Alberta light oil producers have been decimated over the last few years, and especially so in the last nine months following the “blow up” in the Canadian light oil differential in Q4/2018 to over $30 a barrel.

(Edmonton Light oil discount - Source: Alberta Oil Magazine)

This extreme widening in the differential has added to the woes of an industry still reeling from the impact of the 2014 oil collapse and has prompted Alberta’s government to take the rare step of imposing mandatory production caps in order to align the province oil production with limited pipeline export capacity.

(Source: National Energy Board)

Alberta’s intervention was successful in narrowing the differential(for both heavy and light oil) back to its historical range. However, and against the expectation of many investors, Canadian E&Ps valuations failed to rebound in conjunction with the narrowing differential.

(iShares S&P TSX Capped Energy Index – Source: Google Finance)

The disconnect between the recovery in local oil prices and the value of Canadian E&Ps seem to stem, at least in part, from the perception that the differential narrowing was artificial in nature, and that without progress on real egress solutions (additional pipeline capacity) the wide differentials are bound to return. This widespread scepticism only worsened when Enbridge’s Line 3 replacement (the most advanced of the major egress solutions) was delayed by a year in March (and is facing the prospect of further delays). Meanwhile, Keystone XL construction, which was planned to start in 2019, was delayed by at least year due to persistent legal challenges.

Green shoots

Nonetheless, and despite many of the recent setbacks, the Canadian energy sector scored multiple wins on the energy infrastructure front over the last several months, much of which went seemingly unnoticed. On June 18th, the much delayed Transmountain Expansion was approved by the Canadian government and construction is set to start in September. Recently, Enbridge has announced a number of optimization initiatives and expansions to its existing Mainline pipeline network that will add 135K bpd in additional capacity by Q1/2020. Likewise, TC Energy will be adding 50K bpd in additional capacity to its existing Keystone pipeline by Q1/2020. Most recently, Plains Midstream Canada, announced an 80K bpd gradual expansion to its cross-border Rangeland light oil pipeline. It is the latter that’s of most interest to Alberta’s conventional and light oil producers. Related: The Bullish Case For Oil

To understand why Plains Midstream expansion is most significant to light oil producers in Alberta, one most understand the composition of Canada, and specifically Alberta, oil exports. Heavy oil represent 78% (2.8M bpd) of Canada’s 3.6M bpd oil exports (2018 - NEB), with light oil representing the remaining 800K bpd. The numbers are even more skewed to the heavy side when we look at Alberta in isolation. Alberta exported 3.1M bpd in 2018, 84% of which where heavy (2.6M bpd) as compared to only 500K bpd for light.

(Source: National Energy Board)

