The price jump evidenced during the last weeks was blasted through the ceiling with the White House announcing it does not intend to renew waivers to buyers of Iranian crude. The news, labelled a big mistake by Iran’s foreign ministry, was met with shock and dismay in China and Turkey, with India claiming it might bring down Iranian imports to zero. The Trump Administration stated it counts on Saudi Arabia and UAE to offset any potential supply shortages, yet Saudi Aramco already indicated it does not intend to raise output in May 2019. By the middle of the working week, the situation has calmed somewhat due to the IEA’s assurances that the market is adequately supplied and that there will not be any massive supply deficit, yet refiners with a slate tilted towards heavy grades might beg to disagree.

(Click to enlarge)

In view of the above global benchmark Brent traded at 73.8-74 USD per barrel, whilst WTI was hovering around 66-66.2 USD per barrel as of Wednesday afternoon.

1. Full US Iran Sanctions Would Make Prolongation of OPEC+ Deal Senseless

(Click to enlarge)

- If carried through, the US’ announced intention not to extend any of the 8 waivers it handed out to buyers of Iranian oil last November would cut short the relevancy of the OPEC+ agreement.

- In the past 12 months, exports of heavy sweet and heavy sour grades have fallen almost 1mbpd from 6.6mbpd to 5.66mbpd – and spectacularly so from February 2019 onwards as the…

The price jump evidenced during the last weeks was blasted through the ceiling with the White House announcing it does not intend to renew waivers to buyers of Iranian crude. The news, labelled a big mistake by Iran’s foreign ministry, was met with shock and dismay in China and Turkey, with India claiming it might bring down Iranian imports to zero. The Trump Administration stated it counts on Saudi Arabia and UAE to offset any potential supply shortages, yet Saudi Aramco already indicated it does not intend to raise output in May 2019. By the middle of the working week, the situation has calmed somewhat due to the IEA’s assurances that the market is adequately supplied and that there will not be any massive supply deficit, yet refiners with a slate tilted towards heavy grades might beg to disagree.

(Click to enlarge)

In view of the above global benchmark Brent traded at 73.8-74 USD per barrel, whilst WTI was hovering around 66-66.2 USD per barrel as of Wednesday afternoon.

1. Full US Iran Sanctions Would Make Prolongation of OPEC+ Deal Senseless

(Click to enlarge)

- If carried through, the US’ announced intention not to extend any of the 8 waivers it handed out to buyers of Iranian oil last November would cut short the relevancy of the OPEC+ agreement.

- In the past 12 months, exports of heavy sweet and heavy sour grades have fallen almost 1mbpd from 6.6mbpd to 5.66mbpd – and spectacularly so from February 2019 onwards as the Venezuelan sanctions kicked in.

- In a very similar vein, medium sour exports plummeted from their November 2018 level of 17.24mbpd to 16.24mbpd in April 2019, mirroring the time curve of Iranian sanctions.

- In case the Trump Administration does indeed opt for an all-out economic war against Iran, Russia would see no reason not to increase production, bringing back all its brownstream W-Siberian production wells.

- At the same time the White House might have a difficult time to levy new sanctions on Venezuela concurrently with Iran sanctions as it has to balance between the interests of hedge funds and refiners.

2. Nigerian OSPs Fall for First Time in 2019

(Click to enlarge)

- Nigeria’s state oil company NNPC has lowered its official selling prices for most of its May-loading cargoes following four months of very robust growth.

- Nigerian flagship grades like Bonny Light and Brass River saw their month-on-month OSP drop by 27 and 17 cents, respectively (to 1.39 and 1.52 USD per barrel).

- The 22 API heavy sweet grade Eremor saw the biggest m-o-m decrease, dropping from -4.05 to a -6.45 USD per barrel discount in May – yet given its niche character, it will not cause a stir on the global markets.

- Light crudes with minimal sulphur levels, such as Amenam and Akpo, saw their OSPs hiked by 20 and 29 cents per barrel, respectively.

- The latest addition to Nigeria’s crude slate Egina was raised only modestly by 4 cents to a 1.82 USD per barrel premium against Dated, just as Bonga was hiked 4 cents to 1.72 USD per barrel.

- The price shift comes amidst Qua Iboe struggling from another bout of deferrals, with a total of 17 cargoes deferred in April-May.

3. New Alberta Premier Promises More Pipelines Soon

(Click to enlarge)

- Alberta’s new Premier Jason Kenney, having won 55 percent of the regional ballot, promised a more aggressive push to have as many pipelines built as possible to debottleneck the region’s crude production.

- Kenney also indicated that his administration might scrap the 120kbpd rail-car lease plan (would have started in July) negotiated by his predecessor, Premier Rachel Notley.

- Yet given that the contracts are already in vigor, the new administration will most likely sit out the rail-car lease and the production cuts until early 2020 and then place the Canadian crude market in the hands of the free market.

- Since the onset of Iranian and Venezuelan sanctions, Canada’s share in total US crude imports has been increasing, reaching 53 percent in January 2019.

- Alberta’s flagship grade Western Canadian Select was trading at a 10.5-11 USD per barrel discount against WTI this week, down some 1.5 USD per barrel week-on-week.

4. Azerbaijan Exports Expected to Drop on ACG Maintenance

(Click to enlarge)

- The Central Azeri platform of the Azeri-Chirag-Guneshli (ACG) block of fields in Azerbaijan will be out for more than 2 weeks of maintenance until early May 2019, affecting Azerbaijan’s export potential.

- The Azeri platform produced roughly 26 percent of total ACG output in 2018, corresponding to 0.15mbpd out of the aggregate production of 0.59mpb.

