Friday January 12, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Timespreads bolsters oil prices

(Click to enlarge)

- Some geopolitical flashpoints, inventory drawdowns and rising demand are pushing oil prices to their highest point in years. Yet the futures market also offers some validation for higher prices.

- Brent one-year timespreads continue to climb, rising deeper into backwardation territory. Backwardation – when front-month contracts trade at a premium to futures dated further out – signals bullishness in the market.

- Oil traders are willing to pay nearly a $5 premium for oil in February compared to oil 12 months from now. The backwardation is at its most extreme point since 2014.

- From a trading standpoint, buying contracts is profitable because each month the trader rolls into a cheaper contract.

- “Being long oil gives a positive annual return, even if oil stays flat,” Giovanni Staunovo, a commodity analyst at UBS Group AG, told Bloomberg. “The last time you could say that was in 2014.”

- The result is investors piling into long bets on crude oil, which is helping to push up prices.

2. Bullish sentiment seen across commodities

(Click to enlarge)

- Bullish sentiment…

Friday January 12, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Timespreads bolsters oil prices

(Click to enlarge)

- Some geopolitical flashpoints, inventory drawdowns and rising demand are pushing oil prices to their highest point in years. Yet the futures market also offers some validation for higher prices.

- Brent one-year timespreads continue to climb, rising deeper into backwardation territory. Backwardation – when front-month contracts trade at a premium to futures dated further out – signals bullishness in the market.

- Oil traders are willing to pay nearly a $5 premium for oil in February compared to oil 12 months from now. The backwardation is at its most extreme point since 2014.

- From a trading standpoint, buying contracts is profitable because each month the trader rolls into a cheaper contract.

- “Being long oil gives a positive annual return, even if oil stays flat,” Giovanni Staunovo, a commodity analyst at UBS Group AG, told Bloomberg. “The last time you could say that was in 2014.”

- The result is investors piling into long bets on crude oil, which is helping to push up prices.

2. Bullish sentiment seen across commodities

(Click to enlarge)

- Bullish sentiment is palpable right now, and crude oil prices are receiving a jolt from the widespread belief that commodities of all types are going to have a breakout year in 2018.

- Share prices for energy companies are performing strongly, as are commodity indices.

- Continental Resources (NYSE: CLR), a shale driller, is up more than 15 percent since December, as are Rio Tinto (NYSE: RIO), a global mining giant, and Schlumberger (NYSE: SLB), the largest oilfield services company.

- The risk is that oil prices are overstretched, with investors piling into one-sided bets. There are technical resistance levels at about $71 per barrel, some analysts argue. As a result, “$70 to $72 a barrel looks toppish in the short-term,” Michael Hewson, analyst at CMC Markets Plc., told Bloomberg.

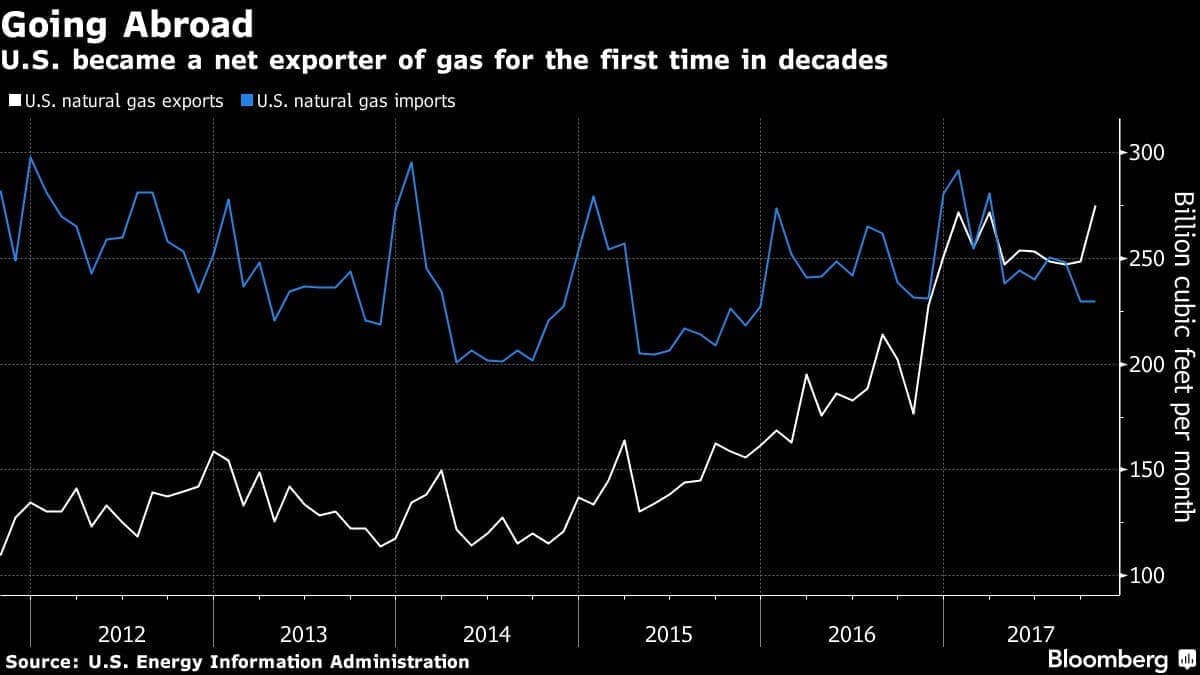

3. U.S. becomes net natural gas exporter

(Click to enlarge)

- The U.S. now exports more gas than it imports for the first time since the 1950s. LNG exports started up in 2016, helping to push the trade balance into net export territory for the first time on an annual basis in 2017.

