percent in STACK, as of the third quarter of 2017.

- Digging deeper, drilling costs have remained essentially flat, but completion costs have climbed. Now, completion costs account for 55 percent of total costs in SCOOP and 60 percent in STACK.

- However, part of the increase is simply the result of longer laterals. Looking at costs per perforated lateral foot, the cost increases are a more modest 10 percent in SCOOP and 13 percent in STACK, Rystad says.

- Another mitigating factor is that initial production rates are up.

6. Surging shale production cutting U.S. imports

(Click to enlarge)

- U.S. shale production continues to break records week after week. The more oil produced, the less oil is imported from abroad.

- OPEC nations have seen a sharp drop in their market share in the U.S.

- To be sure, Saudi Arabia has intentionally curtailed shipments to the U.S. in an effort to drain inventories. Venezuela’s exports to the U.S. have plunged, in large part, because of its own production problems.

- Iraq has captured some of that lost market share, helping to plug the gap leftover by reduced Saudi and Venezuelan flows. Iraq’s exports to the U.S have topped 700,000 bpd a few times on a monthly basis over the past year, surpassing Venezuela.

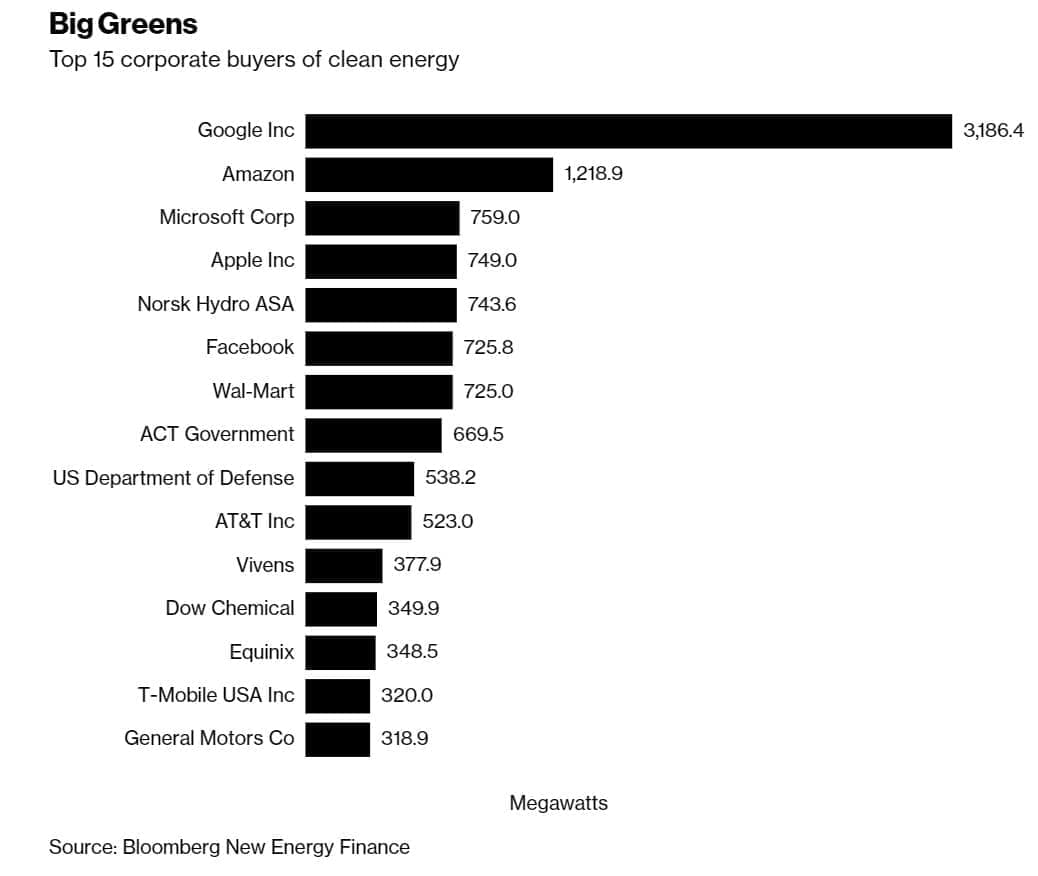

7. $94 billion needed for top 125 corporations to go green

(Click to enlarge)

- One of the biggest drivers of clean energy deployment in recent years has come from major corporations. Google leads the pack with over 3 gigawatts of clean energy procured.

- But for 125 major corporations to follow through on their commitments to switchover to 100 percent clean energy, it would require $94 billion, according to Bloomberg New Energy Finance.

- That would translate into 87 GW of new solar and wind, or about equivalent to the UK’s total electricity capacity.

- These companies have joined the RE100 campaign, which consists of corporations making commitments to go green. Most are aiming to get there by 2030.

- “The clean-energy demands of these corporations will catalyze billions of dollars in clean-energy investment,” Kyle Harrison, a New York-based analyst at BNEF, said in a Bloomberg interview. “Corporations can have a real say in power-market design.”

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.