The bullish spirit of September has turned sour by the end of October, with both analysts and traders expecting a rather difficult 2019. More often than not one encounters global oil demand downgrades for the next year amid emerging market woes, from an almost universally accepted 1.4-1.5 mbpd we see currently forecasts in the 1.1-1.2 mbpd interval. Iran and ailing Venezuela remain the only major upward pressure factors for the time being.

(Click to enlarge)

As a consequence, Brent prices have continued to fall this week, ending it with a w-o-w decline of 6 percent at $73 per barrel. WTI saw a similar trend, with Friday trading oscilatting around $64 per barrel. Oversupply fears still loom large on the market, however, there is some upward potential, too. Next week might turn things around as the US Administration is alleged to have granted eight countries, including India, South Korea, Japan and China, a waiver to sanctions on Iran to be announced officially on Monday.

1. US Stocks rise on the brink of trend reversal

- US commercial crude stocks continued their build for the sixth week in row, this time rising by 3.2 MMbbl week-on-week to 426 MMbbl, whilst crude oil production hit 11.05 mbpd.

- Almost half of the stock rise is due to a 1.5 MMbbl Strategic Petroleum Reserve draw.

- The crude stock buildup will be further mitigated, if not reversed, in the next few weeks as refineries are brought back onstream following fall maintenance…

The bullish spirit of September has turned sour by the end of October, with both analysts and traders expecting a rather difficult 2019. More often than not one encounters global oil demand downgrades for the next year amid emerging market woes, from an almost universally accepted 1.4-1.5 mbpd we see currently forecasts in the 1.1-1.2 mbpd interval. Iran and ailing Venezuela remain the only major upward pressure factors for the time being.

(Click to enlarge)

As a consequence, Brent prices have continued to fall this week, ending it with a w-o-w decline of 6 percent at $73 per barrel. WTI saw a similar trend, with Friday trading oscilatting around $64 per barrel. Oversupply fears still loom large on the market, however, there is some upward potential, too. Next week might turn things around as the US Administration is alleged to have granted eight countries, including India, South Korea, Japan and China, a waiver to sanctions on Iran to be announced officially on Monday.

1. US Stocks rise on the brink of trend reversal

- US commercial crude stocks continued their build for the sixth week in row, this time rising by 3.2 MMbbl week-on-week to 426 MMbbl, whilst crude oil production hit 11.05 mbpd.

- Almost half of the stock rise is due to a 1.5 MMbbl Strategic Petroleum Reserve draw.

- The crude stock buildup will be further mitigated, if not reversed, in the next few weeks as refineries are brought back onstream following fall maintenance season.

- Refinery throughputs have already increased by 150 kbpd last week, with additional increases expected on the back of several PADD 2 refineries’ return to operation.

- US crude imports fell by 334 kbpd w-o-w to a four-week average of 7.4 mbpd, whilst crude exports have risen to 2.5 mbpd (underscoring its sine-shaped movement).

(Click to enlarge)

- Gasoline stocks have decreased 3.1 MMbbl week-on-week for the third week in a row to 226 MMbbl, with exports continuing their growth trend to 1 mbpd.

