Beware of Saudi/UAE Reports of Oil Tanker “Sabotage”

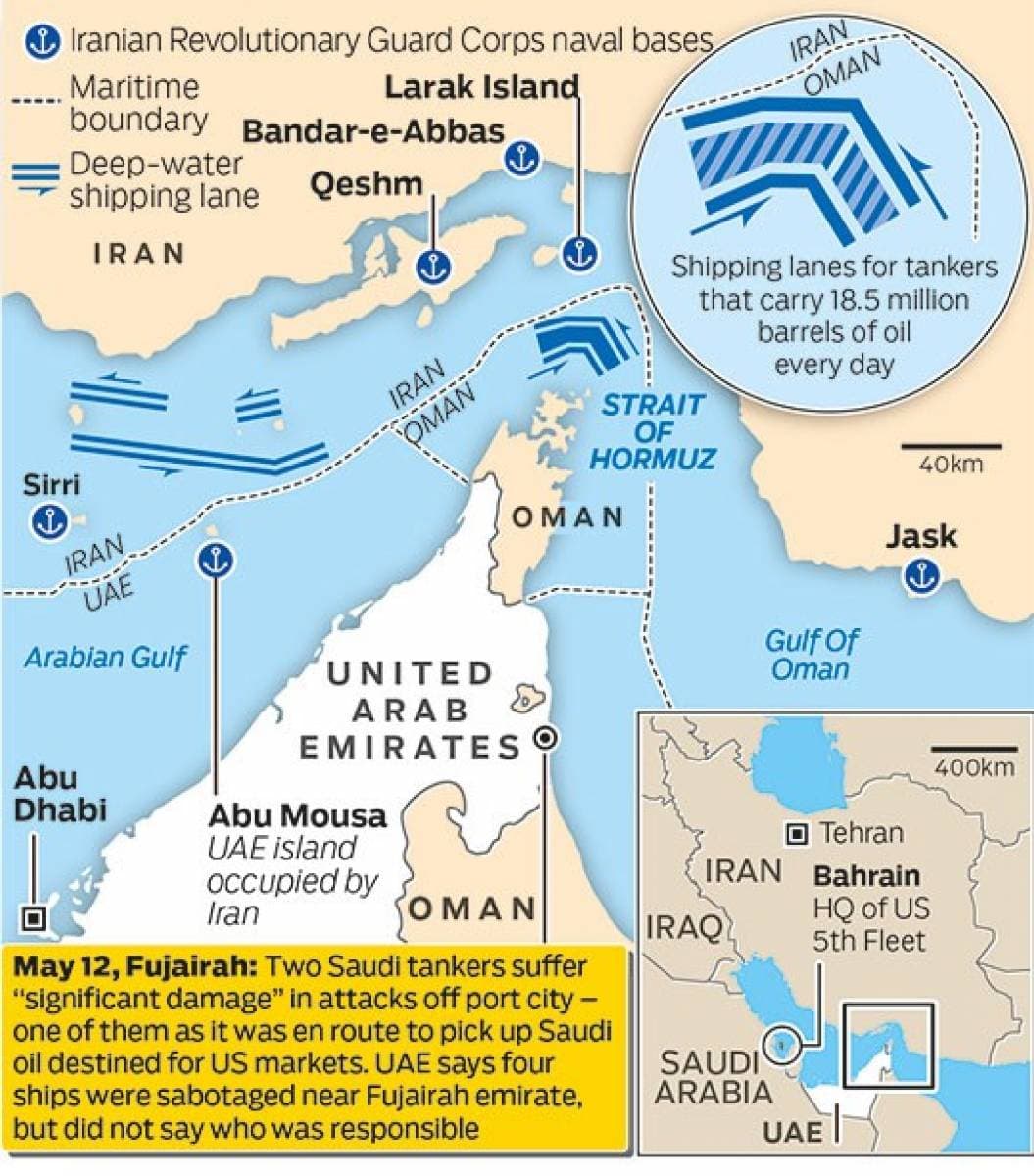

In the span of several days, Saudi Arabia has claimed that two of its oil tankers and a pipeline have been attacked, with the clear implication being that Iran was responsible. The initial reports of a “sabotage attack” on two Saudi oil tankers off the UAE coast (near the Strait of Hormuz) came out of the UAE on Sunday. There have been no details about these attacks, and no evidence whatsoever, with the Saudis saying only that there has been structural damage. Then, on Tuesday, the Saudis said that drones targeted two oil pumping stations along its East-West pipeline, forcing Aramco to halt pumping to evaluate the damage. Output and exports continued without disruption, nonetheless.

The drone attack on the Saudi pipeline has been claimed by Yemen’s Houthis, who align with Iran in what is essentially a proxy war between Saudi Arabia and Iran in Yemen. There is no clear evidence of the alleged attack on the Saudi oil vessels off the UAE coast, but oil prices rose on speculation regardless. Satellite imagery of the vessels does not show any damage, and our assessment of Houthi weaponry suggests that they wouldn’t have reached this area of the coast, nor would they have launched such an attack without claiming it.

