Friday May 4, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

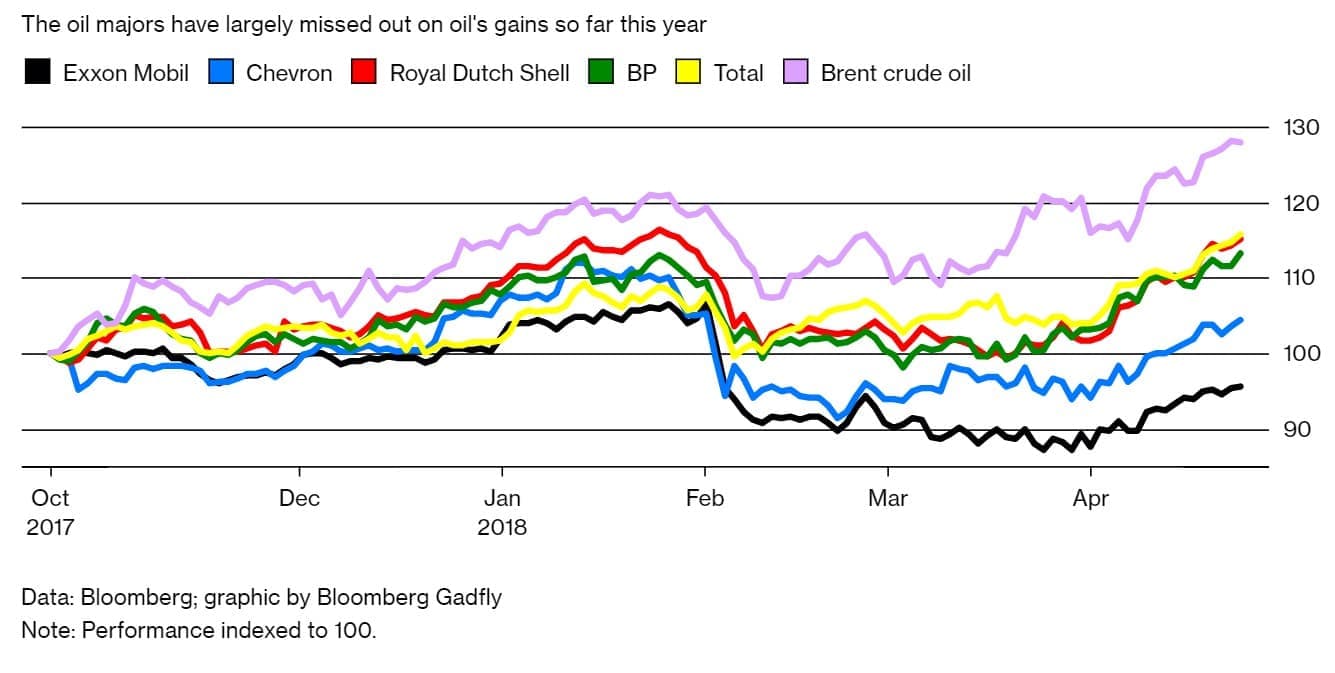

1. Earnings for oil majors up sharply, but Wall Street skeptical

(Click to enlarge)

- The oil majors posted an enormous improvement in earnings, some of them posted their largest profits in years.

- But Wall Street is still skeptical. Even as oil prices have rallied sharply, the majors have barely seen improvement in their share prices. ExxonMobil (NYSE: XOM) has actually posted losses since the fourth quarter of 2017, even though oil prices are now at a three-year high.

- Investors are now wary of high spending levels, which is likely why Exxon has been singled out. Exxon has aggressive spending plans over the next decade in order to grow production. The company’s output dipped by 6 percent in the first quarter compared to a year earlier.

- Still, investment banks keep telling their clients that the oil majors present a huge investment opportunity, with share prices beaten down so much.

2. Exxon stepping up shale drilling

(Click to enlarge)

- With Exxon’s conventional production suffering from some declines in recent years, the oil supermajor is betting on U.S. shale to help revive output.

