Friday February 22, 2019

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy and metals sectors. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

(Click to enlarge)

- Palladium surged above $1,500 per ounce this week, smashing records.

- Soaring prices are the result of a shortage. Palladium is used in vehicles to help with emissions controls.

- Prices for Palladium have tripled since 2016. Citigroup says that more price increases could be on the way because of supply shortages, and prices will only be held in check by a demand shock. Citi sees prices going up to $1,600. A supply shortage for Palladium is outweighing slower global auto sales.

- Palladium is produced mostly in Russia and South Africa.

- “Until you get an increase in supply coming onstream, which isn’t going to happen for a few years yet, this is going to result in a tight market and prices generally trending higher,” Philip Klapwijk, managing director of Precious Metals Insights Ltd., told Bloomberg.

- Not everyone agrees. Commerzbank said that prices are rising despite bearish forces, citing slower car sales in China. “We no longer…

Friday February 22, 2019

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy and metals sectors. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

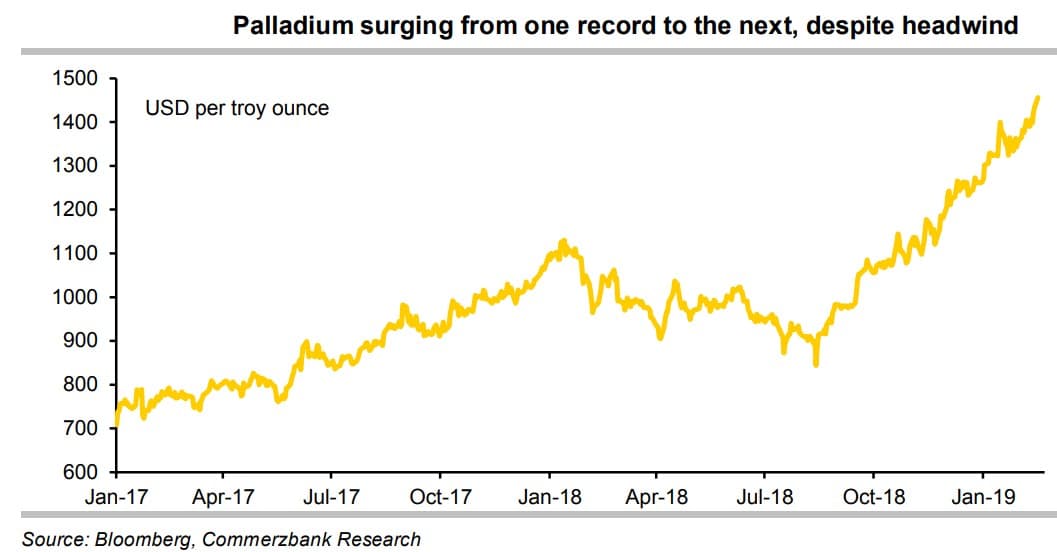

1. Palladium rockets past $1,500

(Click to enlarge)

- Palladium surged above $1,500 per ounce this week, smashing records.

- Soaring prices are the result of a shortage. Palladium is used in vehicles to help with emissions controls.

- Prices for Palladium have tripled since 2016. Citigroup says that more price increases could be on the way because of supply shortages, and prices will only be held in check by a demand shock. Citi sees prices going up to $1,600. A supply shortage for Palladium is outweighing slower global auto sales.

- Palladium is produced mostly in Russia and South Africa.

- “Until you get an increase in supply coming onstream, which isn’t going to happen for a few years yet, this is going to result in a tight market and prices generally trending higher,” Philip Klapwijk, managing director of Precious Metals Insights Ltd., told Bloomberg.

- Not everyone agrees. Commerzbank said that prices are rising despite bearish forces, citing slower car sales in China. “We no longer understand the price response,” the bank said in a report this week. “That said, it is impossible to say when the correction – which we believe is long overdue – will ensue.”