The Iranians are using the threat of withdrawing entirely from the nuclear deal to leverage Europe to find a way around US sanctions. It’s a game of leverage that Iran won’t win because Europe…

Beware of Saudi/UAE Reports of Oil Tanker “Sabotage”

In the span of several days, Saudi Arabia has claimed that two of its oil tankers and a pipeline have been attacked, with the clear implication being that Iran was responsible. The initial reports of a “sabotage attack” on two Saudi oil tankers off the UAE coast (near the Strait of Hormuz) came out of the UAE on Sunday. There have been no details about these attacks, and no evidence whatsoever, with the Saudis saying only that there has been structural damage. Then, on Tuesday, the Saudis said that drones targeted two oil pumping stations along its East-West pipeline, forcing Aramco to halt pumping to evaluate the damage. Output and exports continued without disruption, nonetheless.

The drone attack on the Saudi pipeline has been claimed by Yemen’s Houthis, who align with Iran in what is essentially a proxy war between Saudi Arabia and Iran in Yemen. There is no clear evidence of the alleged attack on the Saudi oil vessels off the UAE coast, but oil prices rose on speculation regardless. Satellite imagery of the vessels does not show any damage, and our assessment of Houthi weaponry suggests that they wouldn’t have reached this area of the coast, nor would they have launched such an attack without claiming it.

The Iranians are using the threat of withdrawing entirely from the nuclear deal to leverage Europe to find a way around US sanctions. It’s a game of leverage that Iran won’t win because Europe is too weak to make it happen. Regardless of this escalation, it is simply not in Iran’s interest to take pot shots at Saudi oil tankers. Iran’s only move in the Gulf right now would be a show of naval force against the US, which it will not do at present. Iran views all US moves right now as psychological warfare, and it’s not biting.

The danger here comes in the form of warmongering in Washington, where administration officials are keen to suggest that Iran is openly attacking Saudi oil destined for the United States at a time when the US is trying to make a show of force in the Gulf against Iran, readying warships to Israel’s delight. There is no point whatsoever in Iran launching a secret sabotage attack of this low-level nature on Saudi vessels. This was almost certainly not the work of Iran. All other actors in this incident would have far more to gain by such an attack, for which there is still no evidence.

Also, beware of any evidence that emerges in the coming days concerning any weapons that may have been used in these attacks. Any attempt to link up that weaponry to a specific actor is irrelevant. The Saudis and the UAE have been arming al-Qaida in Yemen, with US weapons, which have also made their way into the hands of Yemen’s Iran-backed Houthi. There is a bonanza of weaponry floating around this region and it is just as feasible that the Saudis could be attacked with American weapons.

While the US is using the alleged attack on Saudi oil tankers as a springboard to move against Iran, this attack is more likely the work of a US ally and not an Iranian proxy. This will be a war of fake intelligence. It is also an extremely dangerous 2020 election campaign stunt that goes far beyond the last war game in Iraq.

For investors, the media coverage of this event is a minefield. In an attempt to do damage control for MBS after the Khashoggi affair, the Saudis have seen a senior PR advisor (Richard Minz) drop them as a client. Mintz was grooming the crown prince’s brother, Khalid, on ‘behavior’ as ambassador to the US. The remaining big-name PR lobbyist is Michael Petruzello. But in the meantime, the PR arm of MBS is putting together a master list of journalists (with an eye to the West) who are ranked as friends and foes, with the former further ranked in terms of the level of willingness to engage (i.e. willingness to sell the Saudi story). This document has not yet leaked, but when it does it will be a circus because it will basically lay out which journalists have been bought by Saudi money. And that is only part of the media campaign: Both the Saudis and UAE control an army of social media bots through accounts they acquired from dead people. They use these bots to control their messages against Qatar and Senator Lindsay Graham, as well as other enemies, according to our sources, including an Israeli former intelligence source and a DC lobbyist. Be careful what you consume in the media blitz on this one.

Libya Is Lobbying Trump with Oil Sweeteners

The GNA’s desperate attempt to thwart Haftar and external friends by withdrawing the operating licenses of foreign companies last week, including oil giant French Total SA, was reversed 24 hours later. Instead, the national oil company (NOC) opted to hit up Houston and Halliburton to do what the Saudis and friends are doing for Haftar in Washington - lobby for support.

NOC chairman Mustafa Sanalla’s visit to Houston late last week raises all kinds of red flags based on our intelligence network in Tripoli. Sanalla took that opportunity to open an international office for the NOC stateside in a $60-billion procurement drive that has been very poorly received in some circles at home.

