Election Day has finally arrived. Who will win, and why gold will remain the biggest winner of them all? So, today is the day! It's Election Day. For quite some time, national polls indicate that Biden has a significant advantage . He is also polling scarcely close ahead of Donald Trump in key battleground states, but, in some states, the lead has recently narrowed. So, in many places, the race is still too close to call, making them toss-up states. Hence, although according to political pundits, polls, and bets Biden will become the next POTUS, anything could happen.

And we mean - anything. Everyone knows that back in 2016, Hillary Clinton also led in the polls. However, Trump won the election, to everyone’s surprise. Of course, the polling methodology has been improved since. But now, Biden has a much wider advantage than Hillary did in 2016, and he is much more conservative and more moderate in his approach than Clinton (historically, more moderate presidential candidates generally do better in presidential elections).

Additionally, the election results might not be known right away, and there are indications that they might be contested. Who knows what could happen if that’s the case? According to some analysts, contested elections should increase the geopolitical uncertainty and boost the safe-haven demand for gold. On the other hand, some analysts also believe that the contested elections would put downward pressure on the stock market, dragging gold down in the process. The fact of the matter is that contested elections would undoubtedly delay the fiscal stimulus package, which should be negative for gold prices.

So, who is right? It is true that recently, gold has been moving in tandem with the stock prices, responding to the stimulus expectations. But, in times of stress and reduced faith in the American institutional system, gold could decouple from equities and behave more like a safe haven asset.

Related: Oil Prices Rise On Election Day

In any case, tomorrow, the elections will already be behind us. Hopefully, we will get the results quickly. No matter who wins, the new administration and the new Congress will have to deal with the second wave of the coronavirus and fragile economic recovery.

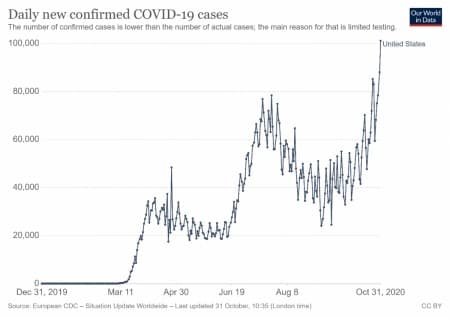

Oh, by the way, as the chart below shows, the US reported 101,273 new Covid-19 cases on Saturday, the daily record not only for America but for any country! And according to some epidemiologists, the worst is yet to come –that is, if the upward trend in cases continues, which could overwhelm the health system.

No matter whether red or blue, the new government is likely to pump more liquidity into the economy. So, gold could thrive under either Trump or Biden, although we could see increased volatility in the short-term precious metals market.

Implications for Gold

What does all the above mean for the gold market? Well, investors should look past the elections already. They matter less than many people believe. The 2016 presidential election is the best example of that. The price of gold indeed declined in the aftermath of Trump’s victory, but the downward trend was eventually reversed.

So, yes, you should be prepared for elevated volatility this week. After all, we are about to witness not only the elections but also the FOMC meeting and equally important economic reports, including the nonfarm payrolls.

However, as I have repeated many times before, gold’s responses to geopolitical events are relatively short-lived. In the long run, what drives gold prices are the fundamental factors. And the fundamental outlook remains positive for the yellow metal. Both the monetary policy and the fiscal policy are extremely dovish. The public debt is ballooning, while the US dollar is weakening. The real yields remain negative.

Yes, as the chart below shows, the real interest rates have stabilized or even increased slightly since August, which explains gold’s struggle in recent months.

Nevertheless, the Fed will maintain its policy of ultra-low nominal interest rates for years, while inflation will accelerate at some point, possibly when the economic recovery sets in for sure. This means that the real interest rates should remain very low or even decrease further, supporting the gold prices in the process.

By Arkadiusz Sieron via Sunshine Profits

More Top Reads From Oilprice.com:

- Rystad Energy: COVID To Accelerate Peak Oil Demand To 2028

- The Future Landscape Of U.S. Oil

- Norwegians Got Paid To Use Electricity As Prices Fall Below Zero