It doesn’t feel that long ago that global oil traders were concerned about rising demand and supply scarcity. The story went something like this- the world was losing barrels as supplies from Iran, Libya and Venezuela grew scarce and Saudi Arabia and Russia didn’t have the spare capacity to keep pace with global demand growth. Traders bought $100 call options and economists began sounding the alarm bell that high gasoline prices were about to eat into consumers health

Two months later the global oil trade is hardly recognizable. Nearly all the globe’s major oil producing nations (excluding Iran and Venezuela) are pumping at record levels highlighted by almost comical output growth from the U.S. Saudi Arabia, Iraq and Libya have ramped up production to replace lost OPEC barrels and demand concerns baked into 2019 forecasts have spread major concerns that we’re now producing too much oil. Large losses in global equities have helped fuel the oil weakness and hedge funds - highly bullish oil just eight short weeks ago - can’t sell contracts quickly enough.

This week we saw the bullish to bearish story come full circle with news that Saudi Arabia and Russia are quietly in talks to reverse their current pact to produce as much oil as possible and begin taking barrels off the market to normalize supplies and avoid another 2015/2016-style price collapse.

At first, this news seems surprising. Aren’t the Saudis supposed to be pumping at full speed as part of the Trump/Saudi…

It doesn’t feel that long ago that global oil traders were concerned about rising demand and supply scarcity. The story went something like this- the world was losing barrels as supplies from Iran, Libya and Venezuela grew scarce and Saudi Arabia and Russia didn’t have the spare capacity to keep pace with global demand growth. Traders bought $100 call options and economists began sounding the alarm bell that high gasoline prices were about to eat into consumers health

Two months later the global oil trade is hardly recognizable. Nearly all the globe’s major oil producing nations (excluding Iran and Venezuela) are pumping at record levels highlighted by almost comical output growth from the U.S. Saudi Arabia, Iraq and Libya have ramped up production to replace lost OPEC barrels and demand concerns baked into 2019 forecasts have spread major concerns that we’re now producing too much oil. Large losses in global equities have helped fuel the oil weakness and hedge funds - highly bullish oil just eight short weeks ago - can’t sell contracts quickly enough.

This week we saw the bullish to bearish story come full circle with news that Saudi Arabia and Russia are quietly in talks to reverse their current pact to produce as much oil as possible and begin taking barrels off the market to normalize supplies and avoid another 2015/2016-style price collapse.

At first, this news seems surprising. Aren’t the Saudis supposed to be pumping at full speed as part of the Trump/Saudi mutual admiration pact? Don’t the Saudis want to take special care of this relationship in wake of the Khashoggi murder? Any supply cutting measures certainly would not be welcomed by the Washington which is vocally pushing for lower oil prices. Unfortunately for the White House, we doubt that the Saudis will hesitate to cut supplies if they feel compelled because the Trump administration is completely boxed in with respect to its antagonization of Iran. The administration will never pivot away from Saudi Arabia and towards Iran for political and ideological reasons. Trump’s entire geopolitical strategy on the campaign trail revolved around ending the Iran nuclear deal created by his predecessor. This gives the Saudis enormous leverage to cut barrels because the White House simply has no flexibility in picking a regional partner.

Another area in which Trump continues to box himself in is with respect to the U.S. central bank. This week, the Fed left the U.S. overnight rate unchanged at 2.0%-2.25% and Trump continues to be a vocal opponent of higher rates for obvious reasons. Unfortunately, the more The Donald cries out related to Fed rate hikes the more pressure the central bank needs to demonstrate its institutional independence by defying him. We certainly aren’t arguing that the Fed is only increasing rates because Trump wants them to be lower, but it doesn’t make it any simpler for policy shapers who need to be viewed as apolitical. This week the US 2yr bond yield touched a 10-year high at 2.97% after hawkish FOMC comments helped maintain expectations that the Fed will hike rates yet again at their December meeting.

Looking ahead, the oil market may very well need a jolt in the form of a Russia/Saudi pact to reduce supplies and calm the bearish trend. This week the deluge of negative news continued in the form of higher production, bloating stockpiles of crude oil and refined products and higher interest rates. U.S. crude oil inventories are now back above their 5yr seasonal average for the first time in 2018. Brent crude has dropped about 19% over the last four weeks and appears desperate in its search for supportive news.

