Jurrien Timmer, Fidelity’s Director of Global Macro, recently made a notable statement about Bitcoin, describing it as "exponential gold" and an emerging player on the "store of value" team.

Timmer's comments were shared through a series of posts, where he elaborated on Bitcoin's evolving role in the financial ecosystem.

In my view, bitcoin is exponential gold and an aspiring player on the store of value team. My work suggests that the price of bitcoin is driven primarily by the growth in its network, which is in turn driven by bitcoin’s unique scarcity feature, as well as the monetary and fiscal…

— Jurrien Timmer (@TimmerFidelity) June 13, 2024

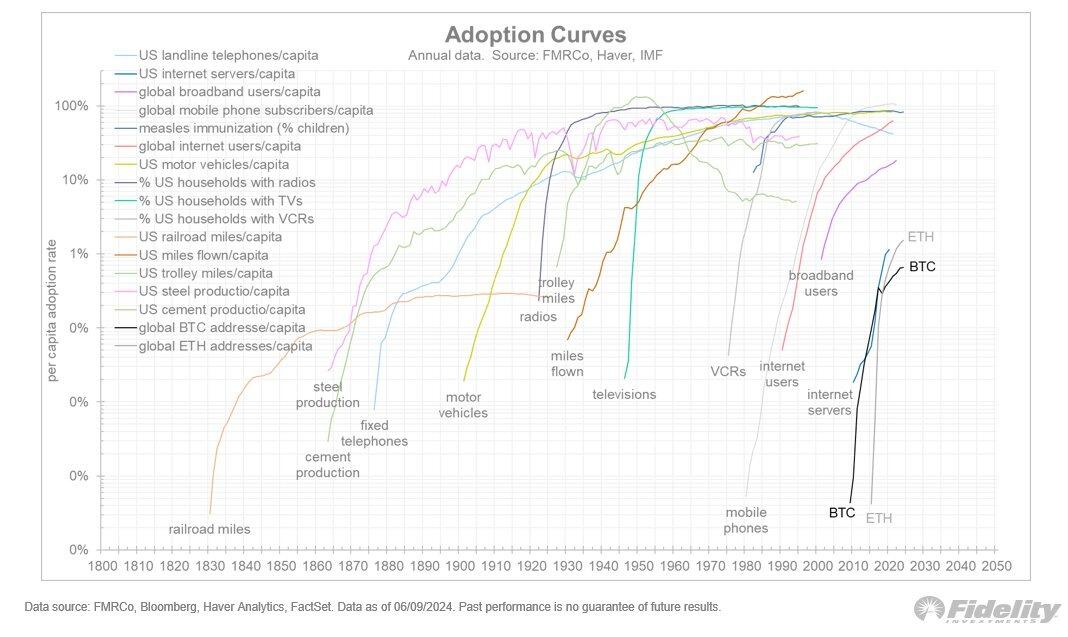

Timmer highlighted Bitcoin's unique position in the market, and compared its growth trajectory to the exponential adoption curves seen in technologies like the internet and mobile phones. He emphasized that Bitcoin’s scarcity and growing acceptance as a digital asset contribute to its potential as a long-term store of value, akin to gold.

In his posts, Timmer suggested that its adoption rate and network growth are critical factors in its valuation.

He noted that while Bitcoin is still in its early stages compared to traditional assets, its adoption is accelerating at an exponential rate, supporting the thesis that Bitcoin could become a significant store of value in the future.

"The chart below shows Bitcoin’s growing network along a simple power curve. The number of non-zero addresses has converged towards this power curve, with Bitcoin’s price oscillating around it like a pendulum," he said.

"Such is Bitcoin’s unique series of boom-bust cycles."

ADVERTISEMENT

Timmer's endorsement aligns with a broader trend among institutional investors recognizing Bitcoin’s potential. His perspective reinforces the growing legitimacy of Bitcoin within the financial industry, suggesting that it could play a vital role in future investment strategies.

"The growth of Bitcoin’s network has slowed in recent months, while its price has continued to gain," he concluded. "In my view, this divergence between price and adoption could explain why Bitcoin has slowed down a bit along its path to potential new all-time highs. The pendulum will only swing so far. For the new highs to continue, the network may have to accelerate again."

By Zerohedge.com

More Top Reads From Oilprice.com: