The Wall Street Journal reports that ExxonMobil, (NYSE: XOM), and Pioneer Natural Resources, (NYSE: PXD) are in preliminary discussions about a merger. There has been a good bit of M&A activity the last year or so in shale country. Quite a bit of which was in the Eagle Ford play in South Texas. I have discussed this activity in a couple of recent OilPrice articles, here, and here. Now it appears the liquids rich Midland, sub-basin of the massive Permian basin is drawing the acquisitive eye of companies looking to bulk up their acreage footprint. There have been some smaller deals focusing on the Midland basin over the last six months. Examples would be Diamondback Energy’s pick up of Firebird Energy last fall and early this year, a buyout of Lario Oil and Gas’ interests in the Permian.

It was clear that the late 2022 lull in M&A activity was coming to an end when news broke last week, that megadeal might be in the works for the Midland basin’s, and indeed the entire Permian basin’s largest producer, Pioneer Natural Resources.

In this article we will discuss some of the drivers behind what will the largest oil company merger since Occidental Petroleum, (NYSE: OXY) bought Anadarko Petroleum in 2019.

The building of a shale giant

Pioneer Natural Resources was born in a 1997 merger between a firm formed by two West Texas Wildcatters, Howard Parker and Joe Parsley with Boone Pickens flagship oil company, Mesa Inc. In 2020 PXD agreed to acquire Parsley Energy a company formed in 2008 by Bryan Sheffield, son of Scott Sheffield, CEO of PXD in a $7 bn transaction. The deal added about 300,000 acres to PXD’s core Midland basin position and about another 100,000 acres in the Delaware basin.

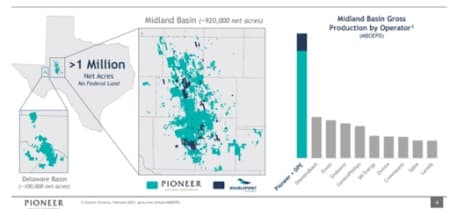

Then, in 2021 PXD shelled out another $6.4 bn to buy privately held DoublePoint Energy for its bolt-on acreage in the heart of the Midland basin. As you can see from the slide below, PXD emerged from this deal with nearly a million acres of very contiguous, blocky acreage that propelled them to the top of the pack of Permian producers.

Related: Oil Prices Head Lower In Calmer Trade

It is this core position that optimizes logistics, including drilling wells with 12-15,000’ lateral legs. In a recent analyst conference call, CEO Sheffield spoke to the importance of these long laterals.

“The contiguous nature of our acreage position provides multiple operational benefits including drilling and completing 15,000-plus foot laterals with greater than 100 of these expected to be placed on production in 2023. These longer laterals “drive improved returns and higher productivity.”

If you are looking for a site for a “well factory,” it doesn’t get any better than PXD’s nearly one million acre footprint in Texas’ Upton, Midland, and Martin counties. Additionally this acreage yields oil-weighted production at a time when it’s clear the demand/supply curve for this commodity is shifting toward a deficit later this year.

Against this back drop incorporating PXD’s assets into its massive Permian footprint is a compelling prospect for XOM. What remains to be seen is if Scott Sheffield and Darren Woods can come to a “gentleman’s agreement,” and stave off other suitors who must be considering challenge for PXD.

ExxonMobil’s conundrum

ExxonMobil in West Texas is also a creation of multiple significant acquisitions beginning in 2009 with gas juggernaut, XTO Energy, for $41 bn in cash and stock. The timing of this purchase was off as gas prices struggled in the 2010’s, leading to the oil giant taking a massive write down on the purchase in 2020.

