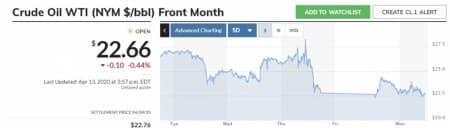

Well, it’s done and dusted. After keeping the world on the edge of its figurative seat for several days last week, OPEC+ announced a paltry 10 mm BOPD cut to its output on Thursday the 9th of April. The oil futures market had built up some anticipation that these oil power players would come up with some meaningful cuts to address the significant fall-off in demand forecast for the second quarter of 2020. The WTI price briefly topped $28.00/bbl in the AM session. When presented with the actual plan, markets collectively “yawned,” and then stepped off the “ledge,” dropping the price back into the mid-$22’s. Some 15% lower than where it began the week.

Now I am on record as being of the opinion that this meeting was all just high comedy for Saudi Arabia, not that there is anything funny about this situation. The point of this farce was always meant to placate President Trump, full stop, end of story.

Trump had been pressuring them to take a step like this, one even larger actually, and giving him this ‘win’ relieves much of that pressure. Of course the humor for the Saudis lies in the notion that, after setting this low-price, market share maximization course, they would shift meaningfully short of their goal-the destruction of American shale. The devil is always in the details.

In order for these cuts to take effect, the G-20 nations had to come up with several million barrels a day on their own. There is no sacrifice, like that which is shared and the Saudis were tired of carrying the water for the world in this arena. It isn’t the point of this article to recap the details of the final agreement. The link provided above will reveal them if that’s where your interest lies.

Then today they released their official selling prices and with them their true intent. Cutting off U.S. exports to Asia, blunting Russian influence in Europe, and getting a few extra nickels from U.S. buyers! All while keeping the oil price low enough that ‘distressed’ crudes (U.S. shale) simply can’t compete. This could set the stage for action by the American government to protect domestic markets.

The possibility of tariffs on Saudi oil

It's beginning to look increasingly like tariffs on imported oil, perhaps targeted to certain countries, are the next 'great idea' to escape market realities. The main market reality being that the world's low cost producer (MbS) has decided to maximize his market share. An abrupt shift in position that developed back in March in a late-night 'tiff' with Russia over a decision to cut, or not to cut.

They decided not to cut, and in fact did just the opposite, and of course an already really well supplied oil market- crashed. Pretty much destroying the economic viability of 80% of the world's oil production over the next two to three weeks, and of course nearly 100% of shale production. Which was the master plan all along.

Premium: U.S. Oil Production Has Already Peaked

U.S. shale producers cried uncle pretty quick. Uncle Sam that is. Some wanted to restrain production at the state level. Some wanted federal intervention in the form of tariffs. Some wanted into the government's corporate bailout package. Anything to avoid the ugly reality that much of shale's output just isn't economic and needs price support to make it viable against Saudis low cost of production.

We are the only ones facing an ugly truth though. The Saudis are finding out that there is such a thing as too much success. You would think all those oil ministers would be able to predict with some accuracy what the effect of "now pump freely," might actually mean to the market at large. Evidently not, as the necessity of this emergency meeting due to the crushingly low oil prices that resulted. The 10 mm BOPD they came up with is an eye-catching number to be sure. And, one that would have rocketed crude higher a few months back. But, it's one that doesn't take into account the well-known and much discussed 25% global demand destruction forecast for Q-2 by those who have the temerity to forecast such things.

In my article last week for OilPrice I argued that I didn't expect much to come of this back and forth. The anemic emission from this summit is pure Trump appeasement at its finest, as previously discussed. No one can say they did nothing. But, nothing is what it amounts to in the face of the huge gap between supply and demand.

And, that leads us to the rationale for tariffs on Saudi oil.

Tariffs: the rationale for them in the case of Saudi oil

President Trump has said that he will consider tariffs to put a U.S. domestic floor on the price of oil. I am not normally a fan of tariffs as they amount to new taxes on commodities, and drive the price of everything downstream from them higher. That said, they are probably the one weapon we have that will have any effect on the Saudis ability to flood the U.S. with cheap oil, and sink American fracking beyond repair.

In this case, I think it is worth a shot. KSA has taken dead aim at our industry, and that sort of targeting shouldn't be allowed to just run rampant. It's also likely a violation of WTO anti-dumping provisions, so we have firm international legal ground for taking action to protect our markets.

Tariffs probably will also come because Saudi doesn't have anything really to counter them with. Other than oil they don't have much to sell. In other words, there will be no China ‘tit-for-tat’ escalation tariff-wise. And, there are a lot of American jobs at stake. Good jobs that pay well in excess of a 100K annually. Trump has a strong constituency in the oilfield cadre that he would do well to pay some lip-service to at the very least. I think he knows this.

