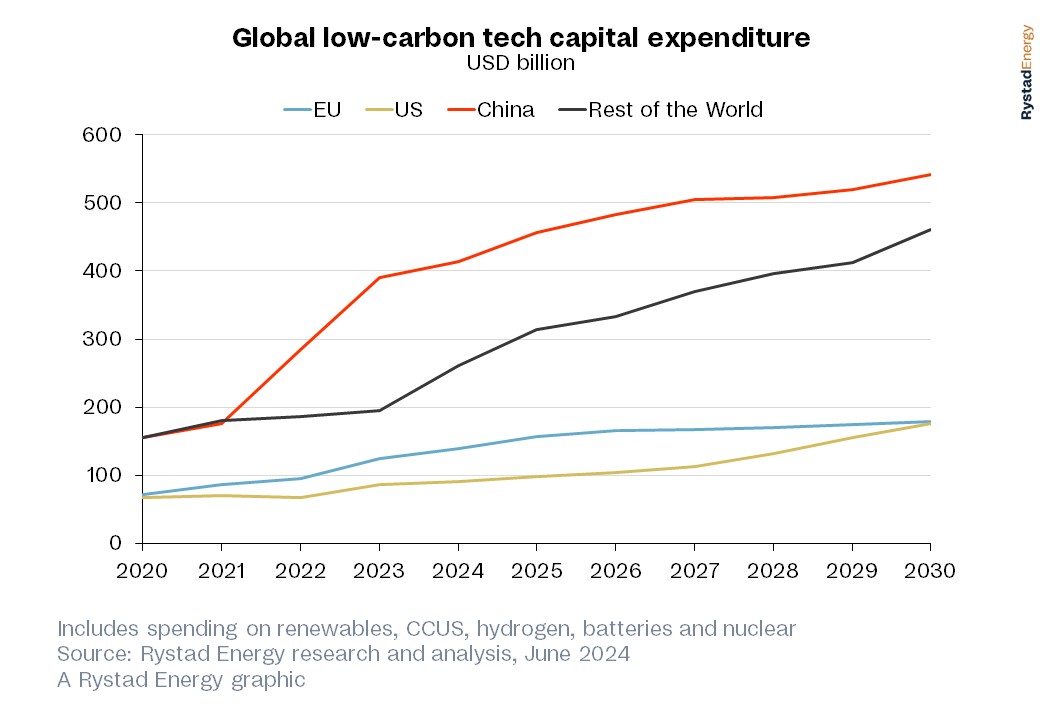

The European Union (EU) is set to fall far behind its ambitious energy transition targets for renewable energy, clean technology capacity and domestic supply chain investments, according to Rystad Energy research and modeling. The bloc’s capital investments (capex) in clean technologies – including renewables, carbon capture, utilization and storage (CCUS), hydrogen, batteries and nuclear – totaled $125 billion in 2023, dwarfed by China’s spending of $390 billion in the same sectors. The US is currently behind the EU in annual clean-tech spending, investing $86 billion in 2023, but the Inflation Reduction Act is set to spur investments while the EU’s spending will plateau in the years to come. The US will all but match the EU in total clean energy spending in 2030, and accelerate past the bloc in the ensuing years.

The Net-Zero Industry Act (NZIA) was passed by the EU earlier this year as a roadmap for the Union to meet its lofty goal of cutting emissions by 92% compared to 1990 levels by 2040 and reaching net zero by 2050. As a direct response to the US’ landmark Inflation Reduction Act, the EU has set ambitious targets through the NZIA to support nascent industries, homeshore supply chains and position the bloc as an attractive investment location through supplier incentives. However, the cleantech investment landscape in the EU is a contrasting story of ambition versus reality, and another dose of reality could be coming soon.

The EU elections are right around the corner, and the results are likely to have sweeping impacts on the bloc’s policy landscape. Many predict a political shift to the right following similar recent results in national elections, which could usher in a period of heightened Euroscepticism and decreased appetite to tackle climate change and the energy transition from a continental perspective. Next year is a pivotal one for the EU’s climate change progress, with reevaluations of its nationally determined contributions (NDC) and emissions goals expected, so significant political upheaval could have a long-lasting impact.

The stakes are high in the upcoming EU election – as the EU strives to remain competitive in the global clean tech market, the rising right-wing populist wave could critically heighten the EU’s risk of falling further behind the US and China. The next few years are critical, and hesitancy or a lack of cohesion could see the bloc lagging its counterparts for decades to come. As things stand, the EU is losing ground and is highly unlikely to reach its lofty goals

Lars Nitter Havro, Senior Energy Systems Analyst, Rystad Energy.

