Breaking News:

3 Solar Stocks To Watch as Earnings Season Starts

First Solar, Nextracker, and Sunrun…

Kazakhstan's Nascent Auto Industry Thrives Amid Controversy

Kazakhstan's controversial auto recycling fee…

Tesla's Strategic Investment Could Make Indonesia A Battery Hub

In December 2020, reports emerged that Tesla would send delegations to Indonesia in January to discuss potential investment in a supply chain for its electric vehicles.

On February 4, the Jakarta Globe reported that Tesla would submit a proposal to the Indonesian government for the establishment of a battery production facility in the country. This is on the back of the automaker strive to secure nickel supplies for its larger 4680 cells that is planned to be used in future Tesla vehicles such as the Cybertruck and the Semi models.

Tesla’s proposal could be one in a series of ore processing and battery investments that the government hope would make up the bulk of the country’s $64 billion investment target for this year, Jakarta Globe reported.

In its latest industry report, analyst Fitch Solutions says it believes the investment proposal by Tesla will cement Indonesia’s status as a strong player and integral component in the global electric vehicle (EV) supply chain.

Previously, Fitch highlighted the potential for Indonesia to become a major component of the EV supply chain due to its large-high-quality nickel reserves and its supportive policies. Since then, the country has attracted a significant amount of investments into its EV battery industry.

Most notable of which was the announcements from Contemporary Amperex Technology (CATL), which announced an investment totaling $5 billlion to set up a new battery production operation in the country, and LG Chem, which signed a Memorandum of Understanding on a $9.8 billion investment in the country’s EV battery sector, Fitch reports.

Related Video: The Silver Squeeze Conspiracy

Nickel is increasingly becoming a critical metal used in batteries for EVs due to its properties that enable mass energy storage capabilities while it reduces the overall cost of batteries by limiting the amount of cobalt required. Nickel-rich batteries have become a way of reducing the dependence of cobalt in battery chemistries due to ethical challenges in sourcing the metal from the Democratic Republic of Congo, Fitch notes.

With the rising demand for EVs, the need to secure critical nickel supplies is becoming ever more pressing for battery producers and automakers alike.

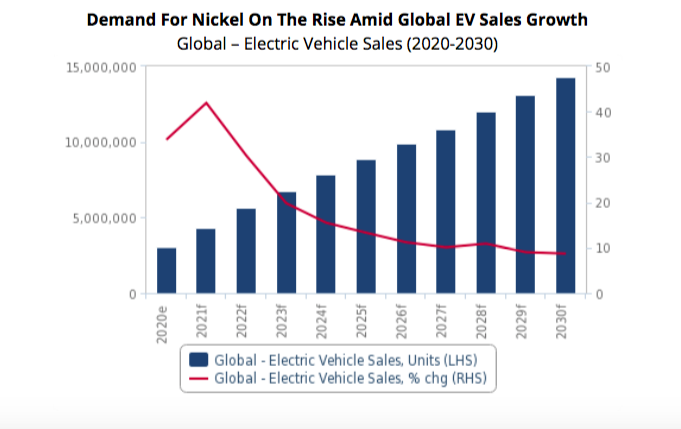

Fitch currently forecasts global EV sales to rise by 41.9% to reach over 4.3mn units in 2021 with sales expected to breach the 14mn mark by 2030. This accelerated pace of EV sales growth will place strong upward pressure on the price of raw materials used in batteries and will force battery producers to develop more affordable batteries, Fitch asserts, which more often than not means higher nickel content and lower cobalt content.

Fitch’s mining team expects higher battery metals prices will benefit miners from a lag in raw materials project development while putting automakers at a disadvantage. The analyst notes that at current prices, the initial increase in mining investment will be inadequate to match the acceleration of demand which would increase the price of batteries and thus create a highly competitive market for nickel supplies.

By Mining.com

More Top Reads From Oilprice.com:

MINING.com

MINING.com is a web-based global mining publication focusing on news and commentary about mining and mineral exploration. The site is a one-stop-shop for mining industry…

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B