Quick Hits

(Click to enlarge)

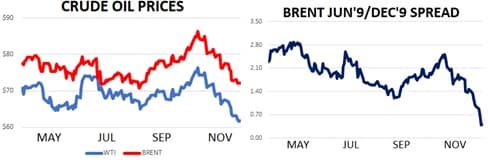

- Crude prices fell to a six-month low this week driven by the relentless climb of global supply while fears of demand decay in 2019 persist. WTI slumped to $61 and Brent fell to $71 as hedge funds continued to sell and the US issued another sharply bearish inventory report.

- Reuters reported that the Saudis and Russia are holding preliminary discussions to curb production in 2019. This is an incredible about-face for the two nations given their recent efforts to cushion the blow of Iranian sanctions by producing as much as possible. The Saudis are were also reported to be exploring a breakup of OPEC via the WSJ.

- Sell side analysts currently peg Iranian exports near 1.8m bpd after peaking at 2.8mbpd earlier this year. Most firms see Iranian exports falling towards 1m bpd but the Trump administration has remained steadfast in their pursuit of pushing them to 0.

- Meanwhile brent spreads - our favorite measure of the health of the global physical oil balances - have moved sharply lower and suggest the market is rapidly moving towards an oversupplied environment. This week the Jun ’19-Dec’19 spread yielded just 6 cents contango /month after offering more than 40 cents / month of contango in early October.

- China’s crude imports skyrocketed higher in October. The Republic imported 9.7m bpd of oil representing an all-time high and an increase of 1m bpd in just the last four months.

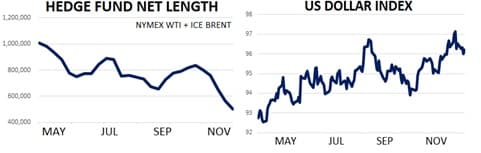

- Hedge funds were net sellers of both NYMEX WTI and ICE Brent last week for the fourth straight week. Funds sold both grades by a combined 64k contracts representing an 11% w/w decline. Funds have cut a total of 40% of their net long position over the last five weeks and brought combined net length 42% below its 1yr average.

- The US midterm elections occurred this week with Republicans maintaining control of the Senate while Democrats won the House. So far, the only impact we can see this having on oil is that it offered a slight boost to the stock market.

- The US Fed is believed to be on track for yet another rate hike in December after the US economy posted +3.5% GDP growth and sub 4% unemployment in recent weeks. The US Dollar Index continues to trade in a bullish pattern and was aided by hawkish FOMC comments following the Fed’s meeting which interpreted the US economy as strong.

DOE ROUNDUP

The overall summary of this week’s DOE report was that it was remarkably bearish. US crude stocks continue to rise rapidly, the country is producing an absurdly high amount of crude and gasoline inventories are ballooning. Demand growth is decent but it’s just not good enough to keep up with rising supplies.

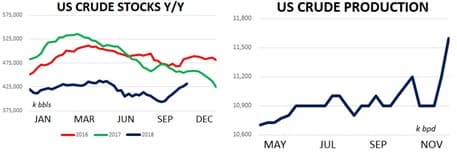

- US crude supplies simply will not draw down. Last week inventories increased by more than 5.5m bbls and are now lower y/y by just 6%.

- For trade – the US exported about 2.4m bpd last week (600k bpd above its 1yr average) and imported 8m bpd which is 100k bpd above its 1yr average.

- Oil inventories in the Cushing, Oklahoma delivery hub have also continued to build and currently stand at 34.3m bbls- higher by 12m bbls over the last six weeks.

- US crude production hit an incredible 11.6m bpd last week. It’s hard to articulate exactly how high a number that is. The mark represented a 2m bpd increase in just the last twelve months and is higher by 3.2m bpd in the last two years. The US is now producing 1m bpd more than the Saudis and 800k bpd more than Russia. Incredible.

- US refiner demand printed a strong 16.4m bpd last week which is higher by about 400k bpd (2.5%) y/y over the last four weeks. Unfortunately high gasoline supplies have kept refining margins down. The WTI 321 crack is currently trading near $15/bbl which won’t exactly incentivize refiners to run at 110% coming out of turnarounds this fall/winter.

- US gasoline stocks added roughly 2m bbls w/w and are now higher y/y by about 7.5%. Gasoline inventories in the PADD IB trading hub (which includes the NY Harbor delivery point) are higher y/y by a ghastly 46% and has caused a collapse in gasoline time spreads.

- US distillate inventories (including heating oil and jet fuel) dropped by more than 3m bbls w/w and are lower y/y by 2.4%.