Hurricane Barry shook things up a bit during this year’s slack season, shutting more than half of oil and gas output in the Gulf of Mexico (some 1.1mbpd on a daily basis). By Tuesday-Wednesday, however, most port infrastructure, all affected GoM refineries including Philips 66’s Belle Chasse Refinery, as well as lightering operations went back to business as usual. As hurricane fears subsided, rumors about a potential rapprochement between the US and Iran, set in motion by Iranian Foreign Minister Javad Zarif claiming to be ready to negotiate their defensive missile program, have pushed crude prices downward. With no other major factors to counteract bearish sentiments, the most recent oil rally seems to have fizzled out.

There is still room for minor rebounds, as the Wednesday morning trading session proved when crude prices partially retrieved the previous day’s losses on news that the US crude inventory drawdown was smaller than expected. But oil prices collapsed once again in the afternoon, with WTI and Brent falling to $57.16 and $64.13 respectively.

1. US Crude Exports to China Bounce Back

- The relative lull in the US-China trade war has allowed US crude exports to China to reach a 14-month high this month, but price developments indicate the buying interest will fade for August-September loaders.

- The root cause for this influx of US crudes into China is the arb opening in May-June 2019, the WTI-Brent spread surpassing a 9 per…

Hurricane Barry shook things up a bit during this year’s slack season, shutting more than half of oil and gas output in the Gulf of Mexico (some 1.1mbpd on a daily basis). By Tuesday-Wednesday, however, most port infrastructure, all affected GoM refineries including Philips 66’s Belle Chasse Refinery, as well as lightering operations went back to business as usual. As hurricane fears subsided, rumors about a potential rapprochement between the US and Iran, set in motion by Iranian Foreign Minister Javad Zarif claiming to be ready to negotiate their defensive missile program, have pushed crude prices downward. With no other major factors to counteract bearish sentiments, the most recent oil rally seems to have fizzled out.

There is still room for minor rebounds, as the Wednesday morning trading session proved when crude prices partially retrieved the previous day’s losses on news that the US crude inventory drawdown was smaller than expected. But oil prices collapsed once again in the afternoon, with WTI and Brent falling to $57.16 and $64.13 respectively.

1. US Crude Exports to China Bounce Back

- The relative lull in the US-China trade war has allowed US crude exports to China to reach a 14-month high this month, but price developments indicate the buying interest will fade for August-September loaders.

- The root cause for this influx of US crudes into China is the arb opening in May-June 2019, the WTI-Brent spread surpassing a 9 per barrel discount in May and averaging 8.18 per barrel in June.

- The WTI-Brent spread has inched lower since then and is currently trading around 7 per barrel, rendering August-loading exports to China less financially attractive but still feasible.

- Following the 6 cargoes that already sailed or are about to be loaded in July, there are so far 4 cargo fixtures for August, all VLCCs chartered by state-owned firm UNIPEC.

- This comes amid China hitting a new refinery throughput record in June, having processed 13.07mbpd, up 0.4mbpd from the previous all-time high attained in April.

- Much of the demand increase boils down to the successful ramp-up of the 400kbpd Hengli Refinery and launching of trial runs at fellow private 400kbpd Zhejiang Refinery in June.

