Unascertainable times we are having on the global oil market. The struggle for Venezuela, with all its twists and turns, should be looming large as pretty much everyone tries to find out whether the Latin American country can avoid an upstream collapse and reroute its cargoes towards Asia. Yet the Venezuelan impact has so far been rather modest and crude prices have actually fallen between Monday and Wednesday.

Thus, despite some genuine bullish potential out there, Russia’s slow compliance with its OPEC/OPEC+ commitments (so far it has only cut 47kbpd from the 228kbpd it had promised in December), the rise of US crude stocks and worries about global economic growth have outweighed other factors.

(Click to enlarge)

On Wednesday afternoon Brent has traded at 61.8 USD per barrel, sliding 1 percent compared to Tuesday closing, whilst WTI crude has dropped 2 percent day-to-day to 53.5 USD per barrel.

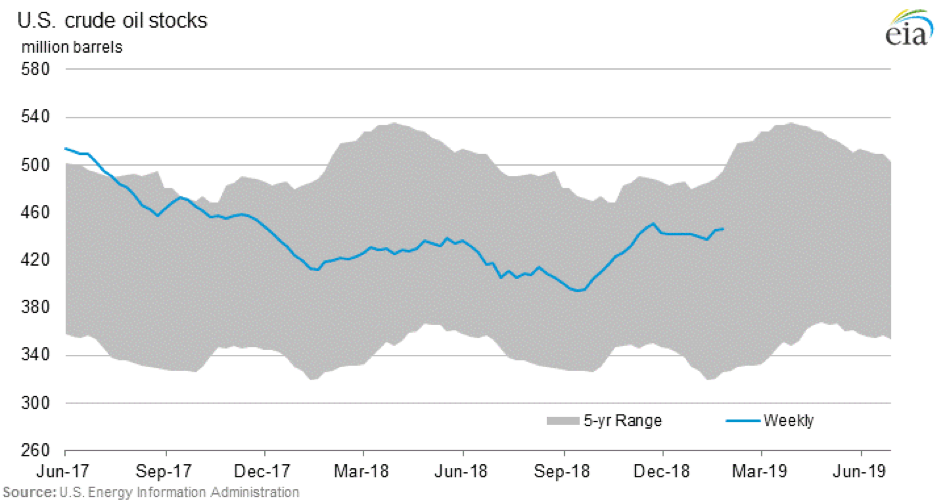

1. US Stocks Grow Further

• US commercial crude stocks have risen by 0.919 MMbbl to 445.9 MMbbl during the week ended January 25 and are expected to grow even further for the week ended February 01.

• Most analysts estimate last week’s increase will be somewhere within the 1.5-2.5 MMbbl interval, with API putting forward the most ambitious build of 2.5 MMBbl.

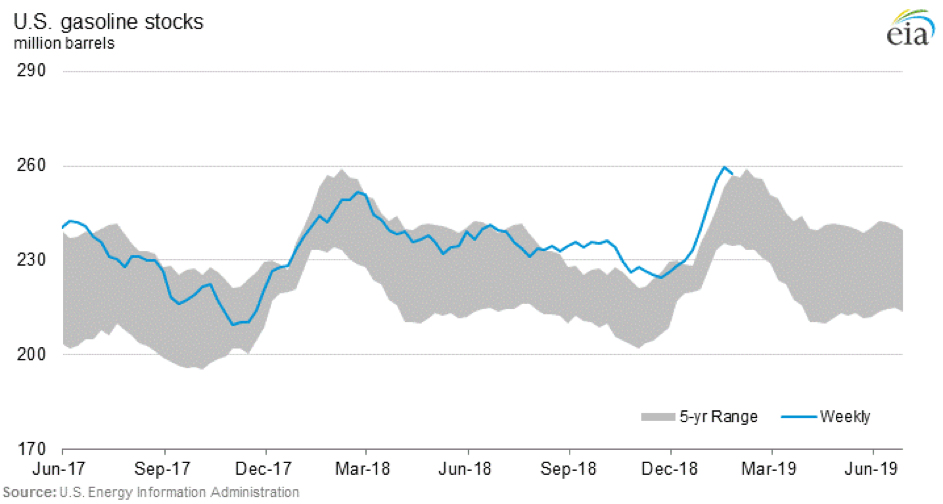

• The week ended January 25 market the first gasoline stock drop following eight consecutive weeks of growth, dropping by 2.2MMbbl to 257.4 MMbbl, still above the 5-year…

Unascertainable times we are having on the global oil market. The struggle for Venezuela, with all its twists and turns, should be looming large as pretty much everyone tries to find out whether the Latin American country can avoid an upstream collapse and reroute its cargoes towards Asia. Yet the Venezuelan impact has so far been rather modest and crude prices have actually fallen between Monday and Wednesday.

