Oil prices are once again under pressure due to uncertainty about China's economy, with the latest manufacturing data reigniting demand fears.

Chart of the Week

- Uranium prices have soared in recent days to $74 per pound, a 50% increase in 2023 to date, as lower production guidance from Cameco and production disruptions in Niger added to worries about the world producing enough U308 to meet the industry’s growing needs.

- Global nuclear capacity currently consists of 440 nuclear reactors in 33 jurisdictions, however by 2030 there will be some 60 reactors more due to a vast build-up in Asian nuclear plants, lifting demand for mined uranium.

- As mines take years to produce at scale and breakeven costs for new mining projects in the West rose to $90 per pound, analysts expect the uranium market to see a supply shortage of some 60-70 million pounds.

- Several hedge funds – Terra Capital, Segra Capital, or Argonaut – have been ramping up their exposure to uranium stocks recently, buoyed by Cameco gaining more than 70% this year to date.

Market Movers

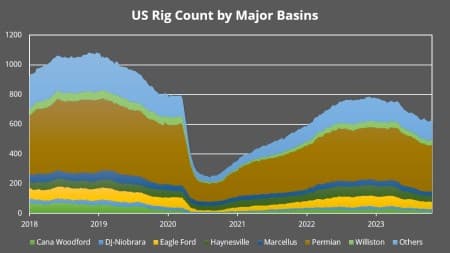

- UK oil major BP (NYSE:BP) is seeking to form joint ventures with US energy companies to ramp up natural gas production around its assets, eyeing the Haynesville gas basin and Eagle Ford for potential positions.

- Canada’s leading midstream firm TC Energy (TSE:TRP) is reportedly exploring asset sales worth several billion dollars to lower debt, working on the sale of a minority stake in the ANR pipeline.

- Bailed-out German utility giant Uniper (ETR:UN01) posted a $10.4 billion net profit in January-September, a sea change compared to the $45 billion loss in the same period in 2022.

Tuesday, October 31, 2023

Bearish sentiment around China's economy dropped away in recent months, but October's manufacturing activity data will undoubtedly bring back the issue of weaker Chinese demand to the global crude agenda. Surprising virtually everyone, China’s manufacturing PMI index dropped to 49.5 from 50.2 in September, whilst non-manufacturing PMI indicated a slowdown in services growth. With Brent trending around $88 per barrel, it seems it would take a serious escalation in the Middle East to send oil prices spiking.

BP Shares Drop After Lukewarm Q3 Result. Adversely impacted by a $540 million write-down on offshore wind projects in New York as well as weak natural gas results, BP (NYSE:BP) reported third-quarter earnings of $3.3 billion, missing analysts’ 4$ billion forecast and prompting a 5% share drop on Tuesday.

Venezuelan Refining Collapses. Just as Venezuela prepares to ramp up crude exports amidst a 6-month sanctions clearance, the country’s 955,000 b/d Paraguana refining complex saw the closure of two CDUs due to fires and lack of feedstock, lowering its utilization rate to as little as 10%.

Investors Start Shorting Crude Futures. Hedge funds and other money managers sold the equivalent of 14 million barrels in the six most important oil futures and options contracts in the week ending October 24, marking the fourth time in five weeks that funds were net sellers.

Chevron Settles Australia Labor Row. Workers at Chevron’s (NYSE:CVX) Wheatstone and Gorgon LNG terminals have endorsed a new trade union-backed pay deal brokered by Australia’s Fair Work Commission, eliminating the risk of further strikes this year to Europe’s great relief.

China Braces for Peak Winter Power Usage. China’s National Energy Administration has warned that the country’s maximum power demand this winter might increase by 140 GW or 12% from last year’s 1,159 GW peak, warning of potential power shortages in Yunnan and Inner Mongolia.

FERC Approves Venture Global LNG Launch. The US Federal Energy Regulatory Commission approved a revised commissioning plan for the Calcasieu Pass LNG facility that has not yet seen full operation, arguing that 3 processing trains can be turned on while work on others continues.

Germany Courts Nigeria for More Gas. With Chancellor Olaf Scholz visiting Nigeria, Germany has been expressing its readiness to invest in natural gas projects in the African country, with Berlin nudging German companies to consider funding pipeline projects and new LNG capacity.

Exxon Wants to Expand Guyana Clout. An Exxon-led consortium bid on the 1,707 km2 S8 shallow water block in Guyana’s first-ever competitive auction, seeking to expand its acreage in the country and joining ranks with a TotalEnergies-QatarEnergy-Petronas consortium that bid for the S4 block.

Mexico Keeps on Subsidizing Pemex. Mexico’s government statistics show that national oil company Pemex received $3.2 billion in October alone, via cash injections and tax cuts, to keep the company afloat, on top of a hefty $5.8 billion in aid received last month to launch the Dos Bocas refinery.

Panama’s Protests Halt Copper Mining. As widespread protests continue to rattle the streets of Panama, the country’s government pledged to reject all new mining projects in the country but keep First Quantum’s Cobre Panama deal extension intact, accounting for 5% of Panama’s GDP currently.

Israel Fast-Tracks New Exploration Deals. Israel’s Energy Ministry awarded 12 offshore exploration licenses to six companies including the BP-Socar-NewMed consortium that will appraise areas to the north of the Leviathan gas field, whilst ENI (BIT:ENI) will explore waters west of the same field.

Argentina Threatens to Cut Oil Exports. Confronted with persistent fuel shortages that spiraled out of control ahead of Argentina’s second round of presidential elections, Economy Minister Sergio Massa warned the country might suspend exports of crude oil if fuel supply doesn’t normalize.

China Doubles Down on Offshore Production. Simultaneously to CNOOC’s (HKG:0883) lifting of its 2023 capex budget to $12.2 billion, China’s state-owned oil firm launched the Penglai 19-3 oil field in the country’s Bohai Sea, in tandem with ConocoPhillips (NYSE:COP) that owns 49% of the project.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Prices Could Test $115 If Hamas-Israel War Escalates Into Regional Conflict

- Middle East Producers Cautious To Hike Prices In Tight Market

- Exxon Misses Profit Forecast Despite Strong Refining Business

Since I haven’t heard for a few weeks any talk about China’s so-called economic woes, I thought for a minute that Western media has come to its senses but I have forgotten that a leopard never changes its spots.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert