Via Metal Miner

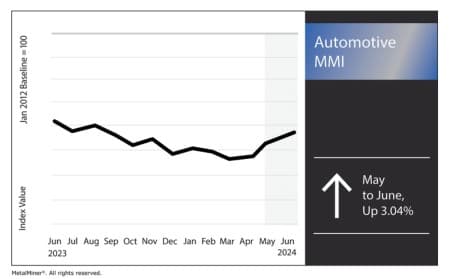

The Automotive MMI (Monthly Metals Index) continued to rise month-over-month, this time increasing by 3.04%. Aluminum and platinum prices rose significantly, which pulled the index up and provided significant bullish price action. Meanwhile, copper prices also added some bullish sentiment to the index, though not quite as much as in May.

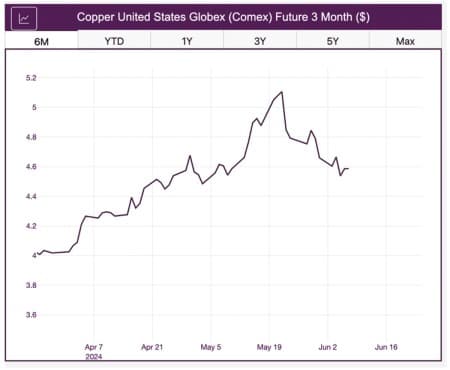

Copper prices continue to be a hot topic of debate, with the recent rally, speculative purchasing and supply concerns causing ample volatility in the global copper market. With this vital metal being a necessity for vehicle construction, how will this price volatility impact the U.S. automotive market?

Recent Increase in Copper Prices: Will the U.S. Automotive Industry See an Impact?

A ten-year high in copper prices has put the automobile sector at risk. This price increase may drive up production costs since copper is an essential component in the construction of cars, particularly electric vehicles (EVs). As a result, automakers could have to raise car costs or deal with lower profit margins, which might limit customer demand.

One major factor contributing to the increase in copper consumption is the growing demand for EVs. This is because electric vehicles need a lot more copper per unit than cars with traditional internal combustion engines. The cost of copper will most likely keep going up as the EV market expands.

Strategies for Automotive Manufacturers to Offset Copper Price Increases

Rising copper costs generally force manufacturers to employ many different strategies. For one, manufacturers can choose to spend less money on substitute materials that are equivalent in terms of performance. Secondly, businesses may also increase the effectiveness of their supply chains to reduce overall expenses.

Source: MetalMiner Insights. Learn how Insights can help your company save millions with detailed metal price forecasting.

Third, negotiating long-term, fixed-price contracts with copper suppliers might help stabilize costs. Lastly, manufacturers ought to consider supporting recycling programs that extract copper from old cars and electronics.

Why Copper Demand Might Not Be as High as People Think

Although the EV industry could result in an increased demand for copper, a number of variables might temper this view. For instance, new developments in material science may result in the creation of copper substitutes, lowering dependency on this copper and bringing down copper prices and demand. In addition, recessions or changes in consumer preferences away from EVs may curb the predicted spike in copper consumption. Additionally, advances in recycling techniques and technology may offer a more reliable source of copper, relieving pressure on primary production.

Even while the EV industry is expanding, it is not yet strong enough to continue the positive trajectory of copper prices. Despite their recent rise, adoption rates remain low when considering the whole automobile industry. Further impeding faster adoption are expensive starting prices and inadequate charging infrastructure. The electric vehicle market by itself won’t be able to continuously push copper prices to all-time highs unless it removes these obstacles.

Baltimore Port Resuming Operations: Major Relief to U.S. Automotive Industry

When the Francis Scott Key Bridge collapsed as a result of a cargo ship collision, it brought the Baltimore port, a significant hub for the import of cars and trucks, to a complete stop. A large portion of the harbor closed following this catastrophe, which had a detrimental effect on the automotive supply chain within the U.S.

As the port resumes operations, the automotive industry will likely benefit significantly. The immediate impact will be the restoration of the smooth flow of vehicles into the U.S. market. This should help alleviate the backlog of orders and reduce waiting times for consumers eager to receive their new vehicles. Furthermore, the logistical challenges and additional costs incurred from rerouting shipments through other ports will no longer burden the industry.

ADVERTISEMENT

As supply chains stabilize, Detroit automakers and other manufacturers should see increased efficiency and lower prices. This means that manufacturers will be better able to fulfill market demand and restore their production schedules once the port shutdown ends.

By Jennifer Kary

More Top Reads From Oilprice.com:

- JPMorgan Analysts Cast Doubt on Tesla's Robotaxi Revenue

- Microsoft: Russian and Chinese State Hackers Pose Growing Threat

- Chinese EV Makers Unfazed by Western Tariffs