Coming back from Christmas and New Year holidays, life does seem a bit better now that oil has been rallying for eight consecutive days, rising by more than 10 percent.

(Click to enlarge)

Whilst Saudi Arabia’s production of more than 0.5 mbpd last month has played a role in bolstering oil prices, it is the thawing of US-China trade talks that have really caused sentiment in markets to turn.

Brent traded above 60 USD per barrel on Wednesday afternoon, whilst WTI moved firmly into the 51-51.5 USD per barrel range.

1. US Commercial Stocks Waiting for the Jump

(Click to enlarge)

- US commercial crude stocks have, for the last five weeks, largely remained within the 441-443 MMbbl range.

- The Bloomberg survey of analysts predicted a 2.7mbpd draw for the first week of 2019.

- World-leading production levels at 11.7mbpd were counteracted by increasing refinery runs and an offset in exports amidst shrinking arbitrage opportunities for US exporters.

- The ICE Brent/WTI Nymex spread average stood at 8.6 USD per barrel for December 2018, yet has shrunk to 7.8 $/bbl in the last week of December and 8.3 $/bbl in the first week of 2019.

- Refinery runs have exceeded expectations at 17.8mbpd, with the US refinery utilization rate surging week-on-week by a whopping 2.1 percent to 97.2 percent of total capacity (USGC particularly strong with 99.4 percent).

- Crude imports averaged 7.4 mbpd in the week ending December 28, down…

Coming back from Christmas and New Year holidays, life does seem a bit better now that oil has been rallying for eight consecutive days, rising by more than 10 percent.

(Click to enlarge)

Whilst Saudi Arabia’s production of more than 0.5 mbpd last month has played a role in bolstering oil prices, it is the thawing of US-China trade talks that have really caused sentiment in markets to turn.

Brent traded above 60 USD per barrel on Wednesday afternoon, whilst WTI moved firmly into the 51-51.5 USD per barrel range.

1. US Commercial Stocks Waiting for the Jump

(Click to enlarge)

- US commercial crude stocks have, for the last five weeks, largely remained within the 441-443 MMbbl range.

- The Bloomberg survey of analysts predicted a 2.7mbpd draw for the first week of 2019.

- World-leading production levels at 11.7mbpd were counteracted by increasing refinery runs and an offset in exports amidst shrinking arbitrage opportunities for US exporters.

- The ICE Brent/WTI Nymex spread average stood at 8.6 USD per barrel for December 2018, yet has shrunk to 7.8 $/bbl in the last week of December and 8.3 $/bbl in the first week of 2019.

- Refinery runs have exceeded expectations at 17.8mbpd, with the US refinery utilization rate surging week-on-week by a whopping 2.1 percent to 97.2 percent of total capacity (USGC particularly strong with 99.4 percent).

- Crude imports averaged 7.4 mbpd in the week ending December 28, down 0.26mbpd week-on-week, cooling the anticipation that the US will become a regular net exporter anytime soon.

- Weak gasoline cracks and improving distillate cracks have resulted in distillate production returning to December 2017 all-time highs of at 5.6mbpd.

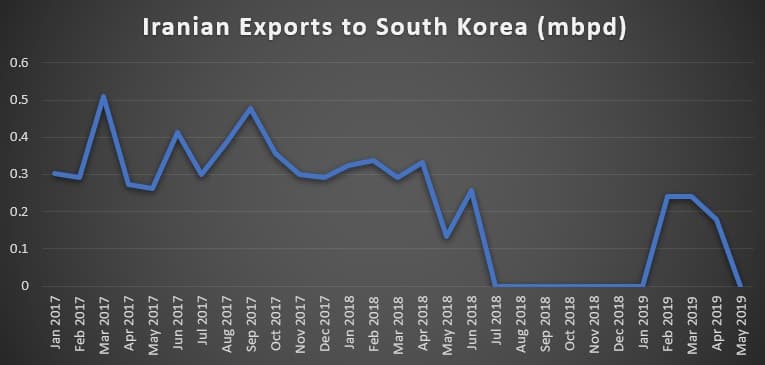

2. South Korea Buys Iranian Condensate Again

(Click to enlarge)

- After a four-month hiatus South Korean refiners Hanwha, Hyundai Oilbank and SK Energy are back at purchasing South Pars condensate, used as a baseload feed for their splitters.

- South Korean refiners have experimented with alternative feedstocks in the past couple of months, including Eagle Ford Condensate, however, due to high metallic content or pricing issues most of them were deemed inferior to the South Pars option.

- Hanwha is expected to take 4Mbbl per month, Hyundai will buy 2Mbbl per month, whilst SK will settle for 1 million barrels per month.

- The condensate supplies will be restarted for a short period of time as the 6-month waiver granted to Seoul by the White House runs out in early May. During the autumn of 2018, South Korean companies are expected to fully nullify their intake before the waiver runs out.

3. ADNOC Cuts its December Prices

(Click to enlarge)

- ADNOC, the state oil company of Abu Dhabi, has cut the retroactive official selling prices for its December crudes amidst lingering light distillate margins in Asia.

- The December OSP for Murban, the main onshore crude of the UAE, was cut back to 59.5 USD per barrel - a 2.18 $/barrel premium to the monthly Dubai average.

- This marks a 26 cent per barrel premium decrease month-on-month for Murban, whilst Das and Upper Zakum contracted by 21 and 16 cents per barrel, respectively.

- ADNOC’s offshore grades, Das and Upper Zakum were cut back to 58.9 USD per barrel and 57.9 USD per barrel, respectively.

