This week’s OPEC joint ministerial monitoring committee (JMMC) meeting in Baku sent a powerful signal to the oil markets – OPEC does not see any fundamental changes taking place in the upcoming two months, calling off the April JMMC meeting altogether. That is not to say that OPEC became complacent – on the contrary, it intends to act upon the United States’ policy course vis-a-vis Iran and Venezuela. The waivers granted by the Trump Administration to eight nations are coming to an end on May 4th and so far there has been little to no information on Washington’s future decision, despite China, India, South Korea and Japan already indicating their interest in seeing the waivers prolonged.

Despite the somewhat comforting news from Baku, oil reacted primarily to a reported impasse in the US-Chinese trade talks, increasing the risk of seeing the negotiations delayed well into summer season. As of Wednesday afternoon, Brent traded at approximately 67 USD per barrel interval, whilst WTI hovered around 58.5-59 USD per barrel mark.

1. US Crude Drops Back After Last Week’s Build

- US Commercial crude inventories dropped somewhat unexpectedly by 3.9MMbbl to 449.1MMbbl during the week ended March 08, proving right the American Petroleum Institute’s draw estimate.

- This comes on the back of crude imports dropping by 255kbpd to 6.7mbpd and exports falling by 257kbpd to 2.5mbpd, whilst aggregate refinery input saw only a modest 30kbpd increase…

This week’s OPEC joint ministerial monitoring committee (JMMC) meeting in Baku sent a powerful signal to the oil markets – OPEC does not see any fundamental changes taking place in the upcoming two months, calling off the April JMMC meeting altogether. That is not to say that OPEC became complacent – on the contrary, it intends to act upon the United States’ policy course vis-a-vis Iran and Venezuela. The waivers granted by the Trump Administration to eight nations are coming to an end on May 4th and so far there has been little to no information on Washington’s future decision, despite China, India, South Korea and Japan already indicating their interest in seeing the waivers prolonged.

Despite the somewhat comforting news from Baku, oil reacted primarily to a reported impasse in the US-Chinese trade talks, increasing the risk of seeing the negotiations delayed well into summer season. As of Wednesday afternoon, Brent traded at approximately 67 USD per barrel interval, whilst WTI hovered around 58.5-59 USD per barrel mark.

1. US Crude Drops Back After Last Week’s Build

- US Commercial crude inventories dropped somewhat unexpectedly by 3.9MMbbl to 449.1MMbbl during the week ended March 08, proving right the American Petroleum Institute’s draw estimate.

- This comes on the back of crude imports dropping by 255kbpd to 6.7mbpd and exports falling by 257kbpd to 2.5mbpd, whilst aggregate refinery input saw only a modest 30kbpd increase week-on-week.

- The week ended March 15 highlights once again the difficulty of forecasting stock changes, with the API predicting a 2.1MMbbl draw, whilst the S&P Platts analyst survey indicated a 1MMbbl build over the given period.

- Gasoline stocks decreased for the fifth consecutive week, by 4.6MMbbl to 246.1MMbbl on the week ended March 08, which still places it some 6MMbbl above the 5-year average.

- Distillate fuel stocks incrased modestly, by 0.4MMbbl to 136.4MMbbl, largely due to a palpable week-on-week decline in exports, down 0.28mbpd to 1.1mbpd.

2. Iraq Cuts Output for Now, Still Seen as Key OPEC Growth Factor

- Iraq has claimed that from March onwards it will comply with its OPEC/OPEC+ production cuts after months of underperformance.

- Even though Baghdad agreed to a 4.51mbpd production cap, some 0.14mbpd below its October 2018 baseline level, it has produced 4.63mbpd in the first two months of 2019.

- Oil minister Thamir Ghadhban now promises stricter adherence to Iraq’s own commitments, stating that it would lower exports by 0.25mbpd in the upcoming weeks.

- At the same time, the IEA sees Iraq as OPEC’s leading member in oil production capacity growth, increasing almost 1mbpd to 5.8mbpd by 2024.

- Yet there is a catch to it – even if output capacity grows, Iraq’s underinvestment in export capacity might hinder development.

- Despite having a nominal export capacity of 4.6mbpd, only 3.7mbpd are actually utilizable as the Khor al-Amaya export terminal remains out-of-use due to its decrepit state.

- Hence, it seems most probable that Iraq will prioritize the modernization of its refinery assets, the 350kbpd Baiji and the 210kbpd Basrah refinery, which would take in a significant part of any output increase.

3. Colombia Struggles With Fuel Shortages

- The Colombian government has asked for emergency fuel supplies from neighboring Ecuador as it struggles with fuel shortages in its southwestern regions.

- Colombia has been asking the Ecuadorian national oil company PetroEcuador for prompt supplies of 150 000 USG per day of diesel, 235 000 USG per day of gasoline and 140 000 USG per day of LPG.

- PetroEcuador consented Tuesday to bring in 705k USG of gasoline, 450k USG of Diesel and 420k USG of LPG.

- For more than one week indigenous groups have blocking the Pan-American highway (denouncing the government’s treatment of them), making it impossible for the Colombian state oil company Ecopetrol to reach distant regions on the Pacific coast.

- As Colombian President Iván Duque has refused to travel to the affected regions until the blockages are cleared, it remains to be seen when the force majeure will end.

