Friday March 22, 2019

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy and metals sectors. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

- Cloud Peak Energy (NYSE: CLD) was once hailed as one of the stronger U.S. coal producers, one that would still thrive in a declining market because of its low-cost coal in Wyoming, far from the mined out seams in Appalachia.

- Last week, Cloud Peak warned that bankruptcy was a possibility, and its stock price now trades at a few cents per share, down from over $5 per share in early 2018, and over $20 per share five years ago.

- Cloud Peak is emblematic of the coal industry as a whole. Shuttered power plants have left the company with a declining customer base. “This is not a problem with a fix,” Jeremy Sussman, an analyst with Clarksons Platou Securities, told Bloomberg.

2. Supply problems for copper

- Trading volume for copper futures spiked in recent days, which Bloomberg says is an indication of a supply shortage.

- A huge bet on higher prices for copper was placed on March 18.

- Citigroup says that supply will fall short of demand by about 116,000…

Friday March 22, 2019

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy and metals sectors. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Another coal miner bites the dust

- Cloud Peak Energy (NYSE: CLD) was once hailed as one of the stronger U.S. coal producers, one that would still thrive in a declining market because of its low-cost coal in Wyoming, far from the mined out seams in Appalachia.

- Last week, Cloud Peak warned that bankruptcy was a possibility, and its stock price now trades at a few cents per share, down from over $5 per share in early 2018, and over $20 per share five years ago.

- Cloud Peak is emblematic of the coal industry as a whole. Shuttered power plants have left the company with a declining customer base. “This is not a problem with a fix,” Jeremy Sussman, an analyst with Clarksons Platou Securities, told Bloomberg.

2. Supply problems for copper

- Trading volume for copper futures spiked in recent days, which Bloomberg says is an indication of a supply shortage.

- A huge bet on higher prices for copper was placed on March 18.

- Citigroup says that supply will fall short of demand by about 116,000 metric tons this year, a second consecutive year of a deficit.

- Inventories have declined by 43 percent in the past year.

3. EVs save on maintenance costs

- The New York City government said that electric vehicles are the cheapest option for its fleet.

- EVs tend to have higher upfront costs, which deters individual motorists, but they are cheaper over time, and not just because of much lower fuel costs. EVs also have lower maintenance costs compared to their gasoline and diesel-fueled rivals.

- New York City had 9,196 light-passenger vehicles in its fleet last year. The Ford Focus had average maintenance costs of $1,805 in 2018 for the city. But the Chevy Bolt only had $205 in maintenance.

- Over the course of a nine-year lifetime, the all-electric Nissan Leaf would cost $32,580, while the gasoline-fueled Ford Fusion would cost $41,328, according to Quartz.

4. Oil volatility jumps

- At the start of the year, oil price volatility steadily declined, as the markets grew comfortable with the pace of the OPEC+ production cuts and the seeming return to balance.

- However, volatility shot up this week, egged on by the delay in the OPEC+ meeting until June and the sudden surge in uncertainty over the global economy after China dug in on trade talks.

- The Cboe Oil Volatility Index rose 10 percent this week.

- “While crude’s rally has been fueled by Venezuela and OPEC’s commitment to curb output, the outcome of trade talks will determine the near-term direction,” Kim Kwangrae, a commodities analyst at Samsung Futures Inc., told Bloomberg.

