Last month the 2018 BP Statistical Review of World Energy revealed that global oil production has now grown for eight straight years. Oil consumption rose to a new high as well, and has increased in 31 of the past 34 years.

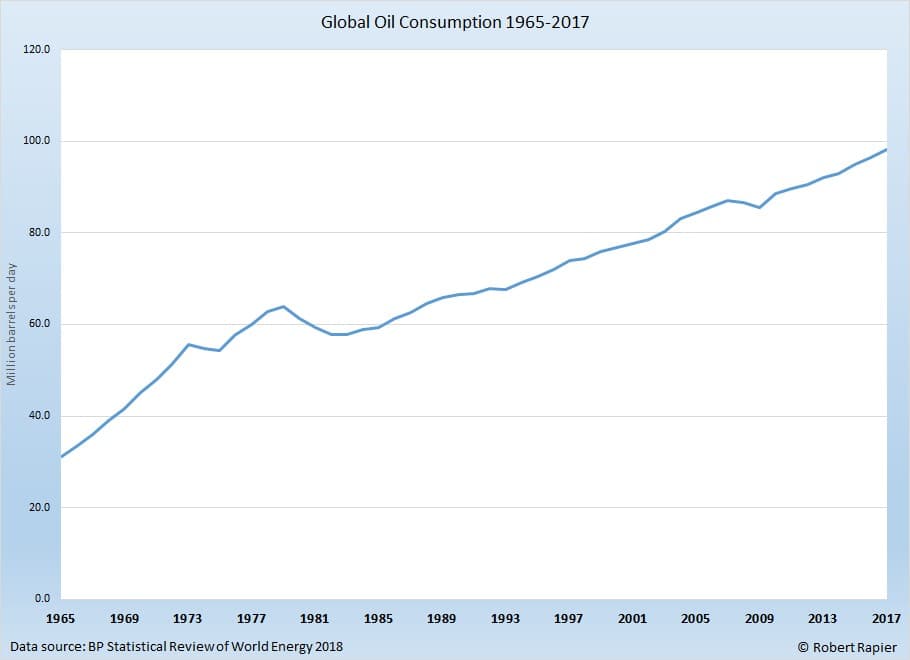

Today I want to take a deeper dive into global oil consumption numbers. Let’s first look at the global picture of the relentless growth of oil demand:

(Click to enlarge)

Global oil consumption 1965-2017

Following several years of softening demand in the early 1980’s, oil consumption turned upward in 1984. Since then, oil demand has risen by 39.2 million barrels per day — an increase of 67% and an average increase of 1.15 million BPD per year over the span of 34 years.

What some may find surprising is the source of that demand growth.

There are three major demand centers for oil in the world: The U.S., the European Union, and the Asia Pacific region. Cumulatively, these three areas are responsible for two-thirds of global crude oil demand. Related: IEA: World Is Not Spending Enough On Energy

While U.S. demand remains relatively high, it isn’t much higher today than it was at the time of the 1973 oil crisis. Likewise in the European Union demand is actually a bit lower today than it was in 1973.

However, it’s a very different story for Asia Pacific:

(Click to enlarge)

Regional oil consumption 1965-2017

U.S. consumption is 3.5 million BPD higher than in 1973, which amounts to growth of just under 15% in 45 years. Demand in the EU has declined by 13% since then.

But demand in the Asia Pacific region climbed from 9.1 million BPD in 1973 to 34.6 million BPD in 2017. This 280% increase in demand is the primary reason the global demand curve has marched steadily higher.

Of course, Asia Pacific is where most of the world’s population resides. Thus, demand growth is being driven by billions of people who use a lot less oil per capita than the U.S., but whose per capita consumption is rising.

Chinese demand has increased by 5.0 million BPD over the past decade, by far the most of any country. But Chinese per capita demand is still only 3.3 barrels per person per year.

In the U.S., we consume about 22 barrels per person per year. That is partially a result of a more mobile and affluent population, but U.S. consumption also drives a much larger economy. To put U.S. demand in perspective, though, if China’s per capita demand were as high, it would be nearly as great as the entire current global demand. Related: Iranian President Threatens U.S. With “Mother Of All Wars”

In second place for the largest increase in oil demand over the past decade is India, which has seen its demand increase by 1.7 million BPD. Third place will probably be a surprise to many. Saudi Arabia has increased its oil demand by 1.5 million BPD over the past decade. These three countries were the only ones to experience demand growth over one million BPD over the past decade.

The largest decrease in demand over the past decade was in Japan, which saw oil demand decline by 1.0 million BPD. Second place will be another surprise, as the U.S. saw oil demand decline by 800,000 BPD. Italy was third with a decline of 493,000 BPD, while the entire EU saw demand fall by 1.7 million BPD.

In the next article, I will discuss the primary sources that are satisfying all of this new demand.

By Robert Rapier for Oilprice.com

More Top Reads From Oilprice.com:

- Is The Oil World In Panic Mode?

- Iraq Orders Internet Blackout To Quell Protests

- India And China Could Mitigate Damage For Iran

According to ExxonMobil’s 2017 “Outlook for Energy: A View to 2040”, oil is expected to remain the world’s primary energy source, driven by demand for transport which is projected to grow by 20% between 2015 and 2040.

A major underpinning factor for the projected steep rise in oil demand is the growing world population and the emergence of megacities. Twenty-five years ago there were only 10 urban areas in the world that could boast more than 10 million inhabitants. Now there are more than 37 so-called “megacities” worldwide. By 2040 the United Nations estimates that nearly 65% of the world’s population will call cities home.

Another major factor is that world gross domestic product (GDP) is projected to double in the next 15 years from $76 trillion in 2015 to almost $150 trillion, accelerating demand for energy. Non-OECD nations, particularly China and India, will experience the most economic growth, driven by urbanization.

And while the economies of the United States, Japan and the European Union (EU) are mature growing at a smaller growth rates and thus needing less oil, the Asia-Pacific economies have a long way to grow and therefore they will need more oil.

By 2020, 15 mbd of new oil supply may be needed to meet a projected annual average rise in global oil demand of 1.59 mbd and also offset an annual natural depletion rate in global oil production estimated by the IEA at 5% or 4.8 mbd, virtually equivalent to losing the current output of Iraq.

As for Saudi Arabia, there is no surprise here whatsoever about its domestic oil demand which is growing at 7% per annum according to figures provided by Saudi Aramco. Apart from the hot weather, the reason for their accelerating oil demand is not due to economic growth, but because oil, water and electricity used to be subsidized until 2016 when domestic prices were raised to help cut the huge budget deficit resulting from the 2014 oil price crash. Until 2016, a litre of gasoline in Saudi Arabia cost 11 US cents resulting in huge amount of waste and excessive use.

At the current rate of oil consumption, Saudi Arabia could be demoted to the ranks of small oil exporters by 2025 and by 2030 it could cease to remain an oil exporter altogether according to my research. This the motivation behind Saudi Arabia Vision 2030.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

As for India, they are going to be hit hard by human leveraged climate change effects (already a direct issue) and will likely do everything they can over the coming decades to counter these. Oil demand growth is mainly in developing countries and these countries have the most to lose when it comes to idleness on the climate change issues we face. So beyond 2030, the good old days for the oil industry will likely be gone and demand will stat to bleed out.

They should prepare now by investing heavily in alternative energy and transportation and by shifting their incoming new generations of workforce towards these alternatives, instead of misleading the public and their investors about the outlook which will likely leave a lot of people without jobs in the second half 2030s and 2040s resulting in a potential global economic and societal crisis.