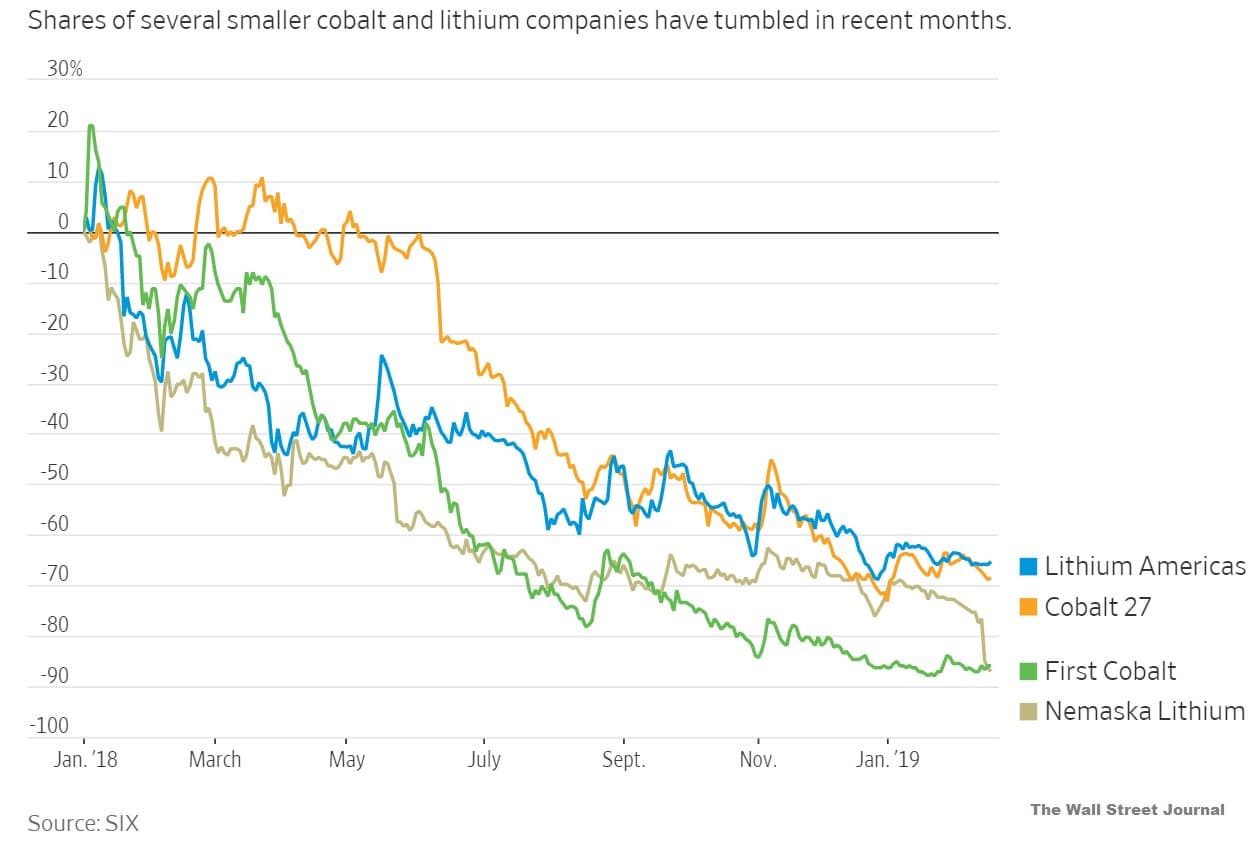

2. Prices for EV metals plunge

(Click to enlarge)

- The bull run for a series of metals needed to build the batteries used in electric vehicles came to an end last year, and the slide has continued in 2019.

- Prices for lithium, cobalt and nickel, among other critical metals, soared in recent years, setting off a scramble for new mines and raising fears of a supply shortage.

- But a surge of new supply has led to a crash in prices. That has crushed the stocks of several metals suppliers. First Cobalt (CVE: FCC) is down more than 80 percent and Lithium Americas (NYSE: LAC) is off by almost half.

- Cobalt prices have declined by 30 percent so far in 2019 alone, according to the Wall Street Journal. Lithium prices also continue to slide, declining for ten consecutive months to date.

- The losses come even as global EV sales soared by 64 percent in 2018.