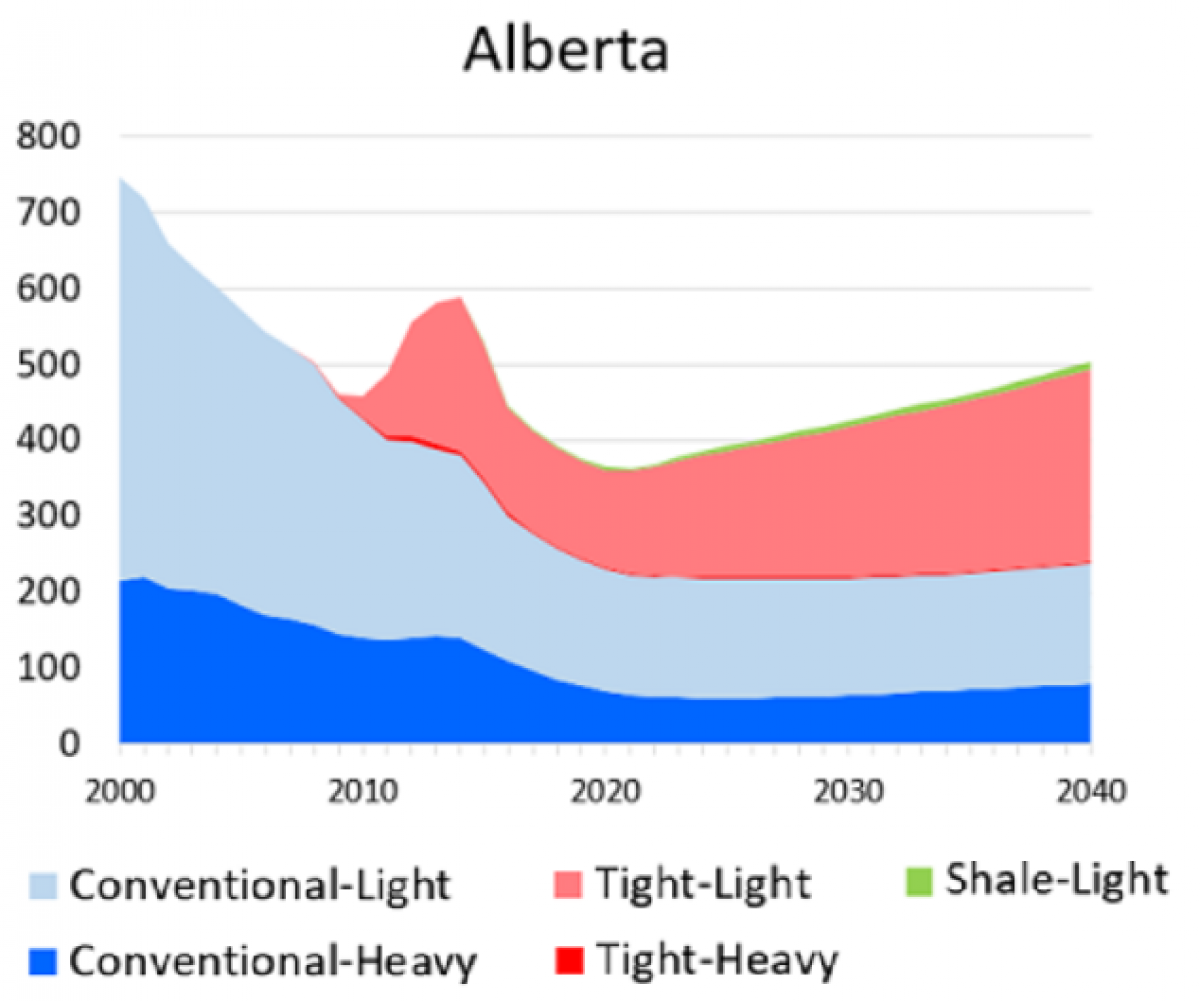

The fact that heavy oil represents the lion share of Alberta’s oil exports is not surprising considering the fact that light oil production in Alberta has been in steady decline over the last two decades, and is only expected to rebound modestly over the next 20 years, mainly due to growth in tight oil production.

(Source: National Energy Board)

The corollary is that heavy oil has gradually elbowed light oil exports out of the pipeline network as exemplified by Enbridge’s Canada Heavy Sweet (CHS) blend launched in 2017, a perfect example of a heavier oil grade encroaching on a previously dedicated light oil egress pipeline (Line 3). This is to begrudge Enbridge, Its only naturel for pipeline operators to focus on finding egress solutions for growing oil sands production at the expenses of a diminishing light oil supply. Related: OPEC: This Is Where Most New Oil Will Come From In 2020

It is in this context that Plains Midstream’s plan to increase its light oil export capacity by 80K bpd to the United States through its Rangeland pipeline could be viewed as a game changer for Alberta’s light oil producers. While an 80K bpd increase in takeaway capacity against a total 3.1M barrels in total oil exports may seem small, when such an increase is measured solely against the 500K bpd of light oil exports, the 80K bpd capacity increase becomes far more significant. Most encouraging is that Plains’ capacity increase is taking place on an existing pipeline, and thus the likelihood of this capacity martializing as planned (in stages between late 2019 and 2021) is very high.

(Source: National Energy Board)

As a result of Plains’ expansion, the Edmonton Light discount is likely to shrink to under $5 in 2020 instead of the expected widening to $10. In a $100 oil a barrel world, a $5 narrowing of the discount may have a marginal impact on producers bottom lines, but a $5 improvement in realizations in a $50 oil world is the difference between life and death for a host of Alberta producers. It is for this reason that Plains Midstream expansion is of such a vital importance to Alberta’s E&Ps, and while additional pipelines are still needed in the medium term to address the industry egress woes for good, Plains’ expansion is a rare measure of good news for an industry under siege.

By Nawar Alsaadi for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Prices Rise Amid Further Rig Count Decline

- WTI Tops $60 On Gulf Of Mexico Shut-Ins

- Oil & Gas Discoveries Rise In High-Risk Oil Frontiers