Breaking News:

Bad News From China Could Be The Harbinger For Lower Oil Prices

Despite some industrial sector gains,…

Oil Rig Count Jumps as Drilling Activity Picks Up

The total number of active…

Petrobras’ Change In Strategy Provokes Strong Reactions

After having reported its earnings last Wednesday, newly installed Petrobras CEO Jean Paul Prates already prepared shareholders for a change of strategy by saying that the company must be ready for an 'unavoidable' energy transition.

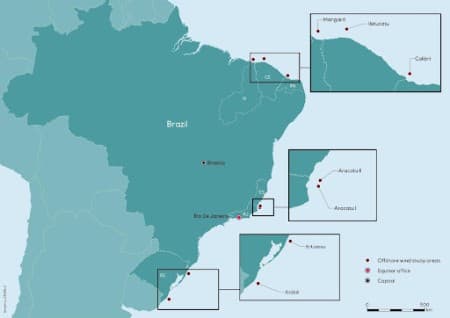

And now it seems that under the helm of Prates, the company is actively pursuing a major expansion of renewable energy assets. On Monday, Petrobras signed a letter of intent with Norwegian oil major Equinor to study the feasibility of another seven strategic offshore wind sites, expanding the partnership the companies signed in 2018.

Image courtesy: Equinor

According to Petrobras CEO Prates, the seven new offshore wind projects would have a combined generation capacity of 14.5 GW, and the cooperation agreement will be effective until 2028. According to Reuters, the new wind farms would take six to 10 years to begin generating electricity. In line with Brazilian President Lula’s intention to jump-start the national economy, Petrobras will seek to produce as many components for its offshore wind parks in Brazil.

Despite the announcement of cooperation with Equinor and the new CEO’s enthusiasm to expand Petrobras' renewables portfolio, investors and associations representing oil and gas producers and suppliers are increasingly nervous about the political change of winds in Brazil.

Especially the sudden halt and revision of the ongoing (downstream) divestments of the company have sparked unrest among stakeholders according to Bnamericas. On one hand, the associations of oil and gas producers and the electric power industry are upset with the new government’s plans to halt Petrobras’ divestments. The associations fear that the halt in divestments will reduce competitiveness and investment in Brazil’s oil and gas sector. Next to this, investors are increasingly concerned that the changes in fuel pricing policy, the development of expensive and less profitable renewable energy projects, and the drive to produce locally will erode the profitability of the oil giant.

On the other hand are the powerful oil worker unions unified under the Federação Única dos Petroleiros (FUP), which are known to be strong supporters of Lula’s workers’ party. The unions have expressed their concerns about the current board of directors of Petrobras, claiming that several of the installed directors continue to support further privatization of the oil major. The unions fear that a divided board of directors could significantly hinder Lula’s energy agenda, including changes to diesel and gasoline pricing policy and dividends.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- Shell Is Reviewing Its Plan To Reduce Oil Production This Decade

- Crude Oil Inventories See Weekly Draw As Fuel Inventories Build

- Rare Earth Elements: What They Are And Why They Matter

Tom Kool

Tom majored in International Business at Amsterdam’s Higher School of Economics, he is Oilprice.com's Head of Operations

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B