Breaking News:

Grid-Enhancing Technologies: The Answer to Growing Power Needs?

Grid-enhancing technologies offer interim solutions…

The Price of Oil Expansion in Argentina

Argentina's energy landscape is evolving,…

Surprise Crash In Crude Inventories Sends Oil Prices Higher

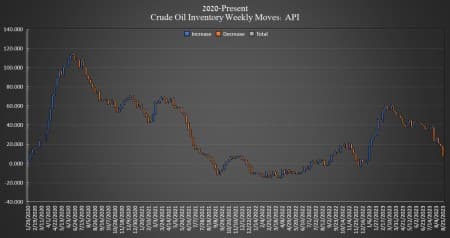

The American Petroleum Institute (API) has reported a massive 11.486-million-barrel draw in U.S. crude inventories, compared with the previous week's 2.418-million-barrel draw as the markets weigh China's economic activity against U.S. crude inventories.

Analysts were expecting an inventory draw of 2.9 million barrels for the week. The total number of barrels of crude oil gained so far this year is just shy of 4 million barrels, according to API data, although there is a net draw in crude inventories since April of almost 44 million barrels.

On Monday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by another 600,000 barrels in the week ending August 21, with the SPR inventory still sitting at a near 40-year low of 349.5 million barrels. At the current replenishment rate, the SPR should return to 2021 levels in a little under a decade.

Oil prices were rising on Tuesday ahead of API data, with Brent trading up 1.28% at $85.50 at 4:16 p.m. ET—a $1.50 gain week over week, while WTI was trading up 1.44%, at $81.25 per barrel—a gain of $1 per barrel from this time last week.

Gasoline inventories saw a build this week, rising by 1.40 million barrels, compared to last week's 1.898 million barrels dip in the week prior. Gasoline inventories are roughly 5% less than the five-year average for this time of year. Distillate inventories rose by 2.46 million barrels, after the 153,000 barrel draw in the week prior, and are already sitting somewhere around 16% below the five-year average for this time of year.

Cushing inventories fell by 2.23 million barrels.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Global Warming To Exceed 2 Degrees Celsius Limit By 2050: Exxon

- Soaring Oil & Gas Prices Made Renewables Cheaper Than Fossil Fuels In 2022

- Chevron Evacuates Gulf Of Mexico Oil Platforms As Hurricane Idalia Approaches

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B