- U.S. net gas exports averaged 0.4 billion cubic feet per day (bcf/d) last year, compared to net imports of 1.8 bcf/d in 2016.

- Total LNG exports will jump from 1.9 bcf/d in 2017 to 3.0 bcf/d in 2018, thanks to Dominion Energy’s (NYSE: D) Cove Point LNG export terminal reaching full capacity this year, plus the inauguration of the first LNG train from Freeport LNG.

- LNG exports will rise to 5.5 bcf/d by 2019.

- Also, pipeline exports to Mexico are rising quickly and will expand by nearly a third between 2016 and 2019, hitting 8.0 bcf/d next year.

4. Renewables, gas will continue to kill coal

(Click to enlarge)

- In 2017, the U.S. added roughly 25 GW of new utility-scale electricity generation capacity, just about half of which came from renewables. An additional 3.5 GW of small-scale solar was also added.

- More than half of the renewables came in the fourth quarter, which is typical because developers race to complete projects before the end of the year to take advantage of various policy incentives.

- The U.S. Federal Energy Regulatory Commission rejected a Trump administration proposal to subsidize aging coal and nuclear power plants this week. The move would have slowed the current market trend underway, a shift to more gas and renewables.

- There was already almost no chance of new coal capacity coming online from here on out. The FERC rejection likely means more existing coal plants will retire in the coming years, paving the way for more power plants using gas, wind and solar.

5. Cryptocurrencies to use energy rivaling medium-sized countries

(Click to enlarge)

- The “mining” of bitcoin and other cryptocurrencies is incredibly energy-intensive, and their rising popularity means that energy consumption related to their operations is skyrocketing.

- Morgan Stanley estimates that bitcoin’s electricity consumption could hit 125 terrawatt-hours (TWh) by 2018, which is roughly equivalent to the electricity consumption of the entire country of Argentina. That energy use will also exceed the demand for EVs in 2025, the investment bank says.

- Morgan Stanley pegs the energy cost of creating an individual Bitcoin between $3,000 and $7,000. That makes low cost regions ideal for bitcoin mining.

- China has been home to a lot of bitcoin mining, but a government crackdown (over fears of too much electricity consumption and the financial risk of cryptocurrencies) could force mining operations to move elsewhere.

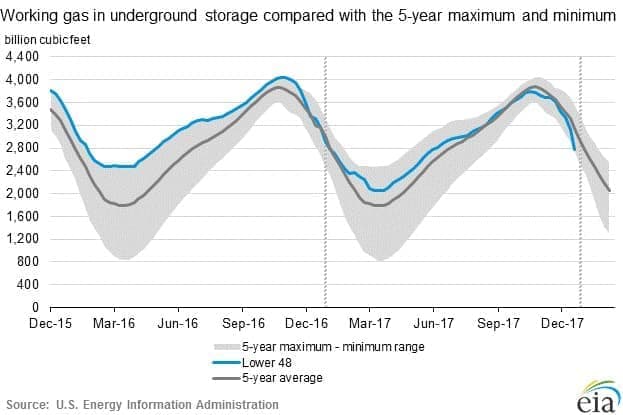

6. Natural gas inventories plunge

(Click to enlarge)

- Cold weather in the U.S. has led to a spike in natural gas consumption. On January 1, the U.S. consumed 143 billion cubic feet of gas, a record high.

- The strong winter season for gas demand has led to sharp drawdowns in inventories.

- Gas storage levels plunged to 2,767 billion cubic feet as of January 5, which is an estimated 415 bcf lower than at the same time last year.

- In fact, gas inventories are now 383 bcf below the five-year average, with about two more months of the drawdown season to go. Storage levels are starting to look alarmingly low.

- Yet, natural gas prices have barely budged. Nymex futures prices for February edged up to about $3/MMBtu this week, a modest gain since the start of winter.

- The reason for tepid price increases in the face of staggering levels of demand is that production is also set to soar this year. The EIA foresees the U.S. adding 6.9 bcf/d in new supply this year, the largest annual gain ever recorded.

7. Hedging prices for 2019 surge

(Click to enlarge)

- Multiple times in recent years, the shale industry repeatedly rushed to lock in hedges for their future production whenever WTI prices seemed to jump above $50 per barrel.

- Many of them did so in the third quarter of 2017 for this year’s production. By the end of the third quarter, the shale industry locked 1.5 mb/d of 2018 production into hedges, or nearly a third of their output.

- That was a period of time in which WTI moved up to $50 per barrel.

- But as Bloomberg Gadfly notes, hedging for 2019 has yet to really get underway. The exciting thing for the industry is that prices are rising.

- 2019 swaps recently jumped to $57.50 per barrel, $8 per barrel higher than they were in the third quarter. These prices are higher than the wave of hedges made in late 2016 that led to a surge of supply last year.

- In short, the shale industry has a unique opportunity to lock in production through next year at attractive prices. This bodes well for strong production gains into 2019.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.