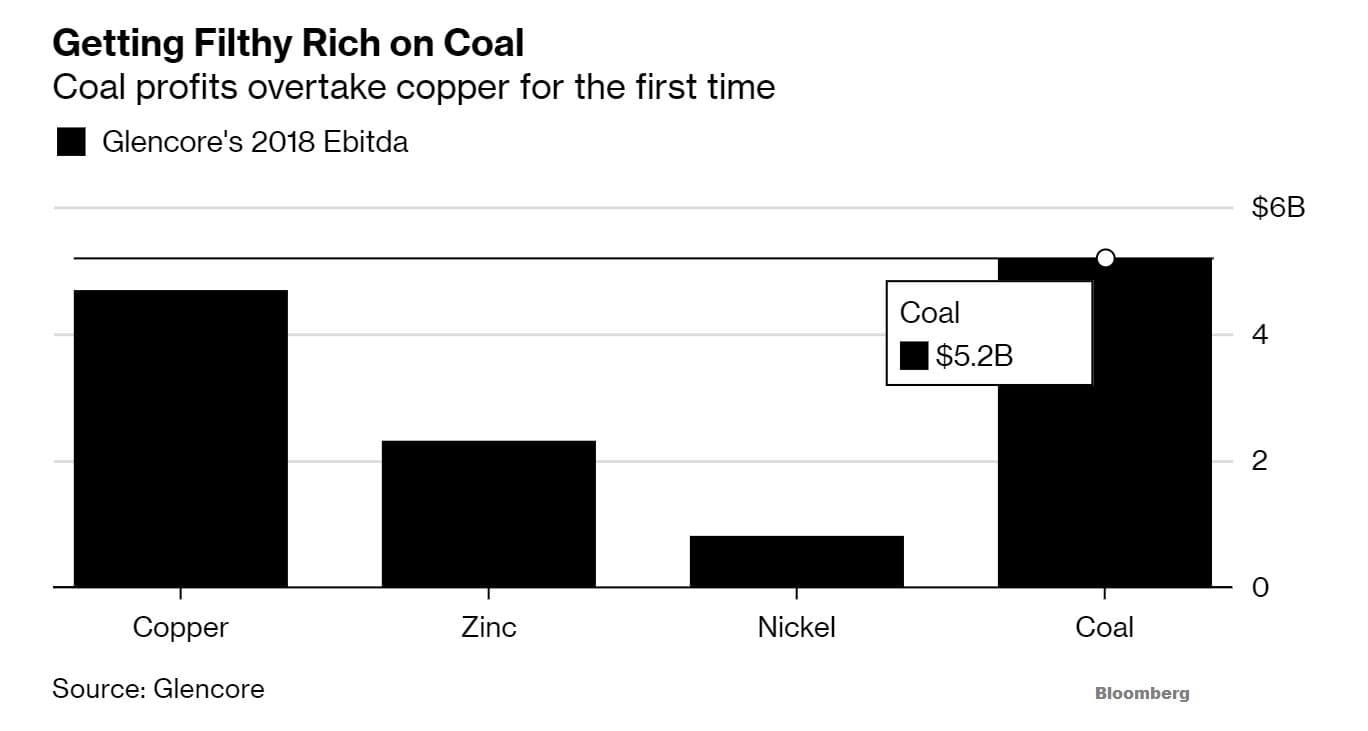

3. Coal phase out?

(Click to enlarge)

- In the face of investor pressure to address climate change, Glencore (LON: GLEN) announced this week that it planned to cap its coal production at 150 million tonnes per year, roughly its planned production level for 2019. New capacity expansion plans are now off of the table.

- The announcement is a devastating one for the global coal market. Glencore is the largest exporter of coal in the world. Coal was also immensely profitable for the miner, taking in more than $5 billion last year.

- Glencore will use the proceeds of coal sales going forward to invest in metals needed for the energy transition, such as copper, cobalt and nickel.

- The flip side is that by capping production, Glencore alone could tighten up coal supplies, boosting prices over time. It’s not unlike the strategy that OPEC takes when cutting production.

- Glencore alone controlled 25 percent of seaborne coal trade last year.

