Last month we wrote a series of notes arguing that risks were either skewed sideways or slightly higher for oil primarily based on the ideas that the US central bank was turning dovish and OPEC+ cuts would tighten physical supply/demand balances. These themes are still the most important sources of risk in the market and we’ve seen key news updates on both items over the last week.

On the central bank front, the Fed’s statement from its recent FOMC meeting took another step in the dovish direction remarking the committee would remain patient in their pursuit of higher interest rates. The overall language of the note took a more accommodative look at employment and inflation trends and seemed increasingly in tune with the idea that the economy needs to be able to run further before policymakers apply the brakes of higher rates. The bankers also noted that they would take slow approach in deciding on whether to continue shrinking their balance sheet. (Our assessment is that Fed balance sheet tightening was a critical driver of stock market and oil prices weakness in 4Q’18.) US Fed officials could ultimately play as important a role as OPEC in shaping oil prices in 2019 and for now they’re clearing the path to higher prices. This could become especially true if US government shutdown, US/China trade or Brexit contagions rise as the central bank could swing even more dovish and work to push asset prices higher.

On the OPEC+ side, January production estimates for the…

Last month we wrote a series of notes arguing that risks were either skewed sideways or slightly higher for oil primarily based on the ideas that the US central bank was turning dovish and OPEC+ cuts would tighten physical supply/demand balances. These themes are still the most important sources of risk in the market and we’ve seen key news updates on both items over the last week.

On the central bank front, the Fed’s statement from its recent FOMC meeting took another step in the dovish direction remarking the committee would remain patient in their pursuit of higher interest rates. The overall language of the note took a more accommodative look at employment and inflation trends and seemed increasingly in tune with the idea that the economy needs to be able to run further before policymakers apply the brakes of higher rates. The bankers also noted that they would take slow approach in deciding on whether to continue shrinking their balance sheet. (Our assessment is that Fed balance sheet tightening was a critical driver of stock market and oil prices weakness in 4Q’18.) US Fed officials could ultimately play as important a role as OPEC in shaping oil prices in 2019 and for now they’re clearing the path to higher prices. This could become especially true if US government shutdown, US/China trade or Brexit contagions rise as the central bank could swing even more dovish and work to push asset prices higher.

On the OPEC+ side, January production estimates for the cartel came in this week and the Saudis clearly mean business in tightening the market. The Kingdom cut production by 450k bpd in January which was exacerbated by unplanned production struggles in Iran, Venezuela and Libya. The group’s overall production fell by about 900k in January with help from a 50k bpd reduction from Russia. Total OPEC production ultimately printed 31.0m bpd in January which was its lowest mark since 2015. Also critical, OPEC exports to the US hit a five-year low in January at 1.41m bpd which we think will begin to aggressively eat into US crude stocks over the next six months. Going forward we expect OPEC’s cut-discipline to increase in an effort to give the market bullish shock therapy and maintain a healthy floor under prices for the near term.

Bearish risks continue to lurk which could sour our forecast and we’ll be sure to keep an eye on them as well. It’s important to note that option skews remain massively negative with put options trading at substantial premiums to call options, US production is running 11.9m bpd and key global trading hubs are still awash with refined products such as diesel and gasoline. On the macro side, global manufacturing data is slowing and flat bond curves continue to yell that the global growth outlook remains unimpressive to anyone who will listen.

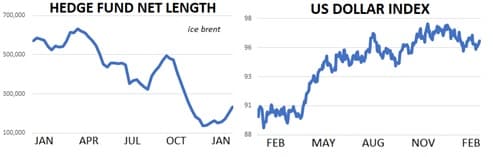

For now, however, hedge funds are back to buying oil. Time spreads indicate that global supply/demand balances are tightening and the US Fed seems keen on providing a macro tailwind. Oil price risk remains skewed to the upside.

Quick Hits

- Oil prices were basically flat to begin the week with Brent trading near $62.50 while WTI was near $54. Both grades are higher by about $9 YTD and seem to be trading in a technically positive trend by slowly building bullish momentum.

- Spread markets also look strong with physical traders eager to buy prompt contracts against later dated deliveries. This week the Brent June ’19 / Dec ’19 spread traded near 30 cents backwardated suggesting healthy inventory draws in the coming months. WTI spreads have a slightly more bearish tilt and currently have a modest contango.

- OPEC production estimates from January have been submitted and the cartel continues to show strong discipline in their effort to tighten the market. Current group production fell by about 900kpd bpd (via Bloomberg) to 31m bpd for its lowest mark since 2015. Qatar, which produced 600k bpd in December also quit OPEC as of January 1st.

- For breakdown, Saudi output fell by 450k bpd to 10.2m bpd. Iraqi output fell by 10k bpd to 4.69m bpd. Iranian output fell 150k bpd 2.74m bpd. Nigerian output fell 80k bpd to 1.69m bpd and Libyan output fell 100k bpd to 900k bpd. Venezuelan output jumped from 1.22m bpd to 1.27m bpd but exports continued to slide.

- Hedge funds were net buyers for the fifth straight week last week bringing overall net length on futures and options to 232k contracts. Net length held by speculators is higher by 80k contracts YTD representing a 53% increase. Much of the increase in net length has been due to a liquidation of short positions as gross shorts have dropped from 99k contracts at the end of 2018 to just 48k contracts.

- Oil majors have been reporting 4Q’18 earnings this week with great news for shareholders. BP offered particularly strong numbers with quarterly profits +65% y/y and 11% return on capital versus 6% last year. BP’s CEO told reporters that they’re planning to run their business with oil prices in the $50-$65 range for 2019. Shell reported their highest profits in four years for FY 2018

- Away from oil markets the US Dollar index continues to trend bearishly due to an increasingly dovish US Fed relative to other G7 central banks. The yield on the US 10yr bond was flat near 2.70%

DOE WRAP UP

- US crude stocks jumped about 900k bbls w/w to 446m and are higher y/y by about 7%.

- US producers are keeping things steady at 11.9m bpd and have produced an average of 11.85m bpd in 2019. If they keep it up, they’ll beat their 2018 average by exactly 1m bpd and beat their 2017 effort by 2.5m bpd- incredible.

- Cushing stocks fell by about 100k bpd to 41.2m bbls.

- Traders exported 1.94m bpd last week which was essentially flat w/w and 200k bpd below their 6-month average.

- Imports fell 1.1m bpd last week to 7.1m bpd for their lowest print in ten months. We can expect to see declining imports as Venezuelan barrels shift away from Houston and towards China and India

- The US currently has 26.1 days of crude oil supply on hand which is 0.6 days below its five-year average. There are 28.8 days of gasoline supply available which is in line with seasonal norms over the past five years.

- US gasoline inventories fell by about 2.2m bbls w/w and are higher y/y by about 7%.

- US distillate stocks fell by about 800k bbls w/w and are flat y/y.

- On the demand side, US refiners consumed 16.5m bpd last week for a seasonally normal drop of about 600k bpd. US refiner demand has averaged 17.1m bpd so far in 2019 for y/y growth of about 2%.

- US refiner demand is being tempered by historically low gasoline margins for much of the country. This week the RBOB / WTI crack offered just $6/bbl and bouncing off a three-year low at $5/bbl late last week.

- US gasoline demand + exports totaled 10.2m bpd last week which was its highest print of 2019. Impleid consumption has averaged 9.6m bpd so far this year which is flat v. 2018.