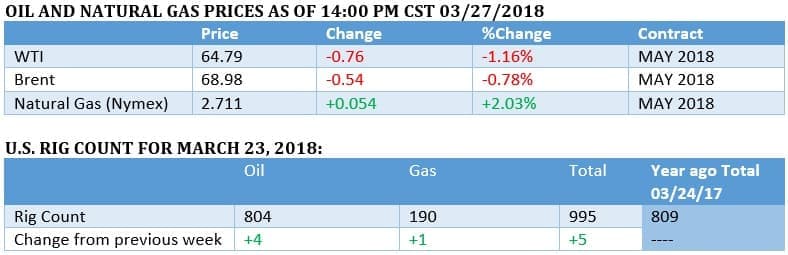

Despite a busy start to the week in oil news, crude prices slipped Monday and Tuesday as traders collecte profits from last week's jump.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

- Solar costs have fallen rapidly over the past decade. The EIA estimates that solar system costs on a per-watt basis declined by 10 to 15 percent per year between 2010 and 2016.

- There are various ways to estimate costs in the solar industry, and a variety of sources, but the EIA puts the installed capital cost of a fixed-tilt PV system at about $1.85 per watt in 2018.

- A single-axis tracking system has installed capital costs of about $2.11 per watt this year, although other analysts have that figure much lower today.

Market Movers

• SM Energy (NYSE: SM) said on Monday that its first quarter production would be at the high end of its guidance, noting that Permian production exceeded expectations. SM jumped by more than 2 percent in afterhours trading.

• Chevron (NYSE: CVX) said that its oilfields in Venezuela are operating normally amid speculation that the country’s oil output is plummeting across the board. Jay Johnson, Chevron’s head of upstream operations, declined to comment when asked if PDVSA had requested Chevron divert oil exports to Venezuelan refineries.

• Concho Resources (NYSE: CXO) said that the cost and time needed to drill a shale well will continue to fall, dismissing concerns that the industry is set for cost inflation. “The changes won’t be this dramatic and this obvious in the future, but there are many small improvements that can occur over the next two to three years," CEO Jack Harper said at the Scotia Howard Weil energy conference in New Orleans.

Tuesday March 27, 2018

Oil prices dipped on Monday as traders booked profits following last week’s enormous jump, and while they fell slightly on Tuesday morning as well, both WTI and Brent are still sitting comfortably above last week’s range.

Shale firms step up dividends. About a third of the top 25 shale producers have either paid or have promised to pay a dividend this year, according to Reuters. That is the largest number in over a decade since the shale revolution began. The shale industry has largely been unprofitable, even when oil prices were high prior to the collapse in 2014. Low prices forced an efficiency drive, and with WTI now above $60 per barrel, a lot of shale companies are beginning to post profits for the first time. Shareholders are finally starting to see some return.

Diamondback Energy (NASDAQ: FANG) became the first shale company in years to initiate a dividend last month when it announced a 12.5-cent quarterly dividend. “You’re going to see more shale producers focus on dividends,” Leigh Goehring of energy investment research firm G&R Associates told Reuters. “Shareholders are demanding it and a trend is forming.” Related: China's Oil Futures Launch With A Bang

China launches oil futures. China’s oil futures contract began trading on Monday on the Shanghai International Energy Exchange, a yuan-denominated futures contract intended to eventually rival WTI and Brent for influence as an oil benchmark. The most actively traded futures contract on the exchange closed up 3.3 percent at 429.9 yuan ($68.07) per barrel on Monday.

PDVSA in danger of closing 3 of its 4 domestic refineries. PDVSA might be forced to shut down three of its four domestic refineries because of a shortage of feedstock and refinery workers. Argus reports that the refineries facing potential closure include the 305,000 bpd Cardon refinery, the 140,000 bpd El Palito refinery, and the 190,000 bpd Puerto La Cruz refinery. Taken together, they account for about half of PDVSA’s 1.3 mb/d refining capacity. Meanwhile, Reuters reports that PDVSA might shut the Petromonagas oil upgrader in April for maintenance, a joint venture with Russia’s Rosneft. Venezuela’s refineries are in a decrepit state, forcing PDVSA to rely more on imports. But without cash, the imports are becoming harder to finance.

Canadian producers continue to suffer from lack of pipeline capacity. Cenovus Energy (NYSE: CVE) said last week that it lowered oil production at two of its facilities in February because it has struggled to ship its oil. Canada’s pipeline system is virtually tapped out, and rail shipments have stepped up to take on some of the burden of moving some of the oil. But a lack of locomotives has also created a bottleneck on the rail system. Canadian oil production exceeded pipeline capacity by 87,000 bpd in December, a gap that is expected to swell to 338,000 bpd by the end of this year as new projects reach completion, according to Genscape Inc.

Saudi-Iran tension rises over missile attack. Saudi Arabia is blaming Iran for intercepted missiles over the weekend, and a Saudi spokesperson said that they “reserve the right to respond against Iran at the right time and right place.” The recent appointment of John Bolton to be President Trump’s National Security Advisor has raised a lot of speculation about heightened confrontation with Iran.

EPA looks to roll back fuel efficiency standards. The WSJ reports that the EPA has readied a document that would initiate a process to weaken U.S. fuel efficiency standards for cars and light trucks. The move is not a foregone conclusion, but if successful, it would gut standards that call for the U.S. auto fleet to average 54.5 miles per gallon by 2025, a standard that had the support of the auto industry prior to the 2016 presidential election.

Iraq’s oil exports dip by 70,000. Oil exports from Iraq’s southern coast declined by 70,000 bpd so far in March, according to Reuters, an indication that the country could post the third consecutive month of declining exports. “We are seeing lower volumes,” a source who tracks Iraq’s exports told Reuters. Part of the southern port was under maintenance, which explains some of the drop off. Exports from Iraq’s north are also down by about half from a year ago, and because of the dispute over control of the oil with Kurdistan, there are no plans to step up shipments north through Turkey.

Trafigura: Oil prices could go higher. Trafigura's co-head of market risk Ben Luckock spoke with Argus and said that oil prices could go higher in the years ahead due to strong demand the slowdown of U.S. shale. “U.S. shale growth has been quick, immediate and flexible but it would be a mistake to think shale is your one solution to meet demand growth, which could lead to higher prices in the next couple of years,” Luckock said.

Related: Trump Looks To Undo Fuel Efficiency Standards

Total, Exxon set to drill first ultra-deepwater well in Mexico. Total SA (NYSE: TOT) and ExxonMobil (NYSE: XOM) are planning to begin drilling on the first deepwater block in Mexican waters since the country opened up to international investment. The block is located in the Perdido Fold Belt, which is considered the most attractive part of Mexican’s offshore offerings.

Brazil’s soaring gas production cuts imports. Brazil’s LNG imports plunged by 75 percent over the past two years as its natural gas production has skyrocketed. Gas output is up because it is produced in conjunction with Brazil’s rising oil production. “No doubt there will be more natural gas coming from the pre-salt fields in the next few years,” Joao Vitor Velhos, a manager at Gas Energy, a consultancy in Porto Alegre, Brazil, told Bloomberg. “There is no expectation Brazil will become a net exporter anytime soon, but the historical dependence on natural gas is being reduced.”

BMW to install 80,000 EV recharging stations in China. BMW announced plans to install 80,000 EV recharging stations across 100 Chinese cities by the end of this year.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Rig Competition Flares Up Amid Permian Boom

- Offshore Oil Closes In On Shale

- OPEC Scrambles To Justify Output Cuts