Three months ago, British oil giant BP Plc. (NYSE:BP) sent shockwaves through the oil and gas sector after it declared that Peak Oil demand was already behind us. In the company’s 2020 Energy Outlook, chief executive Bernard Looney pledged that BP would increase its renewables spending twentyfold to $5 billion a year by 2030 and ‘‘... not enter any new countries for oil and gas exploration.’’ That announcement came as a bit of a shocker given how aggressive BP has been in exploring new oil and gas frontiers.

The investing universe appears to concur with BP’s sentiments, with the oil and gas sector consistently emerging as the worst performer over the past decade. The sector suffered yet another blow after the largest investor-owned oil company in the world, ExxonMobil (NYSE:XOM), was kicked out of the Dow Jones Industrial Average in August, leaving Chevron (NYSE:CVX) as the sector’s sole representative in the index.

Meanwhile, oil prices appear stuck in the mid-40s with little prospects of climbing to the mid-50s that most shale producers need to drill profitably.

Delving deeper into the global oil and gas outlook suggests that it’s peak oil supply, not peak oil demand, that’s likely to start dominating headlines as the quarters roll on.

Source: Bloomberg

Peak Oil Demand

When many analysts talk about Peak Oil, they are usually referring to that point in time when global oil demand will enter a phase of terminal and irreversible decline.

According to BP, this point has already come and gone, with oil demand slated to fall by at least 10% in the current decade and by as much as 50% over the next two. BP notes that historically, energy demand has risen steadily in tandem with global economic growth with few interruptions; however, the COVID-19 crisis and increased climate action might have permanently altered that playbook.

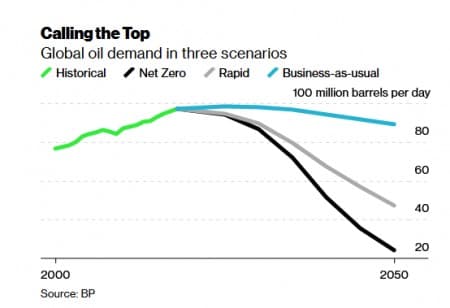

BP has modeled 3 possible scenarios for the future of global fuel and electricity demand: Business as Usual, Rapid Transition, and Net-Zero. Here’s the kicker: BP says that even under the most optimistic scenario where energy policy keeps evolving at pretty much the pace it is today (Business as Usual) oil demand will still suffer declines—only at a later date and a slower pace compared to the other two scenarios.

The oil bulls, however, can take comfort in the fact that under the Business-as-Usual scenario, BP sees oil demand remaining at 2018 levels of 97-98 million barrels per day till 2030 before falling to 94 million barrels per day in 2040 and eventually to 89 million barrels per day three decades from now. That’s a loss in demand of less than 1% per year through 2050.

However, things could look very different under the other two scenarios that entail aggressive government policies aimed at reaching net-zero status by 2050 as well as carbon prices and other interventions aimed at limiting global warming.

Under the Rapid Transition scenario (moderately aggressive), BP sees oil demand falling 10% by 2030 and nearly 15% under Net Zero (most aggressive).

Related: Large Oil Trader Trafigura Books Strongest Trading Year Ever

In other words, the decline in oil demand is bound to be catastrophic for the industry over the next decade under any other scenario other than Business-as-Usual.

Luckily, this is the scenario that’s likely to dominate over the next decade.

David Blackmon, a Texas-based independent energy analyst/consultant, has told Forbes that many analysts are skeptical about BP’s grim outlook. Indeed, Blackmon says a “Business as Usual” scenario appears the most likely path for the time being, given the time the global economy might take to recover from Covid-19 as well as the trillions of dollars that would be required to implement the other two cases.

Further, it’s important to note that BP made those projections before Covid-19 vaccines had entered the fray. With several viable vaccine candidates now on the scene, there’s a good chance that the global economy might recover at a faster-than-expected clip and thus help oil demand to recover more rapidly than earlier estimates.

Peak Oil Supply

Though rarely discussed seriously, Peak Oil Supply remains a distinct possibility over the next couple of years.

In the past, supply-side “peak oil” theory mostly turned out to be wrong mainly because its proponents invariably underestimated the enormity of yet-to-be-discovered resources. In more recent years, demand-side “peak oil” theory has always managed to overestimate the ability of renewable energy sources and electric vehicles to displace fossil fuels.

Then, of course, few could have foretold the explosive growth of U.S. shale that added 13 million barrels per day to global supply from 1-2 million b/d in the space of just a decade.

It’s ironic that the shale crisis is likely to be responsible for triggering Peak Oil Supply.