Thus, despite some genuine bullish potential out there, Russia’s slow compliance with its OPEC/OPEC+ commitments (so far it has only cut 47kbpd from the 228kbpd it had promised in December), the rise of US crude stocks and worries about global economic growth have outweighed other factors.

(Click to enlarge)

On Wednesday afternoon Brent has traded at 61.8 USD per barrel, sliding 1 percent compared to Tuesday closing, whilst WTI crude has dropped 2 percent day-to-day to 53.5 USD per barrel.

1. US Stocks Grow Further

• US commercial crude stocks have risen by 0.919 MMbbl to 445.9 MMbbl during the week ended January 25 and are expected to grow even further for the week ended February 01.

• Most analysts estimate last week’s increase will be somewhere within the 1.5-2.5 MMbbl interval, with API putting forward the most ambitious build of 2.5 MMBbl.

• The week ended January 25 market the first gasoline stock drop following eight consecutive weeks of growth, dropping by 2.2MMbbl to 257.4 MMbbl, still above the 5-year average range.

• Crude oil imports have fallen by more than 1.1mbpd to 7.083mbpd for the week ended January 25, with the four-week average hitting 7.66mbpd, some 0.4mbpd lower than a year ago.

• Crude exports, on the other hand, have been somewhat timid in the second half of January, after the 2.035mbpd documented on the week ended January 18, the following week did not produce a usual rebound at 1.944mbpd.