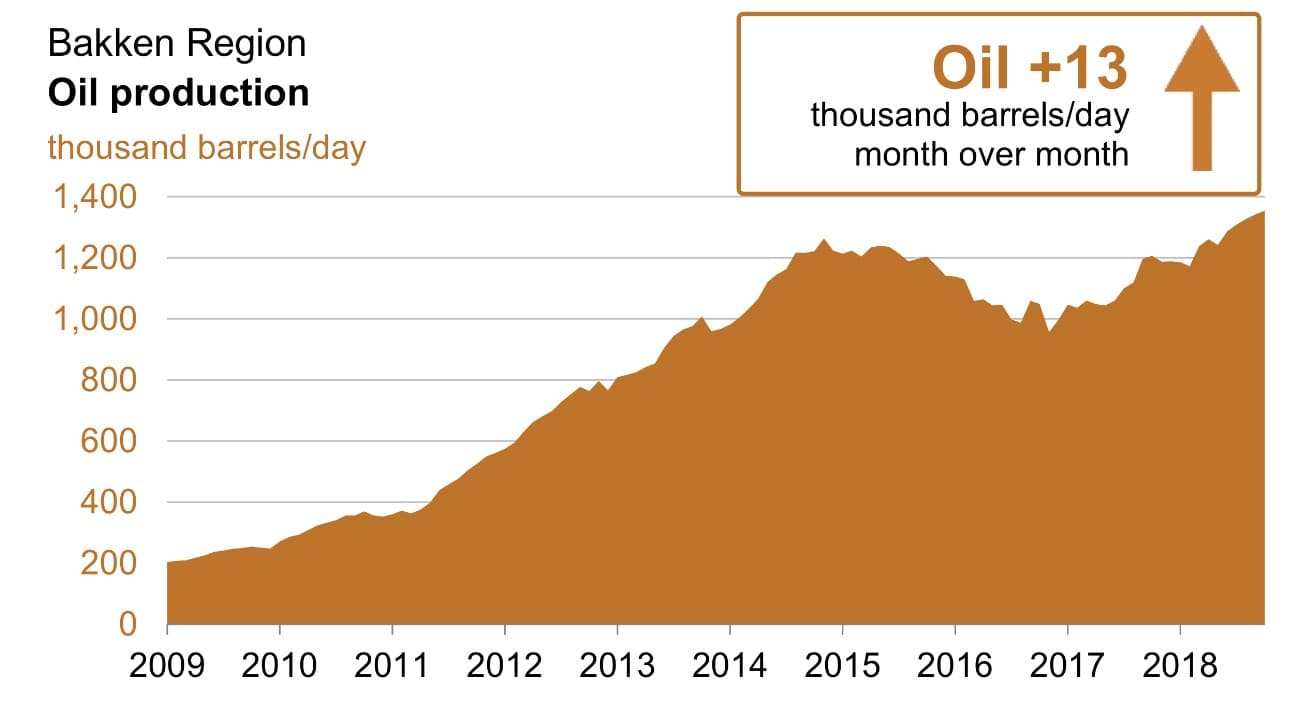

2. Bakken reaping the fruits of technology advances

- Several producers have announced upcoming production increases in the Bakken region, where oil production is expected to reach 1.354 mbpd this November.

- Hess Energy has vowed to increase production, currently at 118kbpd (up 15kbpd y-o-y), by roughly 60 kbpd in the next three years thanks to sophisticated wellbore planning and extended reach laterals.

- Similarly, Continental Resources is on the increase as it produced 167 kbpd in Q3 2018, 23 percent up year-on-year.

Source: US EIA.

- Technological advances are the main factor behind Bakken’s rise, new well oil production per rig tripled within the last three years, surpassing 1.5kbpd this fall.

- Gas production in the Bakken is rising, too, hitting 2,566 MMcf per day in November.

3. Colombia starts fracking next year

- The Colombian oil company Ecopetrol intends to start hydraulic fracturing operations in the Middle Magdalena Basin as soon as 2019.

- This marks the first time fracking is to be introduced in Colombian oil production, four years after the Energy Ministry gave it a green light amid heavy debates about environmental consequences.

(Click to enlarge)

- According to fracking advocates, introducing fracking into Middle Magdalena could yield an additional 2-7 billion barrels worth of reserves, which would triple Colombia’s 1.78 billion barrels of proven reserves.

- Currently the average Colombian production efficiency rate is 19 per cent – reportedly fracking could raise the national average to 24-30%.

- As opposed to former President Juan Manuel Santos who was rather lukewarm towards fracking, recently elected successor Ivan Duque Marquez is a supporter.

- Overall, drilling activity is on the rise in Colombia as it faces palpable depletion problems, with 620 wells to be drilled in 2018 and the doubling of operating rigs around the country.

- Colombia produced 715 kbpd of oil in 2017 and intends to increase output this year to 725 kbpd.

4. Replaying the botched Rosneft privatization

- Rosneft’s privatization deal, first announced in December 2016, remains a sore area in Russia’s otherwise robust oil sector.

- Having sold 19.5% of Rosneft shares to a Glencore-QHG consortium and China’s CEFC last year, only one shareholder remains a part of the shareholder structure, QHG (bought out the others).

- After the spectacular failure of CEFC to join the deal and its consequent bankruptcy and asset freeze, Russia is looking to woo other Chinese companies.

- Compounding Rosneft’s Chinese plight, it has a valid 5-year contract to supply an annual volume of 5 million tons of crude to CEFC, endowed with a prolongation option for another 5 years.

- According to recent rumours, the state-owned CITIC investment company is in talks to take over CEFC’s supply contract and potentially getting into Rosneft’s shareholder structure.

5. Petrobras asset firesale coming soon

- According to Reuters, the Brazilian oil giant Petrobras is bent on divesting assets worth $20 billion next year as it struggles get rid of a severe debt burden.

- Petrobras remains the world’s most heavily indebted publicly listed company, despite some success in selling off part of its assets in 2016-2017.

- The progress is only piecemeal, as Petrobras divested only half of its intended $21 billion package intended for 2017-2018.

- The election of new Brazilian President Jair Bolsonaro will inevitably slow down the divestment process as new elects traditionally replace the top management of 50.2 percent state-owned company.

- Thus, the transfer of the Pasadena refinery from Petrobras to Chevron, reportedly for up to $1 billion, seems increasingly real.

- Despite Petrobras selling some fields in the prolific Campos Basin (Enchova, Pampo, a 25 percent stake in Roncador), the jewel in the divestment crown will be the $7 billion TAG pipeline company.

