U.S. West Texas Intermediate and international benchmark Brent crude oil futures are in a position to post solid gains for the week despite below-average volume and volatility toward the latter half of the week. Natural gas is also starting to show signs of life after taking a beating for more than a month.

Crude oil opened the week with a bullish tone as buyers took insurance against a potential supply disruption due to rising tensions between the United States and Iran. Prices were further supported by another bigger than expected drawdown in U.S. stockpiles.

However, the markets became rangebound into the end of the week as many of the major players took to the sidelines ahead of the meeting between U.S. President Donald Trump and Chinese President Xi Jinping at the G-20 summit in Osaka, Japan on Saturday. Also contributing to the range-bound trade was general uncertainty ahead of the OPEC meeting in Vienna on July 1-2.

Natural gas began the week flat despite weather forecasts calling for hot temperatures throughout the United States. Helping to keep a lid on prices were mixed cash prices and strong production. However, the market is likely to finish the week with an upbeat tone following a weaker than expected government storage report and the anticipation of increasing heat over the next 10 to 15 days.

Technical Analysis

Weekly August West Texas Intermediate Crude Oil

The main trend is down according to the weekly swing chart.…

U.S. West Texas Intermediate and international benchmark Brent crude oil futures are in a position to post solid gains for the week despite below-average volume and volatility toward the latter half of the week. Natural gas is also starting to show signs of life after taking a beating for more than a month.

Crude oil opened the week with a bullish tone as buyers took insurance against a potential supply disruption due to rising tensions between the United States and Iran. Prices were further supported by another bigger than expected drawdown in U.S. stockpiles.

However, the markets became rangebound into the end of the week as many of the major players took to the sidelines ahead of the meeting between U.S. President Donald Trump and Chinese President Xi Jinping at the G-20 summit in Osaka, Japan on Saturday. Also contributing to the range-bound trade was general uncertainty ahead of the OPEC meeting in Vienna on July 1-2.

Natural gas began the week flat despite weather forecasts calling for hot temperatures throughout the United States. Helping to keep a lid on prices were mixed cash prices and strong production. However, the market is likely to finish the week with an upbeat tone following a weaker than expected government storage report and the anticipation of increasing heat over the next 10 to 15 days.

Technical Analysis

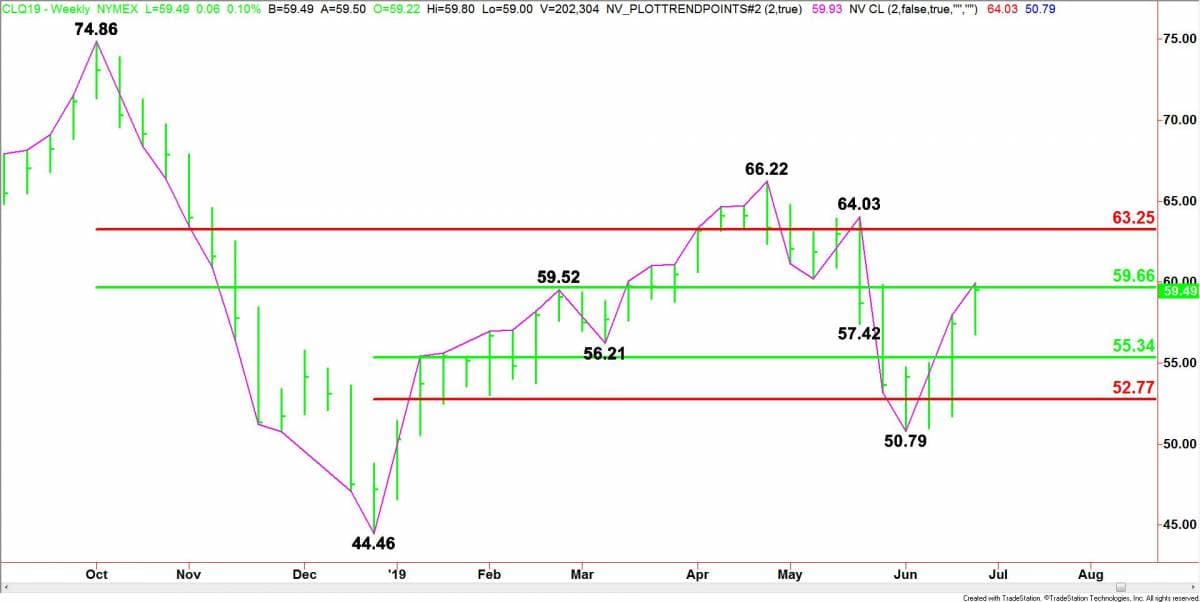

Weekly August West Texas Intermediate Crude Oil

The main trend is down according to the weekly swing chart. However, momentum has been trending higher since the formation of the weekly closing price reversal bottom at $50.79 during the week-ending June 7.