- The 39° API and 0.7 percent Umm Lulu, ADNOC’s latest addition to its offered grades, has seen its December price se tat a 1.73 USD per barrel premium, down 21 cents month-on-month.

- Similarly to ADNOC, the Qatari QP has cut its December OSPs by 8.2 and 8.5 USD per barrel for both its Qatar Marine and Qatar Land grades.

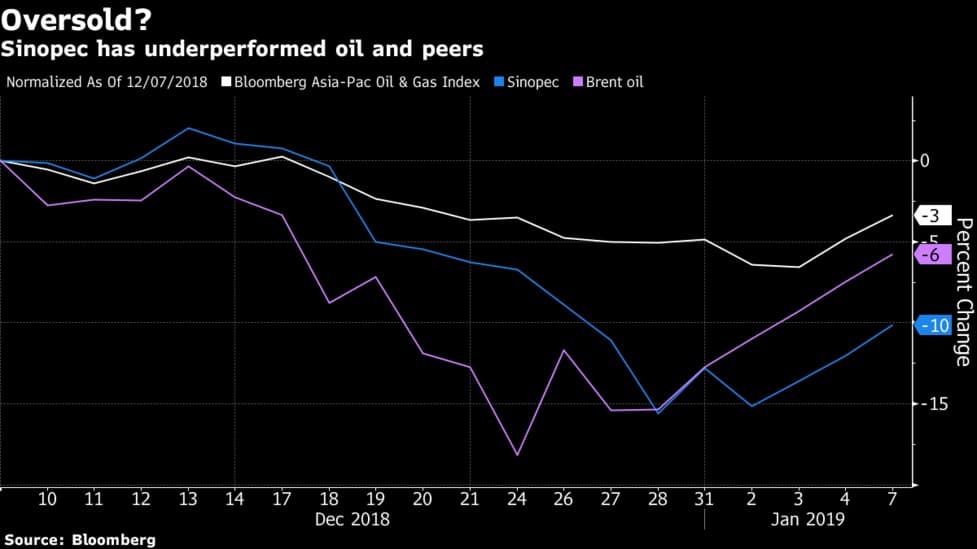

4. Sinopec, the Deranged Titan

(Click to enlarge)

- Sinopec seems to be recovering from the year-end turmoil that saw its shares tumble by more than 10 percent in December, with the last 5 trading days indicating a slow but steady recovery.

- Much of the panic was caused by the suspension of 2 top officials at Unipec, Sinopec’s trading arm and China’s largest crude oil importer, officially for “work reasons” which, as it transpired, means losing several million on the company’s derivative strategy in H2 2018.

- The decision to suspend Chen Bo, President of Unipec, and Zhan Qi, the company’s Communist Party secretary, was made on December 26 on a company board meeting.

- The situation seems to be calmer now (no wonder given that Sinopec is state-owned and should not be perceived as a haven for corruption) despite the probe that Chinese authorities launched into the operations of other Chinese giants CNOOC and Petrochina.

5. ExxonMobil Pushing Forward For New Guyana Discoveries

(Click to enlarge)

- Having discovered 10 fields in the Stabroek block since 2015, US major ExxonMobil is pushing hard to extend its Guyanese assets even further.

- Having begun operations on January 2, two drillships are currently spudding wells, the Stena Carron is drilling Haimara-1 (30 km east of last discovery Pluma), whilst Noble Tom Madden is spudding Tilapia-1 (5km off Longtail).

- This comes as a bit of surprise after the December 23 Ramform Tethys incident with a Venezuelan navy ship, which saw seismic surveying suspended for fears of conflict escalation.

- However, following President Maduro’s reinauguration on January 10, the danger of a maritime conflict should decrease despite Venezuela’s immutable claim that the Orinoco Delta and its surrounding areas should be under Venezuelan control.

- If all goes well, Exxon’s Guyanese tally should increase to 12 discovered fields by early April.

6. Angolan Refinery Trouble

- Angola’s only refinery, the 65kbpd Luanda refinery operated by national oil company Sonangol, remains shut down a month and half after it should have been started up.

- The refinery went into maintenance on October 1, 2018 for a planned period of 60 days, with Sonangol stating the need for deep interventions for “rehabilitation and replacement” at the site.

- Interestingly, Sonangol clinched a deal this summer with the Italian major ENI to provide technical assistance in upgrading the Luanda refinery and improving production quality and reliability.

- The refinery startup delay does not bode ill for Angola’s highly ambitious refining capacity ramp-up program.

- The 60kbpd Cabinda refinery will be built by the United Shine consortium (the members of which are unknown), whilst the fate of the Lobito refinery, estimated to be a 200kbpd site before then-CEO Isabel dos Santos cancelled the project, has not been disclosed so far.

7. First Colombian Pipeline Attack of the Year

(Click to enlarge)

- It took Colombian insurgents 5 days to conduct the first 2019 attack on the Cano Limon – Covenas pipeline, forcing national oil company Ecopetrol to shut transportation.

- This foreshadows a year-long continuation of the difficulties Colombia faced in 2018, when 89 attacks were perpetrated on Colombian pipelines – an increase that was due to President Ivan Duque refusing to renegotiate a ceasefire with Marxist insurgents.

- Connecting inner Colombia with the Caribbean port of Covenas, the pipeline offers an exclusive conduit for crude from the LLanos Orientales basin.

- As the Colombian-Venezuelan border is porous and the movements of guerilla groups virtually untraceable, it is difficult to ascertain the perpetrators of the attack, however, it is most likely they were connected to the Ejército de Liberación Nacional (National Liberation Army).