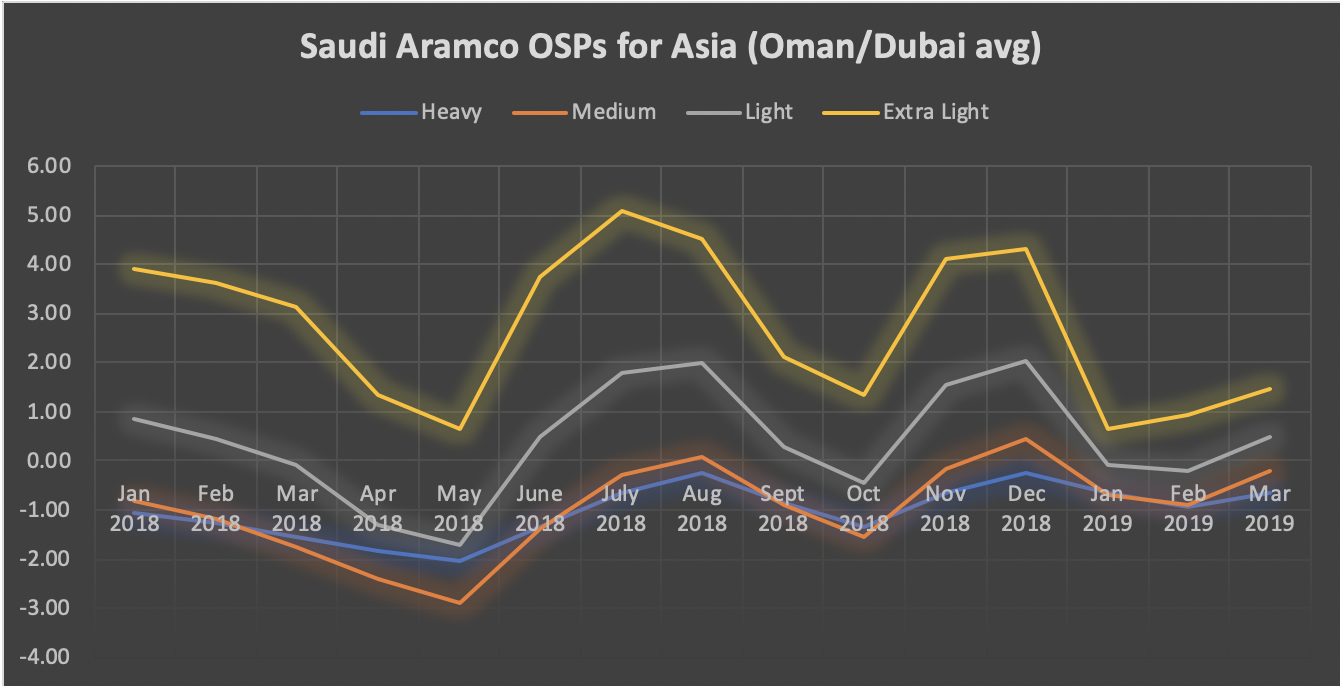

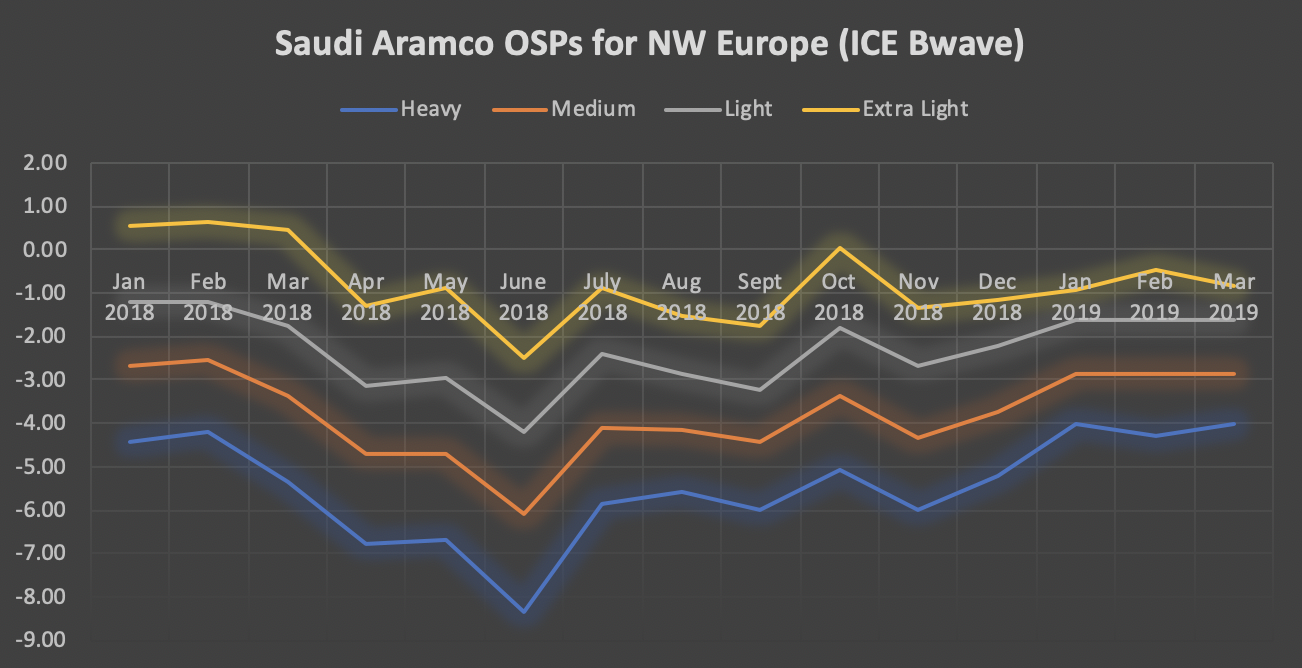

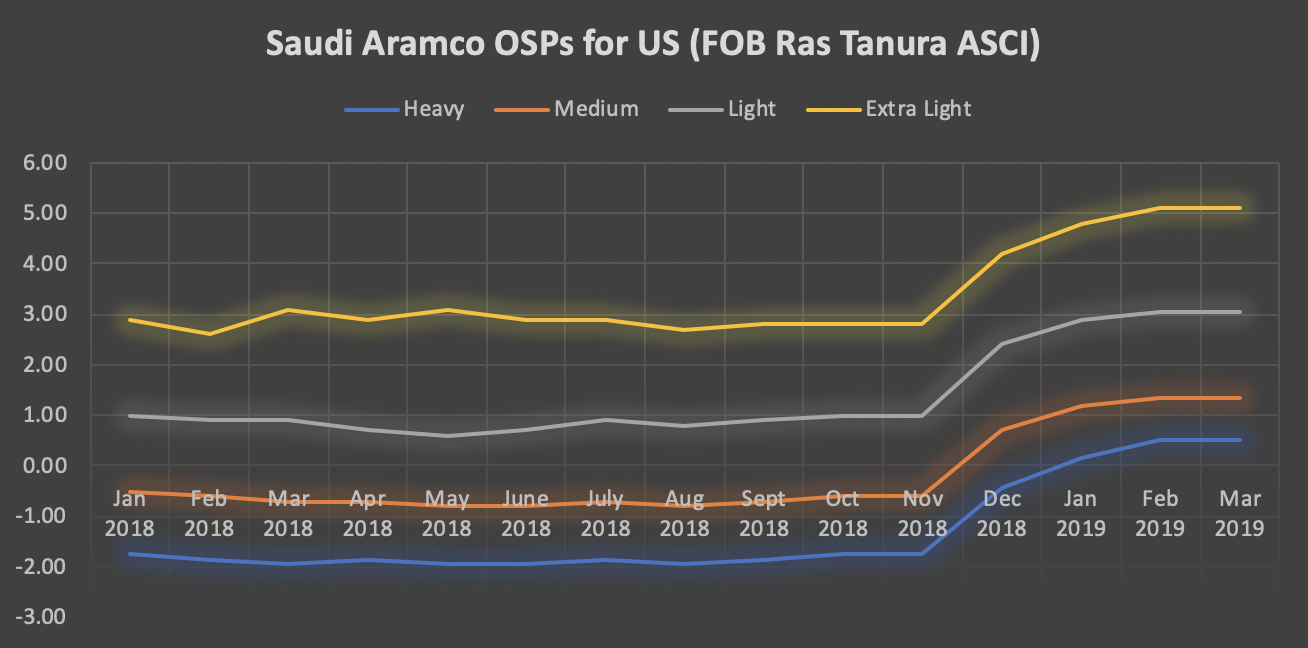

2. Saudi Arabia Raises Asia OSPs, Goes Wild on Med

Source: Oilprice Data

Source: Oilprice Data

Source: Oilprice.com Data

• Saudi state oil company Saudi Aramco has raised most of its official selling prices for Asia the second month in a row, with a special focus on the increasingly scant heavier volumes.

• Arab Heavy and Arab Medium headed towards Asia were hiked by 30 and 40 cents per barrel respectively (to -0.65 and +0.45 vs the Oman/Dubai average), whilst Arab Light was rolled over and Arab Extra Light dropped by 20 cents.

• Quite in line with the Asian developments, Aramco has raised NW Europe-bound prices for Arab Heavy by 30 cents to -4 USD per barrel, rolled over Arab Medium and Arab Light, whilst cutting Extra Light by 40 cents to -0.85 USD per barrel vs ICE Bwave.

• Saudi Aramco has simply rolled over the prices for all its US-bound March loadings, after significant increases in December-February.

• Saudi Aramco made the most dramatic changes to its March OSPs bound for the Mediterranean, hiking all prices on a FOB Ras Tanura basis by 0.35-1.15 USD per barrel, most notably Arab Heavy was cut from -3.85 to -2.70 USD per barrel in March 2019.

• FOB Sidi Kerir prices for the Mediterranean followed the same logic, increasing by 0.4-1.2 USD per barrel.

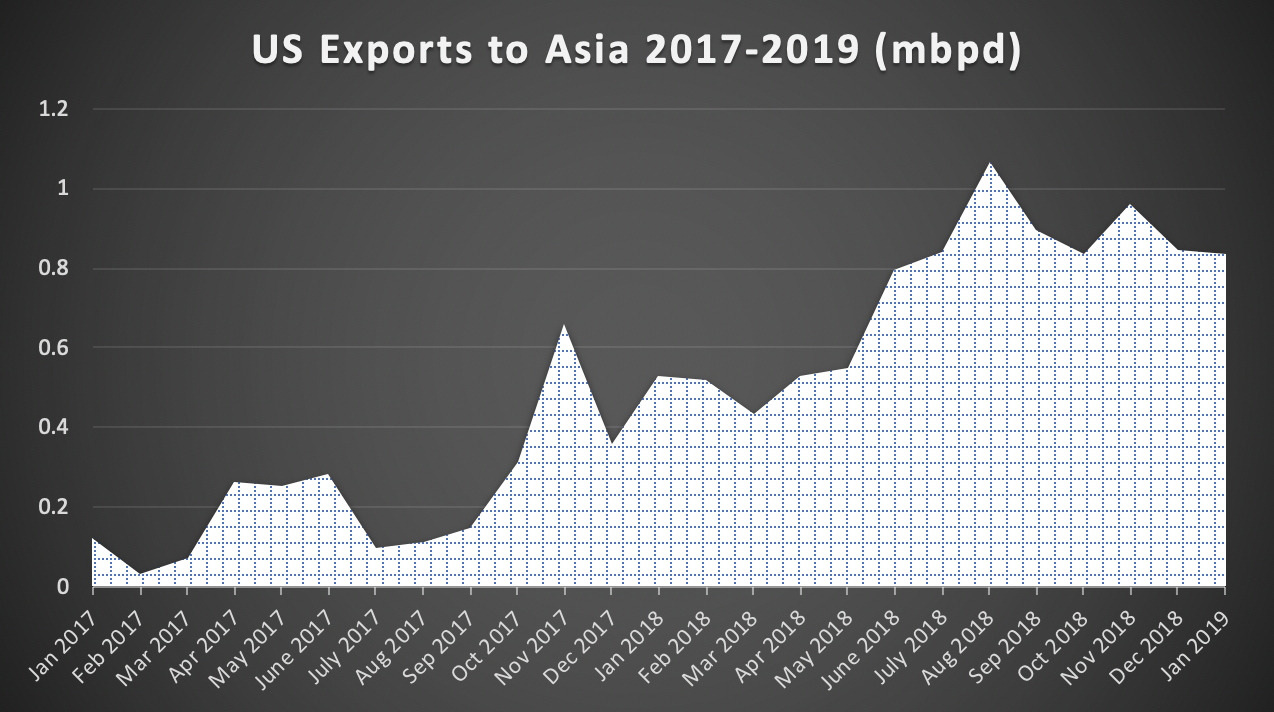

3. More US Crudes To Move Towards Asia

Source: OilPrice data.

• Amid favorable freight rates and competitive prices vis-à-vis Persian Gulf crudes, a whole array of US crude exports is expected to be loaded in February, heading to Asian customers.

• According to Platts, at least 17 VLCCs have been booked already for February loading (compared to 16 in January 2019 and 7 in December 2018), with more expected to emerge as time passes.

• Arbitrage economics – medium sour Mars trading at -3 USD and WTI Midland at -2 USD per barrel on a CFR North Asia basis – is the main cause of the export upswing, with decreasing freight rates contributing, too.

• The Platts WTI-Murban CFR Northeast Asia spread has widened some 60 cents to 0.7-0.8 USD per barrel month-on-month.

• Thus far there has been no sign of China restarting US crude purchases amid the ongoing China-US trade talks – South Korea emerged as the leading buyer of US crude in the upcoming months.

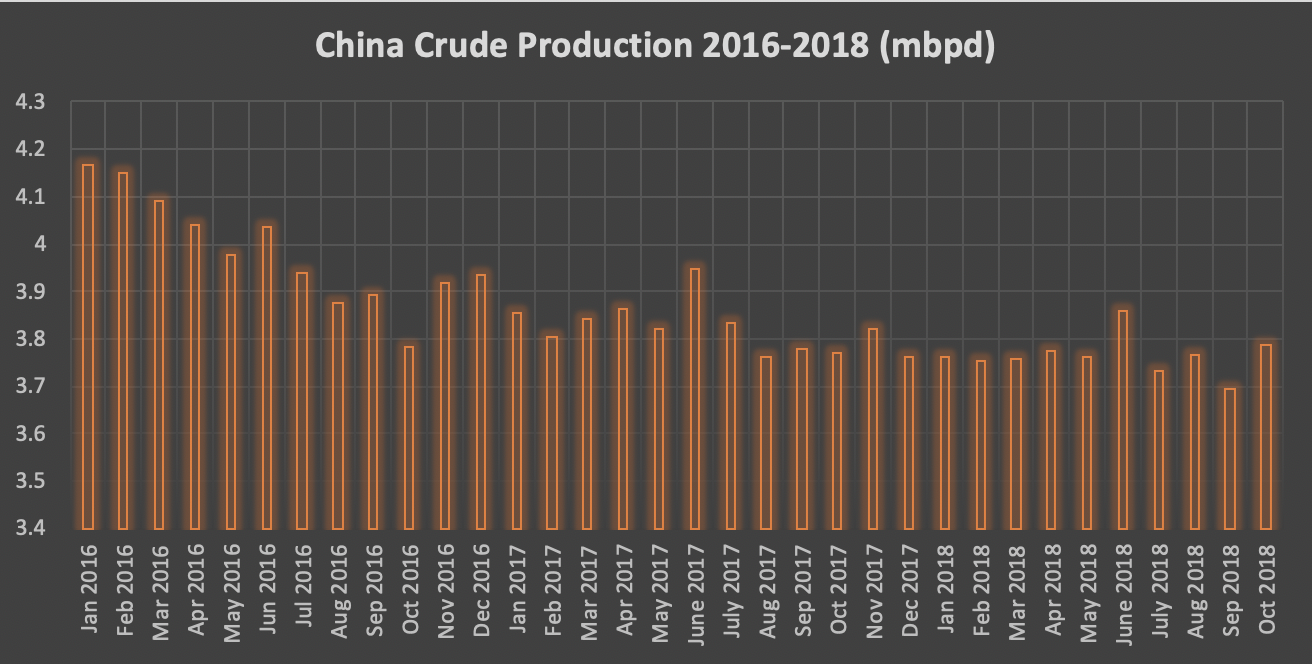

4. Chinese Companies Drill More

Source: EIA.

• According to media reports, Chinese state-owned oil and gas companies are poised to intensify drilling in China this year to the highest level since 2014.

• Concurrently to the onset of the Chinese-American trade war, the General Secretary of the Communist Party of China Xi Jinping has launched a drive to boost the country’s energy security.

• Between 2016 and 2018 China’s domestic crude output has dropped from 4.1mbpd to 3.7mbpd amid gradually increasing aggregate crude demand levels.

• China’s dependence on import oil has risen in 2018 to 70 percent (some 6 percent year-on-year), whilst its dependence on imported gas increased to 40 percent.

• All three Chinese majors – Sinopec, PetroChina and CNOOC – have been instructed from above to ramp up production, especially with regard to natural gas (against the background of the potential 25 percent LNG tariff Washington was floating).

• Natural gas, the demand for which is expected to grow annually by 7-8 percent in the upcoming years, remains a key element of China’s switching away from coal usage.

• PetroChina has boosted its risk exploration budget fivefold to 5 billion yuan (approx. $750 million).

• Buoyed by the 2.5Tcf Lingshui discovery in 2014, much of the exploration is presumed to be focused on China’s deepwater.

5. EU Wants to Move Oil Trade from Dollars to Euros

• The European Union will soon start a series of events destined to persuade European oil and gas companies to use EURO for physical crude oil and natural gas deals instead of the traditional US Dollar, kicking off with a February 14 workshop.

• The moves come against the background of a weaker-than-expected SPV mechanism and European fears that Washington might use dollar-denominated trade to the detriment of European interest.

• According to the European Commission, 85 percent of EU import deals are denominated in US Dollars.

• The EC has already distributed a non-legally binding recommendation paper on the issue and is actively collecting industry opinion on how to facilitate the move as smoothly as possible.

• Interestingly, Russian oil companies have already advocated the EURO switch this winter for 2019 term contracts, wary of what they perceive as arbitrary US sanctions.

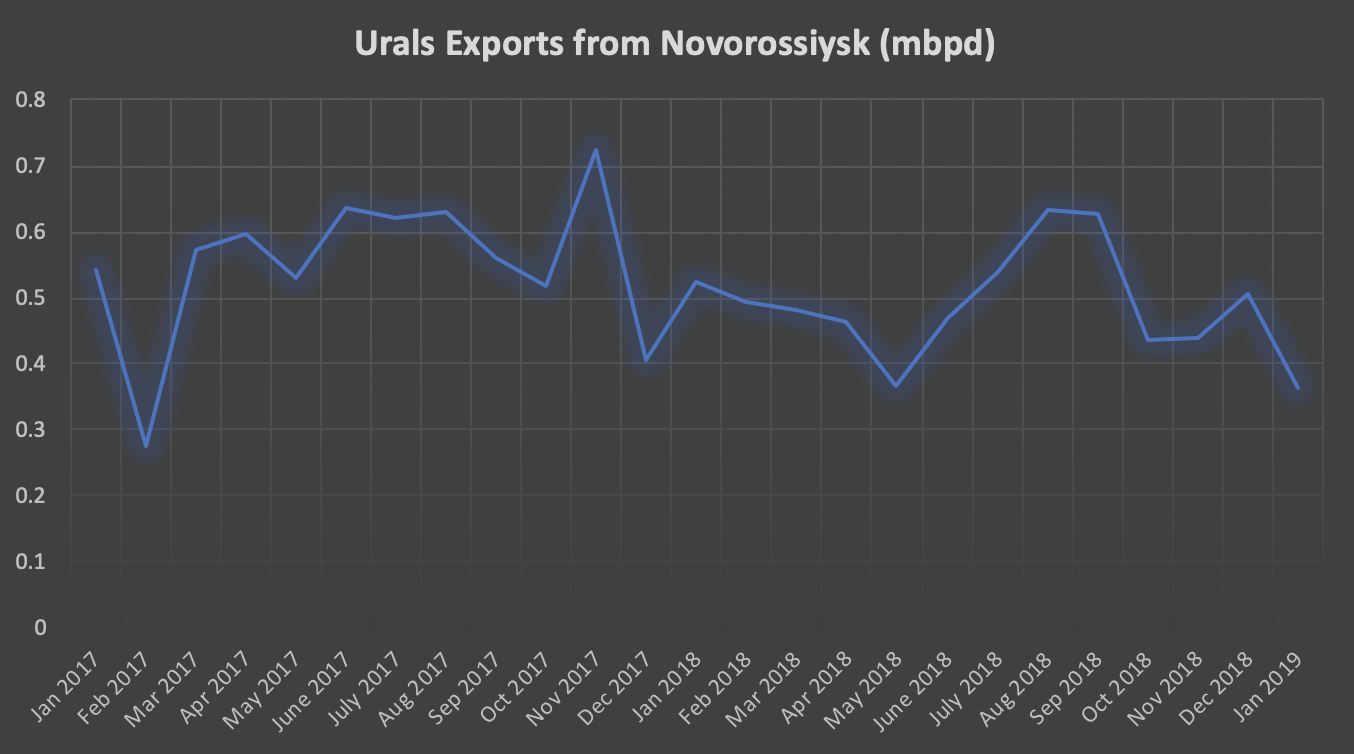

6. The Turkish Straits Completely Clogged

• Shipping delays through the Turkish Straits – the Bosphorus and Dardanelles – have reached record numbers, standing at 17 days southbound and 18 days northbound.

• Exports from Black Sea ports – primarily Novorossiysk, Yuzhnaya Ozereevka (CPC terminal) and Supsa – have also been hit by difficult weather as January-February has been traditionally stormy.

• Novorossiysk exports of Urals and Sib Light were down 28 percent month-on-month at just 0.365mbpd, a level unseen since February 2017.

• New regulations issued in late 2018 added to the Turkish Straits difficulties – now all tankers must pass the straits strictly during daylight hours.

• On top of the bad weather, the delays were heavily exacerbated by a shortage of tug-boats to accompany the tankers.

• Currently, at least 38 tankers are awaiting declaration to pass through the Dardanelles.

7. Iraq, Jordan Start Feasibility Study of Basrah-Aqaba Oil Pipeline

Source: MEES.

• Baghdad and Amman are edging closer to each other, buttressed by an array of new energy-related agreements.

• The two sides have agreed to start a feasibility study on the long-mooted Basrah-Aqaba oil pipeline that would bring Iraqi oil to the Red Sea coast.

• Initially, the 1680km pipeline was estimated to have a throughput capacity of 1mbpd, it remains to be seen whether the sides amended the 2012-2013 project blueprint.

• Jordan also pledged to buy at least 10kbpd of Kirkuk crude at a whopping $16 discount from the price of Dated Brent, to be transported (by trucks) to the 105kbpd Zarqa Refinery.

• Iraq is ready to supplant Saudi Arabia, now accounting for more than 75 percent of crude supply to Jordan, which is fully dependent on imports to cover its needs.