Breaking News:

U.S. Electricity Prices Surge Amid Grid Strains and Rising Demand

The expected higher expenditures, as…

OPEC Oil Reserves in Decline

Rystad Energy disputes OPEC’s claim…

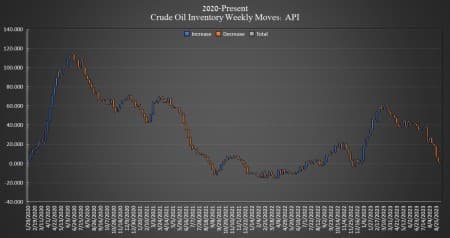

Strong Crude Draw, Falling Inventories At Cushing Support Oil Prices

The American Petroleum Institute (API) has reported a large 5.25-million-barrel draw in U.S. crude inventories, offsetting last week’s 1.174-million-barrel build.

Analysts were expecting an inventory draw of 2.667 million barrels for the week. The total number of barrels of crude oil moves so far this year is now squarely in the red, according to API data, and there is a net draw in crude inventories since April of more than 52 million barrels.

On Monday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by 600,000 barrels last week, with the SPR inventory still sitting at a near 40-year low of 351.2 million barrels. The amount being purchased to put back into the SPR is a small portion of the hundreds of millions of barrels that were sold off out of the SPR over the last couple of years.

Oil prices were trading up on Tuesday ahead of API data release, with Brent trading up 0.23% at $94.65 at 4:11 p.m. ET—a $2.50 gain week over week, while WTI was trading up 0.15%, at $91.62 per barrel—a gain of more than $2.50 per barrel from this time last week.

Gasoline inventories saw the only rise this week, by 732,000 barrels, on top of the 4.21 million barrel build in the week prior. Gasoline inventories are roughly 2% less than the five-year average for this time of year. Distillate inventories fell by 258,000 barrels, partially offsetting the 2.592-million barrel build in the week prior, and are 13% below the five-year average for this time of year.

Cushing inventories fell by another large 2.564 million barrels after falling 2.417 million barrels last week, leaving just over 22 million barrels in Cushing.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- An Apparently Unstoppable Oil Price Rally

- Chevron Continues Australian LNG Exports Despite Plant Fault And Strikes

- Hedge Fund Partner Blasts Oil Demand Decline Narrative

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

Long $slb Slumberger strong buy