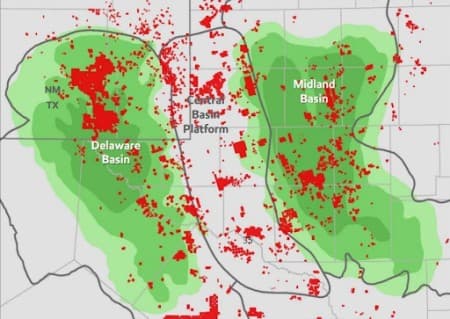

XOM doubled-down on the Permian with its 2017 purchase of Bass family holdings, better known as BOPCO. This time the quest was to increase liquids (crude oil and condensate) production, as newly appointed XOM CEO Darren Woods noted in the announcement-

“This investment gives us an exceptional Delaware Basin position in a proven multi-stacked play that can generate attractive returns in a low-price environment. The highly-contiguous position will provide significant cost advantages in developing 3.4 billion barrels of resource, of which 75 percent is liquids. By utilizing ExxonMobil’s technological strength coupled with its unconventional development capabilities we can drill the longest lateral wells in the Permian Basin, reducing development costs and increasing reserve capture.”

Discerning readers will note the similarity in the language used by these two CEO’s as they described the advantages that would come from combining their companies with the companies being acquired at the time.

Scale, Logistics, Lower Cost, Technology and longer laterals are common to each CEO’s pitch as what their respective deals would bring to the parent company. I discussed these attributes in an article on ConocoPhillips, (NYSE:COP), shortly after its ~$10 bn buyout of Shell’s, (NYSE: SHEL) Delaware position in 2021.

It is now necessary to compare each company’s acreage footprint to fully understand ExxonMobil’s conumdrum. How to grow efficiently in the Midland basin, and obtain those longer laterals throughout their widely scattered, but sizeable acreage position in the basin. When you do that XOM’s desire for PXD becomes obvious.

ExxonMobil and the Law of Large Numbers

The company has made no secret of its intention to grow Permian production to a million barrels equivalent per day by 2027. At today's current level of ~600K, that requires a 12% CAGR and gets you comfortably through that million on schedule. To get there they have to replace ~128K BOEPD of decline and add about ~80K BOEPD of new production in 2023, and then the Law of Large Numbers really kicks in.

For 2023 XOM will need to drill several hundred wells in the Permian to stay on track with this target. They have about $4 bn budgeted for the Permian this year, and that should deliver about the 350 or so wells, figuring $10-12 mm per well needed to hit the target for 2023.

What about 2024? 2025, and so on? The capex required will be higher each year, probably another half a billion, and the results may be elusive, as the best locations get drilled and the production curve begins to flatten. I discussed the problem of the quality in remaining shale acreage in an OilPrice article back in February, “Will U.S. Shale Ever Return To Its Glory Days?” Readers desiring more color on this topic should definitely give this a read.

ExxonMobil will probably hit its target in 2027. They are really good at big project development. Given their deep pocketbook and their ability to attract resources, they’ve got a good shot at it. But, why wait? It will only get more expensive and they might hit a resource wall- there’s only so many pad walking drilling rigs available, as an example. They can get to a million BOEPD and more this year and all it takes is money, and the two CEO’s making a deal.

Your takeaway

Using conventional metrics PXD is fairly valued at 5X EV/EBITDA and ~$80K per flowing barrel. To go beyond that you have to factor in XOM’s need for growth-PXD would double their output to ~1.3 mm BOEPD, and their need to operate their Midland basin acreage in the most efficient manner possible. XOM will have to put a factor on what the value of PXD’s ~$11 bn of TTM EBITDA, their 600,000 BOEPD of liquids weighted production, and 2.2 bn bbls of 2P production are worth. We may be surprised at what they come up with.

Hopefully they won’t take too long, PXD shareholders are expecting a nice “payday” bump from current share pricing, and counting on Mr. Sheffield to drive a hard bargain. With his more than 568K share position in the company, they don’t have much to worry about.

We don’t have anything official yet, but there is too much synergy in this transaction for it not to go through eventually, in my estimation. I doubt we have long to wait.

By David Messler for Oilprice.com

More Top Reads From Oilprice.com:

- The One Catalyst That Could Keep Oil From Hitting $100

- Inventory Draws Across The Board Push Oil Prices Higher

- Middle East Oil Prices Jump After Surprise OPEC+ Cuts