Breaking News:

Centrica's Profits Decline Amid Return to Market Normalcy

Centrica, the owner of British…

Oil Prices Under Pressure Despite Bullish Catalysts

Oil prices are under pressure…

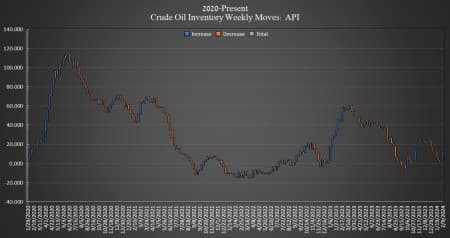

U.S. Oil Inventories Rise, Gasoline and Distillate Stocks See Strong Draws

Crude oil inventories in the United States rose by 8.52 million barrels for the week ending February 9, according to The American Petroleum Institute (API), after analysts predicted a build of 2.6 million barrels. The API reported a 674,000-barrel rise in crude inventories in the week prior.

On Tuesday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by 0.8 million barrels as of February 9. Inventories are now at 358.8 million barrels.

Oil prices were up ahead of the API data release on persistent tensions in Russia and the Middle East but capped by new data showing that inflation remained high in January, which could delay Fed rate cuts.

At 4:01 pm ET, Brent crude was trading up 0.74% on the day at $82.61, up $4 per barrel from this time last week. The U.S. benchmark WTI was trading up on the day by 1.08% at $77.75, also up $4 per barrel compared to this time last week.

Gasoline inventories saw a significant drawdown this week, falling by 7.23 million barrels, more than offsetting the 3.652 million barrels rise in the week prior. As of last week, gasoline inventories were about 1% below the five-year average for this time of year, according to the latest EIA data.

Distillate inventories also fell this week, by 4.016 million barrels, on top of last week’s 3.699 million barrels drop in the week prior. Distillates were already 7% below the five-year average for the week ending February 2, the latest EIA data shows.

Cushing inventories rose by 512,000 barrels after rising by 492,000 barrels in the previous week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Norwegian Intelligence Warns of Risk of Attack from Russia

- 90,000 NATO Troops Mobilize in "Biggest Exercise" Since Cold War

- Oil Markets Are Much Tighter Than Oil Prices Suggest

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

-

Presumably the EIA will confirm tomorrow. The USA continues to move with incredible aggression away from pure play ICE platforms. All of Europe very much moving away from diesel engines and diesel fuel as well. All the while Northwest Europe minus Russia now of course still a massive producer of refined product...as is Canada now too as well. US natural gas prices continue to plunge as well so having a hard time seeing any type of energy crisis in the USA no matter what type of market manipulated "price shock" might be en route.quite the opposite the USA remains flooded with energy product to include now methanol.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B