- Exxon has plans to deploy at least…

Friday May 4, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Earnings for oil majors up sharply, but Wall Street skeptical

(Click to enlarge)

- The oil majors posted an enormous improvement in earnings, some of them posted their largest profits in years.

- But Wall Street is still skeptical. Even as oil prices have rallied sharply, the majors have barely seen improvement in their share prices. ExxonMobil (NYSE: XOM) has actually posted losses since the fourth quarter of 2017, even though oil prices are now at a three-year high.

- Investors are now wary of high spending levels, which is likely why Exxon has been singled out. Exxon has aggressive spending plans over the next decade in order to grow production. The company’s output dipped by 6 percent in the first quarter compared to a year earlier.

- Still, investment banks keep telling their clients that the oil majors present a huge investment opportunity, with share prices beaten down so much.

2. Exxon stepping up shale drilling

(Click to enlarge)

- With Exxon’s conventional production suffering from some declines in recent years, the oil supermajor is betting on U.S. shale to help revive output.

- Exxon has plans to deploy at least 30 rigs in the Permian Basin by the end of this year, which will make it the most active driller in the basin, surpassing Concho Resources (NYSE: CXO), which includes figures from RSP Permian (NYSE: RSPP), a company that Concho is taking over.

- Exxon is planning on spending $30 billion per year by the mid-2020s.

- Exxon’s assets in the Permian will produce 800,000 bpd by 2025, or about a fifth of the company’s entire planned production by that year.

3. Shell’s profits surge, but investors disappointed

(Click to enlarge)

- Royal Dutch Shell (NYSE: RDS.A) saw its profits surge by more than 40 percent in the first quarter, but its share price didn’t benefit. Shell’s share price sank after the report.

- Shell is now making enormous profits, but shareholders are demanding a piece of the action. The fact that Shell did not initiate a share buyback program, to offset some of the dilution to shareholders during the oil market downturn, was not received well on Wall Street.

- Total SA (NYSE: TOT), on the other hand, also posted strong profits, but its share price jumped after it released its quarterly figures. The difference was that Total announced more share buybacks.

- Shareholders are no longer all that interested in growth. They just want cash returned to them. The companies that are pursuing this strategy are being rewarded.