Learn more with Rystad Energy’s Energy Macro Solution.

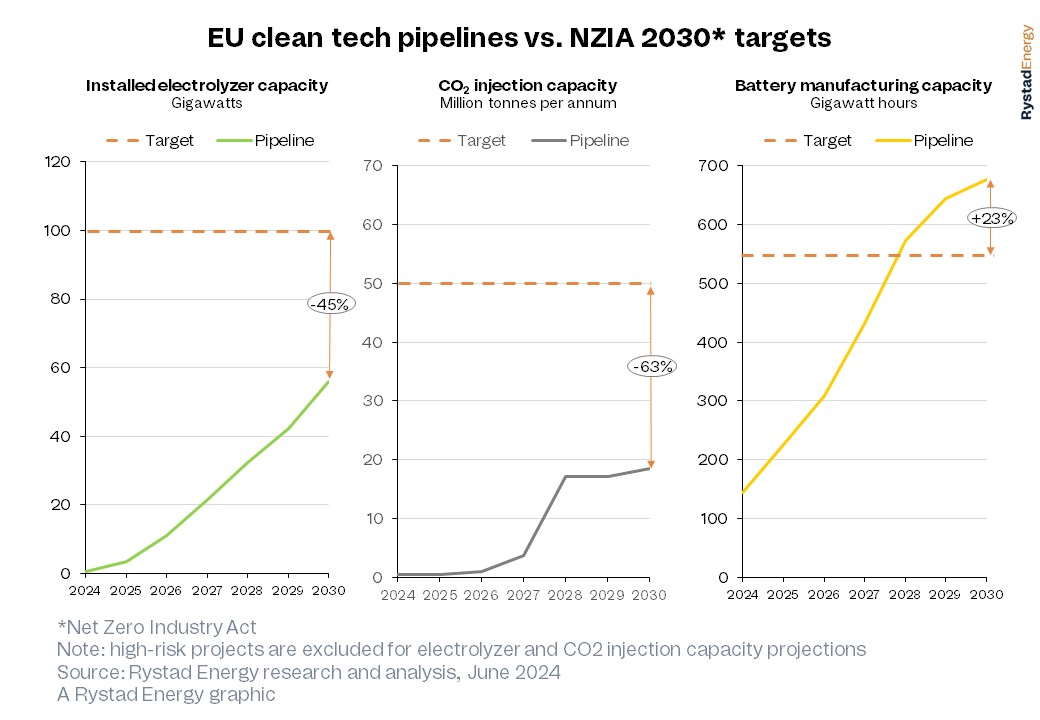

The NZIA sets forth ambitious targets and provisions to boost the production and deployment of key clean technologies, including batteries, CCUS and hydrogen electrolyzers, as part of the EU's broader emissions reduction and energy security goals. The Act outlines production targets and regulatory frameworks to accelerate the development and commercialization of these technologies, but only the battery sector is showing genuine promise. Yet despite the favorable outlook, as with solar manufacturers, some European battery manufacturing companies are favoring the greener pastures across the pond, emphasizing the need for competitive developer conditions. For instance, FREYR Battery, originally based in Norway, has relocated its headquarters to the United States and is setting up a gigafactory in Georgia to benefit from the Inflation Reduction Act's tax incentives. Similarly, Volkswagen, after its initial heavy investment in Northvolt, is now exploring opportunities in Canada to align with the IRA and maximize tax credits, illustrating a broader trend of shifting manufacturing to capitalize on favorable policy environments and sending a clear signal to policymakers. In addition, the Chinese manufacturers are doubling down in the EU, with EVE Energy targeting BWM offtake most recently with their announced Hungary manufacturing plant.

For CCUS, the NZIA focuses on enhancing injection capacity, a critical step for the permanent sequestration of carbon dioxide (CO2) and lowering atmospheric CO2 levels. While capture technologies at emission sources have matured, the development of injection and storage infrastructure is not advancing at the same pace. The growth in injection capacity, essential for realizing the full potential of CCUS, has been hampered by a slower-than-expected development of storage sites, which remains a significant bottleneck. Recent data indicates the projected CO2 injection capacity will fall short of the NZIA target by about 63% by 2030, reflecting a widening gap between ambitious decarbonization goals and the current pace of infrastructure development.