- Azerbaijan generally exports its crude via the Georgian port of Supsa and the Turkish port of Ceyhan – both saw significant decreases in April export volumes.

- Supsa became the prime casualty of the ACG maintenance, with only one vessel leaving it this month instead of the usual four-five and loading rates plummeting 67 percent m-o-m.

- BTC Blend as Azerbaijani crude is marketed in Ceyhan (with the addition of Turkmen volumes) was less impacted, falling from March’s 687kbpd to the current 582kbpd (a 15 percent drop).

- In mid-April BP and the other ACG shareholders clinched a FID on the construction of the 100kbpd Azeri Central East platform, to be completed by 2023.

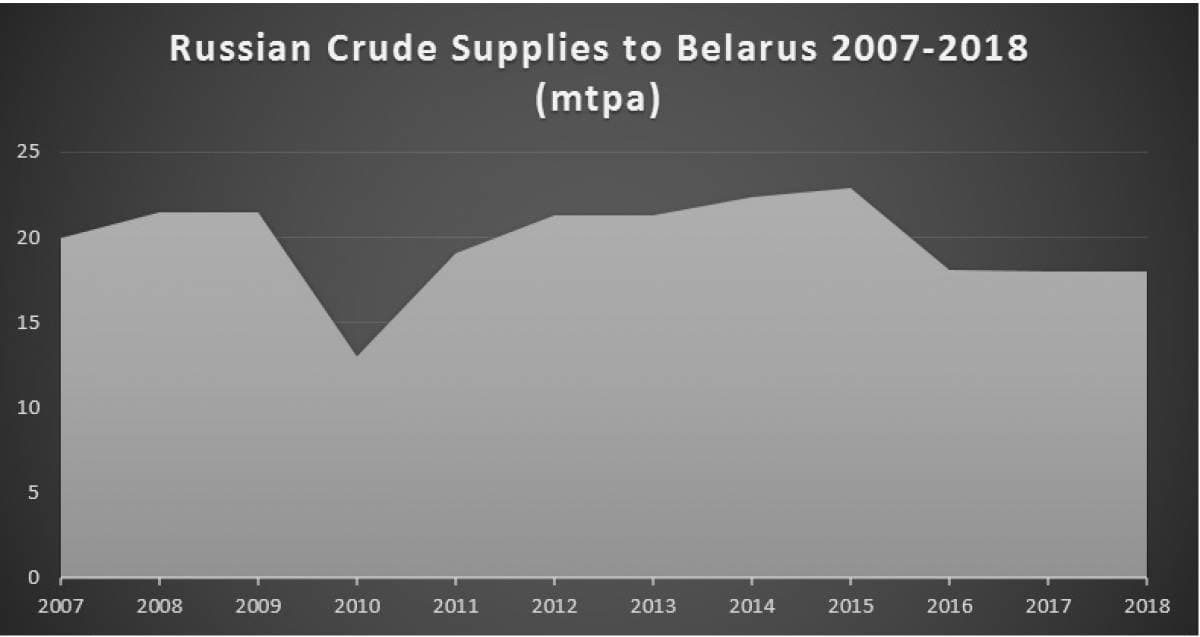

5. Belarus Rants About Worsening Urals Quality

(Click to enlarge)

- A number of Belorussian energy officials have complained about the quality of crude Russia supplies to its neighbour via the 1.3mbpd Druzhba pipeline, the longest in the world.

- This comes just several days after the Belorussian President A. Lukashenko threatened to cut Druzhba pipeline supplies altogether, stating the crude conduit needs to be closed for maintenance.

- Belorussian refiners have apparently curbed refinery output, fearing the seventeen-fold increase in organic chlorides will corrode heat exchange equipment.

- Russian transportation monopoly Transneft claims the crude quality deterioration was brought about by technical issues and is in no way bound to political issues at hand.

- Russian authorities are finding it increasingly harder to deal with the ever-erratic Belorussian President and there have been rumours about Moscow preferring to have another counterpart to deal with.

6. Total Brings Onstream Sourest Angolan Grade

(Click to enlarge)

- Having launched the 115kbpd Kaombo Sul production unit offshore Angola (Block 32), Total and block partners Sonangol, Sinopec, ExxonMobil and Galp are bringing the sourest Angolan grade to the market.

- Labelled Mostarda – after the largest field that the Kaombo Sul FPSO unit is fed from - the new grade will most likely start trading in May, albeit just one.

- As per Total’s assay, Mostarda is a 28.2 °API and 1.08 sulphur content crude, with an acidity level of 0.49 KOH/g.

- Given the heightened demand for sour Angolan grades following the levy of Iranian and Venezuelan sanctions, Mostarda is certain to be met with extreme buyer interest.

- Given that Angola’s June export programme is the lowest in 1 years (38 vessels) as the Saturno field if off for maintenance and Girassol output is constrained.

7. ExxonMobil Can’t Stop Hitting Oil in Guyana

(Click to enlarge)

- Last week ExxonMobil announced its 13th discovery offshore Guyana, drilling the Yellowtail-1 well to a total depth of 5.6km (18 445 feet).

- The Yellowtail discovery boosted Exxon’s aggregate Guyana portfolio to 5.5 billion barrels of oil equivalent already, with further wells expected to be drilled in the upcoming months.

- Located six miles to the north of Tilapia, another recent discovery, the Yellowtail-1 well hit approximately 292 feet (90 meters) of high quality sandstone reservoir.

- ExxonMobil now intends to drill the Hammerhead-3 and Ranger-2 wells, as well as completing development drilling for the first discovery there, Liza.

- Liza is expected to come onstream in March 2020, with production averaging around 120kbpd in the first year and gradually hiking up to 750kbpd in 2025.