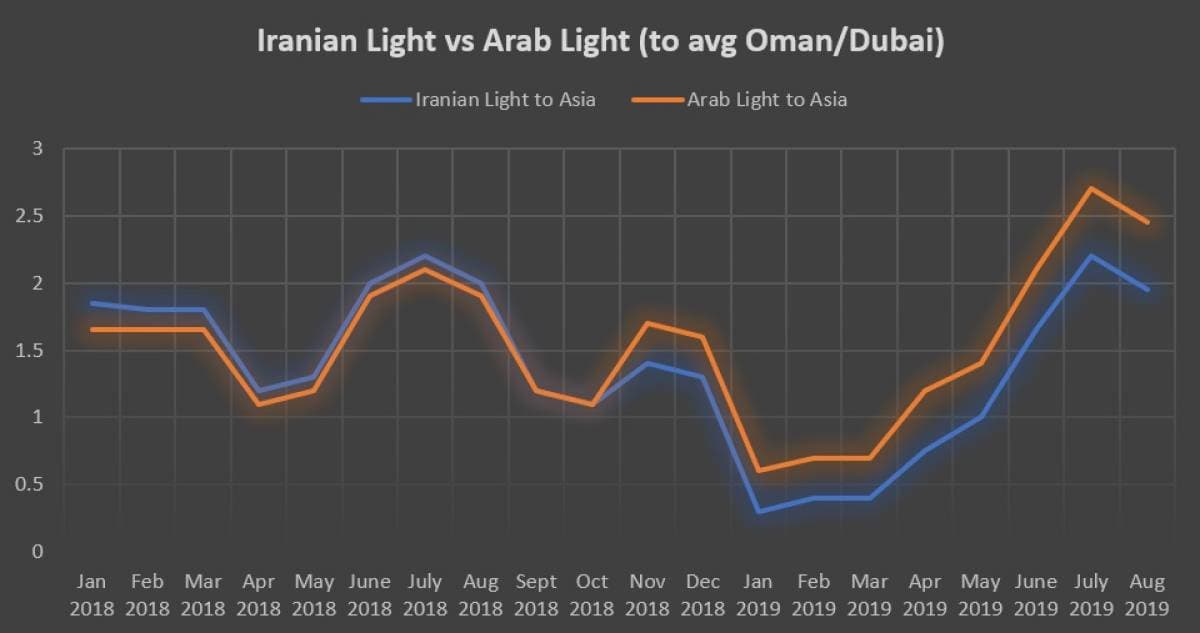

2. Iran Drops August-Loading OSPs

- The Iranian state-owned oil company NIOC dropped the official selling prices for August-loading cargoes for all of its export destinations, whether in Asia or in Europe.

- Keeping the 50 cent per barrel difference to Arab Light, NIOC has decreased the Asia-bound OSP for Iranian Light by 25 cents, to a 1.95 per barrel premium against the monthly Oman/Dubai average.

- After 7 months of Saudi Aramco increasing Arab Light prices to Asia (and NIOC following suit), August marks the first month when both grades decrease, in a simultaneous manner.

- NIOC has lowered NW Europe-bound cargo OSPs by $1.6 per barrel for both Iranian Heavy and Iranian Light, whilst dropping OSPs destined for the Mediterranean by $2.4 and $2.2 per barrel, respectively.

- The Mediterranean OSP for August-loading Iranian Heavy cargoes was thus set at a $8.8 per barrel discount to BWave, the lowest in many years.

- Iranian exports have dropped to 200-250kbpd, with China providing the sole relatively stable market outlet now that India and Turkey have backed out.

3. Kuwait Conforms With August Pricing Trends

- Conforming to the general Middle Eastern trend as charted by Saudi Aramco, the Kuwaiti national oil company KPC has dropped its August-loading official selling prices for its flagship crude, KEB.

- August Kuwait Export Blend OSPs to Asia Pacific were decreased by 25 cents per barrel month-on-month, to a $1.4 per barrel premium against the Oman/Dubai average.

- Thus, the AXM-KEB margin widened by 5 cents to 35 cents per barrel, whilst the BASL-KEB margin narrowed by 10 cents to the same amount, marking one of those rare months when Arab Medium and Basrah Light OSPs converged.

- After 4 months of OSP premium growth, KPC also cut the August-loading price of its latest addition, Kuwait Super Light Crude (KSLC), by 50 cents to a 2.5 per barrel premium against the Dubai/Oman average.

- KPC is in the stage of reconfiguring its crude sales – after no KEB deliveries to European receivers in February-March 2019, May has seen the arrival of 3 cargoes in May, followed by 2 VLCCs discharging in both June and July.