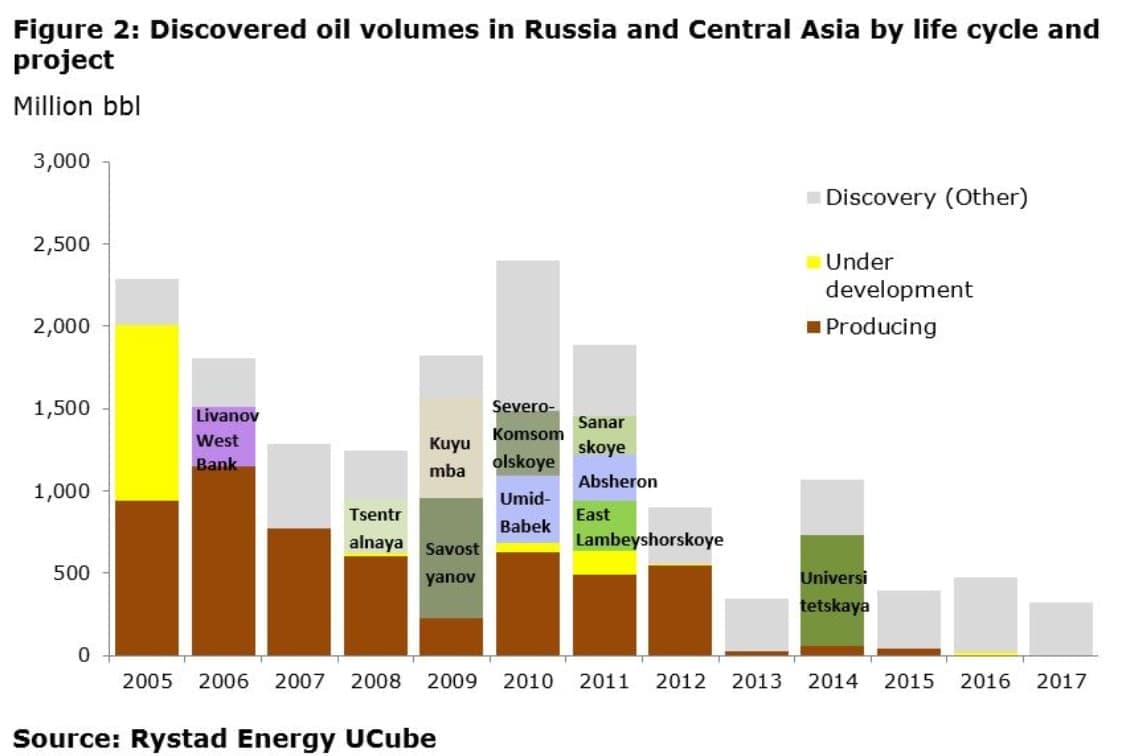

4. Russian oil production set to decline

(Click to enlarge)

- Russia’s oil production could grow until 2020, particularly as the OPEC/non-OPEC production limits are lifted.

- But Russia’s oil fields are mature, and a lack of discoveries in recent years means that depletion will take over and overall production will decline in the 2020s.

- Russian output could average 11.1 million barrels per day (mb/d) in 2019, according to Rystad Energy, but thereafter, output is expected to decline steadily.

- Rystad notes that since 2009, the vast majority of oil discoveries in Russia and other former Russian satellites have not been sanctioned. “Remote location, lack of required technologies, and thus high development costs are the key factors affecting the time from discovery to commercial development,” Rystad says.

- Only by developing new discoveries will output declines be arrested.

5. China oil futures contract gaining a bit of traction

(Click to enlarge)

- China launched the Shanghai oil futures contract in March, hoping to both gain influence in the oil trade and boost the prestige of its currency.

- Yuan-denominated oil futures will reduce currency risk for Chinese refiners. Also, the benchmark will more accurately reflect supply and demand conditions in Asia.

- It isn’t easy to establish a new benchmark. The Oman benchmark was launched more than a decade ago and still has languished with very low trading volumes.

- The Shanghai contract has already surpassed the Oman marker in terms of volume traded.

- Still, while yuan-denominated oil futures present benefits to Chinese consumer, it creates new risk for international traders.

6. Refiners benefitted from enormous WTI discount

(Click to enlarge)

- U.S.-based refiners have been a profitable bet over the past seven years, particularly between 2011 and 2014.

- During that period, U.S. oil production surged, but a lack of pipeline capacity combined with the fact that crude oil exports were banned, led to WTI routinely trading at a massive discount relative to Brent.

- That allowed refiners to buy cheap U.S. shale oil and churn out refined products that they could sell on the international market at prices more closely linked to Brent. It amounted to a sort of arbitrage trade.

- In the past five years, according to the WSJ, the three leading independent refiners – Andeavor (NYSE: ANDV), Marathon Petroleum (NYSE: MPC) and Valero (NYSE: VLO) – have produced an average shareholder return of 195 percent. The WSJ notes that an index of oil producers was down by 27 percent over the same time period.

- It was no wonder refiners were strongly opposed to lifting the crude oil export ban.

7. Refiners using lightest mix of oil in three decades

(Click to enlarge)

- The surge in U.S. shale production is starting to lead to a mismatch between the qualities of oil available and the qualities that refiners want.

- Complex refiners can swap out one type of oil for another, but a lot of refiners on the U.S. Gulf Coast are equipped to handle medium and heavy sour blends.

- Meanwhile, all the oil coming from the Permian is light and sweet.

- The API gravity has climbed to an average of 32.55, according to Bloomberg, the lightest average in 28 years.

- There will be a limit to how much refiners can take in, which will help supercharge crude oil exports.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.