The main trend will change to up on a trade through $64.03. This is followed by another main top at $66.22. A trade through $50.79 will negate the chart pattern and signal a resumption of the downtrend. The next target under this level is $44.46.

The main range is $74.86 to $44.46. Its retracement zone at $59.66 to $63.25 is the primary upside target. This week, buyers drove the market into the lower or 50% level at $59.66. Since the main trend is down, sellers stepped in to stop the rally at $59.93.

The minor range is $44.46 to $66.22. Its retracement zone at $55.34 to $52.77 is its support. This area was straddled for several weeks in early June before prices surged to the upside.

Weekly Technical Forecast

Based on this week’s price action, the direction of the August WTI crude oil futures contract next week is likely to be determined by trader reaction to the main 50% level at $59.66.

Bullish Scenario

A sustained move over $59.66 will indicate the presence of buyers. If this move is able to create enough upside momentum then look for a potential rally into the main Fibonacci level at $63.25. Taking out this level will indicate the buying is getting stronger. It will also put the market in a position to take out the main top at $64.03. Trading through this level will change the main trend to up.

Bearish Scenario

A sustained move under $59.66 will signal the presence of sellers. If this move generates enough downside momentum then look for the selling to possibly extend into the minor 50% level at $55.34. If this fails to hold as support then the minor Fibonacci level at $52.77 will become the next downside target, followed by the main bottom at $50.79. Taking out this level will signal a resumption of the downtrend.

Technical Analysis

Weekly September Brent Crude Oil

The main trend is down. However, momentum has been trending higher since the formation of the weekly closing price reversal bottom at $59.45 during the week ending June 7. The main trend will change to up on a trade through $73.95. A move through $59.45 will negate the closing price reversal bottom and signal a resumption of the downtrend.

The main range is $83.30 to $51.90. Its retracement zone at $67.60 to $71.31 is the primary upside target. This zone is controlling the longer-term direction of the market.

The short-term range is $51.90 to $73.95. If the selling pressure resumes then look for a pullback into its retracement zone at $62.93 to $60.32. Counter-trend buyers could come in on a test of this zone, but if it fails then look for a resumption of the downtrend.

Weekly Technical Forecast

Bullish Scenario

Based on this week’s price action, the direction of the September Brent crude oil market next week is likely to be determined by trader reaction to the main 50% level at $67.60. Overcoming this level will indicate the buying is getting stronger. This could create the momentum needed to overcome the Fibonacci level at $71.31. This is the last potential resistance level before the $73.95 main top.

Bearish Scenario

The inability to overcome $67.60 will signal the return of sellers. The first target is the 50% level at $62.93. If the downside momentum increases then look for the selling to possibly extend into the minor Fibonacci level at $60.32, followed by the main bottom at $59.45. This price is a potential trigger point for an acceleration to the downside.

Weekly Crude Oil Summary

The catalyst behind the price action early next week is likely to be the outcome of the Trump-Xi meeting this weekend. If a deal is struck to resume trade negotiations, then look for an upside bias to develop.

Prices will also be underpinned if OPEC and its allies strike a deal to extend the program to cut production. We could see a surge to the upside if they decide to cut more than the original 1.2 million barrels.

The wildcard will remain U.S. – Iran relations. No one is certain how this will play out at this time, which is one reason why the markets have been supported lately.

Technical Analysis

Weekly August Natural Gas

The price action in the August Natural Gas market isn’t too exciting at this time, but there is potential for a short-term rally if the weather turns hot in key demand areas. In order to generate anything long-lasting, we’re going to need to see a lingering heat dome over a broad-based area, but this isn’t in the forecasts.

The main trend is down according to the weekly swing chart. A trade through $2.745 will change the main trend to up. This is unlikely at this time, but there is room to rally into a series of retracement levels. A trade through $2.134 will signal a resumption of the downtrend.

The short-term range is $2.745 to $2.134. Its retracement zone at $2.440 to $2.512 is the first target. Since the main trend is down, sellers are likely to come in on a test of this zone.

The major range is $3.003 to $2.134. Its retracement zone at $2.569 to $2.671 is another potential upside target.

Conclusion

Keep an eye on this market because there is potential for an upside breakout, but remember the major players are short and it’s going to take a major shift in weather, lower production and stronger cash markets to turn this market bullish. Therefore, the better trading opportunities may be on the short side following the usual seasonal rally.