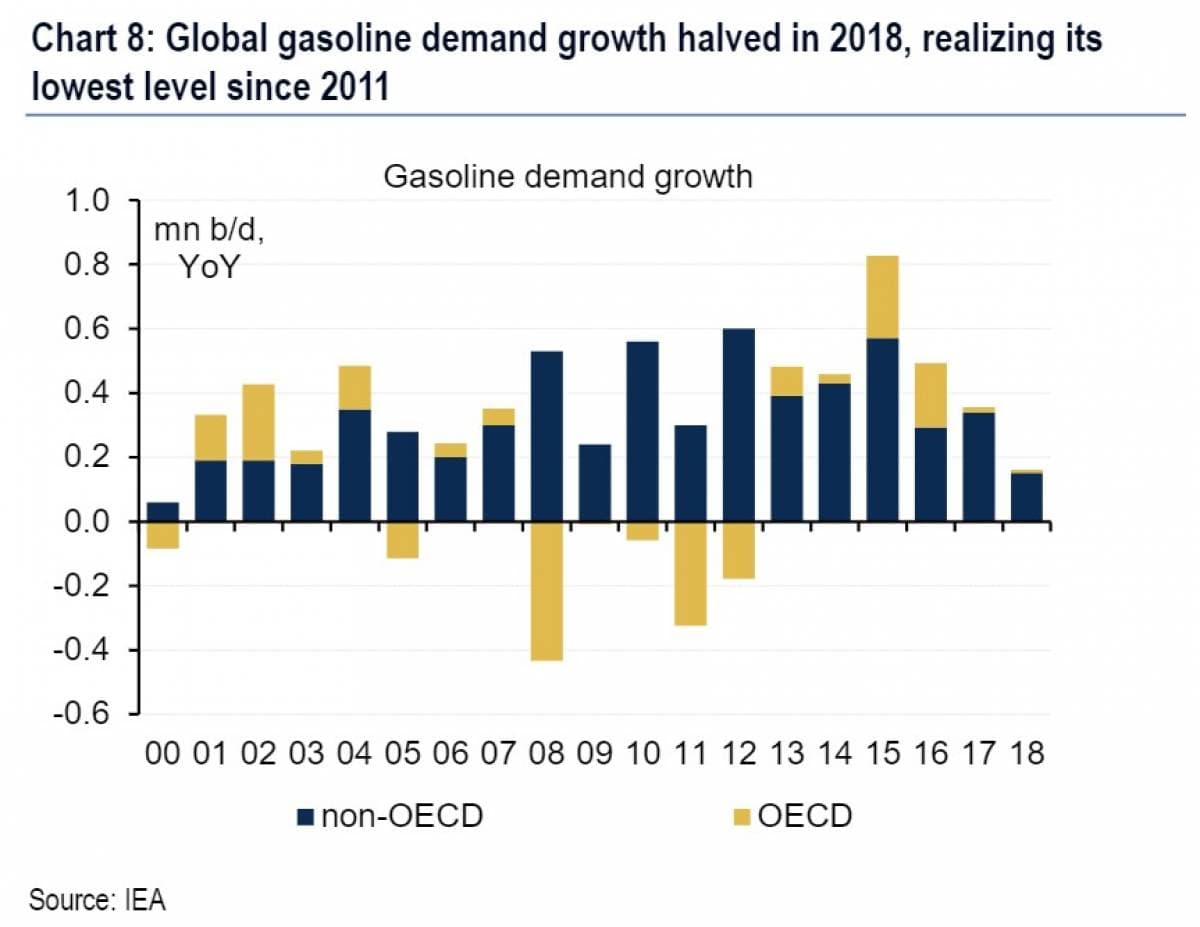

5. Global gasoline demand growth fell to 7-year low

- Global gasoline demand growth fell by half last year, falling to the lowest level since 2011.

- Higher prices kept consumption in check, and a strong dollar depressed demand. The slowdown came after rapid growth years between 2015 and 2017 following the oil market bust.

- Total gasoline demand only grew by 200,000 bpd from a year earlier.

- Sluggish demand is ill-timed for refiners, who have been ramping up processing as they chase high distillate margins. The result is a glut of gasoline in many parts of the world.

6. Buy gold and sell stocks

- A top-performing hedge fund said that buying gold while selling stocks is the “trade of the century” because another meltdown could be coming, according to Bloomberg.

- Crescat Capital LLC, a small fund with only $50 million under management, warns that a recession is coming in 2020 or 2021.

- The fund is betting long on gold in Chinese yuan, while shorting global equities.

- Crescat also said that prominent corporate insiders have been selling equities, another sign that trouble is on the way.

- “We’re not perma-bears by any means,” Tavi Costa, a global macro analyst at Crescat, told Bloomberg. “This is a very tactical bearish view right now, and hopefully when the market turns, we want to also time the bull market at some point.”

7. Agricultural crisis spreading

- An agricultural crisis is brewing in the American heartland. Prices are down because of Trump’s trade war, while a glut in grain markets has depressed prices further.

- Soybean prices are trading around $9 per bushel, half of the prices from 2012.

- American farmers are now sitting on record levels of debt, totaling $427 billion.

- Income is a fraction of what it was in the last few years, down 44 percent from 2013 levels.

- According to Bloomberg, farmers’ debt-to-income ratio is at its highest point since the mid-1980s, the last major crisis in farm country.