4. US Stops Buying Kuwaiti Crude

- The US shale revolution continues to upend long-standing trade patterns, the cessation of Kuwaiti exports to the United States being one of the most recent examples attesting tot he trend.

- Kuwait was a consistent supplier for US refiners, supplying on average 300-400kbpd every singly month between 1992 and 2012, i.e. after the Saddam Hussein-led invasion of Kuwait, in what from now on will be seen as the heyday of Middle Eastern US exports.

- The surge of US shale output depressed the market for Kuwaiti imports, which averaged 125kbpd in 2017 and 90kbpd in 2018.

- Between March 03 and June 13 this year there was not a single US-destined cargo loaded at Mina al-Ahmadi, due to which the 2019 YTD import rate stands at a mere 60kbpd.

- Interestingly, Asia’s share in Kuwait exports has dropped from 90 percent in April 2019 to 79 percent in June 2019 – exports to the Dutch port of Rotterdam have supplanted the missing US and Asian volumes to a certain extent.

- On a long-term basis, however, KPC will grow more reliant on Asia as it brings onstream its 200kbpd Nghi Son refinery in Vietnam, co-owned with PetroVietnam and Idemitsu Kosan.

5. Saudi Aramco Kickstarts South Africa Refinery Project

- Following Saudi Aramco’s advances into South Korea’s downstream segment, the Saudi national oil company has set its sights on South Africa where it intends to build a new refinery.

- The refinery, whose capacity is still undetermined, will be most probably located in Richards Bay, in the province of Kwa-Zulu Natal, meaning the South African government gave up on its intent to persuade Aramco to build it in Coega, Eastern Cape.

- Saudi Arabia generally accounts for some 40 percent of South Africa’s crude imports, with the overwhelming majority of cargoes destined for the port of Durban.

- With no crude production of its own, South Africa averaged 450kbpd in refinery runs over the past couple of years.

- South Africa’s 6 existing refineries with an aggregate refining capacity of 525kbpd have been operating at a 85 percent utilization rate this year.

6. Vitol Takes a Tangible Doba Position

- Vitol has bought three of the four available Doba cargoes (the fourth going to Chinese petrochemicals firm ChemChina), marking the arrival of leading tradinghouses into the Doba market.

- The heavy sweet Doba (containing a mere 0.1 percent sulphur) has been a staple diet for Indian and Chinese refiners throughout this year, as firms like Unipec or Reliance prepare for a post-IMO 2020 landscape.

- As refining margins generally fell in Asia Pacific, prices of Doba gradually dropped down from their all-time highs attained this May when Doba was assessed at a 2 per barrel premium to Dated Brent.

- Doba falling to a 0.75 per barrel discount to Dated and LSFO quotes indicates hefty returns for refiners and renewed interest in the Chadian crude, as represented by Vitol’s taking it (most probably) to its UAE Fujairah refinery.

- Doba exports from the Kome-Kribi FPSO Terminal in offshore Cameroon have averaged 140kbpd so far this year, up 35 percent against the annual 2018 average of 104kbpd.

7. Israel’s Second Offshore Licensing Round Fails to Impress

- All previous major discoveries and infrastructure buildup notwithstanding, Israel’s second offshore licensing round will most probably go down in history as a rather disappointing one.

- Only 2 consortiums submitted bids on 19 blocks on offer (Zones A, B, C, D and E below), expressing interest in a total of 12 blocks.

- No European or any other Western majors participated in the bidding, with the first consortium consisting of Cairn Energy, Soco and Ratio Oil, with the second comprising Energean Oil & Gas and Israel Opportunity.

- This might lead to the emergence of leaders in Eastern Mediterranean drilling activity and acreage ownership (e.g.: Energean), however will disappoint Israeli authorities.

- The first licensing round saw similar results, as only Energean and a consortium of Indian firms submitted bids for the 24 blocks offered.