Breaking News:

Kazakhstan, Azerbaijan, and Uzbekistan Forge Green Energy Export Alliance

Kazakhstan, Azerbaijan, and Uzbekistan join…

South Korea Could Lead the Way in a Successful Nuclear Renaissance

Despite all the recent hype…

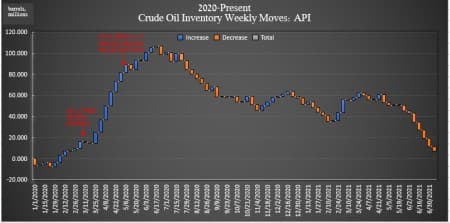

Oil Falls Slightly Despite Crude Draw

xThe American Petroleum Institute (API) on Tuesday reported a draw in crude oil inventories of 4.079 million barrels for the week ending July 9, bringing the total 2021 crude draw so far to 50.01 million barrels, using API data.

Analysts had expected a loss of 4.333 million barrels for the week.

In the previous week, the API reported a draw in oil inventories of 7.983 million barrels after analysts had predicted a draw of 3.925 million barrels.

The price of a WTI barrel has risen more than 50% so far this year and is still on the rise after gaining nearly $1.50 over the course of the last week as OPEC+ appears locked in a stalemate between members who wish to ease up on the production quotas and those who do not. Oil prices were up over 1.5% on Tuesday afternoon in the runup to the data release.

At 12:29 p.m. EST, WTI was trading up 1.50% on the day at $75.22 prior to the data release. Brent crude was trading up 1.58% for the day at $76.35.

While crude oil inventories continue to drop, U.S. oil production, with shale producers continuing to ease up on their until-now restraint, has increased by 200,000 bpd to an average of 11.3 million bpd for the week ending July 2, according to the latest data from the Energy Information Administration.

The API reported a draw in gasoline inventories of 1.545-million barrels for the week ending July 9—compared to the previous week's 2.736-million-barrel draw.

Distillate stocks saw an increase in inventories this week of 3.699 million barrels for the week, on top of last week's 1.086 million-barrel increase.

Cushing inventories fell this week by 1.585 million barrels, compared to last week’s 152,000 barrel decrease.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Natural Gas Prices Still Have Room To Run

- A Contrarian Investor’s Approach To OPEC’s Oil Spat

- U.S. Shale Can’t Afford To Gamble On The OPEC+ Outcome

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B