|

Louisiana Light • 2 days | 81.18 | +0.12 | +0.15% | ||

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% | ||

|

Mars US • 266 days | 75.97 | -1.40 | -1.81% | ||

|

Gasoline • 10 hours | 2.461 | -0.007 | -0.29% |

|

Bonny Light • 29 days | 86.00 | -0.62 | -0.72% | ||

|

Girassol • 29 days | 87.27 | -0.38 | -0.43% | ||

|

Opec Basket • 2 days | 81.37 | -0.08 | -0.10% |

|

Peace Sour • 18 hours | 72.28 | +0.69 | +0.96% | ||

|

Light Sour Blend • 18 hours | 72.28 | +0.69 | +0.96% | ||

|

Syncrude Sweet Premium • 18 hours | 79.18 | +0.89 | +1.14% | ||

|

Central Alberta • 18 hours | 72.28 | +0.69 | +0.96% |

|

Eagle Ford • 3 days | 74.07 | +0.63 | +0.86% | ||

|

Oklahoma Sweet • 2 days | 75.00 | +2.00 | +2.74% | ||

|

Kansas Common • 3 days | 67.75 | +0.50 | +0.74% | ||

|

Buena Vista • 4 days | 83.27 | -2.82 | -3.28% |

Chinese Mining Operations in Tajikistan Spark Environmental Backlash

Chinese mining and agricultural companies…

3 Solar Stocks To Watch as Earnings Season Starts

First Solar, Nextracker, and Sunrun…

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

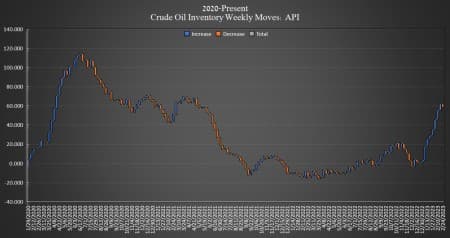

Crude Oil Inventories See Weekly Draw As Fuel Inventories Build

By Julianne Geiger - Mar 07, 2023, 3:40 PM CSTCrude oil inventories in the United States slipped this week, with a 3.835 million barrel decrease, the American Petroleum Institute (API) data showed on Tuesday, bringing the total number of barrels gained so far this year to nearly 55 million barrels.

This week, SPR inventory held steady for the eighth week in a row at 371.6 million barrels—the lowest amount of crude oil in the SPR since December 1983.

Oil prices traded down on Tuesday in the run-up to the data release. At 4:12 p.m. EST, WTI was trading down $3.04 (-3.78%) on the day to $77.42 per barrel, flat on the week. Brent crude was trading down $2.99 (-3.47%) on the day at $83.19—down $0.70 from this same time last week.

U.S. crude oil production stayed at 12.3 million bpd for week ending February 24—the highest production rate since last April 2020. U.S. production is still 800,000 bpd lower than the peak production seen in March 2020.

WTI was trading at $77.41 shortly after the data release.

Gasoline inventories rose by 1.840 million barrels, offsetting last week’s API data that showed the fuel inventories fell by 1.774 million barrels. Distillates rose by 1.927 million barrels after falling by 341,000 bpd in the week prior.

Inventories at Cushing, Oklahoma, increased by 24,000 barrels on top of the 483,000 barrel hike reported last week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- OPEC’s Oil Production Rises By 120,000 Bpd As Nigerian Output Rebounds

- Oil Trade Is Moving Away From Europe

- Small Nuclear Reactors Get Boost As Western Cities Vote ‘Yes’

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Related posts

EXXON Mobil

-0.35

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

BUY 57.15

Sell 57.00

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Merchant of Record: A Media Solutions trading as Oilprice.com