Breaking News:

Palestinian Political Factions Agree to Reconciliation Government

Palestinian factions Hamas and Fatah…

Porsche Shares Slide as Sportscar Maker Slashes Revenue Forecast

Shares of the German sportscar…

Surprise Crude Oil Draw Sends Oil Prices Higher

The American Petroleum Institute (API) reported a surprise draw in crude oil inventory of 4.2 million barrels for the week ending February 22, coming in under analyst expectations that predicted that crude oil inventories would build by 2.842 million barrels.

Last week, the API reported a build in crude oil of 1.26 million barrels. A day later, the EIA reported a larger one of 3.7 million barrels.

Oil price movements were fairly bland on Tuesday prior to the data release, with the WTI benchmark trading essentially flat on the day at $55.48 while the Brent benchmark trading up $0.37 (+0.57%) at $65.28 at 2:25pm. Both benchmarks were trading down a couple dollars per barrel week on week.

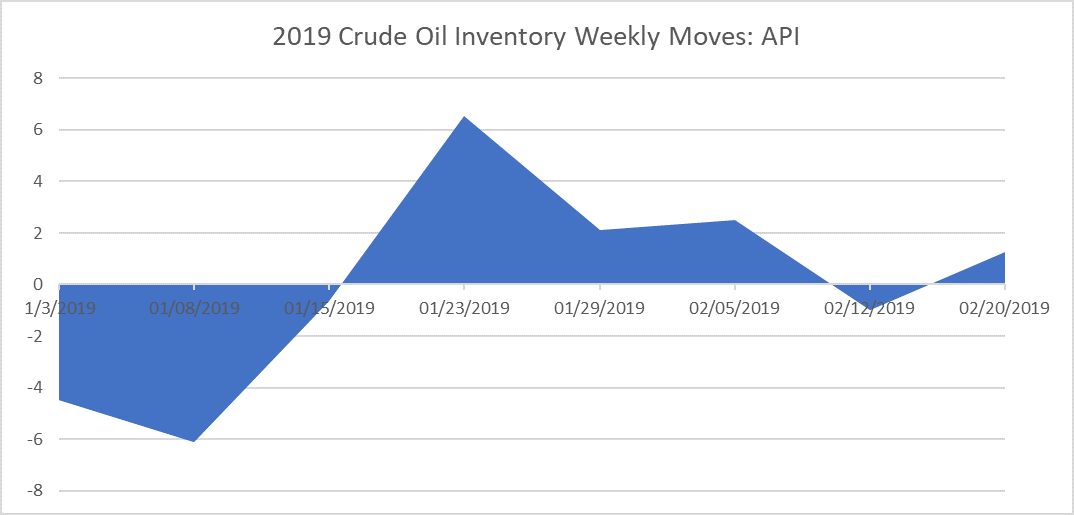

While 2019 has been a wild ride for oil prices, inventory moves for crude have been innocuous, with a net build of 147,000 barrels for the eight reporting periods prior to this week, using API data, with only two big swings that essentially cancelled each other out.

(Click to enlarge)

The API this week reported a draw in gasoline inventories for week ending February 22 in the amount of 3.8 million barrels. Analysts estimated a draw in gasoline inventories of 1.686 million barrels for the week.

US crude oil production as estimated by the Energy Information Administration showed that production for the week ending February 15—the latest information available—averaged 12 million barrels per day –another high for the US, breaking yet another psychological barrier.

Distillate inventories increased this week by 400,000 barrels, compared to an expected draw of 1.951 million barrels.

Crude oil inventories at the Cushing, Oklahoma facility grew by 2.0 million barrels for the week.

The U.S. Energy Information Administration report on crude oil inventories is due to be released on Wednesday at 10:30a.m. EST.

By 4:39pm EST, WTI was trading up at $55.63 and Brent was trading up at $65.49.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- European Oil Demand Is Shockingly Weak

- Cracks Begin To Form In Saudi-Russian Alliance

- An Underestimated Niche In Oil & Gas

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

The API and EIA have been for years performing 'a good cop bad cop act' with oil prices. However, the global oil market and prices have seen through their ploys and are starting to ignore their game.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London