Breaking News:

U.S. Electricity Prices Surge Amid Grid Strains and Rising Demand

The expected higher expenditures, as…

European Natural Gas Prices Fall as Freeport LNG Resumes Operations

European natural gas prices are…

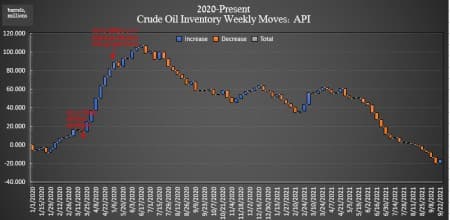

Surprise Crude Build Caps Oil Prices

The American Petroleum Institute (API) on Tuesday reported a surprise build in crude oil inventories of 4.127 million barrels for the week ending September 24.

The build runs contrary to the analyst expectations who had estimated a loss of 2.333 million barrels for the week.

In the previous week, the API reported a draw in oil inventories of 6.108 million barrels—a larger loss than the 2.400 million barrel draw that analysts had predicted.

Oil prices fell on Tuesday leading up to the data release, despite weekly reports of falling U.S. crude oil inventories and market sentiment that is eyeing a tighter market ahead—especially on the back of the natural gas crunch in Europe that is assumed will spill over into other countries.

WTI fell 0.70% on Tuesday afternoon leading up to the data release.

At 3:38 p.m. EST, WTI was trading at $74.92—a roughly $4.50 gain on the week, but a loss of $0.53 on the day. Brent crude was trading down 1.01% for the day at $78.73.

Oil inventories in the United States have drawn down nearly 73 million barrels so far this year, according to API data—well below pre-pandemic levels. The EIA's latest data suggests that crude oil inventories in the United States are now 8% under the five-year average for this time of year, at 414 million barrels.

U.S. oil production had been down more than a million bpd over the last couple of weeks, but crude production ticked up for week ending September 17, to 10.6 million bpd—with more than 84% of Gulf of Mexico oil producers finally back online after Hurricane Ida made landfall at the end of August.

The API reported a build in gasoline inventories also, of 3.555 million barrels for the week ending September 24—compared to the previous week's 432,000-barrel draw.

Adding to the across-the-board builds, distillate stocks saw a increase in inventories this week of 2.483 million barrels for the week, compared to last week's 2.720-million-barrel decrease.

Cushing inventories rounded out the builds this week, adding 0.359 million barrels to the total inventory, after last week's 1.748-million-barrel decrease.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Europe Must Act To Avert An Energy Crisis This Winter

- U.S. Shale Is Finally Ready To Drill

- The Harsh Truth Behind Europe’s Energy Crisis

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B