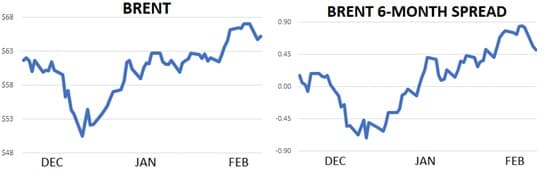

2019 has been lovely for crude oil bulls. Brent prices increased 54 cents on their first trading day of January beginning a move in which oil rose on 26 of the first 39 trading days of the year. Downside corrections have been minimal and the trend has been clear. Anyone with access to a Buy button could have made money trading oil over the last eight weeks.

And who do we have to thank for this ridiculously simple chart? Our assessment is that OPEC+ production cuts, a dovish US Fed (as well as a dovish global central banking community) and progress towards a US/China trade deal have all played a role in fattening the wallets of anyone who is long oil. Hedge funds have been on a significant buying spree in oil derivatives and on the macro side oil has benefited from a broad risk-on move in which stock markets have screamed higher.

Unfortunately, there’s a puzzling trend in place through the first two months of the year which will have to reverse in order for crude oil to continues its winning ways- bearish DOE data. US crude oil and gasoline stocks have revealed a persistently bearish trend in the last two months of too much supply and not enough demand. The results are seemingly the same each week. Crude oil stocks increase highlighted by a substantial increase of oil in the Cushing delivery hub. Refiner demand growth is less than 1% y/y. Meanwhile gasoline stocks continue to balloon and US gasoline demand and exports have actually decreased versus 2018.

Interestingly,…

2019 has been lovely for crude oil bulls. Brent prices increased 54 cents on their first trading day of January beginning a move in which oil rose on 26 of the first 39 trading days of the year. Downside corrections have been minimal and the trend has been clear. Anyone with access to a Buy button could have made money trading oil over the last eight weeks.

And who do we have to thank for this ridiculously simple chart? Our assessment is that OPEC+ production cuts, a dovish US Fed (as well as a dovish global central banking community) and progress towards a US/China trade deal have all played a role in fattening the wallets of anyone who is long oil. Hedge funds have been on a significant buying spree in oil derivatives and on the macro side oil has benefited from a broad risk-on move in which stock markets have screamed higher.

Unfortunately, there’s a puzzling trend in place through the first two months of the year which will have to reverse in order for crude oil to continues its winning ways- bearish DOE data. US crude oil and gasoline stocks have revealed a persistently bearish trend in the last two months of too much supply and not enough demand. The results are seemingly the same each week. Crude oil stocks increase highlighted by a substantial increase of oil in the Cushing delivery hub. Refiner demand growth is less than 1% y/y. Meanwhile gasoline stocks continue to balloon and US gasoline demand and exports have actually decreased versus 2018.

Interestingly, this is all occurring in the context of strong US economic growth and aggressive OPEC+ production cuts which have drastically reduced oil imports into the US. Our view for now is that the massive rise in US crude production and improvements in vehicle fuel economy deserve some credit for the trend, but it seems unlikely they alone could drive such bearish DOEs. We’re frankly surprised and a little confused regarding the weak trend in US crude fundamentals. But we do know they can’t continue if oil prices want to keep moving higher.

Oil prices are up about 24% in 2019 and you can bet that traders will become increasingly picky in looking for reasons to push the market higher. Bears will begin looking for entry points to fade such a strong rally while bulls look to trim positions and take profits. The easy money has been made from the long side and in order to continue we’ll need hard evidence that oil fundamentals are improving in the weekly US DOE reports. To be clear, we aren’t predicting a bearish move for oil (or any type of move) at current levels but pointing out that we’ll need more supply/demand substance in order to push above $70.

January and February have seen rallies based on expectations that OPEC+ will tighten supplies, the US Fed will keep rates low and the US and China will quit bickering on trade. March and April will have to provide hard evidence these hopes are being met in order to keep the bullish party going.

