Uncertainty about the Iran nuclear deal and disappointing Chinese crude demand and refinery throughput are creating headwinds for crude.

Chart of the Week

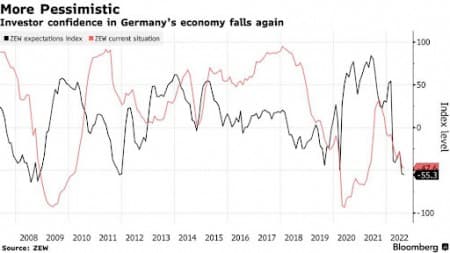

Can the German Economy Fall by the Wayside?

- Investor confidence in the German economy has plummeted to the lowest level in at least decade, with market gloom surpassing the impact of COVID-19 as German households face another challenge, a $300 annual gas levy destined to help gas retailers stay afloat.

- The large-scale impact of economic headwinds is still yet to be felt - Germany’s economy stagnated in Q2 and the IMF has cut its projections of economic growth to 1.2% in 2022 and 0.8% in 2023.

- Extremely low water levels of River Rhine, the navigation chokepoint at Kaub hasn’t been this low since the early 1990s at this time of the year, is sending coal and oil products prices soaring in the southern regions of the country.

- Tomorrow’s earning call of leading gas firm Uniper (ETR:UN01) – already bailed out by the government for $15 billion - will be a harbinger of future developments, with expectations ranging from bad to worse.

Market Movers

- Russia’s state gas company Gazprom (MCX:GAZP) warned that gas prices could spike by a further 60% to $4,000/Mcm amidst reduced production and exports, potentially indicating that there will not be any drastic upticks in Nord Stream 1 flows.

- The activist energy investor Kimmeridge Energy Management amassed a 4% stake in California Resources (NYSE:CRC) recently and has been pushing for policy changes, including sales of acreage to real estate purposes.

- According to Bloomberg, UK energy major BP (NYSE:BP) will be soon quitting its Mexican oil assets as it continues to pivot towards renewables.

Tuesday, August 16, 2022

Last week’s oil trading closed on an upbeat note – U.S. inflation data surprised to the upside and demand seemed to be picking up nicely. What a change can several days make as weak Chinese macroeconomic readings added a lot more bearish pressure, causing headaches for global policymakers. Not only were Chinese crude demand and refinery runs at their lowest in the post-pandemic period, but its July industrial activity also rose less than anticipated at 3.8%. Add to this the ongoing uncertainty surrounding a possible Iran nuclear deal and you will inevitably see why the bears have taken over this week, with Brent futures dropping as low as $92.60 per barrel.

Chinese Refining Still Underwhelming. Chinese refinery runs dropped to the lowest daily rate since March 2020 at 12.53 million b/d, down almost 1 million b/d, surprising many in the oil markets who expected a strong post-lockdown recovery, though prolonged maintenance might have played a role.

Permian Hits Another Record High. Cementing the Permian Basin’s reputation as the leading force of incremental US crude production, oil output in the largest US shale play is set to rise to a record 5.408 million b/d in September according to the EIA, equivalent to 60% of the country’s shale production.

Saudi Aramco Flaunts Maximum Capacity Coming Soon. Announcing net Q2 profits of $48.4 billion, the head of Saudi Aramco (TADAWUL:2222) Amin Nasser claimed the company is ready to bring production to its maximum capacity of 12 million b/d if asked by the government.

Related: Barclays Slashes Oil Price Forecast To $103 Per Barrel

PEMEX Needs Another $6.5 Billion for Refinery. Mexico’s state oil company PEMEX requested another 6.5 billion in additional funding from its government for the 320,000 b/d Dos Bocas refinery, taking the commissioned yet still-unfinished refinery’s price tag to almost 15 billion.

Cracks Appear Again in Iranian Deal. Whilst the oil markets warmed up to the possibility of an Iranian deal lately, the US State Department cooled off some of that optimism by saying Iran must abandon its extraneous demands that go beyond the scope of the JCPOA.

PDVSA Stops Oil-for-Debt Payments. Venezuela’s national oil company PDVSA has suspended crude deliveries to European companies under an oil-for-debt deal, asking Eni and Repsol for products instead as the Latin American country is struggling to get its refineries up and running again.

Chinese Regions See First Industry Power Cuts. The regional government of Sichuan has started rationing industrial power consumption amid its worst heatwave in 60 years, heavily impacting lithium producers Tianqi Lithium (SHE:002466) and Sichuan Yahua (SHE:002497) as well as several major aluminium smelters.

German Power Prices Soar to All-Time Highs. Hamstrung by extremely low Rhine levels impeding usual coal flows and ongoing quarrels around Nord Stream 1, Germany’s 2023 futures contract soared to yet another all-time high of €508 per MWh.

Nigerian Military Steps Up Fight Against Theft. Nigerian authorities have stated that the country’s military is stepping up efforts to combat thieves ravaging oil pipelines in the Niger Delta region, with NNPC reportedly losing up to 400,000 b/d to theft and sabotage.

Big Oil Ready to Embrace IRA Climate Bill. Oil majors and medium-tier independents alike have expressed readiness to tap into the provisions of the Inflation Reduction Act, providing a new $17/mt baseline credit for carbon capture and storage facilities that is set to be in high demand.

Spiking US Exports Lift Freight Costs. The widening Brent-WTI spread is adding an extra appeal to US crude exports globally, however the increased demand for Aframax tankers has also pushed freight costs to Europe to almost $6 per barrel, possibly making Asia-bound VLCC deliveries more profitable.

Norway Keeps Hydro Energy to Itself. Confronted with multi-year water level lows and high demand, Norway has moved to prioritize the domestic market to the detriment of exports, dealing another blow to the UK which relied on plentiful Norwegian hydro power to meet demand in periods of low wind.

Nickel Trading Still Fails to Recover from March Blowout. According to Reuters, the volume of nickel traded on the London Metal Exchange fell by 40% year-on-year in July, at 34,962 lots in total, marred by the one-week suspension of trading in early March that led to the cancellation of billions of dollars in trades.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- Money Won’t Solve America’s Power Grid Problems

- Iran Delivers Nuclear Deal Response But Details Remain Unclear

- Germany Signs Preliminary Deal To Ramp Up LNG Import Capacity