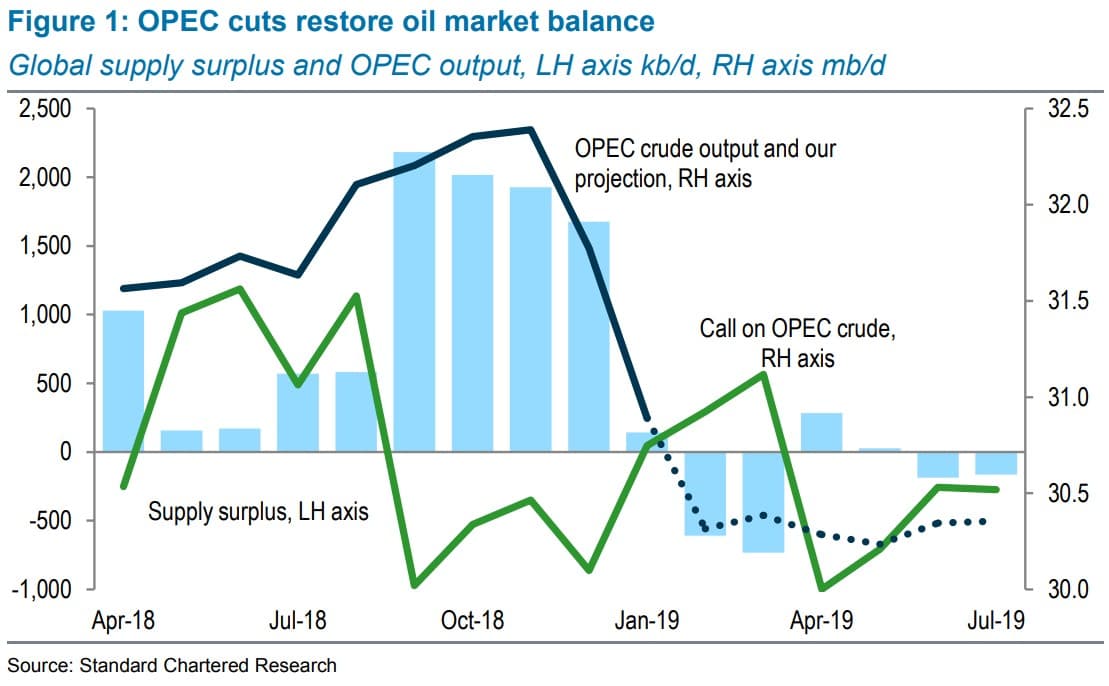

4. OPEC+ cuts could push market into deficit

(Click to enlarge)

- OPEC produced around 30.8 million barrels per day in January, down 880,000 bpd from a month earlier and down 1.5 mb/d from a November peak, according to Standard Chartered.

- Saudi Arabia has pledged to cut another 0.5 mb/d by March.

- That alone should be enough to eliminate the surplus. “We forecast that the oil market will move into a deficit of over 500kb/d in February and March, with the call on OPEC crude rising while output falls,” Standard Chartered concluded.

- Standard Chartered sees Brent prices moving back to $70 per barrel in the relatively near future.

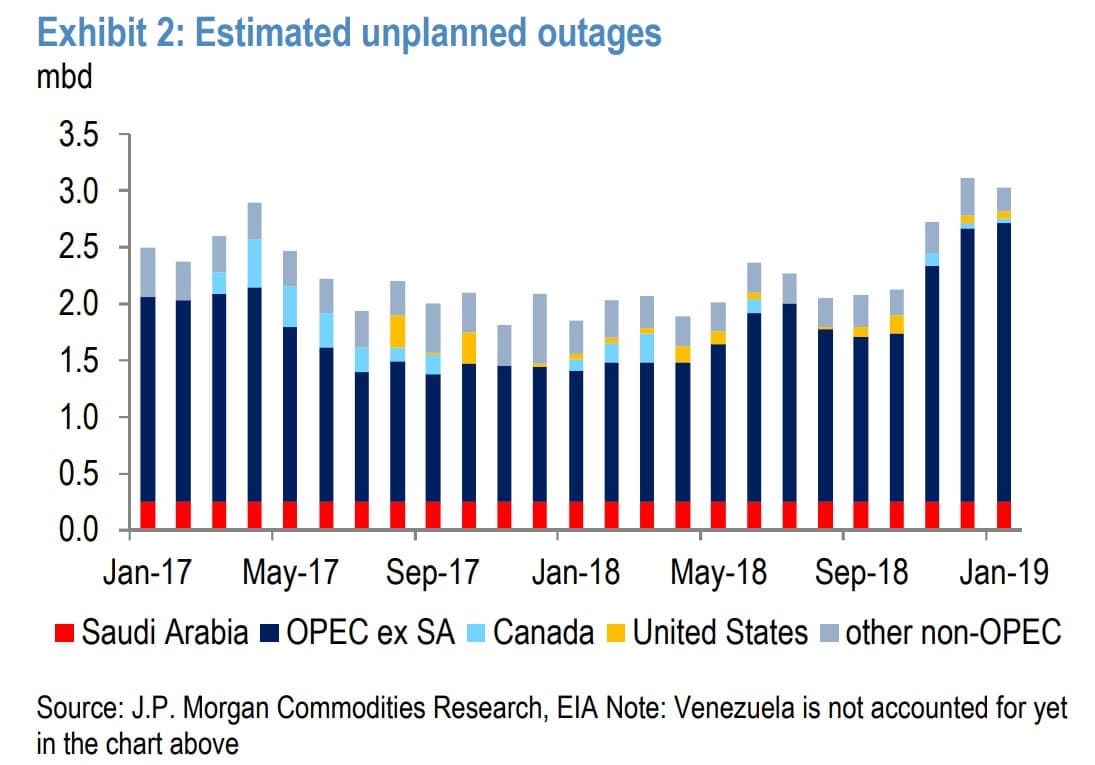

5. Oil supply outages at highest level in years

(Click to enlarge)

- Not only are the OPEC+ cuts slated to erase the supply surplus, but a series of unplanned outages are also tightening the oil market.

- Libya, Nigeria, Venezuela and Iran have all seen unscheduled outages. Canada cut production to rescue prices in the face of midstream bottlenecks. The volume of unexpected supply disruptions is arguably at its highest rate in years.