4. Water Cuts Undercut Brazil’s Export Appeal

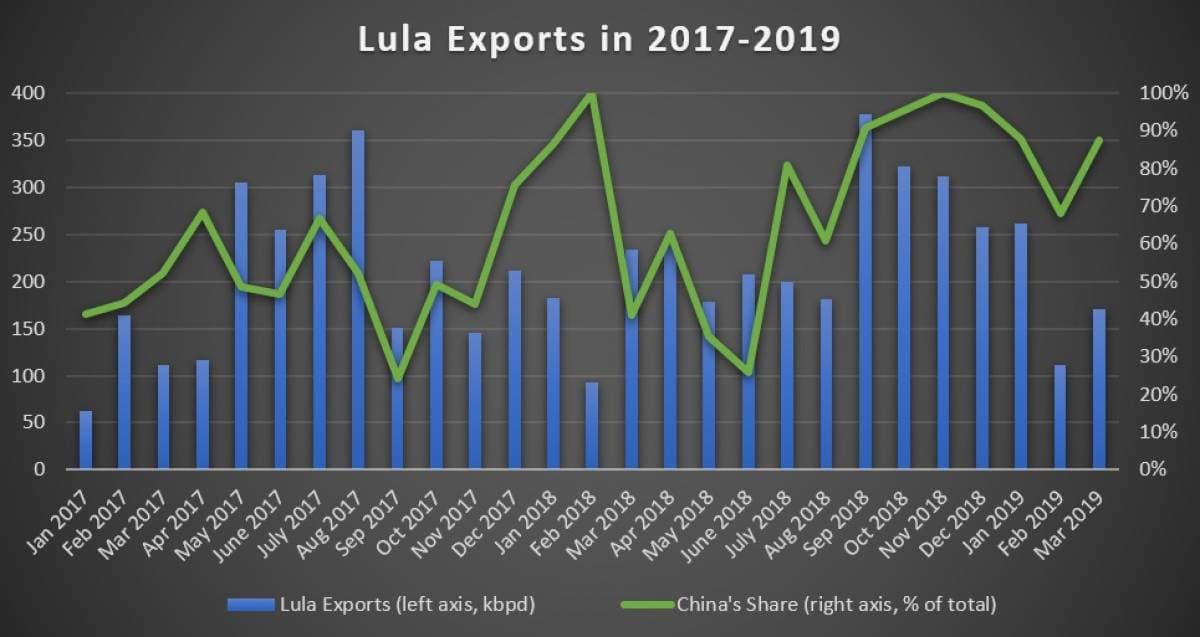

- Rising salinity levels in one of Brazil’s flagship export crude grades Lula have compelled Chinese refiners to slightly alter their intake of it and buy more Russian ESPO instead.

- China’s share in Lula exports dropped to a 6-month low of 68 percent in February 2019, dropping a massive 20 percent month-on-month.

- According to Argus, salinity levels in Lula crude as measured by Shandong refiners grew almost fivefold to 150-200ppm.

- Water cuts in Lula reached an all-time high of 3 percent this January, according to Brazil’s energy agency ANP.

- The quality deterioration seems to have coincided with the installation of new water treatment filters at Lula’s FPSO units.

- Lula’s March export data are showing a rebound in China’s appetite for the Brazilian crude, with almost 90 percent of all volumes sailing to Chinese refiners.

5. Kuwait OSPs Reflect Saudi Aramco

- Kuwait has mirrored Saudi Aramco’s decision to hike Asia Pacific prices, whilst cutting its official selling prices (OSP) to European destinations.

- The Kuwaiti state oil company KPC set the April-loading OSP for its flagship Kuwait Export Crude (KEC) at a 0.55 USD per barrel premium to the average Oman/Dubai.

- The Arab Medium-KEC differential remained unchanged at a 30 cent per barrel, quite a narrow margin historically that it first reached in January 2019 (unchanged since that).

- KEC prices to Europe and Mediterranean were dropped by 20 cents and 70 cents per barrel, respectively, whilst the US exports witnessed a 10 cents per barrel hike against the Argus Sour Crude Index.

- KEP’s latest addition to its grade portfolio, the Kuwaiti Super Light (KSLC), was set at a 1.65 per barrel premium to the Oman-Dubai average, with the KSLC-AXL differential widening to 20 US cents per barrel.

6. Angolan Loadings Bounce Back in May 2019

- Having reached the lowest loading level in 12 years, Angola’s preliminary crude loadings for May foresee a substantial rebound from April’s 1.28mbpd.

- The preliminary schedule sees 48 cargoes sailing off Angola in May, 8 more than in April, with export volumes estimated at 1.49mbpd.

- As Angolan production gradually declines, trading windows in which one can buy Dalia or Cabinda cargoes are getting shorter and shorter.

- The latest Angolan crude grade Gindungo will see 3 cargoes loaded in May at a 92kbpd rate, up from April’s two.

- China alone accounts for 70 percent of all Angolan exports, with India taking in around 8-10 percent, and the United States, Uruguay and Spain importing 1-2MMbbl per month.

- Largely thanks to the disastrous April, Angola’s adherence to its OPEC production cut commitment of 1.48mbpd was beyond reproach – so far in 2019 it averaged 1.4mbpd.

7. ENI Strikes Oil in Angola Again

- Four months after announcing its 200 MMbbl Afoxé discovery in Angola’s offshore, the Italian oil major ENI reported a new discovery in the 15/06 Block it operates.

- The Agogo-1 wildcat was drilled to a total depth of 4.5km in 1.6km of water depth, hitting 120 meters of net oil pay that is estimated to contain 450-650 MMbbl of crude.

- The quality of the Agogo field is somewhat lower than that of previous discoveries Afoxé and Kalimba, falling within the medium sweet category at 31 degrees API.

- ENI indicates preliminary production capacity at 20kbpd, yet with Block 15/06 output combined from the recent finds will be significantly higher.

- The joint venture assessing Block 15/06 comprises also Sonangol (36.84 percent, just as ENI) and SSI Fifteen (26.32 percent).