Breaking News:

Palestinian Political Factions Agree to Reconciliation Government

Palestinian factions Hamas and Fatah…

Net-Zero Targets Could Double Yearly Copper Demand by 2035

Copper shortage fears return as…

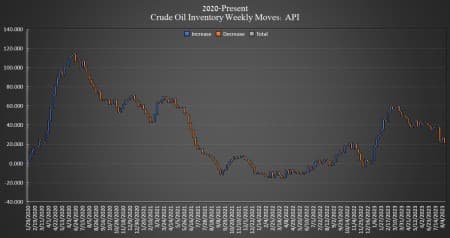

Oil Steady Despite Large Crude Draw

Crude oil inventories in the United States saw a large draw this week of 6.195 million barrels, the American Petroleum Institute (API) data showed on Tuesday, after last week’s surprise 4.067 million barrel build.

Analysts were expecting a draw of 2.050 million barrels in U.S. crude-oil inventories. The total number of barrels of crude oil gained so far this year is nearly 18 million barrels, according to API data, although there is a net draw in crude inventories since April of almost 30 million barrels.

On Monday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by 600,000 barrels in the week ending August 14, with the SPR inventory still sitting at a near 40-year low of 348.4 million barrels. At that rate of replenishment, the SPR should return to 2021 levels in a little under a decade.

The WTI and Brent benchmarks were both trading down on Tuesday morning in the run-up to the data release on continued fear about China’s economic activity and subsequent oil demand being a disappointment. By 4:15 p.m. EST, WTI was trading down 1.85%, at $80.98 per barrel—down nearly $2 per barrel from this time last week. Brent crude was trading down 1.52% at $84.90—down $1.10 from this time last week.

Gasoline inventories saw a build this week, rising by 700,000 barrels, more than offsetting last week’s 413,000 barrels dip in the week prior. Gasoline inventories are roughly 7% less than the five-year average for this time of year. Distillate inventories fell by another 800,000 barrels, after the 2.093 million barrel draw in the week prior, and are already sitting somewhere around 17% below the five-year average for this time of year.

EIA data suggests that crude oil production in the United States rose by 400,000 bpd to 12.6 million bpd for the week ending August 4. If that weekly estimate turns out to be close to accurate, that would be the single largest weekly production increase in years.

Inventories at Cushing, Oklahoma, fell by another million barrels, after falling by 112,000 barrels in the previous week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- U.S. Shale Oil Production Growth Getting Increasingly Difficult: Report

- Oil Prices Under Pressure As China's Economic Woes Worsen

- Russia's Rouble Crisis: Central Bank Hikes Rates To 12%

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

Tesla and pure BEV prices Wars still raging away remain hugely bearish from all of long commodity speculators. Long $IBM International Business Machines strong buy