(Click to enlarge)

Quick Hits

- A certain US politician sent oil prices tumbling to begin the week by Tweeting ‘Oil Prices getting too high. OPEC, please relax and take it easy. World cannot take a price hike – fragile!’ Brent fell from above $67 to below $65 on the new while WTI went from $57.40 to $55.00. While there’s no denying the President’s continued Twitter influence on markets, we aren’t sure what long term leverage he’ll have on oil prices in 2019 the way he did in 2018. As we’ve discussed, the US won’t be able to dupe OPEC into ramping up prices only to grant waivers to Iranian crude buyers again this year. Look for OPEC to continue production cuts on their current course and yield only if prices move substantially higher.

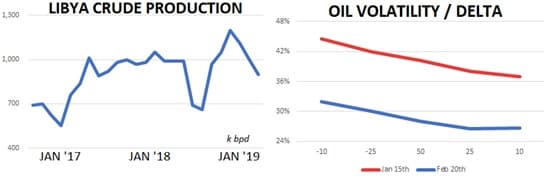

- On the geopolitical front, Libya’s prime minister and top oil boss met this week but couldn’t reach an agreement on terms to restart the 300k bpd Sharara field. Brent spreads weakened in recent trading on profit taking.

- Goldman Sachs’ latest crude oil note forecasts Brent crude oil at $60-$65 in 2019 and 2020. The bank sees OPEC+ supply cuts (both voluntary and involuntary) skewing risk to the upside despite their prediction of further gains in US crude production.

- Goldman’s chief economist released a note this week which was more bullish on the global economy than many of their peers. The bank maintained a global GDP growth forecast of 3.5% for 2019 noting that several economic indicators seemed to have bottomed in December and January and are improving in February with help from dovish central bankers. They remain bullish on risk assets and bearish on the US Dollar.

- US Fed chief Jay Powell is set to testify in front of the US Congress this week and will likely offer some hits on the near-term future of US monetary policy. US 4Q’18 GDP is set to be released Thursday and is broadly forecast near 2.5%. The US Dollar index is slightly higher YTD despite dovish posturing from the US central bank as other G7 countries have similarly looked to implement stimulative policies.

- Options market shave looked curiously sleepy over the last month as prices have continued to rise. WTI 25 delta puts currently trade at 30% implied volatility while call options only imply 26%. This is part due to increased hedging activity from producers who are taking advantage of newly high prices. However, it’s notable that speculators don’t seem to be betting on a price spike by buying call options and driving upside risk higher.

(Click to enlarge)

DOE WRAP UP

- US crude stocks helped tamp down the recent strength in crude prices last week jumping 3.7m bbls to 454.5m.

- US crude production reached a new all-time high this week at 12.0m bpd. Overall crude stocks are higher y/y by about 7% over the last three weeks of data.

- The US currently has 28.2 days of supply on hand which is higher y/y by about 8%.

- Crude stocks in the Cushing delivery hub also continue to rise jumping 3.4m bbls w/w to 45m. Cushing inventories have doubled since September.

- US refiner demand continues to fall in line with seasonal expectations as facilities begin switching from diesel full and other distillates to motor gasoline ahead of the summer driving season. Last week overall refiner demand fell about 60k bpd to 15.7m bpd. US refiner demand is higher by about 130k bpd y/y through the first seven recorded weeks of 2019.

- Good news if you own an oil refinery in the US: cracks are finally trending in the right direction. After several months of extreme doldrums which saw the US gasoline crack trade below $8/bbl overall crack margins (assuming 3 barrels of crude is processed into 2 barrels of gasoline and 1 barrel of diesel fuel) now returns a margin of more than $20/bbl. Overseas, the gasoil/brent crude crack is offering $16/bbl which is about 33% above its 5yr average. Both marks should help boost overall crude demand as they incentivize refineries to run at higher rates.

- US motor gasoline demand + exports continues to run at a frighteningly bearish printing 9.6m bpd for the second straight week. So far the measure is lower y/y by 49k bpd which is shocking in the context of cheap gasoline prices, +3% GDP growth in the US and reasonably strong economies in the markets the US exports too. We’re somewhat baffled by the bearish trend and continue to wonder if fuel efficiency standards and EVs are having a larger impact on gasoline consumption than we think.

- As for refined product supplies, gasoline inventories fell by about 1.5m bbls last week and are higher y/y by about 4%. Distillate inventories also dropped by about 1.5m bbls and are lower y/y by about 1.5%.