Breaking News:

Oil Moves Higher on Crude, Fuel Inventory Draw

Crude oil prices ticked higher…

Volatility Dominates Oil Markets Amid Mixed Signals

It's been a rollercoaster of…

Oil Rally Slows On Surprise Crude Build

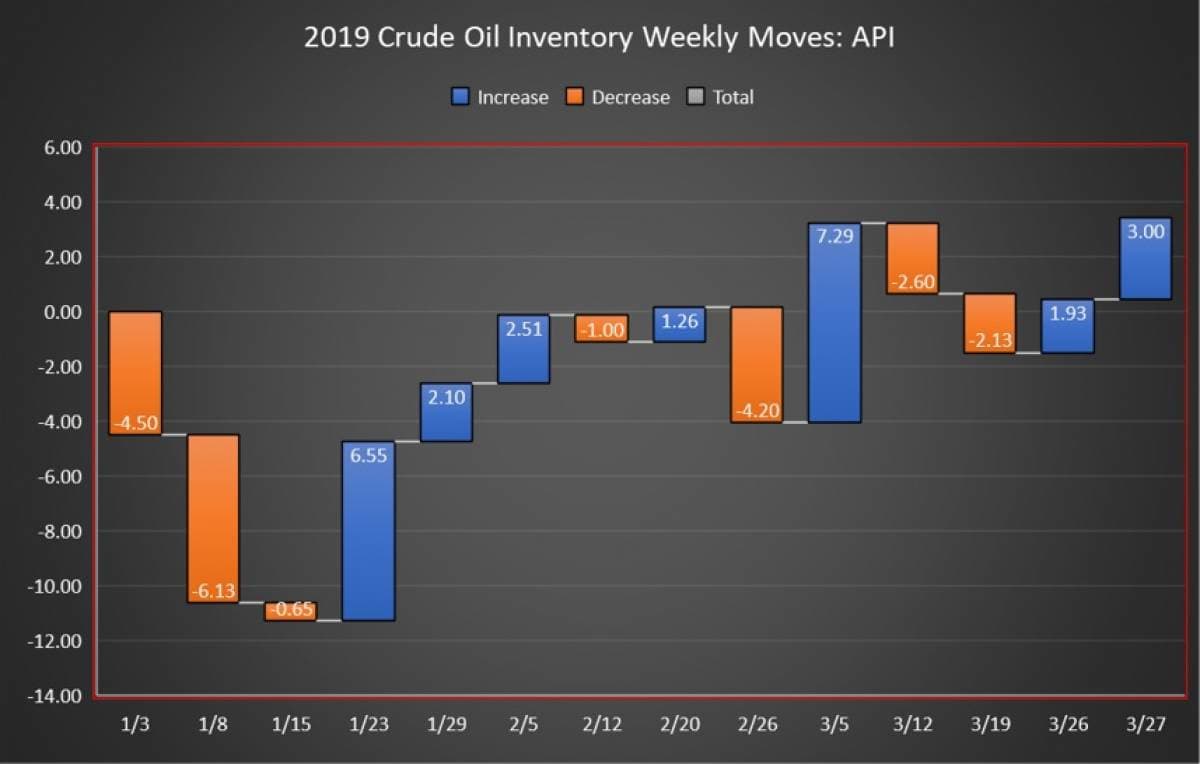

The American Petroleum Institute (API) reported a build in crude oil inventory of 3.0 million barrels for the week ending March 29, coming in over analyst expectations of a 425,000-barrel draw.

Last week, the API reported a surprise build in crude oil of 1.93 million barrels. A day later, the EIA confirmed the build, estimating that crude inventories had grown by 2.8 million barrels.

Including this week’s data, the net build is now 3.43 million barrels for the twelve reporting periods so far this year, using API data.

WTI was trading up on Tuesday in the run up to the data release at $62.60, up $1.01 (+1.64%) on the day at 3:21pm. The Brent benchmark was trading up at $69.43, up $0.42 (+0.61%) at that time. Both benchmarks are up week on week and represent new highs for 2019 as US output saw small declines and global inventories appear to have abated somewhat.

The API this week reported a draw in gasoline inventories for week ending March 29 in the amount of 2.6 million barrels. Analysts estimated a smaller draw in gasoline inventories of 1.542 million barrels for the week.

US crude oil production as estimated by the Energy Information Administration showed that production for the week ending March 22—the latest information available—stayed flat at an average of 12.1 million bpd—the all-time high for the United States.

Distillate inventories decreased by 1.9 million barrels, compared to an expected a draw of 506,000 barrels for the week.

Crude oil inventories at the Cushing, Oklahoma facility grew by 18,000 barrels for the week.

The U.S. Energy Information Administration report on crude oil inventories is due to be released on Wednesday at 10:30a.m. EST.

By 4:42pm EST, WTI was trading up at $62.58 and Brent was trading up at $69.44.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Prices Spike On Shale Slowdown

- Expect Higher Oil Prices As OPEC Clashes With Trump

- Big Oil Is Heading Offshore

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B