In an excellent op/ed, vice chairman of IHS Markit Dan Yergin observes that it’s almost inevitable that shale output will go in reverse and decline thanks to drastic cutbacks in investment and only later recover at a slow pace. Shale oil wells decline at an exceptionally fast clip and therefore require constant drilling to replenish the lost supply. Although the U.S. rig count appears to be stabilizing thanks to oil prices rebounding from low-30s to mid-40s, the latest tally of 320 remains far below the year-ago figure of 802.

Although OPEC+ nations currently have about 8 million barrels of oil per day of spare capacity, the current price levels do not support much drilling at all, and the extra oil might only be enough to cover the shortfall by U.S. shale.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- Finding A Way Around The World's Largest Oil Chokepoint

- Traders Haven’t Been This Bullish On Oil Since August

- The Oilfield Service Industry Will Never Truly Recover

1- BP’s claim that peak oil demand is already behind us is intended to burnish its environmental credentials and distract from the heavy losses the company suffered as a result of the COVID-19 pandemic leading to a major write-down of assets, drastically cutting dividends to its shareholders and making thousands of employees redundant.

2- The claim that the pandemic has accelerated the onset of peak oil demand is based on wrong assumptions. While the pandemic has indeed caused extensive damage to the global economy and particularly the global oil industry, it is reversible and soon will be behind us particularly with the start of anti-COVID vaccination in many parts of the world. The proof is that despite the pandemic, China and India were able to exceed their oil demand and oil imports far beyond the 2019 levels even before vaccines came on the scene. This is bound to be the case with other major economies. In other world, the pandemic doesn’t herald an onset of peak oil demand.

3- The pandemic has irrevocably proven how inseparable oil and the global economy are. By destroying one you destroy the other and vice versa. In other words, the global economy will continue to run on oil and gas throughout the 21st century and far beyond.

4- And while electric vehicles (EVs) might decelerate slightly the global demand for oil, they will never stop its growth.

5- Oil will continue to be the fulcrum of the global economy and the core business of the global oil industry well into the future. Any other claims are untenable.

On the other hand, peak oil supply is governed by oil prices, technology, economic growth and investments. The pandemic has prompted the oil industry to defer some $131 billion worth of oil and gas projects that were slated for approval in 2020. This could translate into a tightening of the global oil market in 2023-2024 causing prices to surge to a range of $80-$100 a barrel. However, this will stimulate global investment in oil exploration and production thus easing any tightening in the market.

Based on the above, I would say that a peak oil supply is still far away for the time being but it could start to manifest itself in the long term.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

"In recent months Toyota and Honda executives have questioned if the world is ready for electric cars, but now they have no choice, but to follow Tesla as the Japanese government just announced a plan to ban cars with internal combustion engines by 2030.

Japan aims to reduce its greenhouse gas emissions to zero by 2050. The previous government had aimed to reduce emissions by 80 percent by 2050. Responding to global warming is no longer an obstacle to economic growth, Suga said. “We have to change our attitude."

This may mean that the most rapid drop of demand is more likely. With no internal combustion cars on the road, less expensive electricity from wind and solar, and with the major benefit of bioplastics, which is that they can be composted, while maintaining the same versatility as traditional plastics, oil demand may go to zero sooner than anyone is anticipating. Civilization can exists without oil.

Also major even ahigher iol prices around $75/barrel will not help balance the budget of major OPEC producers such a s Libya, irna, kuwait, and Venezuela.

But in reality the decline of oil has always been about both peak demand and peak supply. They are two sides of the same coin. To see why consider three questions:

A) What price of oil is high enough to sustain thw expansion of oil production over the long run?

B) What price of oil is low enough to sustain the expansion of oil consumption over the long run?

C) What happens when no range of prices is able to satisfy both A and B?

Peak oil supply theory recognizes that oil extraction becomes increasingly expensive over time. The share revolution may have thrown a wrinkle in this, but even shale has its geologic limits. So the answer to A is an increasing price, but already north of $40/b.

Conversely peak oil demand theory recognizes that alternatives to oil such as renewable energy, video conferencing and EVs become cheaper and more compelling over time. Indeed, the core tech to link renewable energy and transport fuels, the battery, continues to decline about 20% each year. To remain price competitive, motor fuel prices will need to come down quickly as well. Given the fixed costs of refining and distributing motor fuel, a low enough cost of battery can drive motor fuel demand for crude below $0/b. That is, non-motor fuel products will need to bear the full cost of crude and cross-subsidize motor fuels.

So the answer to question C is that ultimately oil producers will need a higher price for crude that what will sustain growth in consumption. The spot price can vary from supply destroy lows to demand destroying highs, but eventually no price sustains both. Past this point both production and consumption enter decline.

There is little point in quibbling whether it's peak supply or peak demand. It’s both. Eventually there is no feasible price that enables oil to grow.