Breaking News:

BP’s Azerbaijani Oil Field Could Be a Game-Changer for Baku

BP's new oil production facility…

Why Germany is Choosing Natural Gas Over Nuclear Power

Germany's anti-nuclear stance, rooted in…

U.S. Shale Oil Production Growth Getting Increasingly Difficult: Report

The average U.S. shale output per well may have doubled over the past decade, but those crazy growth days are now behind us, according to a new report released on Tuesday by Enverus Intelligence Research (EIR), a subsidiary of Enverus.

“The U.S. shale industry has been massively successful, roughly doubling the production out of the average oil well over the last decade, but that trend has slowed in recent years,” said Dane Gregoris, the reports author and managing director at EIR.

The production decline curves—or the rate at which production falls over time—have steepened more than half of a percentage point annually since 2010, the report revealed, and Enverus expects the shape of the curve to continue to steepen over time as well density increases.

One of the key takeaways from the Enverus report is that it expects this curve-steepening to push up the average breakeven prices.

U.S. shale production accounts for most of the non-OPEC oil supply growth, so any drag on the shale production growth rate is a drag on overall U.S. crude oil production growth.

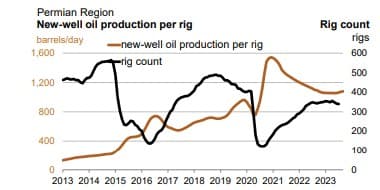

According to the Energy Information Administration’s (EIA) latest Drilling Productivity Report, new well oil production per rig in the most prolific U.S. shale basin, the Permian, has sagged considerably for the last few years.

Source: EIA DPR

The EIA is now estimating that Permian oil production will actually dip in September to 5.799 million bpd from August’s 5.812 million bpd, with production expected to fall in other regions, too, including in Anadarko, Appalachia, and the Eagle Ford.

Summed up, the industry’s treadmill is speeding up and this will make production growth more difficult than it was in the past,” Gregoris said in an interpretation of this data.

ADVERTISEMENT

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- UK Oil Boiler Ban Sparks Debate

- Oil Prices Under Pressure As China's Economic Woes Worsen

- Russia's Rouble Crisis: Central Bank Hikes Rates To 12%

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B