Similarly, despite considerable investment and policy support, including initiatives such as the European Hydrogen Bank auction, hydrogen electrolyzers are not meeting the ambitious goals set by the NZIA. The recent auction results, where a total of 1.5 GW of electrolyzer capacity received support, underline the challenges in scaling up hydrogen production to meet the EU's target of 100 GW by 2030. Currently, the risked pipeline for hydrogen electrolyzers is falling 45% short of this target, highlighting a significant gap in achieving the required installation capacity. This shortfall can be attributed to a variety of factors, including technological challenges, high initial costs, and the slow development of the necessary infrastructure to support a widespread hydrogen economy.

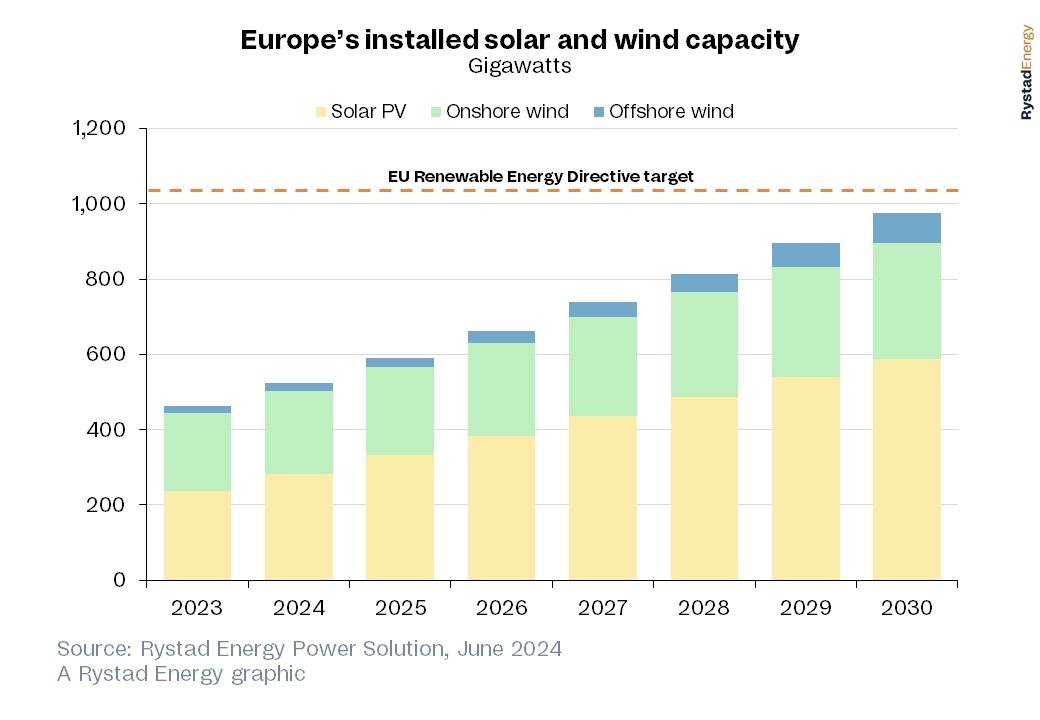

The EU has also laid out specific targets for solar and wind energy capacity build-out in its updated Renewable Energy Directive (RED III), which was passed in October 2023. The bloc aims to generate 42.5% of its total power consumption from renewable sources by 2030 and is not far off that goal. Based on current and expected projects, the EU is expected to have about 975 gigawatts (GW) of combined solar and wind capacity, falling just short of the 1,050 GW required to hit its goal.

The success of this endeavor hinges on continued political and financial support for renewable technologies, which are vulnerable to political shifts and the reliability and availability of adequate manufacturing capacity. The EU has lost much of its manufacturing base to Chinese and US competition, and establishing a resilient supply chain in Europe is proving challenging. Key industry players are departing the bloc and relocating to regions with more attractive incentive structures, such as the US, and the EU simply cannot compete. The migration of these companies not only erodes the EU's manufacturing capacity but also increases its reliance on non-European sources for essential components, making it dependent on other nations to secure its targets.

More Top Reads From Oilprice.com:

- Oil and Gas Wastewater in Appalachia Holds Key to U.S. Lithium Supply

- Biden Administration Approves Limited Ukrainian Strikes in Russia

- Toxic Biosolids Threaten U.S. Farmland and Livestock

The reason is very simply the intermittent nature of solar and wind energy.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert