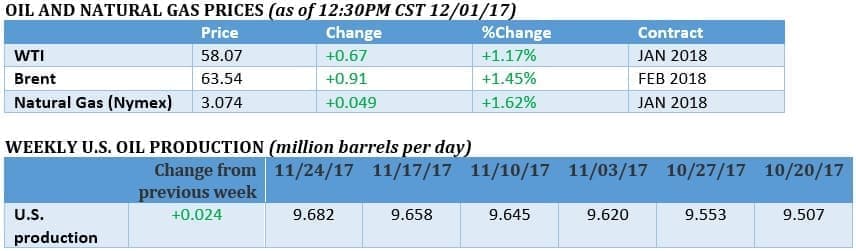

Oil markets' initial reaction to yesterday's OPEC news was rather dull, however oil prices saw a sharp spike on Friday morning as the bulls returned to the mix.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

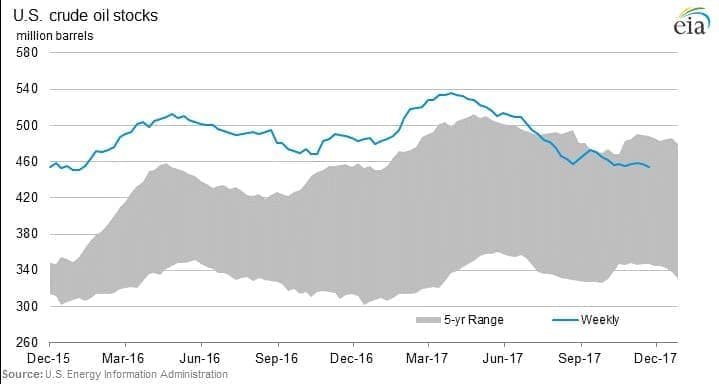

OPEC followed through on its promise, extending the production cuts through the end of 2018, bringing relief to an oil market that had grown jittery in recent days. Oil prices traded in a relatively narrow range after the meeting and appeared muted. But once concerns over a selloff calmed, oil prices rallied once again on Friday morning.

OPEC deal extended through 2018. The deal will run from January through to December, and the exact volumes of the production cuts will be the same as this year. The OPEC/non-OPEC coalition said that they would monitor market conditions and would remain “agile,” ready to respond if the fundamentals deviate significantly from expectations. They will revisit the agreement at the next official meeting in June 2018, but they assume the cuts will last through the end of the year. Russian officials pressed for details on an exit strategy heading into the meeting, but the group offered no information – Saudi oil minister Khalid al-Falih said it would be “premature” to do so. One notable change is that Libya and Nigeria agreed to cap their production levels at their 2017 average, which doesn’t necessarily curtail supply but will prevent any “surprise,” as witnessed this year. The Russian and Saudi oil ministers played up their unity and boasted about their strong relationship. All smiles from Vienna.

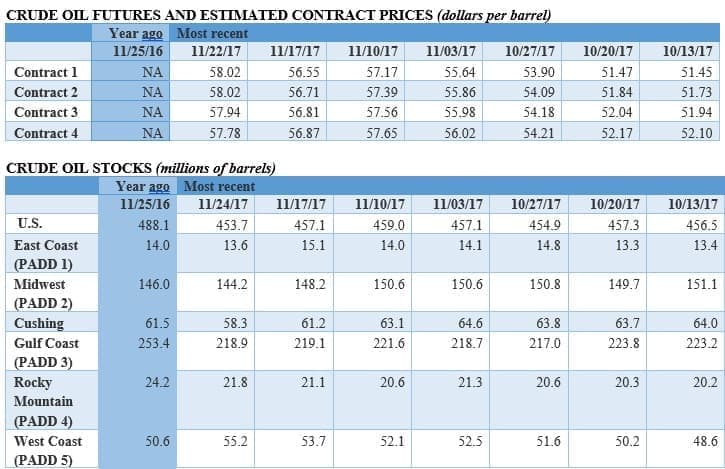

Goldman: Oil market volatility doesn’t make sense. Long-dated oil futures are more volatile than is justified, according to a research note from Goldman Sachs. The investment bank said that assurances from OPEC that the group will respond to market conditions should assuage concerns in the market about an unexpected rush of supply or, conversely, excessive tightening. The responsiveness of OPEC “leads us to reiterate our view that long-dated implied volatility remains too rich,” Goldman analysts wrote in the note published on Thursday. Related: U.S. Shale To Surge After OPEC Extension

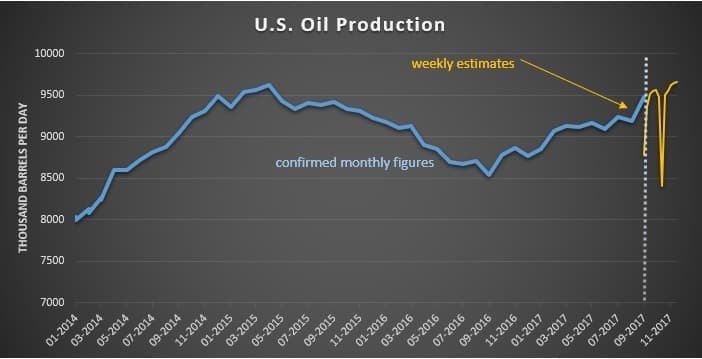

EIA: U.S. oil production surged in September. While OPEC was meeting behind closed doors, the EIA published data for September, showing a dramatic jump in output. The U.S. produced 9.48 million barrels per day in September, an increase of 290,000 bpd from a month earlier. Aside from the size of the increase, the data was significant because it seemed to put to rest the notion that the agency was overestimating supply. For several months, the weekly data diverged from the monthly data, raising questions about how accurate the EIA’s estimates were. Yesterday’s data suggests that U.S. shale production is indeed growing robustly.

Shale hedging soared in 3rd quarter. New hedging contracts in the third quarter encompassed 897,000 bpd of annualized production, according to Wood Mackenzie survey of 33 companies. That is 147 percent increase from the second quarter, and a sign that shale drillers rushed to lock in hedges after WTI rose above $50 per barrel. “Producers that are able to lock in prices above previous expectations may feel more comfortable with increasing activity," Andy McConn, a Wood Mackenzie research analyst, told Bloomberg. “Others may leave budgets unchanged and promote higher cash-flow guidance to an investment community anxious about profits."

China gas consumption surges, leads to shortages. China has tried to replace dirty coal-fired power plants with natural gas to cut down on pollution, and by all accounts, it has succeeded. But now, the country faces natural gas shortages because of the spike in consumption. That has led officials in Hebei province to call on cities to cut their gas use.

Venezuela arrests former oil minister. The purge in Caracas continued to expand this week. After replacing the head of PDVSA and the oil minister with a military general, the Venezuelan government detained Eulogio del Pino, the former oil minister. The reason, like the other arrests, was because of corruption allegations. But the government also risks purging the country of its top oil talent, and PDVSA could struggle as production declines accelerate.

EV recharging along highways is key to adoption. Building out EV recharging networks along highways is crucial to accelerating the adoption of electric vehicles, ChargePoint CEO Pasquale Romano told Bloomberg in an interview, noting that recharging infrastructure is less urgent at homes and workplaces. “Getting a highway infrastructure up and ready is critical,” he said. “It’s a red-herring that there is no charging network in cities.” He went on to add: “The infrastructure is segueing naturally, except for highway charging, where Tesla has already proven this can be done without much trouble.”

Eni receives approval to drill offshore Alaska. Eni (NYSE: E) won approval to drill an exploration well in the Beaufort Sea off of Alaska’s northern coast. The shallow water wells will be drilled in winter months through early 2019. Related: China's EV Plan Could Cause An Oil Price Crash

ExxonMobil begins production at Hebron field. ExxonMobil (NYSE: XOM) said production at the Hebron field in eastern Canada began this week, which will see peak production at 150,000 bpd. The field was first discovered in 1980 and is thought to hold 700 million barrels. Its partners in the project include Chevron (NYSE: CVX), Suncor Energy (NYSE: SU), Statoil (NYSE: STO) and Nalcor Energy-Oil and Gas Inc.

ExxonMobil close to exploration deal in Mauritania. ExxonMobil (NYSE: XOM) said it is nearing a deal with Mauritania to explore for oil and gas offshore, which would mark its first deal in the West African country. Interest in Mauritania has climbed because of the sizable discoveries in neighboring Senegal.

Elon Musk’s claim for world’s largest battery to be temporary. Elon Musk made news over the past week when Tesla (NYSE: TSLA) successfully installed the world’s largest energy storage facility in Australia, a 100-megawatt project that came online in less than 100 days. But he will only hold that mantle for a short period of time – Bloomberg reports that a 150 MW project should reach completion in South Korea in three months. Developers are expected to install 1,650 MW of energy storage capacity this year, quadruple the total from 2016.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- Russia Ups Oil Price Forecast For 2018

- Oil Rig Count Rises After OPEC Deal Extension

- BREAKING: OPEC Agrees To 9-Month Extension Of Oil Production Deal

Now look at Nat. Gas its moving like there is going to be an ice age tomorrow. Very mild winter in the US, looks like the guys in the pits are trying to start a hollow rally in Nat. Gas.

oil prices saw a sharp spike on Monday morning as the bulls returned to the mix.