While no actual amounts have been made public that the government is considering, to be meaningful (make shale production economic) these tariffs will have to be at least $25-30/bbl range. From today’s prices in the mid-$22’s, that would make oil in the U.S. effectively above $55.00, preserving tens of thousands of American jobs.

One challenge to going ahead with them ironically comes from the industry itself though. Muddying the water for the President a bit as he hears the wails of the smaller producers.

“While less extreme than production cuts, tariffs are unpopular with a swath of the industry, which has historically championed a free-market approach to oil. The two largest U.S. oil companies, Chevron Corp. and Exxon Mobil Corp., have lobbied against any oil-market intervention.

“Low tariffs are what’s best for our globe and our business in the long term,” Exxon Chief Executive Darren Woods said Tuesday”

The shale stats for this week.

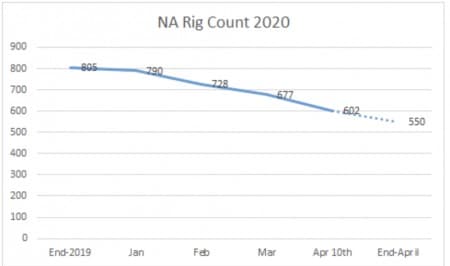

North American land lost another 62 rigs from the week prior, with all shale plays dropping in the count. The Permian was the loss-leader going down 36 rig week over week. I may have under-estimated the April-exit of 550 rigs, given the decline so far.

Baker Hughes

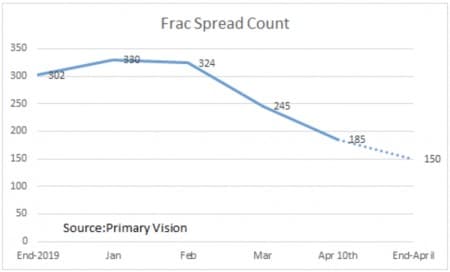

Frac Spreads were down another 30 from the week before, on a trajectory to ~150 or by the end of April. Another indicator that capital has finally fled U.S. shale and equipment is being stacked, and crews laid off in this final firestorm of the oil glut.

Premium: Where Does Oil Go After The Largest Production Cut In History?

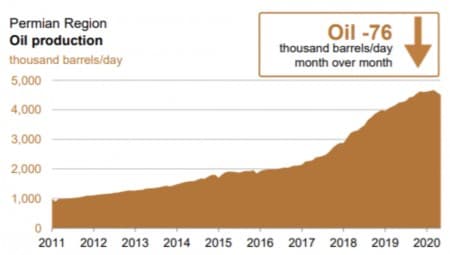

As I’ve been predicting this massive stand down of the shale industry is taking its toll on U.S. production. The current Drilling Productivity report shows a decline of 76K barrels from the Permian (Which I view as being the only shale play that matters in the long run.), from the prior month. This is a new artifact in their reporting, and one we think will be replicated and amplified in succeeding reports to come.

Summary

Over the short haul I don't see anything to support oil going higher, or even staying at its current level. This is due primarily to the huge glut of oil arriving at our shores from Saudi Arabia. This will take a while to work off regardless of other actions taken to raise prices.

What will change this outlook? A big drop in shale production and increased demand forecasts for oil usage. Until then over-supply will weigh on the oil market, keeping prices down.

The next major way point for oil could come from the release of the EIA-914, Monthly Production report, at the end of April. This edition will have production data through February, and might be a market mover as it is a lagging indicator, suggesting a sharp drop in U.S. shale production.

By David Messler for Oilprice.com

More Top Reads From Oilprice.com:

- The Sad Truth About The OPEC+ Production Cut

- OPEC+ Deal Is “Too Little And Too Late”

- The Oil Price Crash Could Trigger A Geothermal Energy Boom

He has been angling for tariffs with the objective of bailing out the bankrupt US shale oil industry at the expense of foreign oil exporters rather than US tax payers. This won’t work as major oil exporters will shift their exports elsewhere rather than pay the tax.

US shale oil producers have been producing recklessly even at a loss without sparing a thought for the oil-producing nations of the world whose livelihood they have trampled on for years. They have been operating on the principle that even if their outstanding debts top $1 trillion, the Trump administration is going to bail them out in one way or another because of their economic and strategic importance to the United States.

However, before considering tariffs, President Trump should ask the shale industry to start producing sensibly and profitably. This and not tariffs could ensure the survival of the shale industry. Still, I don’t think the industry will mend its ways and that is why it will be no more in 4-9 years from now.

As for OPEC+-led global production cuts, no matter how big production cuts are they will hardly have a positive impact on oil prices while the coronavirus outbreak is raging.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London