The NOC’s official statement surrounding this visit said it aimed to use the $60bn investment to upgrade Libya’s oil and gas sector and increase production capacity to 2.1 million barrels per day by 2023. And Houston will serve as a “vital procurement and engineering hub for NOC to tap into the best expertise and technology in the market”. Sanalla also noted that for the NOC’s “US partners”, the Houston office will serve as a gateway for new opportunities in Libya.

This move is contrary to what Libya’s OPEC representative had earlier said. In a 2017 letter that was recently leaked, the OPEC rep told Presidency Council head Faiez Serraj (of the internationally recognized Government of National Accord, GNA) said there is no need for a Libyan NOC office in Houston or elsewhere because the NOC has years of experience already dealing directly with international companies on its own and had already closed other international offices that were redundant and not in Libya’s interests financially.

The NOC’s Sanalla has also met with Halliburton Chairman and CEO Jeff Miller about resuming activities in Libya.

Our sources at the NOC told us that Sanalla’s move was entirely political. By pursuing Halliburton and opening an office in Houston, the political goal was to try to convince the Trump administration to support the GNA against Haftar. If the Saudis are lobbying Washington on Haftar’s behalf, then the GNA feels it must also play the game.

Libya’s top oil analyst says that the NOC’s move is a waste of time and resources. He accuses the US of practicing political blackmail with Libya.

Sanalla with the Halliburton CEO in Houston

It is important to understand the NOC’s relationship with the GNA, and with Haftar. The NOC has attempted to be neutral, maintaining good relations with both sides. That is not the case now though, with the Houston trip confirming that the NOC in Tripoli and Sanalla himself are on the side of the GNA and hostile to Haftar. Many intellectuals in the Haftar camp are now very overtly reminding people of the links between Sanalla and the Muslim Brotherhood (suggesting a tie here to Qatar as opposed to the Saudi/Egypt axis). This sudden revival in such talk is a propaganda tool designed to sway public opinion towards Haftar, but also highlights the break between Haftar and the NOC.

Global Oil & Gas Playbook

- French Total SA has announced that it will begin drilling its first exploration well in Lebanon’s offshore Block 4 in December 2019 and a year later in Block 9.

- Jordan is demanding a complete review of the country’s deal with Israel for gas from the massive Leviathan field in the Levant Basin, operated by US Noble Energy. This puts a $10-billion contract at stake. The Jordanian king is under enormous public pressure here over this deal, which is vital to Jordan’s energy supply but which also means cozying up to Israel--an idea that is strongly opposed with the Palestinian question not only unresolved but intensifying in recent weeks. The Jordanian king is hoping that his call for a review of the deal will appease protesters and also pressure Israel to lower its gas prices. We do not believe the deal itself is at stake at this time. The timing is also important for Noble as Leviathan is now 80% complete and the company is expecting first gas by the end of this year.

- As we noted last week, investors eyeing the Exxon/Hess string of discoveries in Guyana and first phase 1 production planned for 2020 are uneasy over the potential for new elections that create uncertainty over already controversial PSAs. On May 10th, the Caribbean Court of Justice (CCJ) was scheduled to rule on the validity of a no-confidence motion against the current government; however, the Court reserved judgment and there are not yet any indications as to when a decision will be announced. Our sources indicate that it could be more than a week. Again, we do not expect the situation to change in terms of Exxon’s PSA; rather, the point of the opposition here is to try to gain control of the National Assembly, which would be in charge of approving the distribution of revenues from Guyana’s new-found oil wealth. We believe that all talk of a deal with Exxon that is not in the national interest is for campaign purposes only.

- Saudi Aramco is opening a trading office in London this summer, with the aim of increasing oil supply to Europe by 300,000 bpd over the next two years. The goal is to supply Europe with crude and offtake refined products to supply to the southern countries (Italy, Cyprus, Balkans).

- Exxon’s LNG project development plans in Mozambique have been granted government approval, and the FDI on the project is now expected later this year. This is for the Rovuma LNG project, which Exxon took over from Italy’s ENI in 2017 in a $2.8-billion deal. The project includes two LNG plants with a total capacity of more than 15 million tons of LNG annually. Sales and purchase agreements have been submitted for approval. The project is in Area4 offshore Mozambique and is owned by Exxon, Eni and China’s CNPC.

- Investors are also uneasy about the state of affairs in Angola following the sacking of the CEO of state-run Sonangol, Carlos Saturnino. This comes in the middle of a major restructuring of Sonangol designed to woo foreign investment. More specifically, the restructuring is meant to make the state-owned oil company more transparent and reduce its dominance of the country’s economy. Our assessment is that the shakeup at the top here is in line with this restructuring and will not derail it.

- As we anticipated, China has slapped a 25% retaliatory tariff on US LNG, but has not targeted American crude oil. The new LNG tariff adds to a previous 10% tariff from China on US LNG. China is already importing significantly reduced amounts of crude oil from the US. In June 2018, it was importing over 500,000 bpd from the US; by February this year that was down to about 135,000 bpd, based on EIA figures.