Breaking News:

The Rise of the Middle Corridor Trade Route

The Ukraine war has catalyzed…

OPEC Oil Reserves in Decline

Rystad Energy disputes OPEC’s claim…

Oil Holds Steady Despite Surprise Crude Build

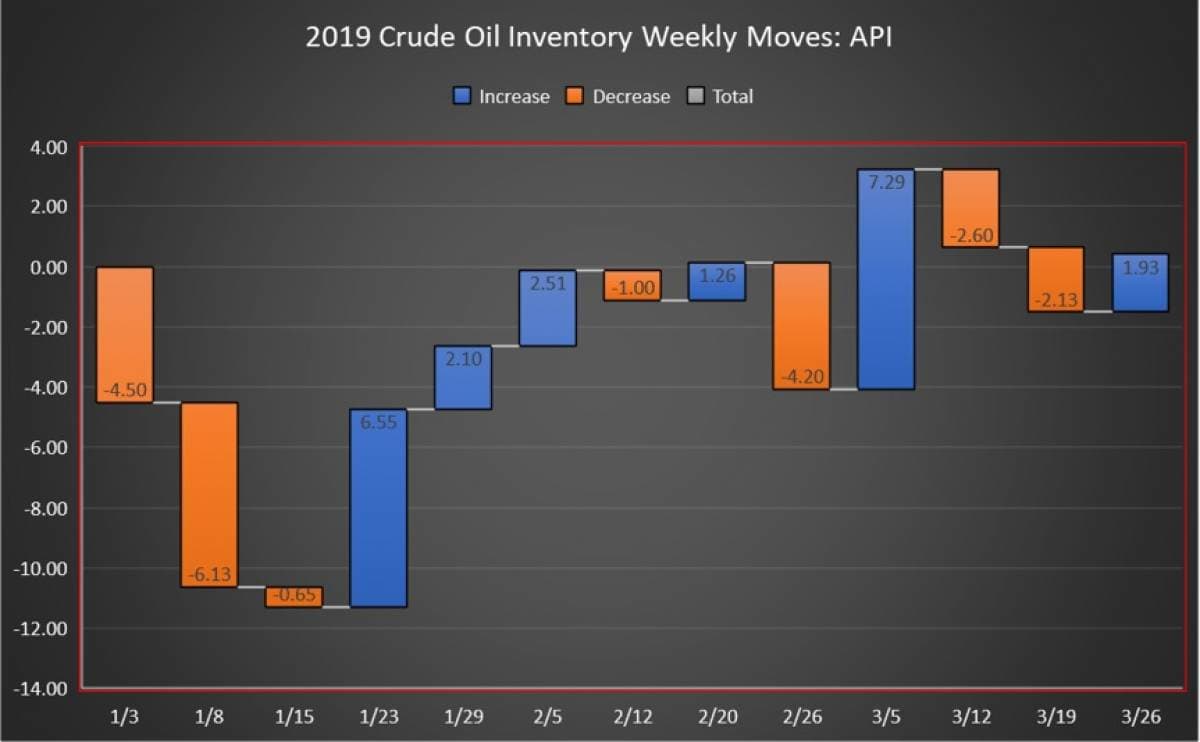

The American Petroleum Institute (API) reported a build in crude oil inventory 1.93 million barrels for the week ending March 22, coming in under analyst expectations of a 1.1-million-barrel draw.

Last week, the API reported a large surprise draw in crude oil of 2.133 million barrels. A day later, the EIA reported a draw of a much larger amount, estimating that crude inventories had drawn down by 9.6 million barrels.

Including this week’s data, the net build of just 430,000 barrels for the twelve reporting periods so far this year, using API data.

WTI was trading up on Tuesday in the runup to the data release at $59.94, up $1.12 (+1.90%) on the day at 1:25pm. The Brent benchmark was trading up at $67.43, up $0.62 (+0.93%) at that time. While the WTI benchmark is trading up roughly $.70 week on week the Brent benchmark is trading down $.15 per barrel.

Oil prices are still near four-month highs, with WTI even breaking the $60 mark earlier on Tuesday, as Saudi Arabia reaffirms its commitment to hold fast to its production cuts and hints that it is looking for at least $70 oil. Still, economic worries that threaten future oil demand serve as the current barrier for further price gains.

Related: Trump’s Last Chance To Subdue Gasoline Prices

The API this week reported a draw in gasoline inventories for week ending March 22 in the amount of 3.469 million barrels. Analysts estimated a draw in gasoline inventories of 2.900 million barrels for the week.

US crude oil production as estimated by the Energy Information Administration showed that production for the week ending March 15—the latest information available—resumed its 12.1 million bpd average—an all-time high for the United States.

Distillate inventories decreased by 4.278 million barrels, compared to an expected draw of 716,000 barrels for the week.

Crude oil inventories at the Cushing, Oklahoma facility grew by 688,000 barrels for the week.

The U.S. Energy Information Administration report on crude oil inventories is due to be released on Wednesday at 10:30a.m. EST.

By 4:39pm EST, WTI was trading up at $60.04 and Brent was trading up at $67.52.

By Julianne Geiger for Oilprice.com

More Top Reads from Oilprice.com:

- Sources: Saudis Admit They Want $70 Oil

- Schlumberger Won’t Take New Full-Oilfield Management Projects

- Mexico Scrambles To Save Its Sinking Oil Company

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

-

No mention of the spike in Brent spreads lately? The Brent 1-2 has jumped from 19 cents last Friday to close at 54 cents yesterday. Nick Cunningham wrote an article here on Brent backwardation in August 2017 and Brent rose from $52 to $68 by January 2018.

-

Such a large gas and distillate draws compared to the oil builds, sounds like bullish news for oil.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B