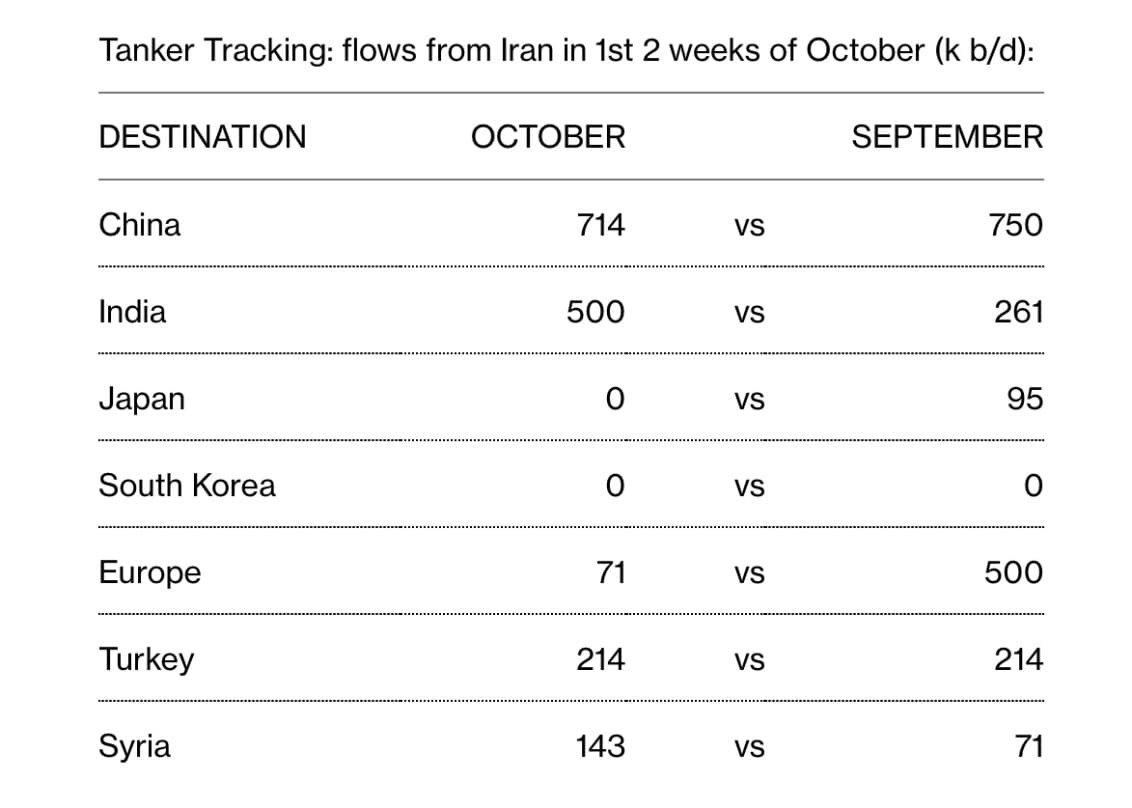

6. Sinopec cuts a way around Iranian sanctions

- Sinopec is reported to hold negotiations with the Chinese government on the modalities of further Iranian crude supplies after November 4.

- China remains the largest buyer of Iranian crude, with national oil company Sinopec accounting for roughly two-thirds of the volumes.

- China took in approximately 714 kbpd of Iranian crude in the first two weeks of October 2018, whilst adjacent Japan and South Korea have ceased imports altogether (still hoping for a waiver, though).

Source: Bloomberg.

- Sinopec’s reasoning is based on a refining optimization logic, stating that many of its refineries were built to process primarily Iranian crude, therefore any discontinuation will hurt refining margins.

- Sinopec has significant clout to back it up, being the world’s largest refiner.

- Statistics, however, prove the Chinese company’s claim a little bit unfounded, as it processed 20 million tons of Iranian last year – roughly 10 percent of its aggregate refinery intake.

- Since it takes roughly 35-45 days to reach China, it can be estimated that China’s November imports from Iran will still be significant at 600-650 kbpd.

7. Russia launches LNG fueled vessel oilfleet

- To relatively little media coverage, Russia completed the world’s first laden commercial voyage across the Northern Sea Route with a LNG-fueled vessel.

- The 114kt deadweight Lomonosov Prospect Arc4 tanker is the second LNG-fueled oil tanker out there (the first one being Gagarin Prospect, which, however, has so far only been on maiden voyages).

- The Russian national shipping company Sovkomflot is gradually transforming its fleet from the usage of heavy fuel oil (HFO) to LNG, in compliance with IMO 2020 norms.

(Click to enlarge)

Source: DNV GL.

- According to Sovkomflot, LNG-fueled tankers emit zero sulfur oxide and particulates, 76 percent less nitrogen oxide and 27 percent less carbon dioxide than vessels that use HFO.

- Sovkomflot will operate a fleet of 6 LNG-fueled Aframaxes in the first phase of their introduction, transporting crude oil and petroleum products in the Baltic Sea and Northern Europe for Royal Dutch Shell.

- If the pilot turns out to be successful, further moves into Suezmaxes and VLCCs are expected.

So much for the Numbers Report. We will see you next week with a new portion of fresh energy insights.