- “Angola and Mexico continue to over-comply due to lack of investments causing natural decline,” JP Morgan added in a report.

- In the chart above, the fine print notes that these figures do not even include the unfolding declines in Venezuela, nor do they include the likely disruptions from Iran later this year.

- JP Morgan argues that the markets are “not pricing in the risk premiums associated with such events fairly.”

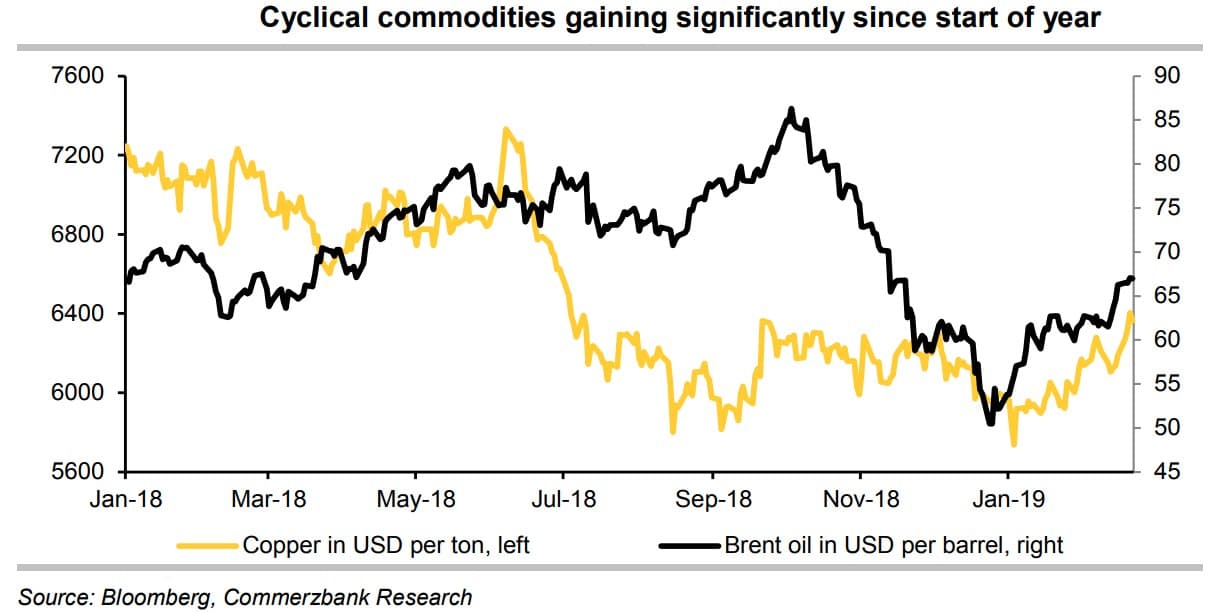

6. Brent more backwardated than WTI

(Click to enlarge)

- Copper prices hit a seven-month high this week, rising above $6,400 for the first time since last summer.

- “We believe that a generally benign market environment and technical buying have been boosting the price rise,” Commerzbank wrote in a note.

- At the same time, optimism is rising that the U.S. and China will reach a trade deal, or at least postpone possible tariffs.

- That has boosted sentiment in commodities, including copper and crude oil.

- The Fed’s course reversal a few weeks ago, putting off more rate hikes, has also been a tailwind for commodities this year.

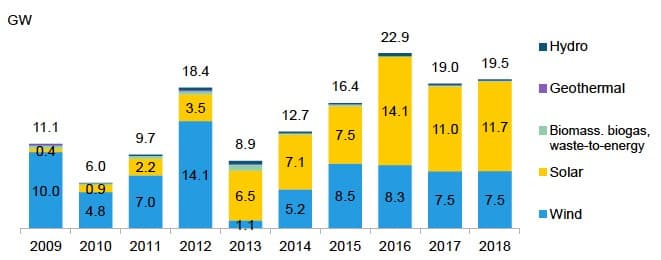

7. Solar soars in 2018, despite tariffs

(Click to enlarge)

- U.S. solar installations grew by 6 percent in 2018 to 11.7 gigawatts. That came despite U.S. tariffs on imported Chinese solar panels, not to mention the broader trade war with China.

- Solar installations outpaced wind (7.5 GW) for the fifth year in a row.

- Corporate-led renewable energy installations is a growing trend, as opposed to more traditional utility-scale projects, according to PV Magazine.

- Corporate buyers accounted for 8.6 GW of new wind and solar last year, more than twice the previous record of 3.4 GE in 2015, PV Magazine found.-

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.